Canadian Highlights

Canada is likely to avoid a technical recession, with July GDP showing a rebound from the second quarter’s contraction and Q3 growth tracking in line with our forecast.

July’s payroll report showed job vacancies slipping further, signaling a weaker hiring appetite and supporting our expectation for the unemployment rate to rise.

Below-trend growth and softer labour demand point to enough slack in the economy to justify another Bank of Canada cut in October.

U.S. Highlights

With the House and Senate unable to pass a continuing resolution and both chambers on recess until next week, a government shutdown looks increasingly likely on October 1st.

President Trump announced new tariffs on pharmaceuticals, furniture and heavy trucks on Thursday, all effective October 1st. However, exemptions on pharmaceutical tariffs likely mean most drugs will remain duty free.

Data out this week suggest the U.S. economy is faring considerably better than previously thought, but the softening labor market remains a concern for the Fed.

Canada – Canada’s Call to Diversify

Macro data took a back seat for much of the week, until the GDP report landed on Friday. Earlier, the spotlight was on central bankers and policymakers at the UN General Assembly. Both Prime Minister Carney and Governor Macklem warned of tectonic shifts reshaping the global economy, urging Canada to diversify trade and reduce our reliance on the U.S. Macklem went further, cautioning that tariffs have already hit trade-sensitive industries hard and put the economy on a permanently lower growth path. The latest data offered some encouragement – growth was supported by export-oriented industries. But it also underscored just how much work remains to make trade diversification a lasting driver of resilience.

Markets, meanwhile, stayed focused on near-term signals. Equity investors were uncertain early in the week, and the TSX Composite looked set to snap a seven-week winning streak. But late strength pushed the index marginally higher, extending gains by 0.1% on the week. Long-term yields climbed, ending nearly eight basis points above where they stood after the Bank of Canada’s September 17th cut.

The hard numbers showed an economy stabilizing after the second quarter’s trade shock. GDP expanded 0.2% in July, with the advance reading for August suggesting no growth. If September holds steady, Canada would avoid a technical recession, with Q3 growth tracking at an annualized 0.7%—right in line with our forecast. That’s still below-trend growth and reflects stabilization rather than renewed contraction.

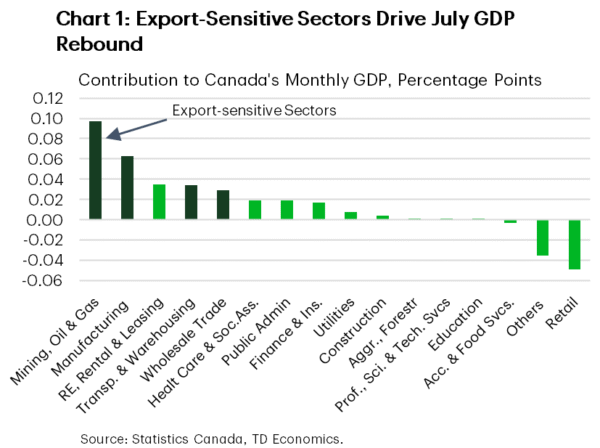

Encouragingly, the rebound was led by industries hardest hit by falling exports: mining, oil and gas, manufacturing, transportation, and wholesale trade (Chart 1). Transportation, in particular, saw a boost from activity tied to the LNG Canada project in Kitimat, built to ship natural gas to Asia rather than south of the border. This underscores how diversification beyond the U.S. can generate tangible growth benefits. The performance of these sectors also highlights their importance and how vulnerable Canada remains when they turn.

Still, July wasn’t all positive. Retail trade and information and cultural services contracted. Retail weakness echoed last week’s report that pointed to a likely August rebound, but the bigger picture suggests consumers are starting to ease off after driving much of domestic demand this year.

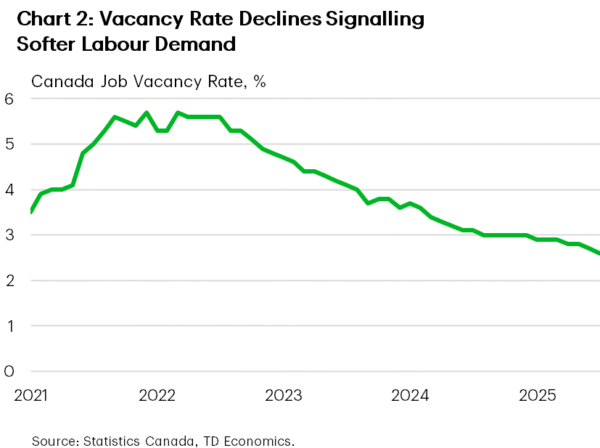

The cooling labour market is part of that story. July’s payroll report showed job vacancies slipping to 2.6% of total labour demand – the lowest since early 2017 (Chart 2). This signals a weaker hiring appetite, underlying our expectation for unemployment to rise to 7.3% by year-end.

Below-trend growth and softer labour demand point to enough slack in the economy to justify another Bank of Canada cut in October. As this week’s tariff announcements and tough CUSMA negotiations remind us, monetary policy can buy time. Turning rupture into opportunity will ultimately depend on the government’s ability to reorient the economy toward more diversified and sustainable growth.

U.S. – Economy Finds Renewed Strength

Numerous Fed speeches, a looming government shutdown, and a handful of new tariff announcements made for a busy week. Chair Powell’s remarks on Tuesday were parsed for any hints surrounding the Fed’s next move. However, Powell stuck to the script, reiterating the challenging environment faced by policymakers due to rising inflation and a weakening labor market. But fears of a softening economy were lessened this week, following an upward revision to Q2 GDP, a healthy read on August personal income & spending and a sharp drop in jobless claims. Meanwhile, President Trump’s announcement on Thursday evening to impose a 100% tariff on pharmaceuticals, 25% on heavy trucks, and 50% on furniture did little to jar markets. The S&P 500 is trading slightly higher on Friday morning but looks to end the week 0.6% lower.

In recent years, the threat of a government shutdown has become a regular occurrence marking the beginning of each new fiscal year. This year appears to be no different. House Republicans passed a ‘clean’ continuing resolution (CR) on September 19th that would have funded the government through November 21st. However, the bill failed to garner the 60-vote majority required to pass the Senate. Meanwhile, Senate Democrats put forward a separate CR, which came with several provisions, including a permanent extension to the expiring expansions of the Affordable Care Act subsidy. The bill had no chance of passing the Senate, but was meant to serve as a stake in the ground from which Democrats hoped to negotiate. However, this all backfired on Tuesday when President Trump cancelled his meeting with top Democratic leaders. With both the House and Senate on recess until next week, odds now heavily favor a government shutdown come October 1st.

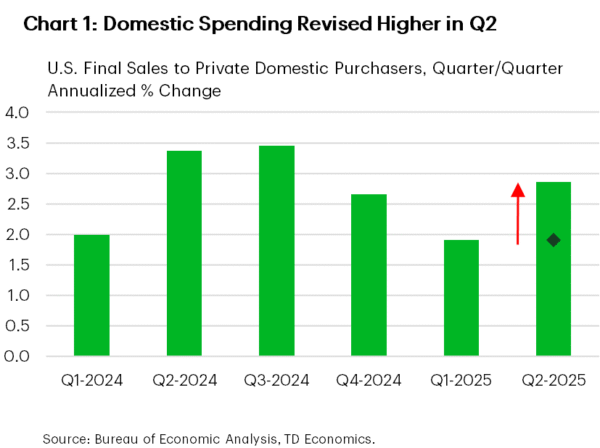

Turning to the economic data, the third revision to Q2 GDP showed a notable upgrade to growth (3.8% from 3.3%). Nearly all the additional strength came from consumer spending on services (2.6% from 1.2%) and business investment (7.3% from 5.7%). As a result, final sales to private domestic purchasers – our best gauge of underlying demand – was revised to 2.9% (from 1.9%), suggesting a more resilient economy (Chart 1).

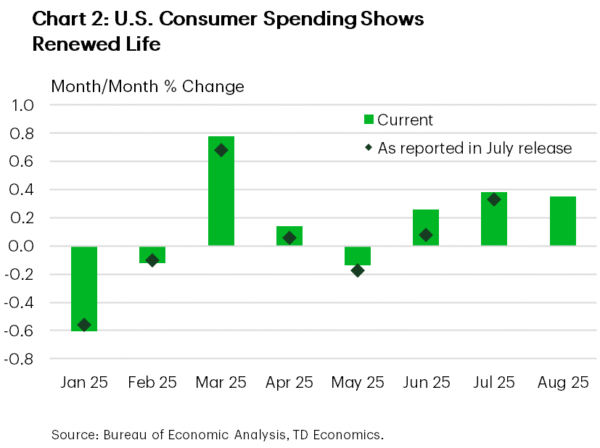

Encouragingly, the new-found momentum looks to have carried into Q3. Personal spending for August advanced 0.35% m/m (Chart 2), while income growth also remained healthy. Elsewhere, durable goods orders – a leading indicator of CAPEX – also came in on the hotter side. After incorporating this week’s data, our Q3 GDP tracking is now north of 3%.

But even with the renewed strength, the labor market remains an ongoing concern for the Fed. Higher frequency data on jobless claims and job openings suggest conditions have stabilized in the ‘low hire, low fire’ environment, but next week’s payrolls report will be key in shaping the Fed’s next move. However, a government shutdown would delay its release, leaving both policymakers and market participants in the dark.