The bank was instructed to release a timeline. But it omits some important entries, including a fateful special board meeting on Valentine’s Day, the Spinoff can reveal.

Scroll down for a comprehensive timeline.

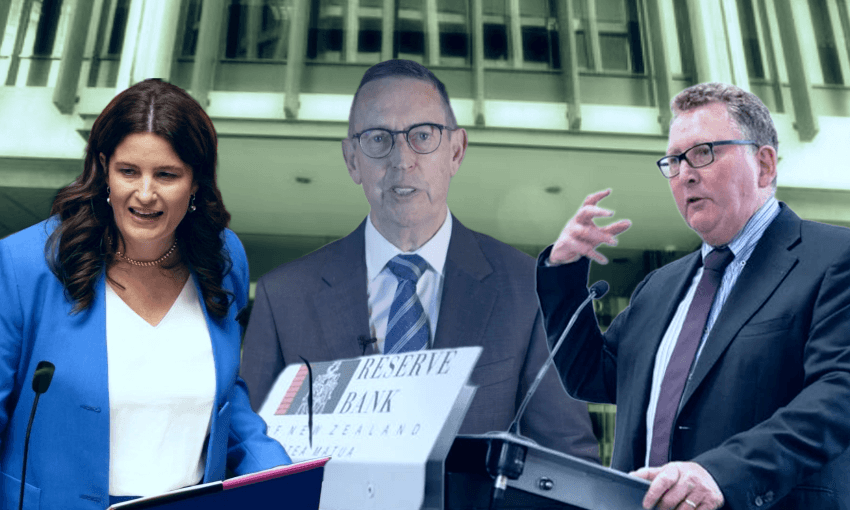

Resignations by both the governor and the board chair of the Reserve Bank of New Zealand, separated by just six months, have delivered a welter of headlines over recent weeks. A drip feed of information – and at times misdirection – has in turn generated ongoing speculation around the circumstances of the departures of Adrian Orr and Neil Quigley, all the while raising suspicions of a cover-up and questions about whether politicians have overstepped in their influence on the central bank, for which statutory independence in monetary policy is considered sacrosanct.

A Spinoff attempt to parse the saga, drawing on official information releases, reporting by a range of media and conversations with those involved, has identified a number of previously undisclosed events, including a pivotal extraordinary board meeting on February 14 – less than three weeks before the announcement of Orr’s resignation. The Valentine’s Day meeting had been called to discuss a paper prepared by the governor and staff that explored a “minimum viable product” funding proposal.

On February 13, the day before, the Treasury provided advice to the minister of finance on the existing five-year funding bid from the governor. In a memo released yesterday, the Treasury tells Nicola Willis it “does not support the proposal due to significant value for money concerns and the proposal not aligning to your expectations in the March 2024 letter to focus the baseline review on low value spending and non-essential back-office functions”. It suggests that instead of the sought $981 million, five-year funding of $692 million would be more appropriate.

None of the above had been included in the timeline released by the Reserve Bank last week. That timeline, issued at the demand of the chief ombudsman after complaints about the bank’s response to official information requests, begins with an entry on February 20. Numerous documents that have been sought by a range of parties continue to be withheld by the Reserve Bank, which cites grounds of privacy and obligations of confidence.

Willis told the Spinoff yesterday via a spokesperson that she had not been made aware of the February 14 special board meeting. Of the minutes, she added: “My office has asked the Reserve Bank why they were not provided in response to previous Official Information Act requests. The bank has advised that the minutes of five board meetings were overlooked when responding to OIA requests. Obviously, that is completely unacceptable and underscores the importance of the Bank urgently reviewing the way it responds to public information requests.”

‘Obviously, that is completely unacceptable’: Nicola Willis

Deficiencies in responses to OIA requests were instrumental in the exit of the board chair. Quigley, who is also the vice-chancellor at University of Waikato, departed with immediate effect after 15 years on the board, including nine as chair, last Friday afternoon. Nicola Willis told Newstalk ZB: “If Mr Quigley had not offered his resignation, I would have asked him for it.”

The Reserve Bank has now provided the Spinoff with a copy of the minutes to the special meeting on February 14. They confirm that the chair said the paper prepared by Reserve Bank staff for discussion, centring on an adjusted $900m funding application, had been superseded by “strong signals from the minister and Treasury” he had received, “that a FYFA at $900m will not be accepted, that Treasury advice and the minister’s initial starting position are substantially lower, and that the Bank will need to show willingness to work with a much lower FYFA funding limit if it is to have influence on the minister’s final determination.”

Speaking to RNZ on Wednesday morning, Willis rejected suggestions she had not been sufficiently candid in previous accounts of the circumstances surrounding Orr’s exit, saying she had been “as upfront and transparent on this as you could be”. “It’s not helpful for the minister who doesn’t know the ins and outs of what they’re talking about to wade in with reckons,” Willis said. “I’ve left it to the Reserve Bank to communicate about this at all times … Ultimately, I haven’t been happy that they’ve done a good enough job of that.”

Willis told Newstalk ZB she had not read the contents of a “statement of concerns” issued to Orr, which has since been withdrawn by the board. She said: “I do not also know what response Adrian Orr, either personally or via his lawyers, gave to it. And I’m very conscious not to defame anyone and to be careful about how I characterise that letter when I have not seen it.”

Orr has not made any comment since his resignation in March. Appointed to lead the central bank by Grant Robertson when Labour came to power in 2017, he faced sharp criticism from the National opposition, most volubly over the response to the Covid crisis. As opposition finance spokesperson Willis said she was “appalled” by Robertson’s decision to reappoint Orr for five years in 2022 absent an independent review of the bank’s performance.

Willis has stressed that she has remained “very conscious” of respecting Reserve Bank independence throughout the recent saga.

Concerns about potential corrosion of the Reserve Bank’s pioneering independence on monetary policy settings have also been raised in relation to comments made by the prime minister. In an August 25 interview with Mike Hosking on Newstalk ZB, the prime minister said it was his practice to meet the governor ahead of official cash rate announcements and “can often give my views”, his “reckons and perspective” on interest rates.

In the most recent example he agreed with Hosking that the cut should have been twice the 25 points that materialised, and had “pretty much” shared that view with Christian Hawkesby, the acting governor, on behalf of the Monetary Policy Committee. Luxon later told reporters: “I want to be under no illusions. I do not direct the Reserve Bank. Its independence is sacrosanct.”

Orr declined a request for comment. Quigley directed inquiries to the Reserve Bank.

A timeline, wrapped around a timeline

What follows is a more comprehensive timeline than that issued by the Reserve Bank – theirs, however, is included in full and verbatim (italicised for clarity).

September 2024

The Reserve Bank board chair, Neil Quigley, and governor, Adrian Orr, present a proposal to Treasury, in its role as adviser to the minister, seeking funding of $981 million in operating expenditure over five years. The board is “actively involved in the preparation of this proposal through multiple reviews and updates as well as a focused workshop”.

(In April of 2024, the minister of finance had written in a letter of expectation to Quigley that she expected the Bank funding proposal to “align with the Crown’s fiscal sustainability programme”, which had sought 6.5% cuts across the public sector.)

February 13, 2025

The Treasury sends advice to the minister of finance on the existing five-year funding bid from the governor. Its “preliminary assessment of the Reserve Bank of New Zealand’s funding proposal” is offered “to support your discussion on 24 February 2025 with the RBNZ’s chair and governor on the 2025-30 FYFA [five-year funding agreement] and any earlier engagement with them.”

The top line: “The Treasury does not support the proposal due to significant value for money concerns and the proposal not aligning to your expectations in the March 2024 letter to focus the baseline review on low value spending and non-essential back-office functions.”

Treasury notes that $981 million would represent a significant increase from the previous five-year allocation of $655 million. Its counter-suggestion – based on what it calls “a bottom-up analysis” – is that “an adequate 2025-30 FYFA funding envelope would be around $692 million in opex [operating expenditure].”

February 14

At 7.39am, ahead of a special meeting of the Reserve Bank board, the governor emails a “context note” to the board. Having not been made aware of Treasury advice to the minister, he writes: “We have not heard from Treasury as to a preferred number – but we have responded significantly and continuously to their – and the Board’s – signalling regarding cost-effectiveness.” Orr has tabled for board discussion a “minimum viable product” proposal for five-year funding, revised to $900 million.

He adds: “The reduction in proposed expenditure alters the total and balance of risk the Board must traverse in the years to come – absent any unanticipated shocks. … The FYFA [five-year funding agreement] construct is deliberately five years to attempt to maintain appropriate operational independence for the central bank – for monetary policy and prudential settings, amongst other CB tasks as designated … The importance and clarity of operational independence for central banks is judged by global financial markets now and in the future. Not by any current government.”

At 10.15am, the special meeting of the Reserve Bank board opens. The chair asks at the outset that Reserve Bank management do not attend. The Spinoff understands that staff remain standing outside the meeting room for more than an hour. (“Closed door, board-only time is routine at Reserve Bank meetings,” said a Bank spokesperson.)

The chair asks that the $900 million proposal be put aside and notes he has “received strong signals from the minister and Treasury that a FYFA at $900m will not be accepted, that Treasury advice and the minister’s initial starting position are substantially lower, and that the Bank will need to show willingness to work with a much lower FYFA funding limit if it is to have influence on the minister’s final determination”.

The minutes record that the board then discuss “the need to have sufficient funding to deliver on RBNZ’s core mandate, and to support the statutory independence of the bank” and “the importance of the Board now being more directly involved in the FYFA process, including discussions with Treasury and the minister”. The chair asks the governor to prepare a new board paper “built around a funding envelope of $750m”, according to the minutes. “The paper should clearly explain the risks of funding at this level, and of funding at any lower level.” Finally: “It was agreed that the chair and the governor would meet with Treasury officials to advance the discussion and seek a basis for joint advice to the minister on the FYFA including any exclusions from it.”

Former Reserve Bank governor Adrian Orr (Photo: Hagen Hopkins/Getty Images)

February 18

A memo is sent to the board and Reserve Bank executive staff formally requiring that a document be provided to the board exploring a $750 million funding agreement.

An impact analysis prepared by staff and provided to the Spinoff estimates that a $750 million funding level would likely require “an indicative headcount reduction of between 182 and 265 based on a weighted average cost per headcount.” At that point the workforce numbered around 660. (In August, the Reserve Bank said it was looking to cut 142 roles.)

February 20

Meeting between Professor Quigley, Mr Orr and Treasury officials regarding the five-year funding agreement for the RBNZ. There was disagreement between Mr Orr and Treasury officials about the appropriate level of funding for the RBNZ.

The Reserve Bank chair writes to a Treasury official after a meeting which included discussion of the funding agreement: “I am sorry Adrian lost his cool with you this afternoon.”

February 24

Meeting between Professor Quigley, Mr Orr, the minister of finance and Treasury officials relating to:

Capital requirements for banks

The five-year funding agreement for RBNZ

Mr Orr emailed the RBNZ Board to relay his view of the discussions at the meeting with the minister of finance and to express his concerns about what level of funding was needed for RBNZ. Mr Orr stated that he considered that he was unable to perform his duties given the uncertainty over funding and described what he perceived as a lack of trust between the parties.

The lack of trust appears to stem largely from the process that led to the February 14 meeting and an absence of examination of the implications of a cut in funding on the Bank’s work. Concerns around proposed loosening to bank capitalisation requirements appear also to have played a part.

Orr recuses himself from further discussions on the funding agreement and leaves the meeting.

Minutes from the meeting note that Orr “made it clear” he disagreed with the Treasury over the funding necessary for the bank to meet its requirements and “expressed his frustration regarding the relationship between the RBNZ and the Treasury”, according to the Herald.

February 26

Mr Orr emailed the RBNZ board ahead of a meeting with the board, stating that the governor and the board are at an impasse due to the disagreements over funding and that it was for the board to take the next step.

Ahead of a planned board strategy day in Auckland, the governor had sought an expression of support to lead negotiations over the funding agreement. This was not provided. (A Reserve Bank spokesperson declined to comment on this, saying: “It is in the interest of the effective conduct of public affairs for the governor and the RBNZ Board to be able to engage in free and frank dialogue about disagreements to do with the governance of RBNZ. This is particularly the case where tensions arise. If this information were released, this could limit this type of communication in the future.”)

Mr Orr met with the RBNZ board. Following this meeting Professor Quigley emailed Mr Orr advising that the board intended to write to him with its concerns.

February 27

Mr Orr advised the board chair that he will remain out of the office until resolution of the matter and that Christian Hawkesby would be acting governor. This was agreed to by the board.

Professor Quigley, on behalf of the non-executive members of the board, writes to Mr Orr to set out various concerns relating to:

The tenor of dialogue at meetings with Treasury officials on 20 February and the minister of finance on 24 February 2025

His apparent lack of trust in the RBNZ board, minister of finance and Treasury

Whether he would be able to undertake his role with lesser funding.

The letter sought Mr Orr’s response to the concerns raised.

This is the “statement of concerns”.

March 3

Mr Orr rejected the assertions in the letter but accepted that he considered there was a lack of trust between the parties.

March 5

An exit agreement was reached between Mr Orr and RBNZ, which included Mr Orr agreeing to resign and for the board to withdraw the 27 February letter.

The governor’s resignation is announced. The finance minister says she is disinclined to “characterise the reasons”. The chair of the Reserve Bank board, Neil Quigley, says the resignation is a “personal decision” from someone who “feels he’s achieved the things he wanted to achieve”.

An “exit agreement” is negotiated between the parties, with terms including a “non disparagement” clause.

The board withdraws its “statement of concerns” – the veracity of which the governor had questioned.

March 6

A paper was circulated to the RBNZ Board to:

Approve the acceptance of the resignation of Adrian Orr

Approve the exit agreement entered into

Note the next steps are for the board to recommend a temporary governor.

March 14

Quigley sends a memo to the minister of finance, via the office of the governor (“due to the sensitive nature of the document”), acquiescing to the reduction in funding sought. The board chair writes: “The proposed $750 million would represent a reduction of approximately $234 million or 24% over the five-year period compared to the RBNZ’s anticipated expenditure for the current financial year (adjusted for inflation). While there is significant uncertainty in forecasting forward over a five-year period given the level of change required, the RBNZ board is fully engaged with the process of bringing the Bank’s spending down from the level of the current year and to meeting the funding target that we are proposing.”

He adds: “In making our proposal the RBNZ board has considered two fundamental challenges associated with change to RBNZ expenditure at the proposed level: 1. While some reductions in spending may be identified relatively quickly, any reductions in staffing in key operational areas will require careful consideration of operational risk and retention of core capability. The majority of this complex change will not be able to be completed in the current financial year so will result in costs in 2025/26 and thus in the new FYFA.

“2. The culture within the Bank has evolved to embrace the funding uplift provided over the past seven years, and bringing Bank spending back to levels consistent with a FYFA of $750 million will involve changing that culture as well as reducing headcount.”

April 1

A minute of the Expenditure and Regulatory Review Cabinet committee – also released yesterday – notes that the minister of finance has negotiated a new five-year funding agreement for $750 million and intends to sign the new agreement as soon as possible.

The minister advises: “The Treasury has undertaken a review of the Reserve Bank’s funding proposals, and I have discussed and agreed the final terms of the new funding agreement with the Reserve Bank’s chair.”

April 9

A funding agreement is signed by Willis, Quigley and Hawkesby, with a total operating expenditure of $750 million across five years. It specifies that there will be no carrying over of any underspend year-to-year.

Quigley says: “Our new FYFA presents an opportunity for RBNZ to shape ourselves for the future. Our priority in the coming months will be to work with our people to redesign our way of working to optimise our resources while continuing to deliver on our mandate.”

April 16

A new five-year funding agreement for the Reserve Bank is announced by the minister of finance, set at $750 million.

June

The Reserve Bank hires a senior lawyer in response to the finance minister “urging more transparency” in official information responses “and querying omissions in their summary of events”, Willis will later tell the NZ Herald. “They engaged a KC [King’s Counsel] and pushed back on my view, emphasising their operational independence in responding to OIA requests.”

June 11

Quigley attracts further criticism from experts and commentators after rebuffing a question from an Interest.co.nz reporter about whether he had met stated Reserve Bank commitments to transparency with the rejoinder: “I’m not interested in having you question me like you’re a lawyer.”

August 25

The prime minister, Christopher Luxon, explains to Mike Hosking that he “can often give my views” to the Reserve Bank governor (who chairs the Monetary Policy Committee) ahead of interest rate decisions.

Neil Quigley. Photo: University of Waikato

The Reserve Bank announces that independent international experts Sir John Vickers, Thorsten Beck and Elena Carletti have been commissioned to “review and challenge our analysis” on minimum capital requirements.

(In response to questions from the Spinoff about whether preliminary advice had already been received from this group, the Reserve Bank acknowledged that the group had “provided some initial thoughts prior to consultation”, but that “the views expressed in the consultation paper are those of the Reserve Bank”. The spokesperson added: “The independent experts will provide their full and final views once they’ve had the chance to have a detailed review of the consultation material and consider the feedback received on the consultation from stakeholders.” The review process is expected to conclude in time for decisions to be made by the end of the year.)

August 28

The Reserve Bank releases a timeline of events, as required by the chief ombudsman, following media complaints about its responses to official information requests. (The full contents of that timeline are included in this timeline in italics.)

Quigley offers the following comment alongside the timeline: “The chief ombudsman has asked us to release a timeline of events covered by this information but has not required any additional documents or other information to be released. The chief ombudsman has also provided guidance on the different grounds that applied to withhold information and where the public interest lies. We therefore conclude that apart from being late with our OIA responses, the approach we took in responding to OIA requests was a reasonable one to the requests and met the overall public interest by balancing transparency with privacy and other legitimate concerns.”

August 29

In a 5.50pm statement, the finance minister announces Quigley’s immediate resignation, with the following commentary: “Mr Quigley has decided that having overseen a number of key workstreams for the Bank, now is the appropriate time for him to hand over to a new chair. Mr Quigley departs with a new funding agreement in place, a major review of capital settings out for consultation and the recruitment of a new governor well-advanced. He leaves the Bank well-positioned for the future. I thank him for his service and wish him well for the future.”

Shortly afterwards, in an interview with Heather du Plessis-Allan on Newstalk ZB, Willis says she had raised with Quigley in discussions earlier in the day concerns around the release – or non-release – of materials relating to Adrian Orr’s departure. “I had expressed to him my concern that the Bank’s reputation was being impacted, and he had agreed with me that that was a serious matter.”

She says: “I had expressed to him clearly my views, and he had also expressed to me that, with the government’s decision to establish a new medical school at the University of Waikato, that he did want to be able to focus his efforts on work for the university.”

Had Quigley not resigned, Willis confirms, she would have asked him to.