Support CleanTechnica’s work through a Substack subscription or on Stripe.

The 3 reasons fossil fuels have such a hard time competing are:

It keeps getting harder to find and extract fossil fuels.

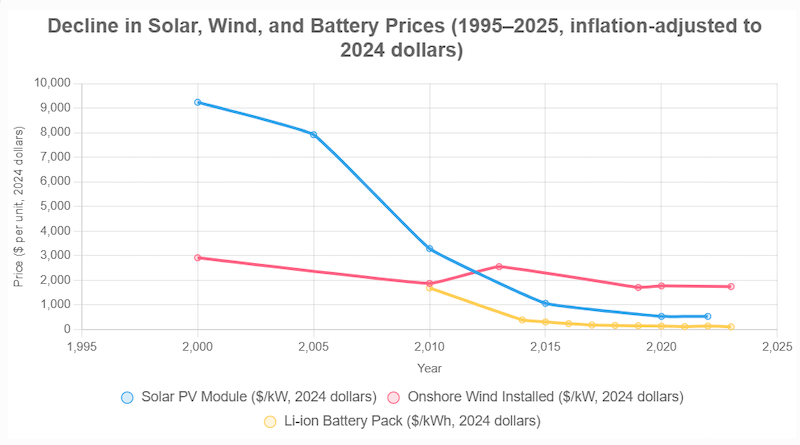

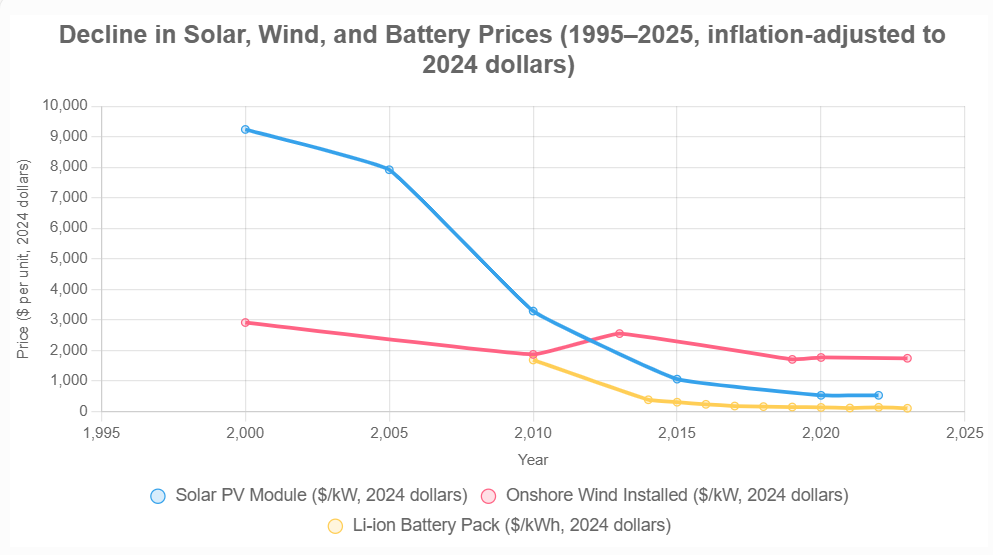

Renewable technology lowers costs far faster than technology improves fossil fuel cost due to Wright’s law.

People don’t like the negative effects of fossil fuels — namely, pollution and carbon impact — so they discourage its use.

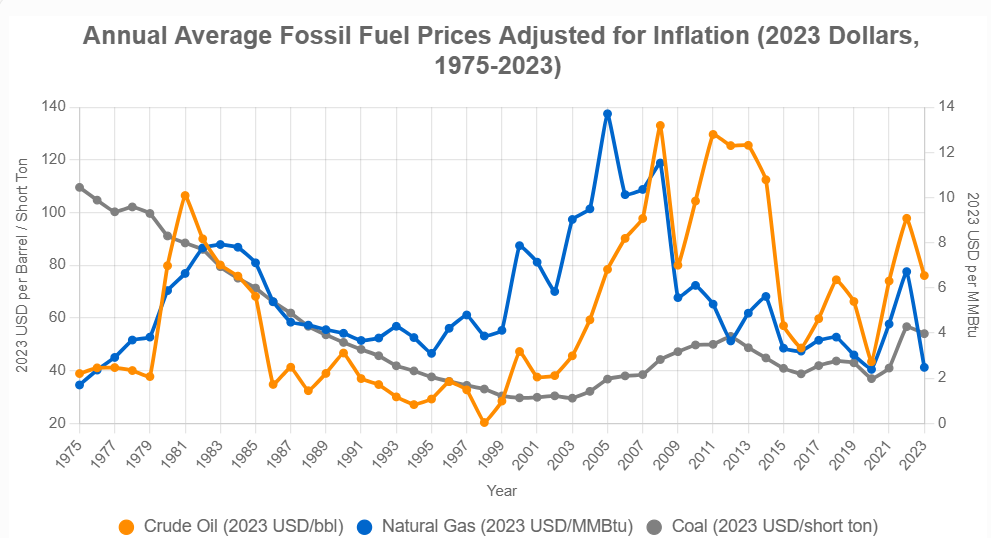

When All The Easy To Find And Extract Fossil Fuels Are Gone, Things Get Expensive

Its getting harder to find oil, gas, and coal since we already got the easy stuff. I’ve been tracking the energy shift for years now, and it’s fascinating how the old guard of fossil fuels is stumbling under its own weight. You see, the easy wins, like those shallow onshore oil fields, are long gone, picked clean decades ago. Now, companies are chasing the tough stuff: ultra-deep offshore drills plunging over 3 kilometers, icy Arctic frontiers, and tricky shale plays that scream for cutting-edge tech. Think about it — the cost to discover a barrel of oil? It skyrocketed from $1.18 in 2001 to more than $3 by 2009, thanks to fancier seismic gear, beefed-up rigs, and pricier steel. And don’t get me started on the human side: these ops need elite crews, jacking up risks and bills even higher.

This research from Rystad Energy explains how the breakeven price of oil is higher in the new oil fields vs the sources we discovered years ago. Then there’s the geopolitical drama — Russia and Venezuela cranking up taxes and rewriting deals, spooking investors with that uncertainty tax. Fast-forward to today: inflation and supply snarls have nudged breakeven prices for new projects up 5% yearly, hitting $47 a barrel overall, with oil sands lagging at $57. As these finite reserves dwindle, it’s no surprise the tide’s turning. Without breakthroughs, fossil crunches will keep prices volatile, but hey, that’s our cue to accelerate the green revolution.

Wright’s Law Favors Renewables

Fossil technology continues to improve its efficiency (for example, fracking has allowed us to greatly increase oil and gas production in the US). However, there’s important nuance here. Wright’s Law is similar to the famous Moore’s Law of semiconductor progress, which has been pretty accurate for almost 60 years at predicting that the number of semiconductors (and therefore computing power) doubles every 2 years. Wright’s Law is more general, because it predicts price declines for all mass produced products. Wright’s Law states that the price of production for a given product will go down a fixed amount (different for different products) every time the cumulative number of units doubles. The insight this gives you is that costs go down in products that are relatively new and early in their production ramp. Fossil production doesn’t double nearly as quickly as wind, solar, and batteries, so costs don’t drop nearly as quickly.

People Don’t Like The Negative Effects Of Using Fossil Fuels

People around the world don’t like fossil pollution (carbon and traditional emissions), so fossil fuels have political headwinds (with the exception being the Trump administration). The world’s patience with fossil fuels’ dirty tricks, spewing CO2 and all those nasty traditional pollutants into our skies, is wearing thinner than a worn-out oil filter. From bustling European capitals to sun-soaked Pacific islands vanishing under rising seas, folks are fed up, demanding cleaner air and a stabler climate that doesn’t jack up insurance bills or scorch harvests. That’s fueling a tidal wave of political pushback: think bold COP pledges to slash oil, gas, and coal production that world leaders swore to in 2023 but are hilariously dragging their feet on, or national plans that straight-up sabotage 1.5°C goals. Voters everywhere, even across partisan lines, are cheering policies to curb carbon and pivot to renewables — 97% want fossil-free power grids in the next decade.

But here’s the wildcard: while the globe tightens the screws, the Trump administration’s firing up the drill bits, hell-bent on unleashing more natural gas, oil, and coal to “restore prosperity,” dismantling Biden-era climate wins and arguing federal law doesn’t even touch greenhouse gases. It’s a stark outlier in this green-leaning storm, but even that pro-fossil fervor can’t drown out the roar for a renewables revolution that’s already cheaper and smarter.

Conclusion

Solar and battery prices from ourworldindata.org, wind prices from nrl.gov, Inflation data from bls.gov, formatted by Grok 4 Fast

Solar and battery prices from ourworldindata.org, wind prices from nrl.gov, Inflation data from bls.gov, formatted by Grok 4 Fast

So, in summary, while renewables just get cheaper and cheaper every year, fossil fuels get cheaper when technology improves but get more expensive as it gets harder to find them. In addition, fossil fuels are very susceptible to extreme price volatility due to conflicts between nations. The positive and negative forces are fairly balanced and have caused inflation adjusted fossil fuel prices over the last 50 years to be relatively stable (even though they show a lot of volatility in the short term). If you go back further in time, 100 years, fossil fuels were the new technology and they did get a lot less expensive in that time period.

Fuel Price Data from eia.gov and Inflation data from bls.gov, formatted by Grok 4 Fast

Fuel Price Data from eia.gov and Inflation data from bls.gov, formatted by Grok 4 Fast

So, fossil fuels get less cost competitive as people get more annoyed with their pollution. Of course, fossil fuels still produce massive revenues and profits, so that drives massive political contributions and propaganda campaigns. These slow the transition (but can’t stop it) from fossil fuels to renewables.

Disclosure: I am a shareholder in Tesla [TSLA], BYD [BYDDY], and XPeng [XPEV]. But I offer no investment advice of any sort here.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Advertisement

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.