Canola hung on fairly well during the week ended Oct. 9, making a net gain of C$3.10 in its November contract at C$616.90 per tonne.

There had been strong expectations in the trade for canola to slip below the psychological level of C$600/tonne before the week was out, but that didn’t happen. However, some trade participants remain convinced that drop is still going to happen very soon.

And why not? Right now, there’s a great deal stacked against the Canadian oilseed.

Read Also

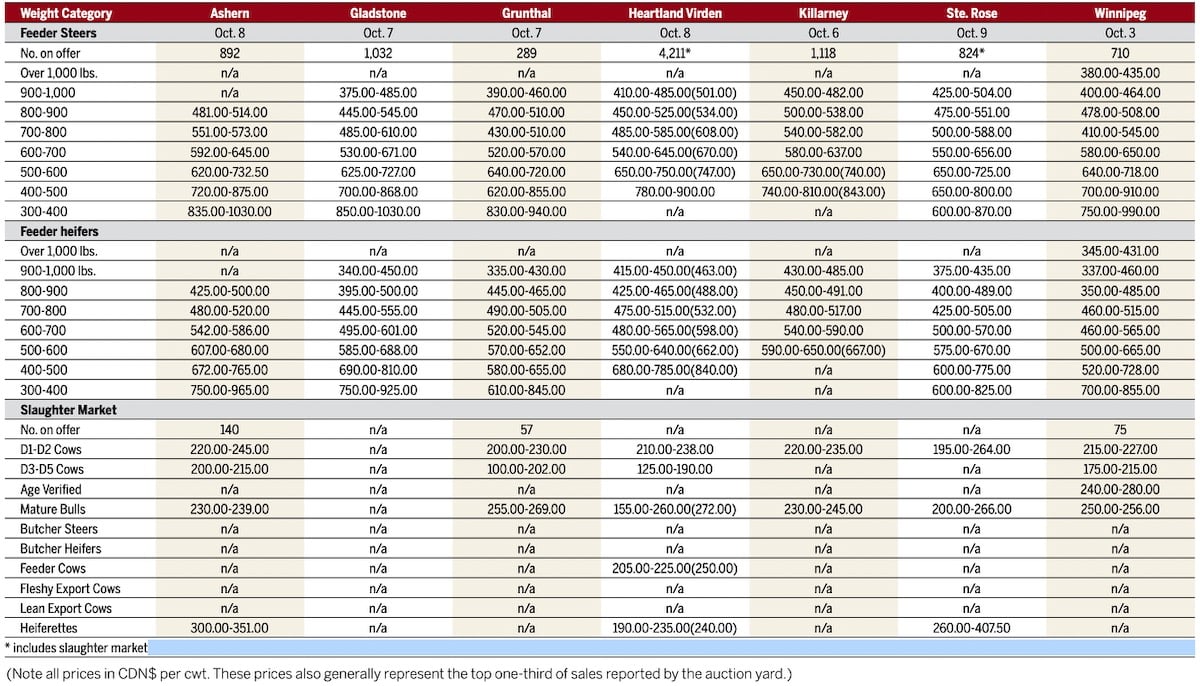

Manitoba cattle prices, Oct. 10

Foremost is China’s disappearance from the export market. Just as China remains committed not to buy U.S. soybeans anytime soon, it is just as resolute to avoid purchasing canola from Canada. With buyers for China faced with import tariffs of nearly 76 per cent on Canadian canola seed and 100 per cent duties on the oil and meal, why would China acquire canola from what has long been its number one source?

Until Ottawa and Beijing smooth out their dispute over Canada’s 100 per cent surcharge on imports of electric vehicles from China, it’s likely very little will be resolved on the canola front. And if something does happen, look for it after the New Year.

The numbers from the Canadian Grain Commission bear out the canola doldrums, showing 2025/26 year-to-date canola exports of canola at about 796,000 tonnes – nearly 1.16 million tonnes short of where they were this time last year.

Even an earlier one million-tonne lead for this year’s domestic use has virtually dissipated. At about 2.08 million tonnes, it’s now roughly 144,000 tonnes up on the same point in 2024/25.

Then there’s the Prairie canola harvest that’s soon to wrap up. Numerous anecdotal reports of better-than-expected yields has many in the trade thinking production will very likely exceed the 20.03 million tonnes Statistics Canada estimated last month. There are thoughts of a canola harvest of around or even above 21 million tonnes. StatCan’s next production report is set for early December.

One positive aspect to canola has been Chicago soyoil, which has climbed a half cent at 50.95 cents per pound. The spillover from that gain was largely responsible for propping up canola.

Some in the trade said that as long as soyoil remains above 50 cents/lb., canola very likely won’t push below C$600/tonne.

But in the long run, even that might not be able to sustain canola. There will be maneuvers to bump up the oilseed temporarily, there’s just not enough fundamentals within canola to safeguard it from sliding below C$600.