Smart Building Delivery Robot Market Forecast and Outlook (2025-2035)

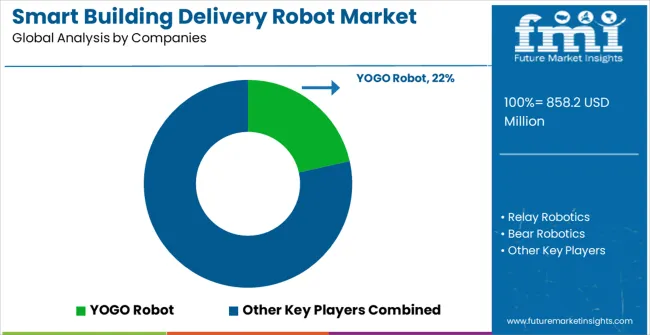

The global smart building delivery robot market is projected to grow substantially from USD 858.2 million in 2025 to USD 1,704.1 million by 2035, representing a forecasted CAGR of 7.1%. This steady growth reflects the rising adoption of automation and robotics in facility management, healthcare, logistics, and commercial buildings. Key growth drivers include increased investments in smart building infrastructure, advancements in AI and robotics, and growing demand for contactless delivery solutions, especially in the wake of post-pandemic operational shifts. Early adoption in sectors such as healthcare, hospitality, and e-commerce is contributing strongly to the market momentum.

Quick Stats for Smart Building Delivery Robot Market

Smart Building Delivery Robot Market Value (2025): USD 858.2 million

Smart Building Delivery Robot Market Forecast Value (2035): USD 1,704.1 million

Smart Building Delivery Robot Market Forecast CAGR: 7.1%

Leading Application in Smart Building Delivery Robot Market: Commercial Area (58.0%)

Key Growth Regions in Smart Building Delivery Robot Market: China, India, and Germany

Top Key Players in Smart Building Delivery Robot Market: YOGO Robot, Relay Robotics, Bear Robotics, Richtech Robotics, SoftBank Robotics, OTSAW, Beijing Yunji Technology, Dreame Innovation Technology, Pudu Technology, KEENON Robotics, CloudMinds, Gausium

Year-on-year (YoY) analysis reveals consistent growth across the forecast period, with annual increments rising from USD 60.9 million between 2025 and 2026 to USD 113.0 million between 2034 and 2035. The first three years (2025–2028) exhibit steady increases averaging 7% YoY, driven primarily by the integration of delivery robots in pilot projects for hospitals, hotels, and large office complexes. Adoption in this phase is boosted by cost reduction in robotics and improved reliability. This reflects the market’s early expansion phase, where innovation adoption is strongest and application diversity begins to broaden.

The mid-phase of the forecast (2028–2032) is marked by stronger growth, with annual increments increasing to over USD 75 million. A combination of broader deployment across commercial sectors and advancements in navigation systems, IoT integration, and AI algorithms drives this period. Regulatory frameworks for autonomous systems and safety standards also mature during this period, allowing accelerated adoption. 2030 marks an inflection point where growth accelerates, with the market crossing USD 1.3 billion, a significant milestone representing maturity in deployment and scaling across multiple smart building verticals.

Smart Building Delivery Robot Market Key Takeaways

Metric

Value

Market Value (2025)

USD 858.2 million

Market Forecast Value (2035)

USD 1,704.1 million

Market Forecast CAGR

7.1%

In the final phase (2032–2035), the market growth becomes even more robust, with annual increases exceeding USD 95 million. This reflects both the scale of adoption and expansion into new applications such as automated goods transport within smart cities, last-mile delivery in large complexes, and integration with building energy management systems. Growth restraints during the forecast period could include regulatory delays, high initial costs for integration, and cybersecurity risks. Advancements in technology and increasing demand for automation outweigh these challenges, positioning the market for steady expansion through 2035.

Why is the Smart Building Delivery Robot Market Growing?

Market expansion is being supported by the rapid increase in smart building development worldwide and the corresponding need for automated delivery systems that provide superior efficiency and contactless operation capabilities. Modern commercial facilities rely on consistent delivery performance and automation to ensure optimal building operations including office complexes, residential towers, and mixed-use developments. Even minor delivery inefficiencies can require comprehensive logistics protocol adjustments to maintain optimal building management standards and occupant satisfaction.

The growing complexity of building operations and increasing demand for autonomous delivery solutions are driving demand for delivery robot systems from certified manufacturers with appropriate navigation capabilities and technical expertise. Building management companies are increasingly requiring documented delivery efficiency and system reliability to maintain operational quality and cost effectiveness. Industry specifications and safety standards are establishing standardized delivery procedures that require specialized robotic technologies and trained maintenance personnel.

The shift toward contactless services accelerated by global health concerns is creating unprecedented opportunities for robotic delivery solutions that can operate safely in shared building environments. Smart city initiatives and urbanization trends are driving demand for intelligent building systems that can integrate seamlessly with automated delivery networks and building management platforms.

Opportunity Pathways – Smart Building Delivery Robot Market

Smart Building Delivery Robot Market Opportunity Pools

The decade ahead will be transformative for delivery robotics in commercial, residential, and mixed-use smart buildings. Facility managers, real estate developers, policymakers, and technology providers are converging on one goal: efficient, safe, and automated last-50-meters logistics inside and across buildings. This creates eight powerful growth pathways, together unlocking USD 9–14 billion in incremental revenue by 2035.

Pathway A – Core Productivity Expansion

Autonomous robots for food, parcel, and office supply delivery inside buildings accelerate adoption. Driven by labor shortages, 24/7 availability, and rising e-commerce in dense urban hubs.Expected revenue pool: USD 2.5–3.5 billion by 2035.

Pathway B – Functional & Specialty Robots

Robots tailored for specialized applications (healthcare delivery, pharmaceuticals, secure document transfer, high-temperature food service). Includes UV-sanitizing add-ons and cold-chain modules.Opportunity size: USD 1.2–1.8 billion.

Pathway C – Geographic Penetration

Emerging smart cities in Asia, Middle East, and Latin America scale robot adoption in new residential towers, hospitals, and office complexes. Early adoption programs in SE Asia and GCC drive growth.Potential pool: USD 1.8–2.6 billion.

Pathway D – Premiumization & Branded Solutions

Robots integrated with branded building ecosystems (luxury residences, tech-enabled offices, hospitality). Certification for safety, hygiene, and energy efficiency adds premium value.Incremental value: USD 0.8–1.2 billion.

Pathway E – Digital Integration & AI-Driven Optimization

AI-enabled navigation, cloud-based fleet orchestration, and integration with building management systems (BMS), elevators, and access controls. Delivery robots become part of a smart-services platform.Expected revenue pool: USD 1.0–1.6 billion.

Pathway F – Circular Service & Multi-Utility Innovation

Robots extend beyond delivery into waste collection, recycling transfer, and resource optimization within smart buildings. This multifunctional reuse of robot assets drives cost-savings.Market pool: USD 0.7–1.0 billion.

Pathway G – ESG & Eco-friendly Monetization

Robots reduce carbon footprint by replacing elevator trips by staff, cutting manual labor energy intensity, and enabling low-emission building certifications (LEED, WELL). Links to green financing and tenant ESG reporting.By 2035, may add USD 0.5–0.9 billion.

Pathway H – Public-Sector & Institutional Scale-Up

Government-funded smart city initiatives, hospital automation programs, and subsidies for robotics adoption in aging societies accelerate penetration. Cooperative procurement frameworks support small and mid-size facilities.Expected upside: USD 0.9–1.4 billion.

Segmental Analysis

The market is segmented by robot type, application, and region. By robot type, the market is divided into wheeled delivery robot, tracked delivery robot, and others. Based on application, the market is categorized into commercial area, residential area, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

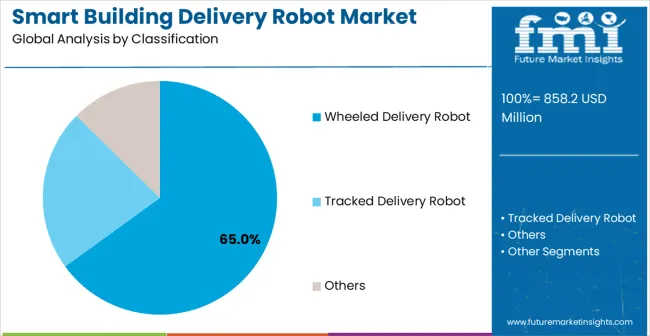

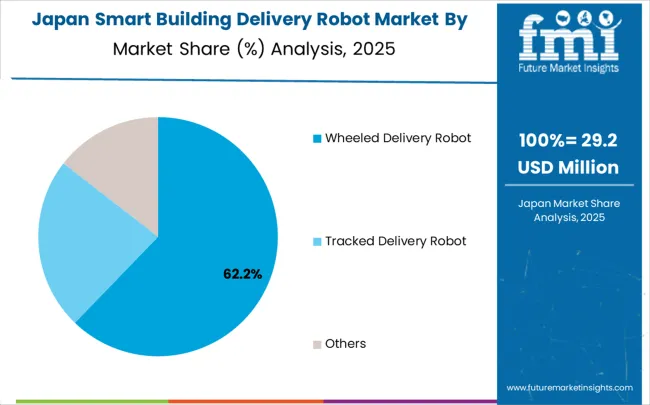

By Robot Type, Wheeled Delivery Robot Segment Accounts for 65% Market Share

In 2025, the wheeled delivery robot segment is projected to capture around 65% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of wheeled robotic systems that provide superior maneuverability and energy efficiency, catering to a wide variety of indoor building applications. The wheeled delivery robot is particularly favored for its ability to deliver smooth navigation across various floor surfaces and elevator systems, ensuring operational reliability in complex building environments. Office buildings, residential complexes, healthcare facilities, and retail centers increasingly prefer wheeled delivery solutions, as they meet diverse navigation requirements without imposing excessive infrastructure modifications or maintenance complexity.

The availability of well-established wheel-based navigation technologies, along with comprehensive sensor integration and mapping support from leading robotics manufacturers, further reinforces the segment’s market position. This robot type benefits from consistent performance across applications, as it is considered a versatile solution for environments requiring both precision navigation and reliable operation. The combination of efficiency, adaptability, and cost-effectiveness makes wheeled delivery robots a practical choice, ensuring their continued dominance in the smart building automation market.

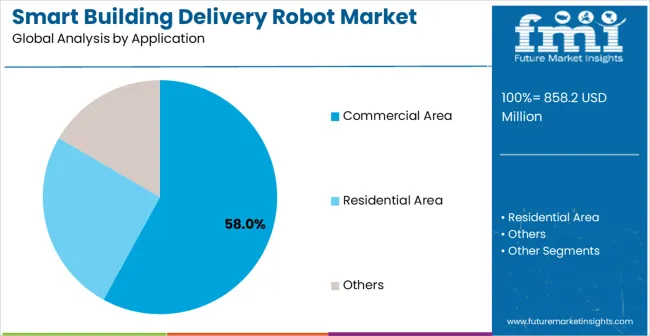

By Application, Commercial Area Segment Accounts for 58% Market Share

The commercial area segment is expected to represent 58% of smart building delivery robot demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of commercial building environments, where consistent delivery efficiency and professional appearance are critical to business operations and tenant satisfaction. Commercial applications often feature high-volume delivery requirements that demand continuous system availability throughout long business hours, requiring reliable and sophisticated delivery solutions.

Smart building delivery robots are particularly well-suited to commercial applications due to their ability to deliver efficient package distribution and document delivery services effectively, even during peak business periods and complex routing requirements. As commercial real estate developers expand globally and emphasize improved building services, the demand for delivery robots continues to rise. The segment also benefits from heightened competition within the commercial property industry, where building operators are increasingly prioritizing automation and efficiency as differentiators to attract and retain tenants.

With commercial building owners investing in smart building technologies and operational efficiency, delivery robots provide an essential solution to maintain high-performance building services. The growth of flexible workspace solutions, coupled with increased focus on contactless building operations, ensures that commercial area applications will remain the largest and most stable demand driver for smart building delivery robots in the forecast period.

What are the Drivers, Restraints, and Key Trends of the Smart Building Delivery Robot Market?

The market is advancing rapidly due to increasing smart building development and growing recognition of autonomous delivery advantages over manual delivery methods. Key drivers include rising urbanization trends, contactless service demand, and smart city initiative implementations requiring automated building solutions. The market faces significant challenges including higher initial investment costs compared to traditional delivery methods, need for specialized infrastructure integration, complex safety regulations for autonomous indoor navigation, and technical limitations in elevator integration systems. Performance optimization efforts and artificial intelligence advancement programs continue to influence delivery robot technology development patterns.

Development of Advanced Navigation Technologies

The growing development of sophisticated autonomous navigation systems is enabling superior indoor positioning accuracy with improved obstacle avoidance and route optimization capabilities. Advanced navigation technologies including LiDAR sensors, computer vision systems, and simultaneous localization and mapping (SLAM) algorithms provide superior navigation performance while maintaining safety standards and operational efficiency. These innovative technologies offer real-time path planning, dynamic obstacle detection, and multi-floor navigation capabilities. Advanced sensor fusion techniques such as ultrasonic sensors and depth cameras enable precise environmental mapping for specific building applications. These technologies are particularly valuable for building operators requiring reliable autonomous navigation supporting complex delivery requirements.

Integration of Artificial Intelligence and IoT Systems

Modern smart building delivery robot manufacturers are incorporating machine learning algorithms and Internet of Things connectivity features that enhance operational intelligence and system integration capabilities. Integration of predictive analytics, cloud-based management platforms, and optimized delivery scheduling enables superior performance tracking and comprehensive building system integration. AI technologies including natural language processing, behavioral learning algorithms, and predictive maintenance systems eliminate traditional operational limitations. IoT-enabled systems provide real-time performance monitoring, remote system management, and automated fleet coordination capabilities. Advanced intelligence features support operation across diverse building platforms while meeting various operational requirements and integration specifications throughout global smart building networks.

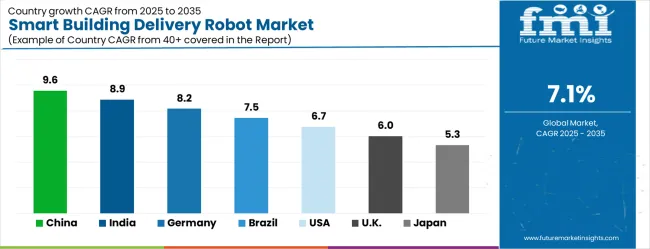

Analysis of Smart Building Delivery Robot Market by Key Country

Country

CAGR (2025-2035)

China

9.6%

India

8.9%

Germany

8.2%

Brazil

7.5%

United States

6.7%

United Kingdom

6.0%

Japan

5.3%

The market is experiencing robust growth, with China leading at a 9.6% CAGR through 2035, driven by massive smart city investments and increasing adoption of building automation technologies. India follows at 8.9%, supported by rapid urbanization and growing commercial real estate development. Germany grows strongly at 8.2%, integrating delivery robot technology into its established smart building infrastructure and industrial automation sectors. Brazil records 7.5%, focusing urban development modernization and smart building technology advancement initiatives. The United States shows solid growth at 6.7%, focusing on commercial building automation and smart city implementations. The United Kingdom demonstrates steady progress at 6.0%, maintaining established building automation applications and smart city initiatives. Japan records 5.3% growth, concentrating on technology advancement and precision robotics integration in smart building applications.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Growth Outlook for Smart Building Delivery Robot Market in China

China is projected to exhibit the highest growth rate with a CAGR of 9.6% through 2035, driven by unprecedented expansion of smart city infrastructure and increasing demand for building automation solutions. The country’s massive urbanization projects and expanding smart building development are creating substantial demand for autonomous delivery systems. Major technology companies including Alibaba, Tencent, and Baidu are establishing comprehensive robotics development networks to support the increasing requirements of building operators and property management companies across major urban centers including Beijing, Shanghai, and Shenzhen.

Government smart city initiatives under the 14th Five-Year Plan are supporting establishment of advanced building automation infrastructure and research centers, driving demand for sophisticated delivery robot technologies throughout major metropolitan areas. The Ministry of Housing and Urban-Rural Development has established comprehensive smart building standards, ensuring market growth for automated delivery solutions. Smart city modernization programs are facilitating adoption of delivery robot technologies that enhance building efficiency and operational automation standards across urban development networks. China’s position as the world’s largest construction market, expanding commercial real estate sector, and growing smart city investments are creating unprecedented opportunities for building delivery robot applications, while the country’s strong robotics manufacturing capabilities and technological innovation position it as the global leader in smart building delivery robot production and deployment across diverse building types and urban environments.

Growth Assessment of Smart Building Delivery Robot Market in India

India is expanding at a CAGR of 8.9%, supported by increasing urban development and growing recognition of building automation technology benefits. The country’s expanding commercial real estate sector and rising smart building adoption are driving demand for sophisticated automated delivery solutions. Property development companies including DLF, Godrej Properties, and Embassy Group are gradually implementing autonomous delivery systems to maintain operational efficiency and modern building standards across major urban hubs including Mumbai, Bangalore, and Delhi National Capital Region.

The Smart Cities Mission and Digital India initiatives are creating favorable conditions for building automation technology adoption, while increasing foreign direct investment in real estate technology is supporting advanced robotics integration. Urban development growth and smart building infrastructure expansion are creating opportunities for robotics suppliers that can support diverse building requirements and operational specifications. Professional training and research programs through institutions like Indian Institute of Technology and Indian Institute of Science are building technical expertise among building automation professionals, enabling effective utilization of delivery robot technology that meets building management standards and operational requirements. India’s rapidly growing urban population, expanding IT sector, and increasing commercial space demand are driving substantial growth in building automation applications, while the country’s large construction market and growing focus on smart infrastructure development support market expansion for automated delivery solutions across commercial and residential building sectors.

Sales Analysis of Smart Building Delivery Robot Market in Germany

Germany is projected to grow at a CAGR of 8.2%, supported by the country’s focus on building automation quality standards and advanced technology integration. German property technology companies including Siemens Real Estate, TLG Immobilien, and Deutsche Wohnen are implementing sophisticated delivery robot systems that meet stringent performance requirements and regulatory specifications. The market is characterized by focus on technological excellence, operational reliability, and compliance with comprehensive building safety standards established by the German Institute for Building Technology (DIBt).

Industry 4.0 initiatives and the High-Tech Strategy 2025 are promoting advanced building automation technologies and precision robotics capabilities that support delivery system innovation. Real estate industry investments are prioritizing advanced delivery robot solutions that demonstrate superior performance and durability while meeting German environmental and safety standards. Professional certification programs through institutions like the German Facility Management Association (GEFMA) are ensuring comprehensive technical expertise among building automation professionals, enabling specialized delivery system capabilities that support diverse building applications and operational requirements. Germany’s leadership in automation technology, strong commercial real estate sector, and focus on green building development are creating cross-industry synergies for delivery robot applications, while the country’s aging population and focus on building efficiency are driving demand for advanced automation solutions and high-performance building management systems across office and residential developments.

Opportunity Analysis of Smart Building Delivery Robot Market in Brazil

Brazil is growing at a CAGR of 7.5%, driven by increasing urban development and growing recognition of building automation technology advantages. The country’s expanding real estate sector is gradually integrating autonomous delivery systems to enhance building capabilities and operational efficiency. Property development companies including Cyrela, MRV Engenharia, and Brookfield are investing in delivery robot technology to address evolving market expectations and building management standards across major urban regions including São Paulo, Rio de Janeiro, and Belo Horizonte.

The Smart Cities Program and private sector modernization initiatives are facilitating adoption of advanced building technologies that support comprehensive automation capabilities across regional markets. Brazil’s growing commercial real estate sector and increasing collaboration with international building technology providers are creating opportunities for delivery robot technology development and application. Professional development programs through universities and real estate institutes are enhancing technical capabilities among building management professionals, enabling effective delivery robot utilization that meets evolving building standards and operational requirements. The country’s large urban population, growing e-commerce sector, and increasing commercial building development are driving substantial opportunities for automated delivery applications, while government initiatives promoting smart city development and urban infrastructure modernization support market expansion and technology adoption across public and private building networks throughout the Brazilian real estate landscape.

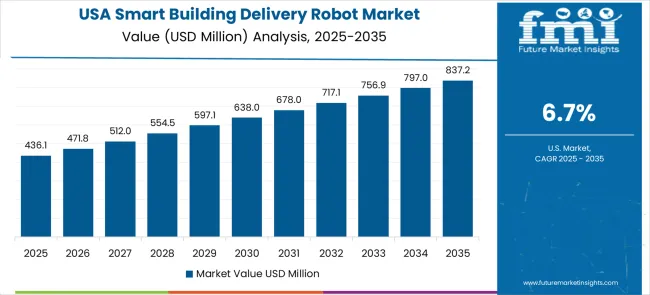

Demand Outlook for Smart Building Delivery Robot Market in the United States

The USA is expanding at a CAGR of 6.7%, driven by established real estate industries and growing focus on building automation advancement. Large property management companies and technology providers including CBRE, JLL, and Amazon are implementing comprehensive delivery robot capabilities to serve diverse commercial and residential building requirements. The market benefits from established regulatory frameworks through local building codes and safety standards, along with professional training programs that support various building automation applications across property management facilities and smart building developments.

The Department of Energy funding and National Institute of Standards and Technology initiatives are supporting advanced building automation technology development, while private sector investment in proptech solutions is accelerating delivery robot innovation. Real estate industry leadership is enabling standardized delivery robot utilization across multiple building types, providing consistent operational quality and comprehensive building service coverage throughout regional markets. Professional certification programs and continuing education requirements are building specialized technical expertise among building automation professionals, enabling advanced delivery system capabilities that support evolving building requirements. The USA large commercial real estate market, focus on contactless building services, and growing smart building adoption are creating substantial market opportunities for autonomous delivery solutions, while the country’s strong technology sector and innovation ecosystem position it as a global leader in building delivery robot technology development and deployment across diverse commercial and residential building markets.

In-depth Analysis of Smart Building Delivery Robot Market in the United Kingdom

The UK is projected to grow at a CAGR of 6.0%, supported by established property sectors and growing focus on building automation capabilities. British property companies including Land Securities, British Land, and Canary Wharf Group are implementing delivery robot systems that meet Building Research Establishment Environmental Assessment Method (BREEAM) standards and regulatory requirements. The market benefits from established building automation infrastructure and comprehensive training programs for building management professionals across England, Scotland, Wales, and Northern Ireland.

The UK Green Building Council and Innovate UK funding are supporting building technology development and commercialization, while government smart city initiatives promote delivery robot advancement. Property sector investments are prioritizing advanced automation systems that support diverse building applications while maintaining established sustainability and operational standards. Professional development programs through building services engineering institutions and universities are building technical expertise among building professionals, enabling specialized delivery robot capabilities that meet evolving building requirements. The UK’s strong commercial property sector, established smart city initiatives, and advanced building automation infrastructure are creating favorable conditions for delivery robot technology development and adoption, while the country’s focus on eco-friendly building operations and net-zero targets is driving demand for efficient automated systems across public and private building networks.

Market Potential of Smart Building Delivery Robot in Japan

Japan is growing at a CAGR of 5.3%, driven by the country’s focus on robotics technology innovation and advanced building automation excellence. Japanese technology companies including SoftBank Robotics, Hitachi, and Panasonic are implementing advanced delivery robot systems that demonstrate superior performance reliability and operational precision. The market is characterized by focus on technological excellence, safety assurance, and integration with established building management workflows across major urban centers in Tokyo, Osaka, and Yokohama.

The ministry of land, infrastructure, transport and tourism’s building standards and the Society 5.0 initiative are promoting advanced building technologies and robotic integration in facility management processes. Technology industry investments are prioritizing innovative delivery robot solutions that combine advanced artificial intelligence with precision engineering while maintaining Japanese quality and reliability standards. Professional development programs through robotics engineering universities and research institutions are ensuring comprehensive technical expertise among building automation professionals, enabling specialized delivery system capabilities that support diverse building applications and operational requirements. Japan’s advanced robotics industry, aging society, and strong commercial building sector are creating substantial opportunities for delivery robot applications in efficient building operations and elderly-friendly building services, while the country’s focus on technological innovation and manufacturing excellence positions it as a leader in next-generation building delivery robot technology development and application across specialized building automation markets.

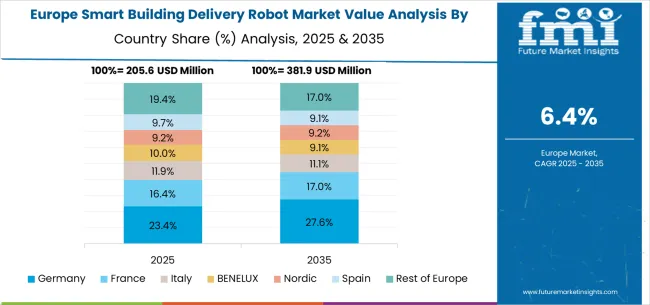

Europe Market Split by Country

The smart building delivery robot market in Europe is projected to grow from USD 1.8 billion in 2025 to USD 4.2 billion by 2035, registering a CAGR of 8.7% over the forecast period. Germany is expected to lead with a 24.5% share in 2025, followed by France at 16.3%, supported by strong adoption in healthcare, hospitality, and corporate campuses. Italy accounts for 13.1% of the market, while the BENELUX region represents 10.2% and the Nordic countries hold 9.8%, reflecting innovation-driven demand. Spain captures 7.6%, while the Rest of Europe collectively contributes 18.5%. By 2035, Germany will further strengthen its position with a 25.9% share, France will rise to 16.9%, and Italy will stand at 13.4%. BENELUX and the Nordics are projected at 10.0% and 9.7%, respectively, while Spain will account for 7.5%, and the Rest of Europe will represent 16.6%, indicating broad-based growth across the continent.

Competitive Landscape of Smart Building Delivery Robot Market

The market is defined by competition among specialized robotics manufacturers, building automation companies, and intelligent delivery solution providers. Companies are investing in advanced navigation technologies, artificial intelligence integration, sensor development, and comprehensive software platforms to deliver reliable, efficient, and user-friendly delivery robot solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

YOGO Robot offers comprehensive smart building delivery solutions with established robotics expertise and autonomous navigation capabilities. Relay Robotics provides specialized delivery robots with focus on commercial building applications and operational reliability. Bear Robotics delivers advanced autonomous delivery systems with focus on hospitality and service integration. Richtech Robotics specializes in intelligent delivery platforms with advanced AI technology integration.

SoftBank Robotics offers established robotics solutions with comprehensive software platforms and technical support capabilities. OTSAW delivers autonomous delivery robots with focus on security integration and multi-functional operations. Beijing Yunji Technology provides smart building automation solutions with delivery robot specialization, while Dreame Innovation Technology, Pudu Technology, KEENON Robotics, CloudMinds, and Gausium offer specialized manufacturing expertise, advanced navigation systems, and comprehensive product development across global and regional market segments.

Global Smart Building Delivery Robot Market – Stakeholder Contribution Framework

The smart building delivery robot market is emerging as a cornerstone of automated facility management, reshaping logistics, service efficiency, and occupant experience in commercial complexes, hospitals, campuses, and residential high-rises. With rising labor shortages, digitalization mandates, and eco-friendly targets, the sector faces pressure to balance cost-efficiency, safety, and seamless integration with building systems. Coordinated action from governments, industry bodies, OEMs/robotics developers, suppliers, and investors is essential to accelerate adoption of safe, scalable, and interoperable delivery robot ecosystems.

How Governments Could Spur Local Adoption and Ecosystem Growth?

Subsidies & Incentives: Offer grants or tax breaks for buildings deploying indoor delivery robots, especially in healthcare and public facilities.

Smart City Integration: Mandate robotics adoption as part of national smart building and urban innovation policies.

Regulatory Standards: Define safety, navigation, and cybersecurity guidelines for autonomous indoor operations.

Public Procurement: Deploy delivery robots in government hospitals, campuses, and transit hubs to set benchmarks.

Green Mandates: Link automation incentives with green building certifications and carbon-reduction goals.

How Industry Bodies Could Support Market Development?

Standardization: Develop interoperability standards between robots, elevators, doors, and building management systems.

Certification & Branding: Position European/Asian delivery robots as secure, efficient, and green-compliant solutions.

Training Networks: Provide facility managers and staff with curricula on robot integration, operations, and maintenance.

Policy Advocacy: Represent robotics stakeholders in labor regulation dialogues and urban planning frameworks.

How OEMs and Robotics Players Could Strengthen the Ecosystem?

Digital Integration: Bundle robots with AI-powered navigation, cloud dashboards, and IoT-enabled facility control systems.

Partnerships: Collaborate with smart building developers and facility management firms for turnkey solutions.

Innovation in Autonomy: Enhance multi-floor navigation, elevator integration, and real-time obstacle detection.

Service Models: Expand from hardware sales into subscription-based “Robotics-as-a-Service (RaaS)” offerings.

How Suppliers Could Navigate the Shift?

Component Innovation: Develop modular sensors, batteries, and AI chips tailored for indoor environments.

Eco-friendly Materials: Use recyclable casings and energy-efficient drive systems to align with green building mandates.

Portfolio Diversification: Expand from standard robots into specialized variants (medical delivery, hospitality service, office logistics).

After-Sales Support: Build local service networks for rapid maintenance and upgrades.

How Investors and Financial Enablers Could Unlock Value?

Infrastructure Financing: Fund robotics docking hubs, charging stations, and integration with elevators/escalators.

Venture Capital: Support startups innovating in autonomous navigation, AI vision, and RaaS business models.

Private Equity & M&A: Consolidate fragmented robotics startups into global players with cross-regional reach.

Insurance Models: Develop liability and operational risk products to de-risk adoption for facility operators.

Key Players in the Smart Building Delivery Robot Market

YOGO Robot

Relay Robotics

Bear Robotics

Richtech Robotics

SoftBank Robotics

OTSAW

Beijing Yunji Technology

Dreame Innovation Technology

Pudu Technology

KEENON Robotics

CloudMinds

Gausium

Starship Technologies

Savioke

TeleRetail

Scope of the Report

Item

Value

Quantitative Units

USD 858.2 million

Robot Type

Wheeled Delivery Robot, Tracked Delivery Robot, Others

Application

Commercial Area, Residential Area, Others

Regions Covered

North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa

Country Covered

China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries

Key Companies Profiled

YOGO Robot, Relay Robotics, Bear Robotics, Richtech Robotics, SoftBank Robotics, OTSAW, Beijing Yunji Technology, Dreame Innovation Technology, Pudu Technology, KEENON Robotics, CloudMinds, Gausium

Additional Attributes

Dollar sales by robot type and application segment, regional demand trends across major markets, competitive landscape with established robotics manufacturers and emerging AI technology providers, customer preferences for different navigation systems and delivery capabilities, integration with building management systems and security protocols, innovations in autonomous navigation and artificial intelligence features, and adoption of green energy solutions with enhanced operational efficiency for improved building automation workflows.