Framed as a way to build national wealth and keep NZ assets in NZ hands, Labour’s new economic policy is heavy on patriotic branding but so far short on detail, writes Catherine McGregor in today’s extract from The Bulletin.

To receive The Bulletin in full each weekday, sign up here.

Labour pitches a new way to build national wealth

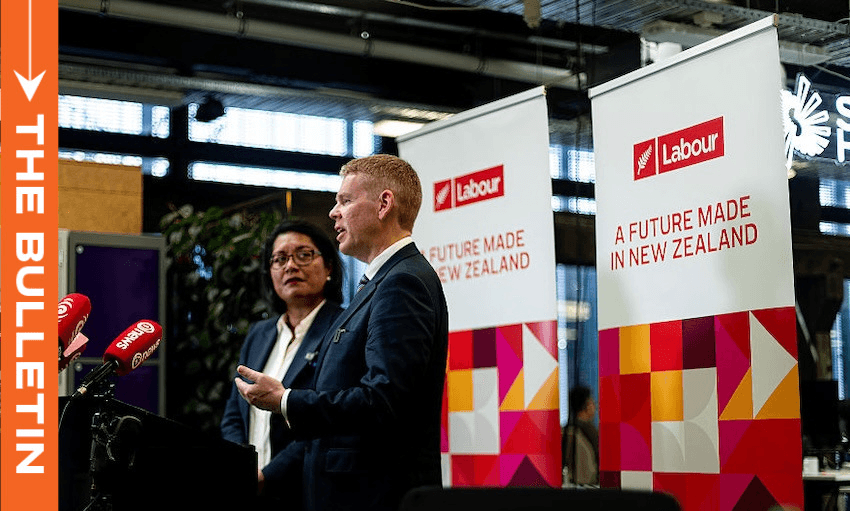

Labour has unveiled the New Zealand Future Fund, its first major policy ahead of next year’s election, promising a new approach to government wealth creation. Announced by leader Chris Hipkins and finance spokesperson Barbara Edmonds, the fund would be seeded with $200 million in government capital and a handful of Crown assets, with dividends reinvested to grow its value. The fund would sit alongside the New Zealand Super Fund, managed by the same Guardians but ringfenced to invest solely in domestic businesses and infrastructure.

Hipkins said it was time to “build new ways of generating national wealth for the benefit of everyone”, while Edmonds described it as a way to “turn innovation into real businesses and real jobs here at home”. The fund’s assets would be protected in law from sale, and its returns – both “financial and social” – would be reinvested for long-term national benefit, the Herald’s Jamie Ensor reports.

Critics question clarity and credibility

Both commentators and political opponents were quick to note the lack of detail. Writing for The Post, Tom Pullar-Strecker observed that while the “buzz terms sound great – ‘backing New Zealand’s potential’, ‘building a resilient economy that works for everyone’ – the rationale behind what is being proposed is harder to dissect”. He also questioned why a new fund was needed when existing Crown entity NZ Growth Capital Partners already invests in local businesses. His colleague Henry Cooke noted “The 11-page document has one page of policy detail, one page of self-criticism, and one page that is just a photo of Chris Hipkins. If you want construction firms or other big movers in the economy to plan for your big changes, you will need to give them some actual detail.”

The government has echoed those concerns. National’s Christopher Luxon called the proposal “totally underwhelming”, while Act David Seymour described it as a “boondoggle proposal”, warning it would drain funds from health and education without delivering measurable returns.

A political strategy disguised as policy?

According to the Herald’s Jenée Tibshraeny (paywalled), the real purpose of the Future Fund may be political rather than economic. “Unveiling a new fund, likely smaller in size than those it created in the past, isn’t going to cut it,” she argued. “But doing something that links investment in Kiwi business to state-owned enterprises creates an opportunity for [Labour] to attack National for its willingness, and Act for its eagerness, to sell SOEs.” Without the SOE element, “Labour’s investment fund idea is economically uncompelling”, she said.

Former Ardern adviser Clint Smith made the same point in a tweet, albeit more approvingly: “National wants to sell our assets in a 2nd term & they want talk about it as little as possible before the election. The NZ Future Fund neatly puts public assets to the fore & creates a choice: invest in them with Labour or sell them with National. No wonder Nat Ministers are annoyed.”

Peters cries plagiarism

The rollout was briefly overshadowed by a furious response from Winston Peters, who accused Labour of stealing the name – and concept – of NZ First’s own “Future Fund”, announced last year. Hipkins brushed off the overlap, saying NZ First’s plan had “skipped my attention” and appeared “more about creating a fund for investment in infrastructure that has overseas investors in it”. Peters was unconvinced, calling Hipkins’ policy a “try-hard Temu mail-order rip-off”.

Subscribe to +Subscribe