46m agoWed 24 Sep 2025 at 12:14amMarket snapshotASX 200: -0.6% to 8,795 pointsAustralian dollar: -0.1% to 65.9 US centsWall Street: Dow Jones (-0.2%) S&P 500 (-0.6%), Nasdaq (-1%)Europe: FTSE (flat), DAX (+0.4%), Stoxx 600 (+0.3%) Spot gold: -0.1% to $US3,759/ounceBrent crude: +0.4% at $US67.91/barrelIron ore: -0.6% to $US106/tonneBitcoin: steady at $US112,036

Prices current around 10:15am AEST

Live updates on the major ASX indices:

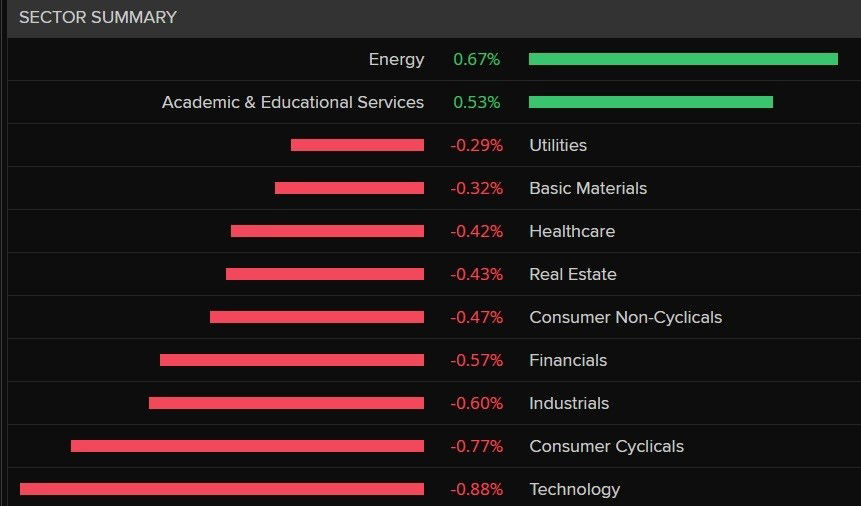

7m agoWed 24 Sep 2025 at 12:54amTech is worst performing sector on ASX, oil prices lift energy sector

The share market has been open for almost an hour and things haven’t improved.

The ASX 200 is still down 0.6% to 8,794 points.

Nearly every sector is down today with technology (-0.9%), consumer discretionary (-0.8%) and industrials (-0.6%) being the worst performers.

But the energy sector (+0.7%) is bucking the trend. It’s getting propped up by a 2% jump in oil prices overnight.

Energy is the best performing sector on the ASX 200. (Refinitiv)19m agoWed 24 Sep 2025 at 12:41amOptus appoints former Sydney Water boss to lead independent review

Energy is the best performing sector on the ASX 200. (Refinitiv)19m agoWed 24 Sep 2025 at 12:41amOptus appoints former Sydney Water boss to lead independent review

Optus has hired former Sydney Water CEO Kerry Schott AO to conduct a review into the causes of its latest scandal.

On September 18, its customers from WA, SA and NT were unable to call triple-0 due to a technical failure which led to at least three deaths.

“The Optus Board is working with Chief Executive Stephen Rue and his team to ensure we develop a full understanding of what went wrong and why, and what we need to do to prevent any repetition,” the company’s chair John Arthur said.

“In the interests of transparency — and to promote greater community understanding of what went wrong and why — we are committed to sharing the facts of the incident.

“The appointment of Kerry Schott to conduct an Independent Review will support these objectives.

“Dr Schott’s extensive cross-industry experience at both the executive and board level, and in both the public and private sectors, particularly in infrastructure, energy, and telecommunications ideally equips her to undertake this review.”

49m agoWed 24 Sep 2025 at 12:12amAustralian share market falls 0.6 per cent in early trade

We’re 10 minutes into the trading day, and the local share market has begun its day moderately lower.

The benchmark ASX 200 is down 0.6% to 8,793 points.

The broader All Ords index fell 0.6% to 9,085 points.

57m agoWed 24 Sep 2025 at 12:04amWhat to expect from August inflation data

The latest ABS inflation data is coming out at 11:30am AEST (in less than two hours).

Here’s what experts from Australia’s largest financial institutions are expecting to see from the August CPI (consumer price index).

Basically, they expect annual inflation will be anywhere between 2.7% and 3.1%.

Commonwealth Bank currency strategist Carol Kong:

“Our Australian economic team estimate the monthly CPI indicator will ease to 2.7%/yr in August, below the consensus estimate of 2.9%/yr.

“The trimmed mean CPI is expected to fall to 2.5%/yr.

“AUD/USD can soften slightly if our CPI forecasts prove correct.

“But the upward trend in AUD/USD remains intact because of the improving outlook for the global economy and the positive response of the Australian economy to interest rate cuts.”

Westpac senior economist Justin Smirk:

“Westpac estimates that the August Monthly CPI will lift 0.1% with the annual rate expected to lift to 3.1% due to base effects.

“There is a high degree of uncertainty, with the recovery in homebuilders’ margins is a notable upside risk.”

AMP chief economist Shane Oliver:

“The Monthly CPI Indicator for August is expected to rise slightly to 2.9% yoy despite a 0.2% mom [month-on-month] fall consistent with a fall back in travel costs and more getting electricity rebates.

Trimmed mean inflation is expected to ease to 2.6% yoy.

“The Melbourne Institute’s Inflation Gauge and the NAB business survey also point to some softening in price pressures in August.”

In case you need a refresher, the July inflation result was worse than expected (jumping to 2.8%, compared to the previous month’s 1.9%).

1h agoTue 23 Sep 2025 at 11:36pmHere’s a sneak peak at your future AI-driven economy

Across everything from the technology sector to education, health care, and professional services, AI promises to reshape commerce and industry.

The investment in artificial intelligence has been so incredible and unrelenting that analysts believe there are trillions more dollars globally waiting to play a role in the rollout of AI over the coming decade.

Though the Reserve Bank’s chief economist Sarah Hunter says there is no way to quantify, just yet, exactly how much artificial intelligence will add to economic growth in coming years.

Here’s the latest story by my colleague David Taylor:

Loading…1h agoTue 23 Sep 2025 at 11:17pmWestpac to axe 200 bank teller jobs

Westpac is planning to sack 200 bank tellers across its branches as part of its “digital first” strategy.

Instead, the banking giant will replace them with 200 lenders and bankers to achieve its “home lending and small business ambitions”, according to an email that Westpac’s retail banking head Damien Macrae sent to his staff yesterday.

The Finance Sector Union has slammed the bank’s decision, saying it “devastate staff and strip away

essential face-to-face banking and put profit before people”.

The FSU national secretary Julia Angrisano said:

“Westpac is asking loyal tellers to migrate customers to digital services that ultimately eliminate their own jobs. It’s callous and short-sighted.

“Communities still rely on face-to-face banking and workers should not be sacrificed for cost-cutting dressed up

as innovation.

“Our expectation is clear: no worker should lose their job. We will hold Westpac to account every step of the

way.”

Unsurprisingly, Westpac disagreed with that view, and said in an emailed statement:

“We adjust the composition of our workforce according to our investment priorities. While we continue to invest in extra bankers, other areas may need fewer resources.

“This means from time to time we make changes that may impact some roles and responsibilities as we actively manage costs and investment. As the skills and capabilities required in banking continue to evolve, so will our workforce.

We try to keep as many employees in the Westpac Group as we can, through retraining and redeployment. For those who leave, we help them with tailored support and assistance with career transition.”

2h agoTue 23 Sep 2025 at 10:42pm

Alan Kohler on gold prices, AI and market shocks

In case you need a refresher before the ASX opens today, I can certainly recommend Alan Kohler’s finance report.

Alan talked about Myer’s disastrous financial performance, Nvidia and OpenAI investing $US100 billion in each other (which he described as a “money-go-round”), and the price of gold surging to a new record, above $US3,700 per ounce.

He says gold is being driven higher by “US rate cuts and Donald Trump doing what he said he would do, which is increase tariffs and cut immigration, a demand shock combined with a supply shock”.

“Global investors see it as a bit like the combination of nitro

and glycerine, and they’re getting out of there before it blows.”

Loading…2h agoTue 23 Sep 2025 at 10:21pmOptus failure may not have been prevented by incoming triple-0 reforms

Efforts to beef up regulation of the telecommunications sector likely wouldn’t have prevented last week’s Optus outage, even if they were in force, according to experts who warn more significant changes are needed to avoid repeat catastrophes.

Instead they argue an investigation into the network’s infrastructure and the addition of conditions into the telco’s operating licence, along with stricter enforcement mechanisms, would go further to prevent serious outages.

The network failure, according to Optus’s version of events, began early on Thursday morning but it was not reported to the communications regulator until more than 10 hours later.

Those initial reports were “perfunctory and some were inaccurate”, Australian Communications and Media Authority chair Nerida O’Loughlin revealed on Monday.

For more, here’s the story by Keane Bourke and Maani Truu.

2h agoTue 23 Sep 2025 at 10:04pmCould AI and a universal basic income eliminate ‘meaningless jobs’?

Australia essentially did it during COVID. The world’s richest man thinks it’s inevitable. And a growing body of research suggests it could be the answer to AI shattering long-held high rates of employment.

A Universal Basic Income, or UBI, is a regular, obligation-free payment to everyone. There are different models, but those key elements endure in research studies and pilot projects around the world.

When the pandemic forced people to stay home, millions of Australians were able to remain in their jobs thanks to JobKeeper payments.

In addition, a further 2.2 million people who received some form or welfare payment (such as JobSeeker, colloquially called ‘the dole’) enjoyed a top-up payment called the coronavirus supplement that massively boosted — in most cases essentially doubled — their income.

At one point, more than 43 per cent of the adult population was receiving a regular, obligation-free payment from the government.

So with artificial intelligence threatening to shatter complete sectors and occupations, my colleague Daniel Ziffer asks whether it’s time to talk about a universal basic income to secure our future?

3h agoTue 23 Sep 2025 at 9:53pm

Market snapshotASX futures: -0.3% to 8,854 pointsASX 200 (Tuesday close): +0.4% to 8,846 pointsAustralian dollar: flat at 65.94 US centsWall Street: Dow Jones (-0.2%) S&P 500 (-0.6%), Nasdaq (-1%)Europe: FTSE (flat), DAX (+0.4%), Stoxx 600 (+0.3%) Spot gold: +0.5% to $US3,764/ounceBrent crude: +2% at $US67.87/barrelIron ore: -0.6% to $US106/tonneBitcoin: -0.3% to $US111,957

Prices current around 7:40am AEST

3h agoTue 23 Sep 2025 at 9:53pmWall Street falls after Powell says share prices are ‘fairly highly valued’

One reason why the ASX is likely to open lower is because it normally follows the direction of larger stock markets (particularly Wall Street).

US markets retreated from their record highs overnight as doubts about the artificial intelligence (AI) bull market weighed on investors’ minds.

Some of the biggest drags on the market were tech giants like Nvidia (-2.8%), Microsoft (-1%), Amazon (-3%), Meta (-1.3%), Tesla (-1.9%) and Oracle (-4.4%).

This led to a significant fall on the US tech index, the Nasdaq Composite, which fell 1% to 22,573 points. Meanwhile, the Dow Jones Industrial Average slipped 0.2% to 46,298 points, and the S&P 500 dropped 0.6% to 6,657 points.

The latest comments from US Federal Reserve chair Jerome Powell also contributed to the falls.

During a speech on Tuesday (local time), Mr Powell was asked how much emphasis his colleagues placed on market prices during their interest rate deliberations.

The Fed chair responded by saying:

“We do look at overall financial conditions, and we ask ourselves whether our policies are affecting financial conditions in a way that is what we’re trying to achieve,” Powell said. “But you’re right, by many measures, for example, equity prices are fairly highly valued.”

He also offered little hint of when he thinks the central bank might next cut interest rates.

Instead, Mr Powell stressed that the Fed needs to balance inflation concerns with a weakening job market.

He also said the decision on whether to cut rates again was a “challenging situation” and unclear.

3h agoTue 23 Sep 2025 at 9:51pmGold hits new record high, ASX to slip ahead of inflation data

Good morning, and welcome to the ABC’s finance blog! I’ll be your guide for the next few hours.

The local share market is expected to fall slightly when trading begins in a few hours. (ASX futures are pointing to a 0.3% drop in morning trade).

In economic news, the focus will be on the latest ABS inflation figures (for the month of August).

Here’s what NAB’s senior FX strategist Rodrigo Catril is forecasting:

“We expect the headline CPI [consumer price index] indicator to remain steady at 2.8% yoy [year-on-year].

“Key movers in the month will be a fall in electricity prices as rebates in NSW are reintroduced, though base effects from a year ago will see the yoy rate tick higher.

“The release will also include updates on inflation for a range of market services — these were relatively benign in Q2 [the second quarter] and are expected to remain moderate.”

The Australian dollar, meanwhile, was steady at about 65.95 US cents.

And spot gold has lifted to another record high. The precious metal’s value rose 0.5% to $US3,764 an ounce.

It appears to have driven by the latest remarks from Federal Reserve chair Jerome Powell, who raised concerns about the state of the US economy.

“Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation,” Mr Powell said at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon in Rhode Island.

“Two-sided risks mean that there is no risk-free path.”

ASX 200: -0.6% to 8,795 pointsAustralian dollar: -0.1% to 65.9 US centsWall Street: Dow Jones (-0.2%) S&P 500 (-0.6%), Nasdaq (-1%)Europe: FTSE (flat), DAX (+0.4%), Stoxx 600 (+0.3%) Spot gold: -0.1% to $US3,759/ounceBrent crude: +0.4% at $US67.91/barrelIron ore: -0.6% to $US106/tonneBitcoin: steady at $US112,036

ASX 200: -0.6% to 8,795 pointsAustralian dollar: -0.1% to 65.9 US centsWall Street: Dow Jones (-0.2%) S&P 500 (-0.6%), Nasdaq (-1%)Europe: FTSE (flat), DAX (+0.4%), Stoxx 600 (+0.3%) Spot gold: -0.1% to $US3,759/ounceBrent crude: +0.4% at $US67.91/barrelIron ore: -0.6% to $US106/tonneBitcoin: steady at $US112,036