Overview

At the end of the third quarter of 2025, the general government gross debt to GDP ratio in the euro area (EA20) stood at 88.5%, an increase compared with 88.2% at the end of the second quarter of 2025. In the EU, the ratio also increased from 81.9% to 82.1%.

Compared with the third quarter of 2024, the government debt to GDP ratio increased in both the euro area (from 87.7% to 88.5%) and the EU (from 81.3% to 82.1%).

At the end of the third quarter of 2025, the general government debt was made up of 84.2% debt securities in the euro area and 83.6% in the EU, 13.3% loans in the euro area and 13.9% in the EU and 2.6% currency and deposits in the euro area and 2.5% in the EU.

Due to the involvement of EU Member States’ governments in lending to certain Member States, quarterly data on intergovernmental lending (IGL) are also published. The IGL as percentage of GDP at the end of the third quarter of 2025 stood at 1.4% in the euro area and at 1.2% in the EU.

These data are released by Eurostat, the statistical office of the European Union.

Euro area and EU general government gross debt

2024Q3

2025Q2p

2025Q3p

Euro area 20

(million euro)

13 228 782

13 676 742

13 854 637

(% of GDP)

87.7

88.2

88.5

(million euro)

337 593

348 052

353 512

(% of total debt)

2.6

2.5

2.6

(million euro)

11 119 788

11 518 784

11 661 087

(% of total debt)

84.1

84.2

84.2

(million euro)

1 771 402

1 809 906

1 840 037

(% of total debt)

13.4

13.2

13.3

(million euro)

224 314

216 518

219 845

(% of GDP)

1.5

1.4

1.4

(million euro)

13 253 694

13 705 122

13 886 456

(% of GDP)

87.3

87.7

88.1

(million euro)

337 593

348 052

353 512

(% of total debt)

2.5

2.5

2.5

(million euro)

11 141 118

11 543 685

11 689 229

(% of total debt)

84.1

84.2

84.2

(million euro)

1 774 983

1 813 384

1 843 714

(% of total debt)

13.4

13.2

13.3

(million euro)

224 314

216 518

219 845

(% of GDP)

1.5

1.4

1.4

EU

(million euro)

14 476 738

15 047 553

15 253 172

(% of GDP)

81.3

81.9

82.1

(million euro)

364 338

374 924

383 938

(% of total debt)

2.5

2.5

2.5

(million euro)

12 101 484

12 591 774

12 752 185

(% of total debt)

83.6

83.7

83.6

(million euro)

2 010 917

2 080 854

2 117 049

(% of total debt)

13.9

13.8

13.9

(million euro)

224 314

216 518

219 845

(% of GDP)

1.3

1.2

1.2

Government debt at the end of the third quarter of 2025 by Member State

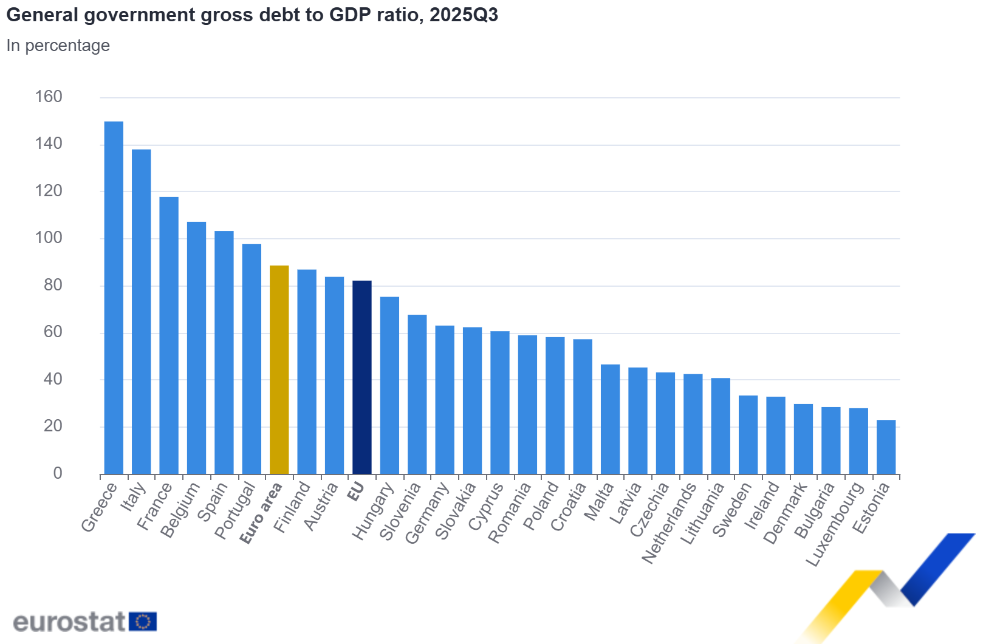

The highest ratios of government debt to GDP at the end of the third quarter of 2025 were recorded in Greece (149.7%), Italy (137.8%), France (117.7%), Belgium (107.1%) and Spain (103.2%), and the lowest ratios were recorded in Estonia (22.9%), Luxembourg (27.9%), Bulgaria (28.4%), and Denmark (29.7%).

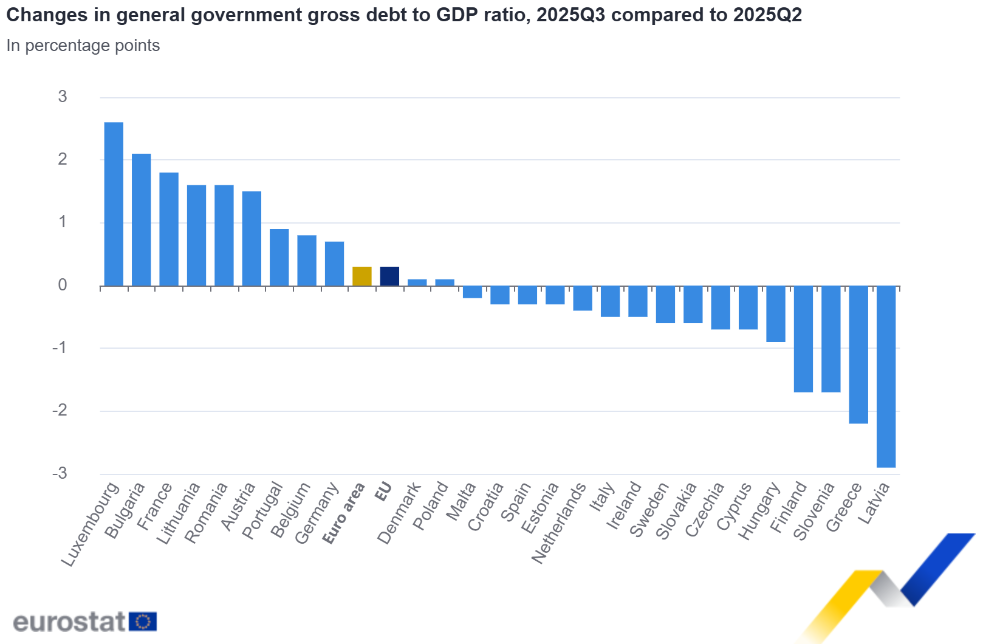

Compared with the second quarter of 2025, eleven Member States registered an increase in their debt to GDP ratio at the end of the third quarter of 2025 and sixteen registered a decrease. The largest increases in the ratio were observed in Luxembourg (+2.6 percentage points – pp), Bulgaria (+2.1 pp), France (+1.8 pp), Lithuania and Romania (both +1.6 pp), and Austria (+1.5 pp). The largest decreases were recorded in Latvia (-2.9 pp), Greece (-2.2 pp), Slovenia and Finland (both -1.7 pp).

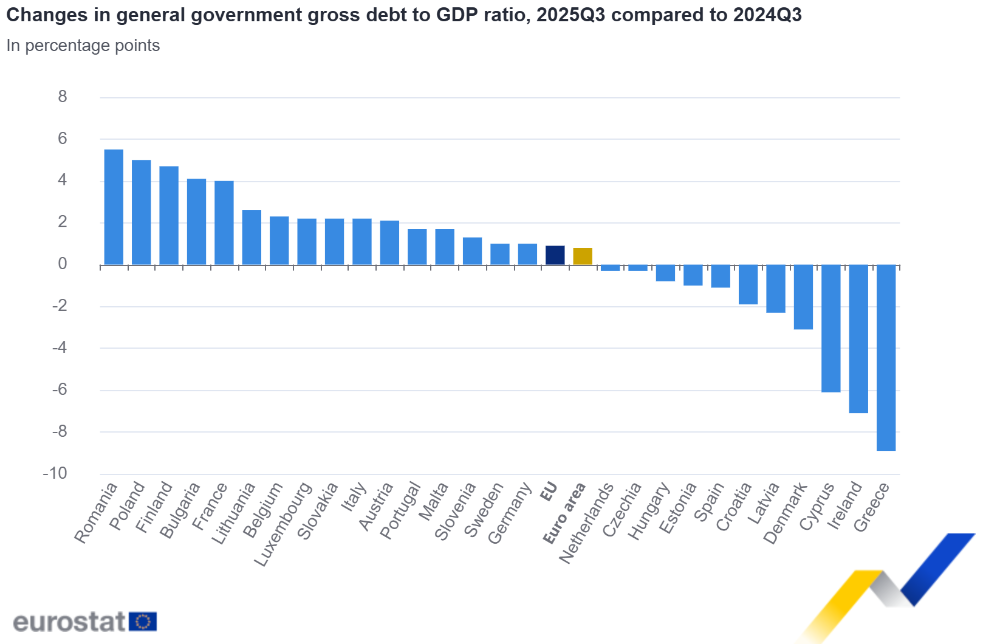

Compared with the third quarter of 2024, sixteen Member States registered an increase in their debt to GDP ratio at the end of the third quarter of 2025 and eleven Member States registered a decrease. The largest increases in the ratio were recorded in Romania (+5.5 pp), Poland (+5.0 pp), Finland (+4.7 pp), Bulgaria (+4.1 pp) and France (+4.0 pp). The largest decreases were observed in Greece (-8.9 pp), Ireland (-7.1 pp), Cyprus (-6.1 pp), Denmark (-3.1 pp) and Latvia (-2.3 pp).

Tables

General government gross debt by Member State

General government gross debt

Millions of national currency

% of GDP

Difference in pp of GDP 2025Q3p compared with:

2024Q3

2025Q2p

2025Q3p

2024Q3

2025Q2p

2025Q3p

2024Q3

2025Q2p

EUR

13 228 782

13 676 742

13 854 637

87.7

88.2

88.5

0.8

0.3

EUR

13 253 694

13 705 122

13 886 456

87.3

87.7

88.1

0.8

0.3

EUR

14 476 738

15 047 553

15 253 172

81.3

81.9

82.1

0.9

0.3

EUR

644 385

670 703

681 157

104.8

106.2

107.1

2.3

0.8

EUR*

24 918

28 386

31 825

24.3

26.3

28.4

4.1

2.1

CZK

3 449 070

3 627 212

3 623 901

43.4

43.8

43.1

-0.3

-0.7

DKK

932 969

888 596

900 757

32.7

29.6

29.7

-3.1

0.1

EUR

2 671 637

2 733 365

2 787 631

62.0

62.3

63.0

1.0

0.7

EUR

9 386

9 461

9 410

23.8

23.2

22.9

-1.0

-0.3

EUR

215 943

207 243

208 960

40.0

33.4

32.8

-7.1

-0.5

EUR

370 820

368 609

367 852

158.6

151.9

149.7

-8.9

-2.2

EUR

1 635 731

1 690 922

1 709 330

104.2

103.5

103.2

-1.1

-0.3

EUR

3 301 444

3 416 302

3 482 180

113.7

115.9

117.7

4.0

1.8

EUR

49 968

50 932

51 838

59.2

57.5

57.2

-1.9

-0.3

EUR

2 962 913

3 071 278

3 080 915

135.6

138.3

137.8

2.2

-0.5

EUR

22 886

21 774

21 748

66.7

61.4

60.6

-6.1

-0.7

EUR

18 853

19 776

18 965

47.4

48.0

45.2

-2.3

-2.9

EUR

29 521

31 815

33 635

38.0

39.1

40.7

2.6

1.6

EUR

21 790

21 870

24 451

25.6

25.2

27.9

2.2

2.6

HUF

60 605 593

63 986 465

64 146 655

76.1

76.2

75.2

-0.8

-0.9

EUR

10 165

11 110

11 215

44.8

46.8

46.5

1.7

-0.2

EUR

469 678

491 700

493 628

42.6

42.7

42.4

-0.3

-0.4

EUR

398 538

412 280

423 892

81.6

82.2

83.7

2.1

1.5

PLN

1 897 487

2 186 171

2 221 829

53.2

58.1

58.1

5.0

0.1

EUR

272 323

287 133

294 420

95.9

96.7

97.6

1.7

0.9

RON

916 404

1 039 857

1 096 295

53.3

57.3

58.9

5.5

1.6

EUR

44 245

47 494

46 930

66.3

69.3

67.6

1.3

-1.7

EUR

77 425

83 484

83 916

60.1

62.9

62.3

2.2

-0.6

EUR

225 432

245 999

242 401

82.2

88.5

86.8

4.7

-1.7

SEK

2 040 847

2 191 695

2 174 022

32.3

33.9

33.3

1.0

-0.6

NOK

2 191 307

2 303 056

2 315 139

40.9

42.0

42.0

1.1

0.0

General government gross debt by Member State

Components of general government gross debt, in % of GDP

IGL (assets)

Currency and deposits

Debt Securities

Loans

% of GDP

2025Q3p

2025Q3p

2025Q3p

2025Q3p

2.3

74.5

11.8

1.4

2.2

74.1

11.7

1.4

2.1

68.7

11.4

1.2

0.4

92.1

14.6

1.3

–

25.1

3.3

0.0

0.4

39.1

3.6

0.0

0.6

27.0

2.1

0.0

0.4

50.2

12.4

1.4

0.3

13.1

9.5

1.2

4.0

22.1

6.8

0.0

3.1

40.0

106.7

0.0

0.3

91.6

11.2

1.7

1.5

105.6

10.6

1.6

0.1

42.2

15.0

0.0

8.6

115.2

14.0

1.9

0.5

35.5

24.7

0.9

1.4

40.0

3.7

0.0

0.2

33.8

6.7

0.0

0.4

23.7

3.8

0.7

0.8

66.1

8.3

0.0

1.7

40.4

4.5

0.9

0.2

35.8

6.3

1.1

0.4

74.3

9.0

1.7

0.3

43.1

14.8

0.0

16.7

57.8

23.2

0.2

1.2

48.0

9.6

0.0

0.3

56.9

10.4

1.6

0.1

55.8

6.4

1.6

0.4

65.6

20.9

1.5

3.0

19.0

11.3

0.0

–

16.1

26.0

–

Notes for users

Methods and definitions

Quarterly data on government debt are collected from the Member States according to European System of Accounts (ESA 2010), see Annex B, ESA 2010 transmission programme, and refer to the Maastricht debt definition, used in the context of the Excessive Deficit Procedure (EDP). Annual EDP data, next to be notified in April 2026, are the subject of a thorough verification by Eurostat.

The general government gross debt is defined as the consolidated gross debt of the whole general government sector outstanding at the end of the quarter (at face value). General government debt consists of liabilities of general government in the following financial instruments: currency and deposits (AF.2), debt securities (AF.3) and loans (AF.4), as defined in ESA 2010.

The debt to GDP ratio is calculated for each quarter using the sum of quarterly GDP for the four last quarters. Quarterly data on GDP are the most recent ones transmitted by the EU Member States. While quarterly debt figures are consistent with annual debt figures at coinciding publications, differences between quarterly and annual data occur at non-coinciding publications. Differences between annual and quarterly GDP figures also occur.

For the purpose of proper consolidation of general government debt and to provide users with information, Eurostat publishes data on government loans (IGL) to other EU governments. The concepts and definitions are based on ESA 2010 and on the rules relating to the statistics for the EDP. The data covered is the stock of loans and partly deposits related to claims on other EU Member States, including loans made through the European Financial Stability Facility (EFSF). The valuation basis is the stock of loans at face value outstanding at end of each quarter. From the first quarter of 2011 onwards, the intergovernmental lending figures relate mainly to lending to Greece, Ireland and Portugal and include loans made by the EFSF.

For stock data such as general government debt, end of period exchange rates are used in the compilation of the EU aggregates. For flow data, such as GDP, average exchange rates are used. The EU aggregates, denominated in euro, can fluctuate as a result of exchange rate movements between the euro and other EU currencies.

All quarterly government finance statistics data for the first three quarters of 2025 have been labelled provisional. Country-specific metadata are published.

Geographical Information

Up to 31 December 2025, the euro area included Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland (EA20). From 1 January 2026, the euro area also includes Bulgaria (EA21).

The aggregate data series commented on in this Euro indicator release refer to the official composition of the euro area in the most recent quarter for which data are available. Thus, Euro indicator releases with data up to the fourth quarter of 2025 comment on EA20 series, while releases with data for the first quarter of 2026 onwards will comment on EA21 series.

The European Union includes Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland and Sweden (EU27).

For more information