Cooling Fan Market Overview

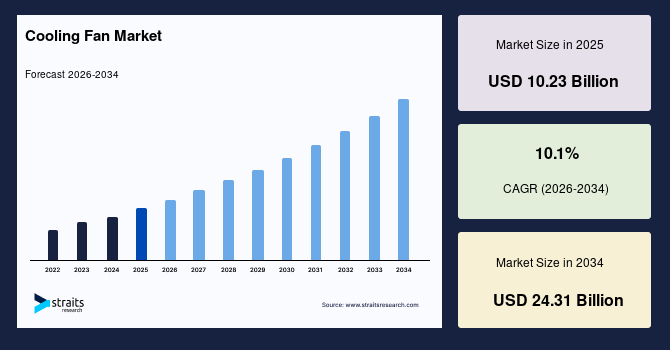

The global cooling fan market size is valued at USD 10.23 billion in 2025 and is estimated to reach USD 24.31 billion by 2034, growing at a CAGR of 10.1% during the forecast period. Consistent growth of the market is supported by the rising demand for efficient thermal management systems across data centers, consumer electronics, and industrial equipment. Additionally, the increasing integration of IoT-enabled and energy-efficient cooling technologies enhances operational performance, reduces energy consumption, and drives adoption across multiple end-use sectors globally.

Key Market Trends & Insights

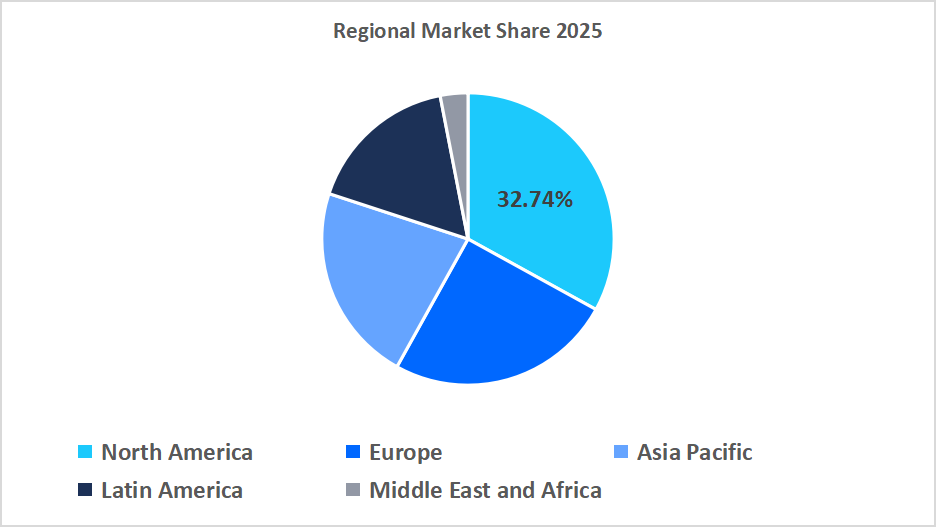

North America dominated the market with a revenue share of 32.74% in 2025.

Asia Pacific is anticipated to grow at the fastest CAGR of 11.8% during the forecast period.

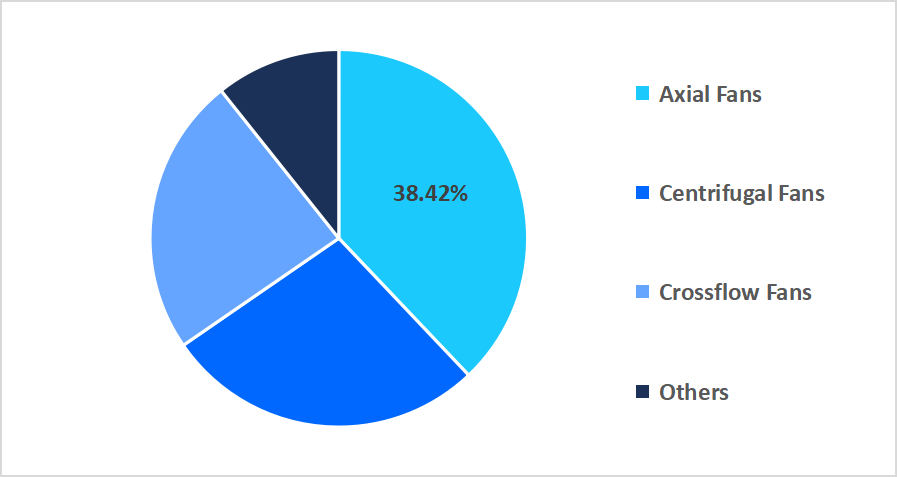

Based on type, the axial fans segment held the highest market share of 38.42% in 2025.

By technology, the IoT-integrated fans segment is estimated to register the fastest CAGR growth of 13.25%.

Based on the end-use sector, the data centers segment dominated the market in 2025.

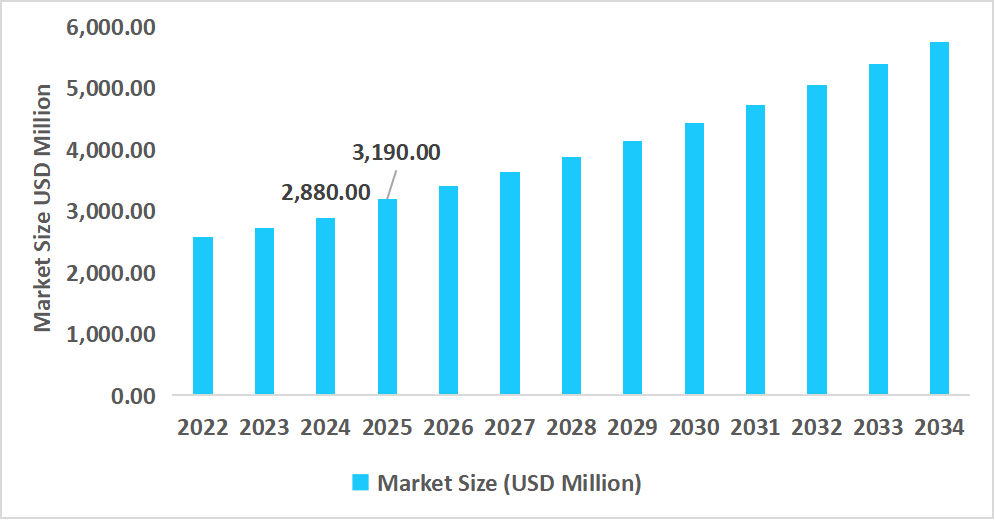

The U.S. dominates the cooling fan market, valued at USD 2.88 billion in 2024 and reaching USD 3.19 billion in 2025.

Table: U.S Cooling Fan Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

2025 Market Size: USD 10.23 billion

2034 Projected Market Size: USD 24.31 billion

CAGR (2026-2034): 10.1%

Dominating Region: North America

Fastest-Growing Region: Asia Pacific

The global cooling fan market covers a wide variety of thermal management technologies, ranging from axial fans, centrifugal fans, and crossflow fans to other advanced specialized fan solutions for maximum heat dissipation in core electronics and industrial applications. These solutions are available in various configurations of technology, from AC fans, DC fans, and brushless DC (BLDC) fans to IoT-enabled smart fan systems, which support high airflow control and higher operation reliability. Also, cooling fans are used in a large variety of end-use markets, including data centers, consumer electronics, industrial equipment, automotive electronics, and other high-performance applications. The market has a well-developed ecosystem of OEMs, technology integrators, and manufacturers that provide scalable and energy-efficient cooling solutions to the world’s electronics and ICT markets.

Latest Market Trends

Implementing Smart Control Systems in Thermal Management

Cooling fan technology is evolving from traditional stand-alone units to smart-driven, networked solutions that combine wise sensors, speed control by automation, and cloud-driven performance tracking. In the past, the majority of thermal control in electronics was based on manual setup and static cooling, which typically resulted in energy wastages and danger of overheating. Currently, with the implementation of smart fan control platforms, real-time performance adaptation based on system load, temperature variances, and power usage levels is possible. Solutions that combine predictive maintenance algorithms and remote diagnostics have yielded quantifiable improvements in equipment availability and operational efficiency. Advanced cooling and smart thermal systems can save data center total energy consumption by as much as 30%, which underscores the extent of technological change to sustainable and autonomous cooling infrastructure, says the U.S. Department of Energy. This shift is changing the way data centers, telecommunications networks, and industrial applications handle thermal loads.

Increased Regulatory Focus on Energy-Efficient Cooling Solutions

Regulatory authorities and industry associations are implementing stronger energy efficiency requirements for cooling technologies to counter increasing power usage in ICT infrastructure. In the first decade of the 2000s, thermal management rules were slim and dealt primarily with fundamental safety compliance. Over the past decade, however, environmental and energy conservation objectives have compelled governments to implement sophisticated performance standards for cooling systems. Cooling is responsible for almost 15% of all electricity consumption in ICT centers around the world, which has driven growth in efficiency standards and certification schemes. U.S. Environmental Protection Agency policy and those of equivalent agencies in Asia and Europe have expedited the adoption of energy-efficient cooling fans by servers, telecom equipment, and industrial control systems. This regulatory drive is influencing procurement agendas and driving demand for low-power thermal management innovation in world markets.

Market Drivers

Increasing Use of Next-Generation Cooling Standards in Data Centers

The implementation of high-end cooling standards and specifications in data centers is proving to be a top growth driver for the cooling fan industry. The U.S., Germany, Japan, Singapore, and South Korea are implementing strict energy efficiency and thermal management policies to enhance ICT infrastructure performance. Following ASHRAE guidelines, deploying standardized cooling designs and high-performance fans can cut server power usage up to 25%, while keeping equipment at optimal operating temperatures. This standards- and regulatory-driven initiative is compelling data center and industrial facility operators to replace existing cooling systems with energy-efficient, high-performance fans. The higher enforcement of these guidelines directly is fueling world demand for technology-driven cooling fans in ICT, industrial, and telecom use.

Market Restraint

Limited Access to Standardized Maintenance Protocols is Inhibiting Widespread Usage

The major limitations in the market for cooling fans is the absence of a standardized maintenance and operation protocol in industrial, data center, and telecom applications, which translates into inconsistent performance and downtime of equipment. The International Telecommunication Union (ITU) estimates that almost 18% of data center and telecom hub network outages are attributed to incorrect or sporadic maintenance of cooling facilities. In most emerging markets, erratic monitoring habits and lack of skilled people further contribute to reliability problems. Consequently, companies tend to encounter operational inefficiencies and are reluctant in mass deploy sophisticated cooling fan systems, thus restraining the overall market penetration despite increasing demand.

Market Opportunity

Green Data Center Expansion

The worldwide drive towards environmentally friendly ICT infrastructure is opening up new growth prospects for the cooling fan industry. The Singapore Economic Development Board (EDB) has launched guidelines and incentives for green data centers, inviting operators to implement energy-efficient and low-emission cooling systems. As per EDB reports, using optimized airflow management and energy-efficient fans can save overall energy by as much as 20% in new buildings. These programs are creating demand for next-generation cooling fans meeting environmental standards, while allowing firms to realize sustainability objectives and gain regulatory advantages. As a result, the emphasis on green and energy-efficient data management is creating huge opportunities for growth in the Asia-Pacific and worldwide

Regional Analysis

North America led the market in 2025 with a market share of 32.74%. This is due to the availability of large-cap data centers, sophisticated ICT infrastructure, and highly developed industrial automation sectors that are greatly dependent on effective thermal management. Furthermore, North America enjoys government-sponsored energy efficiency initiatives and certifications, including the U.S. Department of Energy’s Data Center Energy Efficiency Initiative, which promotes the adoption of high-performance cooling systems. These are the factors combined that are pushing the deployment of advanced cooling fans in commercial, industrial, and ICT applications in the region.

Development of the cooling fan market in the U.S. is fueled by its focus on energy-efficient and reliable cooling solutions for mission-critical ICT infrastructure. U.S. Environmental Protection Agency (EPA) ENERGY STAR program statistics, implementation of high-efficiency fans in data centers helped achieve 15–20% energy savings from 2022 to 2025 without compromising optimal thermal conditions. Technical guidelines availability, performance standards, and government incentives for green operations are building confidence in the market and accelerating large-scale adoption of sophisticated cooling fan systems.

Asia Pacific Market Insights

Asia Pacific is becoming the region with the highest growth rate at a CAGR of 11.8% from 2026–2034 based on countries like China, India, Japan, and South Korea. Sudden growth in hyperscale data centers, electronics manufacturing facilities, and industrial automation units is generating high demand for efficient and energy-saving cooling systems. government policies supporting smart manufacturing, energy efficiency regulations, and industrial upgrading like Japan’s Top Runner Program and China’s energy saving programs are fueling the penetration of high-performance cooling fans throughout the region.

India’s cooling fan market is growing briskly because of massive ICT infrastructure projects, industrial estates, and telecom network development. Policies like the India Data Center Policy offer incentives for energy-efficient, sustainable cooling technology, promoting take-up of high-capacity fans by commercial and industrial customers. Major players also are setting up localized production and service networks to cater to increasing demand, making India a key location for cooling fan deployment in the Asia Pacific region.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is witnessing steady expansion in the cooling fan market, driven by data center modernization, increasing use of industrial automation, and stringent energy efficiency regulations in Germany, France, U.K., and Nordic countries. Government-backed policies such as the European Commission’s Code of Conduct for Data Centres and Energy Efficiency Directive are encouraging operators to implement energy-efficient cooling systems, driving market expansion and high-performance fans adoption in ICT and industrial segments.

Growth of U.K. cooling fans is driven by hyperscale data center expansion and sustainable ICT infrastructure initiatives. Programs like the UK Green Data Centre Charter provide best practices and incentives for the efficient deployment of cooling, promoting high-capacity, low-power fan systems. Deployment of standardized thermal management protocols, complemented by government-backed energy audits, ensures effective utilization of ICT and industrial equipment, driving demand for sophisticated cooling fans in commercial, telecom, and industrial uses.

Latin America Market Insights

The Latin America cooling fan market is driven by countries such as Brazil, Mexico, and Argentina, where growth of data center building expansion, industrial automation, and expansion of telecom infrastructure are driving demand. National energy efficiency programs and policy incentives for green ICT infrastructure are encouraging deployment of high-performance cooling systems, enhancing reliability and energy efficiency.

The Brazilian market for cooling fans is expanding with business and telecommunications providers making investments to improve existing infrastructure to serve growing ICT and industrial demands. Programs such as the National Energy Efficiency Program (PROCEL) drive energy-efficient cooling technology, promoting commercial and industrial adoption. Large regional distributors are also distributing high-efficiency fan products specifically created for industrial and data center applications, making it more accessible and consistent throughout the nation.

Middle East and Africa Market Insights

The Middle East and Africa cooling fan market is expanding with the construction of contemporary data centers and industrial parks with green cooling requirements. The governments of the UAE, Saudi Arabia, and South Africa are enforcing energy efficiency norms for ICT and industrial complexes, stimulating the adoption of streamlined thermal management solutions.

Egypt’s cooling fan market is growing with public and private data centers deploying high-capacity, power-saving cooling systems. Egypt Energy Efficiency Program (EEEP) programs promote the deployment of new thermal management solutions to enable industrial and ICT facilities to meet energy and performance goals. Such initiatives are promoting adoption of smart cooling fans across the nation.

Type Insights

The axial fans segment led the market in terms of revenue share of 38.42% in 2025. The growth is fueled by their ubiquitous application in data centers and consumer electronics, where high airflow and low power consumption are essential for optimum operating temperatures and equipment reliability. Axial fans are the first choice for extensive cooling applications because of their performance in managing high-volume air flow, and they are a common choice in ICT and industrial settings.

The IoT-integrated fans sector is expected to see the quickest growth, with an estimated CAGR of approximately 13.25% in the forecast period. Strong growth is fueled by enhanced demand for intelligent cooling solutions that enable real-time monitoring, predictive maintenance, and adaptive performance enhancement. Increased adoption of connected ICT infrastructure, cloud computing, and automated industrial systems is also fueling the adoption of IoT-equipped cooling fans worldwide.

By Type Market Share (%), 2025

Source: Straits Research

Technology Insights

The AC fans segment led with 31.15% market share in 2025 due to their widespread adoption in consumer appliances and industrial equipment, where reliability and stable voltage operation are most important. AC fans are the preferred choice for fixed usage in servers, network racks, and industrial machinery due to their reliability and long lifespan, delivering consistent cooling during continuous operation.

The crossflow fans market is likely to experience the fastest growth, with a projected CAGR of about 12.8% over the forecast period. Impressive growth is being fueled by increasing demand for balanced airflow in small enclosures, increased energy efficiency, and multi-purpose applications of cooling in consumer electronics, industrial machinery, and automotive systems. Broadening use in data centers, HVAC equipment, and specialized industrial machinery is also fueling the use of crossflow fans worldwide.

End Use Sector Insights

The data centers segment is expected to expand with the highest growth rate of 12.4%, fueled by the explosive growth of cloud computing, hyperscale server facilities, and digital services. As service providers and businesses deploy more massive and powerful computing equipment, the demand for effective, high-capacity cooling systems has grown exponentially. Increasing energy efficiency standards and the need for round-the-clock uptime in mission-critical ICT operations are also driving the use of advanced cooling fans in data center setups worldwide.

Competitive Landscape

The global cooling fan market is relatively fragmented with well-established players and specialty solution vendors existing in the market. There are limited players who command sizeable market share based on their extensive product offerings and in-built thermal management solutions.

A few of the major players of the market include Shenzhen Shunchang Electric Co., Ltd., Delta Electronics, Inc., Nidec Corporation and many more,

These market players are competing with each other to gain a strong market position in the shape of new product launches, strategic alliances, mergers, and acquisitions, increasing their position in the markets for data centers, consumer electronics, industrial, and automotive cooling.

Coolify: An Emerging Market Player

Coolify, a Taiwan-based company, has made a significant impact in the cooling fan market in 2025 with its innovative product offerings. The company introduced the HOLO FAN 2, a revolutionary image-sync holographic fan, and the Zephyr, a voice-controlled RGB smartphone cooler, both unveiled at COMPUTEX 2025. These products combine advanced cooling technology with unique visual experiences, setting new benchmarks in the industry.

In June 2025, Coolify launched an improved cooling fan that synchronizes up to three fan images to provide a breathtaking visual experience. Its reversed blade design provides high efficiency along with minimum noise levels. It comes in 120mm and 140mm sizes, depending on the user’s choice..

These new products have made Coolify a significant global cooling fan player, through the use of advanced technology and innovative design, to meet the changing demands of the consumer

List of key players in Cooling Fan Market

Delta Electronics, Inc.

Nidec Corporation

Sunonwealth Electric Machine Industry Co., Ltd.

S. Tech Corp.

AVC (Asia Vital Components Co., Ltd.)

Mechatronics Co., Ltd.

Papst Group (ebm-papst)

Shenzhen Shunchang Electric Co., Ltd.

Coolerguys Inc.

Zhejiang Hongyuan Electric Co., Ltd.

NMB Technologies Corporation

San Ace Corporation

Shenzhen Dakin Technology Co., Ltd.

Shenzhen Huayu Electric Co., Ltd.

Shenzhen Mingzhi Industrial Co., Ltd.

Sunon Innotech Co., Ltd.

Orion Fans & Cooling Solutions

Mechatronics Systems Pvt. Ltd.

Shenzhen Huanan Electric Co., Ltd.

Shenzhen Tongfang Cooling Technology Co., Ltd.

Strategic Initiatives

October 2025: Sunonwealth Electric Machine Industry Co., Ltd. participated in the OCP Global Summit in San Jose, California, where it showcased its next-generation liquid cooling systems. These systems are designed to meet the high-performance cooling needs of servers.

July 2024: Cooler Master announced an expanded partnership with Infineon Technologies AG to incorporate advanced semiconductor technology into their power supply units (PSUs). This collaboration aims to enhance the performance and efficiency of Cooler Master’s high-wattage PSUs, including the X Silent Edge Platinum series.

November 2024: ebm-papst, a German technology leader in air and drive technology, introduced its “RadiCal” mixed-flow fan with a backward-curved impeller, specifically engineered for extreme energy efficiency in HVAC systems.

May 2025:Nidec Corporation announced the launch of its “G50X-series” of cooling fans, which utilize a new material for the impeller and housing to achieve a 30% reduction in weight while maintaining structural integrity and acoustic performance for data center servers.

Report Scope

Report Metric

Details

Market Size in 2025

USD 10.23 Billion

Market Size in 2026

USD 11.26 Billion

Market Size in 2034

USD 24.31 Billion

CAGR

10.1% (2026-2034)

Base Year for Estimation 2025

Historical Data2022-2024

Forecast Period2026-2034

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends

Segments Covered

By Type,

By Technology,

By End Use Sector,

By Region.

Geographies Covered

North America,

Europe,

APAC,

Middle East and Africa,

LATAM,

Countries Covered

U.S.,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Cooling Fan Market Segmentations

By Type (2022-2034)

Axial Fans

Centrifugal Fans

Crossflow Fans

Others

By Technology (2022-2034)

AC Fans

DC Fans

Brushless DC (BLDC) Fans

IoT-Integrated Fans

By End Use Sector (2022-2034)

Data Centers

Consumer Electronics

Industrial Equipment

Automotive Electronics

Others

By Region (2022-2034)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global cooling fan market size is estimated at USD 11.26 billion in 2026.

North America led the market in 2025 with a market share of 32.74%.

Implementing smart control systems in thermal management and Increased regulatory focus on energy-efficient cooling solutions are key factors driving market growth.

Leading market participants include Delta Electronics, Inc., Nidec Corporation, Sunonwealth Electric Machine Industry Co., Ltd., S. Tech Corp., AVC (Asia Vital Components Co., Ltd.), Mechatronics Co., Ltd., Papst Group (ebm-papst), Shenzhen Shunchang Electric Co., Ltd., Coolerguys Inc., and Zhejiang Hongyuan Electric Co., Ltd.

The axial fans segment led the market in terms of revenue share of 38.42% in 2025.