Is the global economic order shifting? Lately, many economies are questioning the U.S dollar’s dominance (DXY) as inflation erodes other currencies, like the Japanese Yen (JPY) hitting multi-year lows.

From a technical perspective, the JPY/DXY ratio has logged four straight yearly drawdowns, dropping by roughly 35% to 0.06 – A level last seen in the late 1980s, pushing Japan into a renewed economic crisis today.

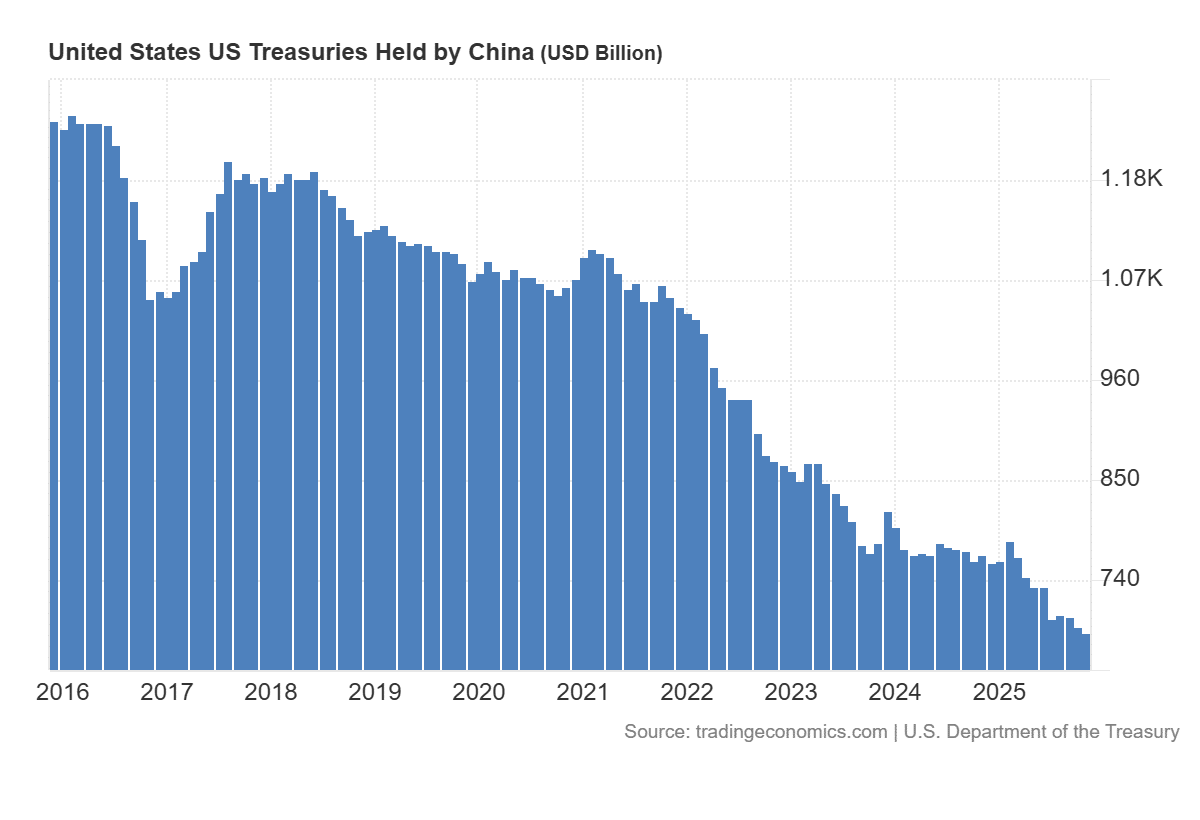

Against this backdrop, it’s not surprising that China appears to be acting early to limit broader fallout, with its U.S Treasury holdings falling to an 18-year low of $686.6 billion in November 2025.

Source: TradingEconomics

In practical terms, falling Treasury holdings usually point to less dependence on U.S debt, broader diversification into alternative assets, and a “strategic” effort to reduce exposure to the dollar-driven volatility.

China’s gold reserves seemed to reinforce this shift. Gold holdings climbed to a record 2.3k tonnes, moving in lockstep with the sell-off in the U.S Treasuries, underscoring China’s growing role in reshaping the global economic order.

Notably, this move isn’t isolated. Other countries are following suit, fueling a broader “gold rush.” As Kobeissi Letter noted, investors added $95 million to the gold ETF, marking the largest single-day inflow since October 2025.

In essence, the gold rally looks like it’s just getting started, strongly backed by China. Hence, the question is – Where does this leave Bitcoin [BTC], and more broadly, U.S President Donald Trump’s “crypto capital” dream?

China’s role shifts the Bitcoin and crypto-capital debate

The shift in the global economic order comes at a tough time.

With momentum building against the U.S dollar and gold reclaiming its “safe-haven” status, U.S economic stress is showing thanks to rising debt and a “shift” of investor capital towards China’s tech stocks.

And yet, the U.S isn’t stepping away from its crypto ambitions. The SEC recently announced a joint meeting with the CFTC to “deliver on President Trump’s promise” of making the U.S the crypto capital of the world.

Source: X

However, China’s moves are reshaping the global order. On one hand, they are testing Bitcoin’s safe-haven status, as investors flock to gold, silver, and other metals, while U.S. Treasury sell-offs push yields near 5%.

From a technical perspective, BTC is losing momentum, still down roughly 30% from its $126k peak. Gold, by contrast, is breaking records, highlighting a clear shift in what investors now see as the go-to “hedge.”

What’s more, analysts say this could be just the beginning.

In fact, some are already speculating a $7,000/oz target for gold. In this setup, China is emerging as a major hurdle. Nor just for Bitcoin, but for U.S President Trump’s broader push to lead the global crypto market.

Final Thoughts

China is reshaping the global order, with treasury sell-offs and record gold accumulation challenging Bitcoin and global U.S influence.

Gold has been rallying, with analysts eyeing $7,000/oz on the charts and highlighting a changing investor preference.

Previous: Dogecoin – Understanding the impact of whales’ redistribution of 410M DOGE

Next: Double Zero: Explaining why 2Z’s 10% rally faces downside risks