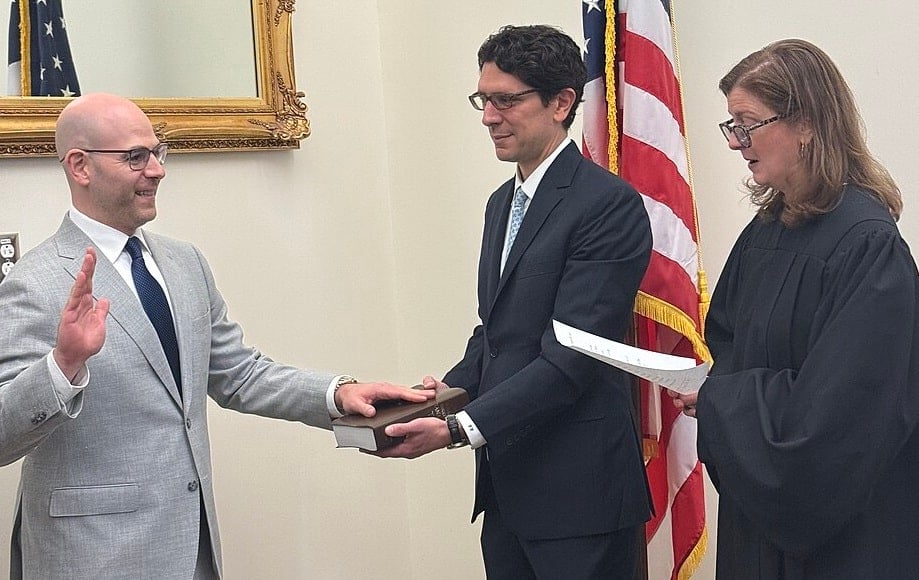

Miran is sworn in as governor on September 16, 2025. Credit: Public Domain

Fed Governor Stephen Miran praised Greece’s economic resurgence on Wednesday, citing the nation’s aggressive deregulation as a global model for sustainable growth.

Speaking at an economic forum in Athens on January 14, 2026—following opening remarks by Kimberly Guilfoyle, Ambassador of the United States to Greece— Miran, who also serves as Chairman of the White House Council of Economic Advisers (on leave), argued that Greece’s turnaround from the 2009 debt crisis was not merely a result of fiscal discipline but a direct consequence of “alleviating suffocating overregulation.”

Fed Governor praises Greece’s “painful” path to stability

Miran emphasized that the Greek recovery required a fundamental restructuring of the state’s relationship with the private sector.

“Greece’s recovery from the crisis that began in 2009 was only possible after the Greek people implemented substantial and painful reforms,” Miran stated. He noted that by “liberalizing product and service markets” and “opening previously restricted professions,” the Greek government successfully removed barriers that had long stifled domestic and international competition.

The Fed Governor specifically pointed to the privatization of key infrastructure, including airports and ports, and the liberalization of utility sectors as turning points. “While it is challenging to quantify how these deregulatory actions have affected the economy,” he admitted, “there is little doubt that these reforms have supported a remarkable return to economic growth and higher living standards.”

Deregulation in Greece and monetary policy

A key theme of Miran’s address was the nexus between national regulation and the effectiveness of central bank policy. Although Greece is part of the Eurozone, Miran argued that its internal reforms have fundamentally improved how it interacts with the European Central Bank (ECB).

“By easing the ability of supply to respond to prices, these reforms have improved the transmission of monetary policy,” Miran explained. He highlighted the dramatic narrowing of Greek borrowing rates, noting that the spread between Greek and German long-term bonds has plummeted from 6% a decade ago to below 1% today.

A global message

Miran’s remarks in Athens carry significant weight in Washington, where he is viewed as a close associate of the US President and a primary advocate for “supply-side” economic theories. His defense of deregulation comes as the US administration pursues similar policies, including a “one-in-ten-out” regulatory revocation mandate.

“Macroeconomic stability has returned to Greece,” Miran concluded. “Unemployment has fallen to its lowest level since the global financial crisis…Greece has come a very long way, impressing the whole world with its recovery.”