“Some newly minted million-dollar markets include more mortgage belt suburbs like Sydney’s Penrith and Melbourne’s Taylors Lakes, along with Oxley in Brisbane’s Ipswich region and Upper Coomera in the Northern Gold Coast,” Ezzy said. “Seven-figure markets are no longer confined to prestigious suburbs, with their reach expanding more broadly.”

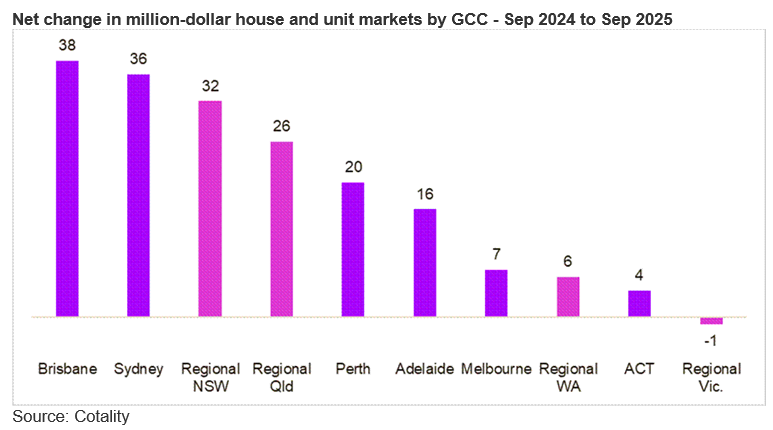

Regional Victoria was the only area to record a net decline in million-dollar markets, with just 11 of 278 analysed suburbs maintaining a median value at or above $1 million, one fewer than last year.

Ezzy also pointed to growing affordability concerns as more suburbs cross the million-dollar line. “A household on the average income of $106,000 with a 20% deposit, would need to dedicate more than 50% of their pre-tax earnings to service a loan on a million-dollar property,” she said. “This increases to more than 60% if they’re using the First Home Guarantee scheme’s 5% deposit, a repayment-to-income ratio few brokers will approve.”

Despite the increasing prevalence of million-dollar sales, Ezzy pointed out that home ownership is becoming less attainable for many. “The average age of first-home buyers has continued to creep higher, while home ownership rates have steadily declined, particularly among younger and lower-income households whose earnings struggle to keep pace with rising housing prices,” she said.