“The gaze must be broad and far reaching.” — Miyamoto Musashi

In markets, as in strategy, perspective determines victory.

While Wall Street fixates on Wednesday’s Fed meeting with tunnel vision, we maintain Musashi’s broad gaze across multiple data points and time horizons.

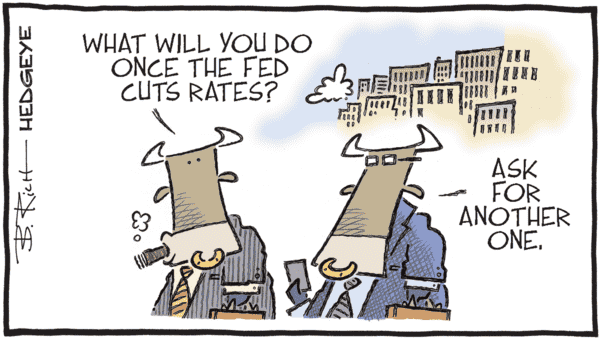

So what actually matters right now? The two-year Treasury yield.

Currently trading at 3.53%, this level carries historical significance.

It’s sitting “right where it stopped going down into the 50 basis point rate cut of September of last year,” Hedgeye CEO Keith McCullough noted on Monday’s edition of The Macro Show.

Like fractals repeating across scales, this pattern has emerged before.

The two-year is the most sensitive part of the yield curve to Fed policy—when traders expect more cuts, they buy two-year notes, pushing yields down.

When those rate cut expectations start to fade, the two-year yield rises.

The Crowded Consensus

With consensus strongly favoring multiple rate cuts, the two-year yield becomes our contrarian indicator.

As McCullough explained Monday on The Macro Show, “Polymarket is a better place to bet on the probability of [rate cuts] than betting on bonds.”

Polymarket offers clean, binary bets on specific Fed decisions, while bonds price in many factors like inflation expectations, term premiums, future rate paths, and more.

That makes bonds messier for pure rate cut bets, but more revealing about what’s actually happening beneath the surface.

When considering the rate cuts left on the table for 2025, both futures and prediction markets are aligned for multiple cuts:

Note the difference: Polymarket is leaning more conservative than futures traders through year-end.

This divergence matters. Futures traders are extrapolating a straight line from weak labor data into three consecutive cuts. Polymarket traders, while still cut-heavy, are a shade more skeptical.

As McCullough put it: “All people are doing is extrapolating the past as the future—they’re saying we get the rate cut because the labor data is terrible and Trump is telling [the Fed] to go really big.”

The stagflation seen in #Quad3 labor slowing has been obvious—already priced into the weakening dollar and suppressed two-year yield.

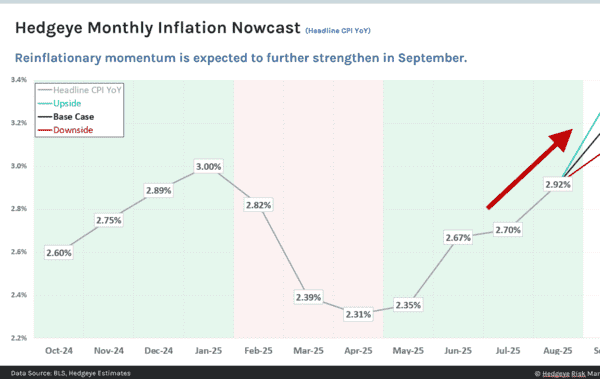

But with the USA Quad Count of 3-2-1 (Q3 #Quad3, Q4 #Quad2, Q1 2026 #Quad1), what happens when growth and inflation re-accelerate in Q4’s #Quad2?

Market Structure at Extremes

The options market reveals extreme positioning ahead of the Fed.

Market makers are long gamma creating mechanical volatility suppression.

Think of it like shock absorbers on a car—when dealers are long gamma, they trade against price moves, smoothing out the market’s bumps.

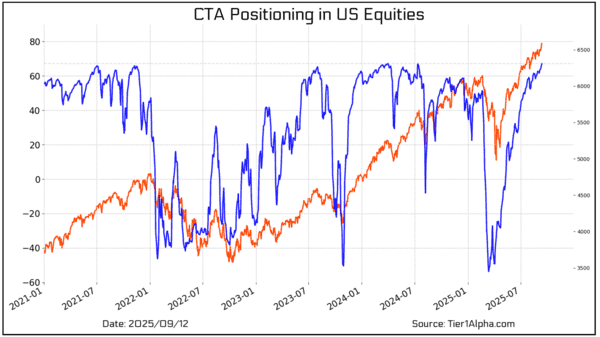

But the real extreme is in systematic positioning. Vol-control funds and CTAs are near five-year highs in equity exposure.

These systematic strategies have to deleverage when volatility rises. With positioning this extreme, they’ve become sellers waiting for a trigger.

Bottom Line

We’re not in the business of making calls. We execute on process.

For daily Macro analysis subscribe to The Macro Show, and see our tactical Asset Allocation updates in ETF Pro Plus.