11m agoFri 5 Sep 2025 at 3:45amMarket snapshotASX 200: +0.3% to 8,854 points Australian dollar: +0.2% to 65.28 US cents S&P 500: +0.8% to 6,502 pointsNasdaq: +1% to 21,707 pointsFTSE: +0.4% to 9,216 points EuroStoxx: flat to 550 points Spot gold: +0.3% to $US3,557/ounce Brent crude: -0.2% to $US66.89/barrelIron ore: -0.2% to $US104.45 a tonneBitcoin: +0.7% to $US110,207

Prices current around 1:40pm AEST.

Live updates on the major ASX indices:

21m agoFri 5 Sep 2025 at 3:36am

Consumer revival to temper RBA rate-cut outlook: analyst

The Australian economy bounced back strongly last quarter, driven by a sharp rise in consumer spending, said Abhijit Surya, Senior APAC economist at Capital Economics.

“With households’ real incomes growing strongly and housing wealth increasing in tandem, we expect consumption growth to remain healthy going forward.”

Mr Surya added that he expected the RBA to deliver only two more 25 basis points rate cuts, rather than three.

“Moreover, the risk of an even shorter easing cycle cannot be ruled out.”

39m agoFri 5 Sep 2025 at 3:18amPublicly funded industries still dominating jobs growth

Also in today’s ABS release were figures on which sectors were creating jobs over the year to June.

“The growth in filled jobs was driven by the non-market sector, which comprises three industries — public administration and safety, education and training and health care and social assistance.

“Non-market sector filled jobs rose 0.3 per cent for the quarter and 3.6 per cent (168,400 jobs) through the year. This accounted for around 62 per cent of the growth in filled jobs through the year to June 2025.

“Market sector, the combined grouping of the remaining industries, rose 0.2 per cent for the quarter and 0.9 per cent (103,100 jobs) through the year. This accounted for around 38 per cent of the growth in filled jobs through the year to June 2025.

“Through the year to June 2025, hours worked grew 1.6 per cent, driven by the 3.5 per cent rise in the non-market sector industries that accounted for 60 per cent of the growth in hours worked. The market sector rose 0.9 per cent, accounting for the remaining 40 per cent of growth in hours worked.

“When comparing filled jobs by private and public sector, private sector jobs accounted for three-quarters of the growth in filled jobs over the past 12 months. Private sector filled jobs rose 1.5 per cent (205,300 jobs) and public sector filled jobs rose 2.8 per cent (66,600 jobs) over this period.”

So, at least up to the end of June, the public sector and industries largely underwritten by public money were accounting for the bulk of job creation.

Will the private sector step up as publicly funded employment growth drops off?

That’s probably the key question for the Australian economy over the coming year.

54m agoFri 5 Sep 2025 at 3:03am

If we know, you know

Is there more to woolies and coles story

– chrisso

Hello chrisso,

We all want to know more about what is going on with Woolies and Coles.

Our reporters are working hard on it as we speak.

Stay tuned!

1h agoFri 5 Sep 2025 at 2:55am

Trump warns of imposing tariffs on semiconductor imports

US President Donald Trump has said his administration will impose tariffs on semiconductor imports from companies that do not shift production to America.

“We will be putting a tariff very shortly,” Mr Trump said without giving an exact time, when speaking ahead of a dinner with major technology company CEOs on Thursday.

“Chips and semiconductors — we will be putting tariffs on companies that aren’t coming in.

“We will be putting a very substantial tariff, not that high, but fairly substantial tariff with the understanding that if they come into the country, if they are coming in, building, planning to come in, there will not be a tariff.”

Since returning to office in January, Mr Trump’s threat of tariffs has alienated trading partners, stirred volatility in financial markets and fueled global economic uncertainty.

He has made tariffs a pillar of US foreign policy, using them to exert political pressure and renegotiate trade deals and extract concessions from countries and companies that export goods to the US.

“If they are not coming in, there is a tariff,” Trump said in his comments on semiconductors,” the president said.

“Like, I would say Tim Cook [Apple CEO] would be in pretty good shape,” he added, as Cook sat across the table.

Apple, the iPhone maker, recently increased its total domestic investment commitment in the US to $600 billion over the next four years.

Taiwanese chip giant TSMC and South Korea’s Samsung Electronics and SK Hynix have announced investments in chip manufacturing in America.

Reporting with Reuters

1h agoFri 5 Sep 2025 at 2:37am

Perth businessman found guilty of fraud over $34 million

Perth businessman Chris Marco has been found guilty of more than 40 counts of fraud of more than $34 million after a five-week trial.

Marco had taken money from clients, telling them he would invest in schemes that promised high interest rates.

The corporate watchdog alleged that between July 2013 and October 2018, Marco obtained over $36.5 million from nine investors with the intention of defrauding them.

ASIC Deputy chair Sarah Court said the result delivered justice to investors who Marco defrauded.

Marco has been remanded in custody for sentencing on October 30.

My colleague David Weber has more.

1h agoFri 5 Sep 2025 at 2:20amFewer Australians working two or more jobs

As flagged by Dan earlier today, the Australian Bureau of Statistics has just released data about the number of Australians working multiple jobs.

The data show a 1.2% drop in multiple job holders to around a million people in the June quarter.

“Secondary jobs fell by 12,200 in the June quarter, and fell 1.9% or 20,500 jobs through the year to June,” said Sean Crick, the ABS head of labour statistics.

“June quarter 2025 was the first time we have seen two consecutive quarterly declines in secondary jobs in the six years since June quarter 2019. As a result, there are now 40,100 less multiple job-holders compared to six months ago in December quarter 2024.

“The fall in secondary jobs saw the proportion of people working multiple jobs decrease by 0.1 percentage points to 6.4%.”

With inflation easing and interest rates on the way down, it’s quite possible that fewer people have felt the need to top up their incomes with a second (third or fourth) job.

It’s also possible that as the jobs market has loosened it is becoming a bit harder to find extra work.

Interestingly, healthcare and social assistance have the largest number of people working in it as their secondary job, even more than retail or hospitality.

However, Australians are working more hours in the jobs they do have.

The growth in hours worked and main jobs drove an increase of 0.1 per cent in average hours worked per filled job, according to the ABS.

1h agoFri 5 Sep 2025 at 2:09amQantas’ former CEO Alan Joyce receives final bonus worth $3.8 million

Former Qantas chief executive Alan Joyce will take home his final bonus of $3.8 million in shares, according to the airline’s remuneration report, which was filed at the ASX today.

Mr Joyce’s bonus caps off a multi-year payment that has ballooned — along with the company’s share price which has soared to near record highs.

Meanwhile, the current CEO Vanessa Hudson’s bonus has been docked by $250,000 for the airline’s cybersecurity breach.

But overall, her total pay package has jumped to $6.3 million (an increase of 44% since last year).

Qantas also says it will not reduce executive bonuses in response to a Federal Court decision, which imposed a record fine of $90 million on the airline for illegally sacking 1,800 ground workers during the COVID-19 pandemic.

The company’s share price was up 1.4% to $11.94 (close to its highest levels ever) by around 12:05pm AEST.

2h agoFri 5 Sep 2025 at 1:50am

RBA hold in November cannot be ruled out: ANZ

Adam Boyton, head of Australian Economics at ANZ, has said he believes a rate cut in November is more likely than not, but the GDP figure increases the chances of a rate hold.

“If evidence of consumer spending momentum continues and weakness does not emerge in the CPI or labour market data, the RBA may assess the cash rate as broadly neutral with no further cuts needed,” he said.

“Rising housing prices could add to consumer momentum, with capital city housing prices up 0.8% m/m in August, the largest monthly increase since May 2024.”

With solid GDP growth of 0.6% q/q despite no growth in public demand in Q2, the private sector recovery is underway, according to an ANZ report.

The report noted that the RBA would likely interpret the strong increase in private demand as a sign of economic momentum.

Just bear in mind that the data does not capture the August rate cut or the full impact of the May rate cut.

2h agoFri 5 Sep 2025 at 1:32amSupermarket wage theft class action continues

The Federal Court has ruled that Coles and Woolworths need to work directly with underpaid workers in a long-awaited industrial relations case.

The ABC’s Bronwyn Herbert reports that Justice Nye Perram delivered a 198-page judgement on Friday concerning four separate legal cases against the major supermarkets.

These include two cases initiated by the Fair Work Ombudsman and two class actions led by former Coles and Woolworths managers.

The dispute involves the interpretation of retail award clauses, annualised salaries, and overtime calculations and the consequences of failing to maintain records.

Justice Perram has ordered that the proceedings go to case management in October before compensation, or the number of employees entitled to payouts is determined.

2h agoFri 5 Sep 2025 at 1:05am

Big group takes 3pc wage deal (with maybe more to come)

Interesting development today as NSW nurses and midwives have voted to accept a 3 per cent interim wage increase offer with improvements to working conditions, but they say it is “not the end” of their dispute with the state government.

Seems like for a big cohort of more than 50,000 workers, this is a “for now” deal.

According to my colleague, Miriah Davis, the interim offer will be back paid to July 1, plus 0.5 per cent in superannuation following years-long industrial action.

Public sector nurses and midwives will also see night shift penalty rates lifted from 15 per cent to 20 per cent, as well as a guarantee of two consecutive days off and no changes made to rosters without consultation.

Workers will also be free from night shifts if they have annual leave booked, unless requested.

Health Minister Ryan Park said about 56,000 healthcare workers across the state would benefit.

This deal would be a slide from what most workers are currently signing up for, if it were to be the final stop.

The Wage Price Index (WPI) is +3.4% for the year to June.

For public sector workers, it’s +3.7%.

So an interesting development.

3h agoFri 5 Sep 2025 at 12:56am

National fiscal boost booked for 2027 with the release of Bluey, The Movie

Book in a low-productivity, high-revenue day for the Australian economy because the release date of Bluey, The Movie has been announced.

Here’s Ludo Studio director Daley Pearson:

“Bluey, The Movie has a release date! Brought to life by BBC Studios, Ludo Studio, and Walt Disney Studios and created and directed by Joe Brumm 💙 ✏️”

Bluey movie poster (Ludo Studios)

Bluey movie poster (Ludo Studios)

3h agoFri 5 Sep 2025 at 12:44am

Obstacles stacking up in Santos takeover bid: Verrender

The ABC’s chief business correspondent Ian Verrender sees the problems piling up in the bid for gas producer Santos.

= = = = = = = = = = =

Yet another obstacle in the path of Abu Dhabi’s mooted purchase of Santos.

The $36.4 billion proposal – the richest all cash takeover in Australian history if it ever proceeds – has been beset by unexpected delays and revelations of shoddy maintenance and undisclosed methane leaks at a key storage facility stretching back years.

The XRG consortium, which features the Abu Dhabi National Oil Company (ADNOC) as the driving force, has twice asked for extensions to its exclusive access as it trawls through the Santos accounts.

While a formal offer is yet to be launched, with the exclusivity period now extended until September 19, controversy over the proposed takeover has fired up the federal parliament.

Independent senator David Pocock has called for a Senate inquiry into the offer, to be finalised by December 9.

While the offer, if it proceeds, will be subject to a Foreign Investment Review Board assessment with a decision ultimately resting with the treasurer, Jim Chalmers, Senator Pocock has called for a public inquiry by a Senate Economics committee.

He wants the Senate to delve into the potential impact on Australian energy security, domestic gas prices and the tension between imports and exports.

He’s also calling for a deep dive into Santos’s remediation programs for decommissioned assets, and how a takeover would affect compliance with our climate obligations.

Pocock is also concerned about the effects on Australian sovereignty and national security if critical infrastructure is owned by a foreign government, and he’s calling for character assessments of all those involved in the XRG consortium.

That follows revelations, first published in the New York Times, about alleged support from a senior ADNOC director to a Sudanese rebel leader in that country’s ongoing war and famine.

3h agoFri 5 Sep 2025 at 12:34am

The US an outlier in ageing trend

Former Reserve Bank governor Luci Ellis and her colleague Ryan Wells have an interesting note about labour supply.

Always worth listening to.

Here’s the top line, the full note is linked at the bottom.

It is usually assumed that an ageing population means a shrinking workforce relative to total population. In many advanced economies, though, the opposite is true. Participation rates are on multi-decade upward trends in many economies, including Australia. Policy responses to ageing, such as raising pension ages, have helped offset the ageing effect, but are only part of the story. More important is that population ageing happens because people are living longer, healthier lives and having smaller families. Higher participation in the 55–64 age group and women aged 25+ has more than offset the rising share of older people. The US is an outlier, though. There, the participation rate for these groups has seen no upward trend in the past quarter-century. Moreover, participation of males aged 25–54 is lower than at the turn of the century, in contrast to peer economies where downward trends have ceased. This divergence is probably because the US has had worse trends in health and life expectancy. These cross-country demographic differences imply different conclusions for macro policy. In Australia, RBA (and Budget) forecasts assume no upward trend in participation from here. If it instead continues, labour market slack will rise more than these forecasters expect. By contrast, the US is developing a singular long-run labour supply issue, irrespective of current migration policies.

3h agoFri 5 Sep 2025 at 12:32am

Coles and Woolies face judgement day

Are you covering Woolies and Coles verdict

– chrisso

Hi Chrisso,

Yes, the ABC’s workplace reporter, Bronwyn Herbert, is leading coverage of the Federal Court judgement that will determine whether thousands of supermarket workers were underpaid.

I believe we’ll know the outcome over the next hour or so, and we’ll republish a link to her story here in the blog.

3h agoFri 5 Sep 2025 at 12:22am

More Gary More Often

Gary Stevenson is waging a war on inequality and bringing it to Australia for a speaking tour.

A way with words. A lot to say. A fascinating chat.

Loading…

3h agoFri 5 Sep 2025 at 12:12am

Market snapshotASX 200: +0.6% to 8,879 points Australian dollar: +0.1% to 65.20 US cents S&P 500: +0.8% to 6,502 pointsNasdaq: +1% to 21,708 pointsFTSE: +0.4% to 9,217 points EuroStoxx: +0.6% to 550 points Spot gold: +0.2% to $US3,551/ounce Brent crude: -0.4% to $US66.75/barrelIron ore: -0.1% to $US104.55 a tonneBitcoin: +0.2% to $US110,615

Prices current around 10:10am AEST.

Live updates on the major ASX indices:

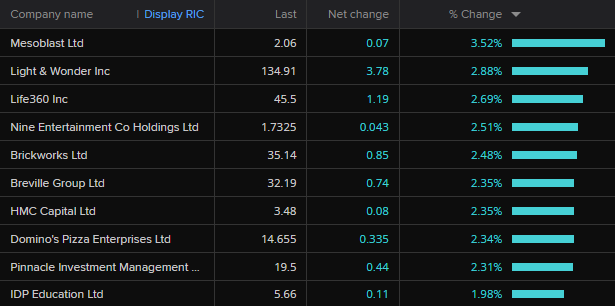

3h agoFri 5 Sep 2025 at 12:10amASX opens higher

The Australian share market is modestly higher at the open, with the ASX 200 up 0.4% to 8,860 points.

Discretionary consumer stocks, banks and financials, real estate and tech are leading the way amid renewed global optimism that the Fed will cut US interest rates this month, potentially allowing other central banks to follow.

ASX 200 biggest gains around 10:05am AEST (LSEG)

ASX 200 biggest gains around 10:05am AEST (LSEG)

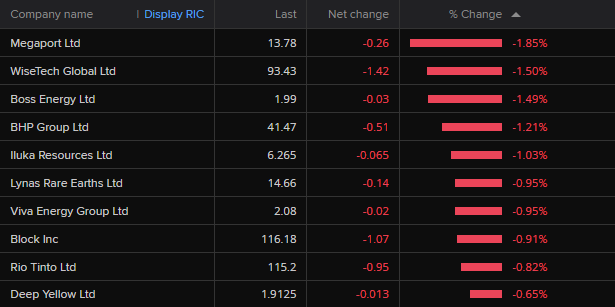

Meanwhile, falls for mining, energy and utilities prevented bigger gains overall for the benchmark index.

ASX 200 biggest falls around 10:05am AEST (LSEG)

ASX 200 biggest falls around 10:05am AEST (LSEG)

3h agoThu 4 Sep 2025 at 11:58pm

S&P 500 record high, as markets ‘lean in’ to interest rate cut hopes

Before we move ahead, let’s look back at movement in the US market overnight.

Here’s Kyle Rodda from capital.com with his take:

Wall Street rises to fresh record highs as rate cut bets deepenUS Non-Farm Payrolls data tipped to show softening jobs market

“Wall Street pushed to record highs as the markets leaned completely into a September rate cut from the US Federal Reserve in a couple of weeks’ time.

“Further underwhelming jobs data added to the case for a cut — and several more to come following that. US jobless claims were higher than forecast, while ADP Payrolls data undershot expectations. While the mainstream view on the latter has been that it has no predictive value when it comes to the official employment figures, that notion is being reconsidered.

“Although it’s true that the ADP figure rarely shows any meaningful relationship to the official report the week of their release, it’s been demonstrated that it’s quite a reliable indicator of labour market activity following revisions to the NFPs.

“When piling on top of that a market that’s more wary of the Bureau of Labor Statistics’ credibility because of President Trump’s attacks on the institution, as well as the proven shortcomings in its analytical process, the ADP is taking on greater import.

“The Non-Farm Payrolls data tonight is something of a sink or swim moment for the markets. The critical question is whether the slowdown in employment is continuing and gathering pace, and whether the Fed is in the right position to lower rates and buffer the economy, or if it’s behind the curve. Should the data point to an economy accelerating off a cliff, that could spark risk aversion and volatility in the markets. Consensus forecasts point to a relatively modest 75,000 job increase in the US economy last month, with the unemployment rate tipped to rise to 4.3%. The devil will be in the details, too. A recent fall in the participation rate, a lot to do with US President Trump’s immigration policies, has masked underlying weakness in labour demand.”

4h agoThu 4 Sep 2025 at 11:45pm

Iron ore prices rise above $US105/t

One of the nation’s top commodity experts is CommBank’s Vivek Dhar and he’s got a lot to say about the iron ore price.

“Iron ore spot prices rose above $US105/t (62% Fe, CFR China) yesterday –marking the highest price since 27 February 2025.”

And this amazing tidbit.

“The lift in prices was attributed to expectations of steel production restarts in northern China. Steel production was halted in northern China ahead of the military parade in Beijing on September 3 to reduce pollution and ensure blue skies. The parade marked the 80th anniversary of the end of World War II. The fall in China’s steel mill margins in recent weeks despite the temporary halt in China’s steel production suggests that steel demand has deteriorated. Some of this deterioration can be explained by the government mandates to ensure blue skies for the parade, given downstream construction activity was also curtailed. But reduced construction activity in northern China is only a small share of China’s steel demand.

“The nationwide construction activity index from China’s non-manufacturing PMI fell from 50.6 in July to 49.1 in August –marking the lowest reading since the pandemic. Excluding the pandemic, the August result was the lowest reading since the index began in May 2012. While adverse weather conditions was a factor in the contraction in China’s construction activity last month, it is unlikely to change the narrative that construction is on a downward trend. China’s construction activity includes both infrastructure and property construction.”

Where to from here?

“We expect iron ore prices will decline to $US95/t by Q4 2025 as China’s steel output falls ~2% in 2025. We believe policy to reduce steel production is the primary driver of the annual reduction in China’s steel output given our expectation of stimulus in coming weeks. High-cost iron ore supply (i.e. $US80-100/t), which came online after Brazil’s production was curtailed following the fatal Brumadinho dam collapse in January 2019, likely prevents iron ore prices from falling too steeply. We estimate that China’s steel output would need to fall 6-7%/yr to justify ~$US90/t by the end of the year. Stimulus is the key upside risk to consider as China’s economy aims to grow ‘around 5%’ this year. We anticipate that China’s policymakers will announce additional stimulus measures in late Q3 or early Q4 that help China’s commodity-intensive economy. Authorities have been leaning on policies that help consumption to help the economy in recent months, but we don’t think this will provide enough economic support.”

ASX 200: +0.3% to 8,854 points Australian dollar: +0.2% to 65.28 US cents S&P 500: +0.8% to 6,502 pointsNasdaq: +1% to 21,707 pointsFTSE: +0.4% to 9,216 points EuroStoxx: flat to 550 points Spot gold: +0.3% to $US3,557/ounce Brent crude: -0.2% to $US66.89/barrelIron ore: -0.2% to $US104.45 a tonneBitcoin: +0.7% to $US110,207

ASX 200: +0.3% to 8,854 points Australian dollar: +0.2% to 65.28 US cents S&P 500: +0.8% to 6,502 pointsNasdaq: +1% to 21,707 pointsFTSE: +0.4% to 9,216 points EuroStoxx: flat to 550 points Spot gold: +0.3% to $US3,557/ounce Brent crude: -0.2% to $US66.89/barrelIron ore: -0.2% to $US104.45 a tonneBitcoin: +0.7% to $US110,207