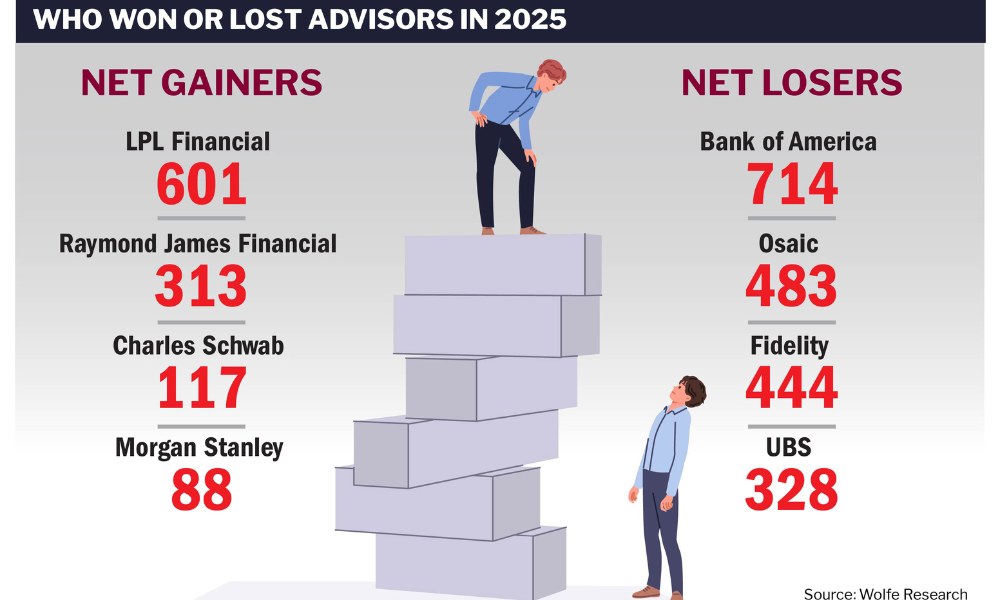

Meanwhile, Bank of America and Osaic lead firms with largest net declines, according to Wolfe Research.

Triggered in part by the sale of privately held Commonwealth Financial Network, with close to 2,900 financial advisors, and a stock market that just wouldn’t quit and was up 17.9% last year, 2025 was a tumultuous year for financial advisors jumping from one firm to a new one, looking for better compensation and service at a new home.

According to a note Monday from Wolfe Research, the biggest net gainers last year of financial advisors were: LPL Financial, up 601; Raymond James Financial; plus 313; Charles Schwab, an increase in headcount of 117; and Morgan Stanley, up 88.

The biggest losers of financial advisors in 2025, according to Wolfe Research, were: Bank of America, a net decline of 714; Osaic, down 483; Fidelity, negative 444; and UBS, a drop of 328.

A spokesperson for UBS declined to comment, as did a spokesperson for Bank of America.

“Advisor movement during the integration period was a natural part of completing a large-scale platform transition, and overall results aligned with our expectations,” a spokesperson for Osaic wrote in an email. “What’s most important is that attrition has meaningfully stabilized, with trends in the fourth quarter of 2025 indicating a return to pre‑integration levels.”

The winners and losers in last year’s recruiting skirmish are likely to surprise few employed in the financial advice industry; Wolfe Research last June pegged Bank of America, Osaic and UBS as firms with the largest attrition or net loss of financial advisors through the first five months of the year.

“Looking back at the last half decade or so, consolidation is the most significant factor when it comes to assessing the market for financial advisor recruiting,” said Jodie Papike, CEO of Cross-Search, a recruiting firm. “That gets advisors looking around. Then comes service. Advisors want to know if the service is better at another broker-dealer?”

The institutions named above all work with thousands of financial advisors, some with multiple firms under a roof where an advisor can park his or her registration and work.

One question facing the industry is exactly how many financial advisors jumped ship after LPL said at the end of last March it was buying its rival Commonwealth Financial for $2.7 billion in cash. LPL said its target was 90% of the firm’s advisors and assets.

Last week, InvestmentNews reported a new analysis from AdvizorPro and Muriel Consulting showed that 653 advisors have departed Commonwealth since the firm announced its sale to LPL, resulting in a 77.5 percent retention of the 2,900 advisors Commonwealth had at the time.

Since the deal announcement, close to 365 advisors – about 12% – have left Commonwealth, according to Wolfe Research. That figure did not include dozens of advisors at the firm at the time who had decided to leave prior to LPL’s announcement it was buying Commonwealth.

The methodologies around counting financial advisors have been skewed at times in the industry, particularly by who is doing the tally and how.

For example, such figures are sometimes based on employment histories of registered employees who are not necessarily advisors. Those workers are can be employed in marketing, administrtive roles, operations, or other jobs.

LPL Financial Holdings on Thursday afternoon releases its fourth quarter earnings and is expected to address the advisor retention question at that time.