42m agoTue 23 Sep 2025 at 12:44amMarket snapshotASX 200: +0.2% to 8,826 pointsAustralian dollar: -0.1% at 65.93 US centsS&P 500: +0.4% to 6,693 pointsNasdaq: +0.7% to 22,788 pointsFTSE: +0.1% to 9,226 pointsEuroStoxx: -0.2% to 575 pointsSpot gold: +0.1% to $US3,749/ounceBrent crude: Flat at $US66.57/barrelIron ore: +0.1% to $US106.60 a tonneBitcoin: -0.1% to $US112,723

Price current around 10:40am AEST

Live updates on the major ASX indices:

2m agoTue 23 Sep 2025 at 1:23am

Queensland Alumina fined $1 million after caustic chemical release in Gladstone

Queensland Alumina Limited (QAL) has been fined $1 million after a major chemical release at its alumina refinery in Gladstone in 2022.

A high-pressure system ruptured, releasing a chemical that caused more than $800,000 in insurance claims from residents.

11m agoTue 23 Sep 2025 at 1:15am

Stretched to the limit

G’day Gareth. Missed your usual informative story on the weekend. Time off for good behaviour ?

– Phillip

Ha thanks Phillip.

I needed a little break to work on something much larger, which you’ll hopefully see in coming weeks..

13m agoTue 23 Sep 2025 at 1:12am

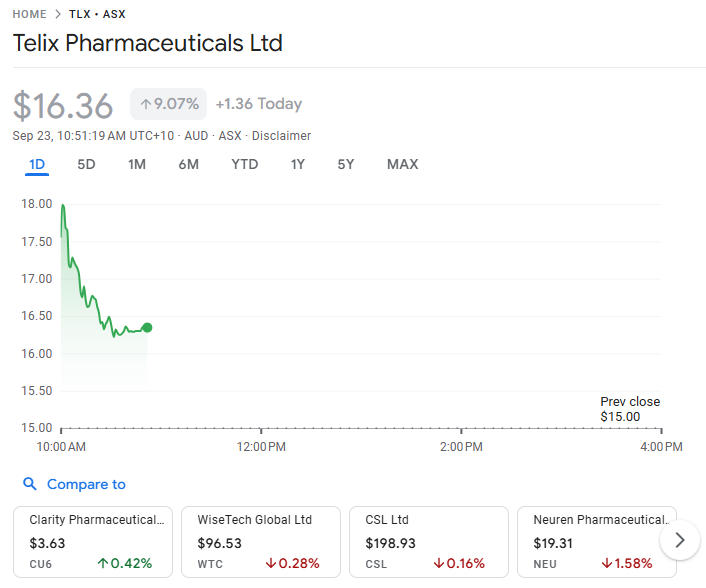

Telix Pharmaceuticals share price up 9pc

Wow, what’s happening with Telix today! Such a large increase.

– LK

Hi LK,

Telix told the stock exchange early this morning (before trading began) that it has been granted Transitional Pass-Through (TPT) payment status for Gozellix (kit for the preparation of gallium-68 (Ga) gozetotide injection), which is Telix’s next-generation PSMA-PET imaging agent for prostate cancer.

In its statement to the ASX it announced:

“This designation enables separate reimbursement for Gozellix under the Hospital Outpatient Prospective Payment System, effective 1 October 2025, and marks a significant milestone in Telix’s US commercial strategy.

“Gozellix has already been assigned a permanent Healthcare Common Procedure Coding System Level II code A9616 to be recognised by CMS and commercial health insurers, effective 1 October 2025.

“Additionally, patients are not subject to the 20% patient coinsurance under TPT.

That’s why its share price surged this morning on the opening bell.

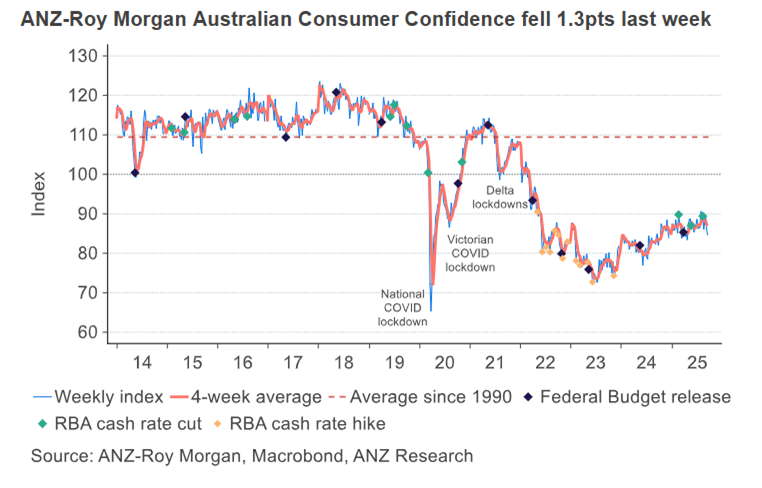

23m agoTue 23 Sep 2025 at 1:02amANZ-Roy Morgan survey shows consumer confidence fell again

23m agoTue 23 Sep 2025 at 1:02amANZ-Roy Morgan survey shows consumer confidence fell again

The latest ANZ-Roy Morgan consumer confidence survey is out.

It shows confidence fell 1.3pts last week to 84.6pts. The four-week moving average

declined 0.3pts to 87.0pts.

ANZ economist Sophia Angala said:

“ANZ-Roy Morgan Australian Consumer Confidence declined for the second consecutive

week, driven by falls across most subindices.

“Economic confidence weakened slightly, as

household confidence in the economy over the next year fell to its lowest level since 13 April

(the first survey week following US tariff announcements).

“Soft labour market data last week may have driven this result.

Ms Angala said looking ahead, ANZ-Indeed Australian Job Ads remain elevated, and a trend upwards in business conditions should see the unemployment rate remain low.

“That should support consumer spending, although the soft patch in confidence does present a note of caution,” she said.

48m agoTue 23 Sep 2025 at 12:37amMyer plunges on profit loss

Myer has slumped nearly 18% at open as the company swung to a loss for the financial year 2025 after incurring a one-off, non-cash impairment of Myer Apparel Brands goodwill.

The department store chain reported a statutory net loss after tax of $211.2 million, versus a profit of $43.5 million a year before.

The company reported that total sales for the year was $3,673.8 million, up 12.5% year on year.

Myer did not declare a final dividend.

Share price is down around 56% so far this year.

56m agoTue 23 Sep 2025 at 12:29amTop and bottom movers in the first 30 mins of trade

Gold stocks are leading the gains in the first 30 minutes of trade, with Ramelius adding 3.5%, Emerald Resources up 3.5%, Westgold climbing 3.8% and Bellevue Gold gaining 3.7%.

(LSEG)1h agoTue 23 Sep 2025 at 12:18amASX opens up

(LSEG)1h agoTue 23 Sep 2025 at 12:18amASX opens up

The Australian share market has opened higher, buoyed by strength in mining and gold stocks following a rally in commodity prices.

The ASX 200 index was up 0.4% to 8,843, by 10:15am AEST.

At the same time, the Australian dollar was flat at 65.98 US cents.

1h agoTue 23 Sep 2025 at 12:06am’The diversifier of choice is the yellow metal’: Pepperstone

Pepperstone’s Head of Research Chris Weston has put out a note this morning explaining why Gold is ripping higher:

Investment managers and traders can and are offsetting their US core equity with long exposures in gold.

With both short- and long-term statistical correlations between the S&P500 and US Treasuries remaining very low — and with the hedge itself (long gold) working so well and trending with such strong momentum — it’s not hard to see why few are refraining from taking out portfolio insurance through the options/volatility channels, even if vol is cheap and premium not overly costly … but for now, the diversifier of choice is the yellow metal, and this makes sense given its low correlation to other major asset classes and that fact [that] everyone can see it ripping higher.

1h agoMon 22 Sep 2025 at 11:36pmHundreds protest high-rise apartments in Sydney’s inner west

Residents packed a community forum on the Inner West Council’s Fairer Future Plan on Monday.

The proposal aims to build 31,000 new homes and includes rezoning parts of Ashfield, Croydon, Marrickville and Dulwich Hill to allow for high-density residential buildings up to 22 storeys high.

Councillors are due to vote on the Fairer Future Plan next Tuesday.

Read more from Ursula Malone.

2h agoMon 22 Sep 2025 at 10:48pmNvidia to supply OpenAI with data center chips

Nvidia says it will invest up to $US100 ($152) billion in OpenAI and supply it with data center chips, the companies said on Monday, marking a tie-up between two of the highest-profile players in the global artificial intelligence race.

The move underscores the increasingly overlapping interests of the various tech giants developing advanced AI systems. The deal gives chipmaker Nvidia a financial stake in the world’s most prominent AI company, which is already an important customer.

At the same time, the investment gives OpenAI the cash and access it needs to buy advanced chips that are key to maintaining its dominance in an increasingly competitive landscape. Rivals of both companies may be concerned the partnership will undermine competition.

The deal will involve two separate but intertwined transactions, according to a person close to OpenAI. Nvidia will start investing in OpenAI for non-voting shares once the deal is finalized, then OpenAI can use the cash to buy Nvidia’s chips, the person said.

“Everything starts with compute,” OpenAI CEO Sam Altman said in a statement. “Compute infrastructure will be the basis for the economy of the future, and we will utilize what we’re building with Nvidia to both create new AI breakthroughs and empower people and businesses with them at scale.”

The two companies signed a letter of intent to deploy at least 10 gigawatts of Nvidia systems for OpenAI and said they aimed to finalize partnership details in the coming weeks. The power for those chips is equivalent to the needs of more than 8 million US households.

Under the new deal, once the two sides reach a definitive agreement for OpenAI to purchase Nvidia systems, Nvidia will invest an initial $US10 billion, the person familiar with the matter said. OpenAI was most recently valued at $US500 billion.

Nvidia will start delivering hardware as soon as late 2026, with the first gigawatt of computing power to be deployed in the second half of that year on its upcoming platform, named Vera Rubin.

With Reuters

3h agoMon 22 Sep 2025 at 10:18pmAustralians lay dead as investors of Optus’s parent company bought shares

The actions by Optus management in the hours following a series of failed attempts by its customers to call triple-0 raises questions about the telco’s fitness to operate in Australia.

Here is the latest analysis on Optus by business correspondent David Taylor.

3h agoMon 22 Sep 2025 at 10:04pmAI ‘gold rush’

Artificial intelligence is set to become an integral part of the Australian economy, with tens of billions in benefits to be gained.

From robots to supercomputers, we are processing information faster than ever, and it is set to revolutionise the economy.

Across everything from the technology sector to education, health care, and professional services, AI promises to reshape commerce and industry.

Read more from business correspondent David Taylor.

3h agoMon 22 Sep 2025 at 9:57pm

ICYMI: Alan Kohler’s Finance Report3h agoMon 22 Sep 2025 at 9:48pmGold hits new highs

In precious metals, gold prices hit fresh record highs, buoyed by investors’ heightened expectations of a dovish rate-cut path, ahead of remarks by Fed officials and key inflation data later in the week.

“There’s a continued flow of safe-haven demand amid geopolitical matters that are still kind of wobbly, including the Russia-Ukraine war. Last week’s Fed interest rate cut and probably more Fed rate cuts coming by the end of the year” are also supporting prices, said Jim Wyckoff, senior analyst at Kitco Metals.

Spot gold rose 1.74% to $3,747.67 an ounce. US gold futures rose 2.03% to $3,745.90 an ounce.

With Reuters

3h agoMon 22 Sep 2025 at 9:45pmNvida and Apple lift Wall Street

All three of the major indexes on Wall Street have posted record closing highs for a third straight session on Monday, as shares of Nvidia rose after it said it would invest up to $US100 ($152) billion in OpenAI.

Also boosting indexes, shares of Apple rose after Wedbush raised the stock’s target price on strong demand signs for the iPhone 17.

Some Fed officials made remarks doubting the need for further rate cuts. Last week, the US central bank cut rates by 25 basis points and indicated more cuts would come at its upcoming meetings.

Both St. Louis Fed President Alberto Musalem and Atlanta Fed President Raphael Bostic, in separate remarks, said that while the Fed’s quarter of a percentage point rate cut at last week’s meeting was appropriate as a way to manage the risk of rising unemployment, lowering inflation remains the priority.

However, Fed Governor Stephen Miran, who last week dissented when the Fed cut the benchmark rate by a quarter of a percentage point and said a half-point cut was warranted, said on Monday that monetary policy “is well into restrictive territory.”

“There needs to be a catalyst for stocks to move materially higher, and markets appear to be kind of ignoring potential headwinds,” said Oliver Pursche, senior vice president and advisor for Wealthspire Advisors in Westport, Connecticut.

“We’re not making any calls that are broad-based or trying to time the market, but we’re certainly pointing out to clients and having portfolios reflect that we’re at all-time highs and valuations are getting stretched.”

Also worrying some investors were US President Donald Trump’s new visa fees for foreign workers, which drew widespread condemnation from technology executives and others across social media.

With Reuters

4h agoMon 22 Sep 2025 at 9:24pmASX to open higher

Good morning and welcome to Tuesday’s markets live blog, where we’ll bring you the latest price action and news on the ASX and beyond.

A rally on Wall Street overnight sets the tone for local market action today.

The Dow Jones index was up 0.2%, the S&P 500 gained 0.4% and the Nasdaq Composite advanced 0.7%.

ASX futures were up 16 points or 0.2% to 8,867 at 7:00am AEST.

At the same time, the Australian dollar was down 0.1% to 65.94 US cents.

Brent crude oil was down 0.1%, trading at $US66.59 a barrel.

Spot gold gained 1.7% to $US3,745.

Iron ore rose 0.1% to $US106.60 a tonne

ASX 200: +0.2% to 8,826 pointsAustralian dollar: -0.1% at 65.93 US centsS&P 500: +0.4% to 6,693 pointsNasdaq: +0.7% to 22,788 pointsFTSE: +0.1% to 9,226 pointsEuroStoxx: -0.2% to 575 pointsSpot gold: +0.1% to $US3,749/ounceBrent crude: Flat at $US66.57/barrelIron ore: +0.1% to $US106.60 a tonneBitcoin: -0.1% to $US112,723

ASX 200: +0.2% to 8,826 pointsAustralian dollar: -0.1% at 65.93 US centsS&P 500: +0.4% to 6,693 pointsNasdaq: +0.7% to 22,788 pointsFTSE: +0.1% to 9,226 pointsEuroStoxx: -0.2% to 575 pointsSpot gold: +0.1% to $US3,749/ounceBrent crude: Flat at $US66.57/barrelIron ore: +0.1% to $US106.60 a tonneBitcoin: -0.1% to $US112,723