For the week ending Sept. 6, Western Canadian feeder cattle markets were relatively unchanged compared to seven days earlier. Prices for yearlings off grass continue to hover at or near historical highs. Background yearlings on grain and silage ration are trading at $20 per hundredweight to similar-weight feeders coming off grass.

For calves, feedlot operators are focused on genetic features and pre-conditioning records. In certain regions, this has provided a variable price structure for similar-weight cattle.

Alberta packers were buying fed cattle on a dressed basis at $525 per cwt., up $15 per cwt. from the week prior. Using a 60 per cent grading, this equates to a live price of $315 per cwt. Current break-even pen closeout values in southern Alberta are in the range of $285-290 per cwt.

Read Also

Canfax cattle market report – September 18, 2025

The Canfax cattle market report for September 18, 2025. Fed & feeder cattle prices, butcher cow trends, and cutout market insights.

For March and April 2026 delivery, Alberta packers were showing bids on a live basis at $326 per cwt. and $329 per cwt. delivered. Cattle on feed 180 days or more in Alberta and Saskatchewan are similar to year-ago levels as of Sept. 1.

The Perlich Bros Auction Market report had a smaller package of Angus steers off grass averaging 1,040 pounds priced at $459 per cwt. at the ring.

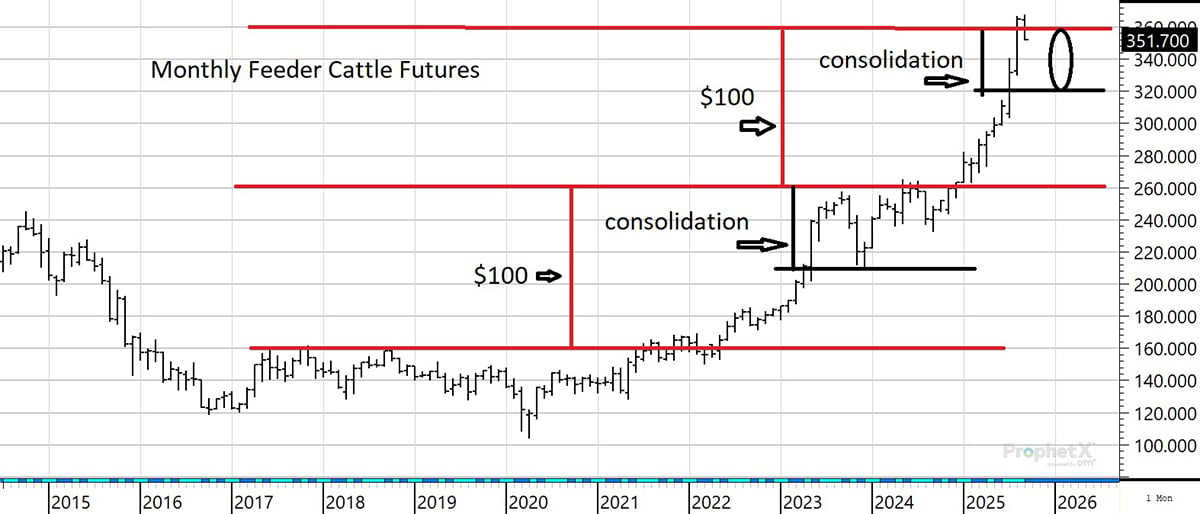

On the monthly chart, we measure from the long-term resistance from years 2016-2020 at $160 to the resistance at the $260 level. We use this measurement to project the upside above $260, which would make the $360 level the objective. The market has fulfilled this objective. After fulfilling the objective, the market has potential to move into a consolidation pattern for an extended period of time. Look for the futures market to consolidate between $320 and $360. Chart Courtesy of DTN Prophet X

On the monthly chart, we measure from the long-term resistance from years 2016-2020 at $160 to the resistance at the $260 level. We use this measurement to project the upside above $260, which would make the $360 level the objective. The market has fulfilled this objective. After fulfilling the objective, the market has potential to move into a consolidation pattern for an extended period of time. Look for the futures market to consolidate between $320 and $360. Chart Courtesy of DTN Prophet X

At the Ponoka sale, a group of 47 Angus-cross steers weighing 910 lb. off grass with full health records were valued at $495 per cwt. At the same sale, 930-lb. mixed heifers off grass with processing data settled at $452 per cwt.

The Perlich Bros Video Sale reported 100 head of Charolais-cross steer calves with a base weight of 640 lb. traded for $585 per cwt. for Nov. 18 delivery.

The Team forward calf sale had 110 head of Black Angus-Hereford cross steers averaging 550 lb. with full processing records coming off grass valued at $685 per cwt. FOB ranch near Patricia, Alta., for Nov. 6 delivery.

Statistics Canada said Western Canadian yearlings outside finishing feedlots on July 1 were 1.107 million head, about the same as last year. We’re now seeing more yearlings come on the market given the favourable pasture conditions earlier in August.

Western Canadian calves under one year of age outside finishing feedlots were 2.830 million head, up 77,900 head from a year ago.

Earlier in spring, we were expecting feeder cattle supplies outside finishing feedlots to be down sharply from year-ago levels. We now find that yearling supplies are similar to last year while calf numbers are up. The only difference is that there have been a record number of calves sold for October and November delivery.

The feeder cattle market is functioning to encourage expansion. Statistics Canada said the number of beef cows that have calved as of July 1, 2025 were up 13,100 head from a year ago. The number of heifers for replacement were up 11,500 head from last year. These numbers tell us that the herd contraction in Canada has come to an end, and we’re expecting more heifer retention over the next year. This could decrease the number of heifers in the total feeder cattle supply by 40,000 to 60,000 head.

The United States Department of Agriculture was forecasting a minor year-over-year decrease in the calf crop. However, some private estimates have the 2025 calf crop up from last year. The number of beef cows that had calved as of July 1, 2025, were up 750,000 head from Jan. 1, 2025. For this reason, analysts are expecting a year-over-year increase in the U.S. calf crop instead of a decrease.

The CME composite price is the official cash settlement price for the CME feeder cattle futures at contract final settlement. Figures have been calculated by the CME Group from prices reported by the USDA. Below is the seven-day average price for 700 to 899-lb. feeder steers for each Friday for the past six weeks. Readers can see how the market has changed through the summer.

Feedlot margins in Kansas during August were near US$700 per head. Healthy feedlot margins caused the CME composite price index to jump by US$35 per cwt. within 30 days.

Wholesale choice beef was trading at US$414 per cwt. during the first week of September. This is a fresh historical high and up US$110 per cwt. from last year.

Beef demand is inelastic. This tells us that a small change in supply has a large influence on the price. North Americans eat the same amount of beef each week regardless of the price.

Lethbridge area feedlots were buying feed barley in the range of $250-260 per tonne delivered in early September. To put this in perspective, this is down $50 per tonne from the first week of July.

Feed barley prices continue to grind lower as the harvest progresses. Farmers tend to sell about one million tonnes of barley per month during September and October. Cattle on feed inventories are at seasonal lows during September. Domestic feed demand is only about 400,000 tonnes per month. Supplies exceed demand which results in lower prices. The barley market is functioning to encourage demand.

We feel comfortable with the U.S. corn crop estimate of 425 million tonnes, up from 378 million tonnes last year. The U.S. farmer sells 65 per cent of the corn in the first three months of the crop year. Weaker feed grain prices will continue to support the feeder market.

In conclusion, we have a neutral outlook for the feeder cattle market over the next couple of months. Feed grain prices are expected to grind lower. Fed cattle prices are expected to consolidate at the higher levels due to the year-over-year decrease on U.S. beef production.