Safaricom is launching Shiriki Pay, a new M-PESA feature that lets you give another person direct access to spend money from your mobile wallet. You can think of it as handing someone your debit card, except it’s all happening through M-PESA.

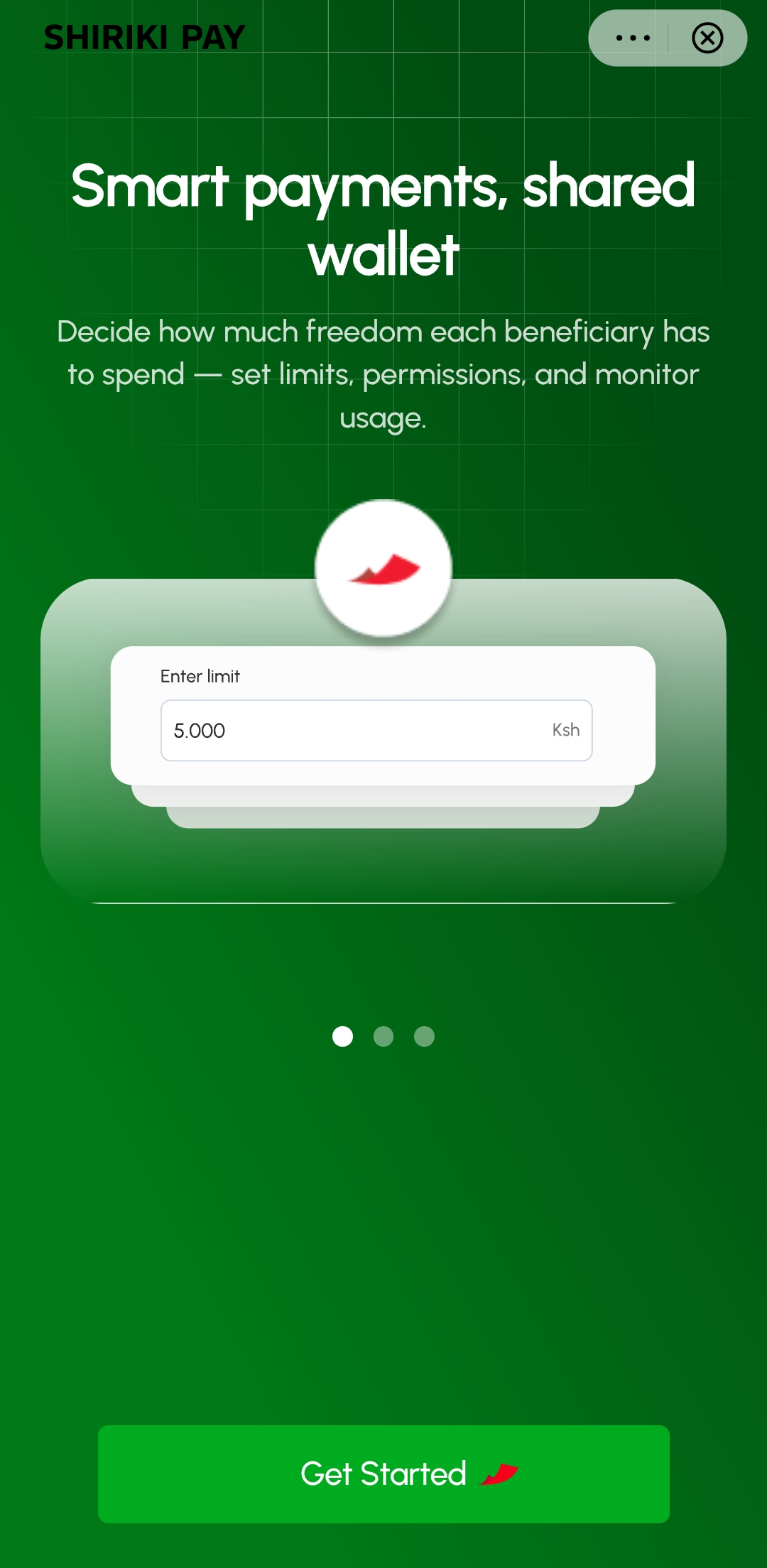

The service works between two registered M-PESA customers. One person, the Account Holder, designates another M-PESA user as an Authorized User and sets a spending limit.

Once authorized, that second person can make payments directly from the account holder’s M-PESA account without needing to ask for money transfers each time.

The Authorized User can pay merchants through Lipa na M-PESA (both Buy Goods and Paybill options) and Pochi la Biashara merchants. They can also see their own transaction history showing what they’ve spent and receive notifications about their transactions.

What they can’t do is exceed the limit set by the account holder or perform transactions outside these specific payment types.

To set someone up as an authorized user, the account holder needs to provide their phone number, full name, contact details, and potentially other verification documents that Safaricom might request.

The authorization happens through the M-PESA App using your M-PESA PIN, which remains confidential to you. Before finalizing, you get to review and confirm the authorized user’s details.

The Account Holder can revoke access anytime through the app, though this doesn’t undo any transactions the Authorized User already made. Similarly, an authorized user can stop using the service whenever they want.

More importantly, the account holder is fully responsible for everything the authorized user does with their money. If the authorized user overspends, makes fraudulent transactions, or causes any problems, that’s entirely on the account holder.

Safaricom can suspend or terminate access for either party without prior notice for various reasons: suspected fraud, security threats, incomplete identity verification, legal requirements, system maintenance, or if continuing the service would make Safaricom non-compliant with regulations.

The service comes with standard M-PESA transaction fees, which the account holder pays.

Once Shiriki Pay launches, it would allow parents to give children access to their M-PESA with set limits, eliminating constant money requests for lunch, school fees, or supplies. University students get independence while parents maintain spending control.

Small business owners can authorize managers or field agents to make purchases throughout the day without reimbursement delays or approval calls, allowing business expenses to happen in real time with full visibility.

Household workers can pay bills and buy groceries without interrupting employers. Family members supporting elderly relatives in other towns can also let them handle medical expenses and bills themselves with dignity.

Couples get a middle ground between merged finances and splitting every bill. Project organizers and wedding planners can pay vendors directly without lump sum transfers that get mixed with personal money.

Shiriki Pay could also work for controlled financial support. Helping someone manage finances becomes transparent when they can only spend at legitimate merchants and you see the transaction history.

M-PESA’s deep integration into Kenyan commerce makes Shiriki Pay a practical tool. You can pay for nearly everything through Lipa na M-PESA, from street vendors to major retailers and utility companies.

READ: Kenya Hits 45 Million Mobile Money Users With M-Pesa in the Lead

Spending limits provide control, transaction history provides transparency, and immediate revocation provides security.

It’s worth noting that Shiriki Pay is restricted to merchant payments only and excludes any person-to-person transfers or withdrawals. This means authorized users can only spend money on goods and services rather than withdraw it as cash.