On Friday in New York, US stocks wobbled lower as Wall Street questioned whether the US job market has slowed by just enough to get the Federal Reserve to cut interest rates to help the economy, or by so much that a downturn may be on the way.

Supermarket giants Coles and Woolworths dipped in early trade.Credit: Getty

After rising to an early gain, the S&P 500 erased it and fell 0.3 per cent below the all-time high it set the day before. The Dow Jones dropped 220 points, or 0.5 per cent, after swinging between an early gain of nearly 150 points and a loss of 400. The Nasdaq composite edged down by less than 0.1 per cent.

The action was more decisive in the bond market, where Treasury yields tumbled after a report from the Labor Department said US employers hired fewer workers in August than economists expected. The government also said that earlier estimates for June and July overstated hiring by 21,000 jobs.

Loading

The disappointing numbers follow last month’s discouraging jobs update, along with other lacklustre reports in intervening weeks, and traders are now betting on a 100 per cent probability that the Fed will cut its main interest rate at its next meeting on September 17, according to data from CME Group. Investors love such cuts because they can give a kickstart to the economy, but the Fed has held off on them because they can also give inflation more fuel.

So far this year, the Fed has been more worried about the potential of inflation worsening because of President Donald Trump’s tariffs than about the job market. But Friday’s job numbers could push the Fed to consider cutting rates in two weeks by a steeper amount than usual, said Brian Jacobsen, chief economist at Annex Wealth Management.

“This week has been a story of a slowing labour market, and today’s data was the exclamation point,” according to Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management.

Strong hiring for health care jobs had been helping to support the overall market, “but with it now showing some tangible signs of decline, the foundation underneath the labor market seems to be cracking,” said Rick Rieder, chief investment officer of global fixed income at BlackRock.

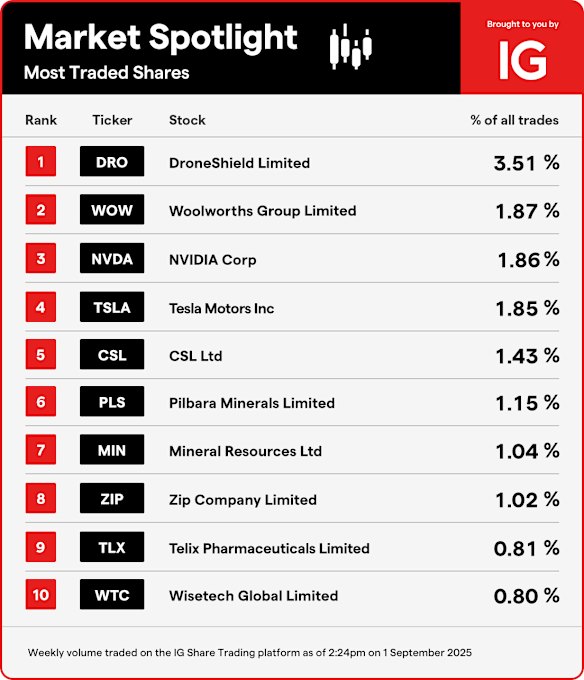

The most traded shares on IG Markets.Credit: IG Markets

While the data on the job market is disappointing, it’s still not so weak that it’s screaming a recession is here, and the US economy is continuing to grow. A big question for investors is whether the job market can remain in a balance where it’s not so strong that it prevents cuts to interest rates but also not so weak that the economy falls off.

Uncertainty about that helped lead to Friday’s swings in the stock market. Wall Street needs things to go as hoped because it already sent stock prices to records amid expectations for a Goldilocks scenario where interest rates ease, and the economy keeps chugging along.

Loading

On Wall Street, Friday’s heaviest weight was Nvidia, the chip company that’s become the face of the artificial-intelligence boom. It’s been contending with criticism that its stock price charged too high, too fast and became too expensive following Wall Street’s rush into AI, and it fell 2.7 per cent.

Lululemon dropped 18.6 per cent after the yoga and athletic gear maker’s revenue for the latest quarter fell short of analysts’ expectations. Chief executive Calvin McDonald pointed to disappointing results from its US operation, while Chief financial officer Meghan Frank said Lululemon was facing “industry-wide challenges, including higher tariff rates.”

Still, more stocks rose on Wall Street than fell. Leading the way was Broadcom, which climbed 9.4 per cent after reporting better profit and revenue for the latest quarter than analysts expected. Chief executive Hock Tan said customers were continuing to invest strongly in AI chips.

Tesla rose 3.6 per cent after proposing a payout package that could reach $US1 trillion ($1.5 trillion) for its CEO, Elon Musk, if the electric vehicle company meets a series of extremely aggressive targets over the next 10 years.

With AP

The Market Recap newsletter is a wrap of the day’s trading. Get it each weekday afternoon.