iPhone maker Apple (AAPL) is facing a lawsuit filed by two authors, who have accused the company of illegally using their copyrighted books to train its artificial intelligence (AI) systems, Reuters reported. The news about the lawsuit comes amid growing instances of legal actions by writers, publishers, and news outlets against tech giants and AI startups for using their content without permission.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple Faces Legal Trouble

The proposed class action filed against Apple in the federal court in Northern California by authors Grady Hendrix and Jennifer Roberson alleges that the tech giant copied protected works without consent and without credit or compensation to train AI models. The lawsuit accuses the company of using a “known body” of pirated books to train its OpenELM large language model (LLM).

Furthermore, the lawsuit stated that Apple didn’t attempt to pay the two authors for their contributions to “this potentially lucrative venture.”

AI companies are increasingly facing legal woes for using data/content without the required permissions. In June, Microsoft (MSFT) was sued by a group of authors who accused the company of using their books without permission to train its Megatron AI model. ChatGPT maker OpenAI has also faced claims over the alleged misuse of copyrighted material in AI training. Notably, Anthropic recently agreed to pay $1.5 billion to settle a class action lawsuit filed by authors who accused the Amazon (AMZN) and Alphabet (GOOGL)-backed AI start-up of stealing their work to train its AI chatbot Claude without permission.

Is AAPL Stock a Good Buy, Sell, or Hold?

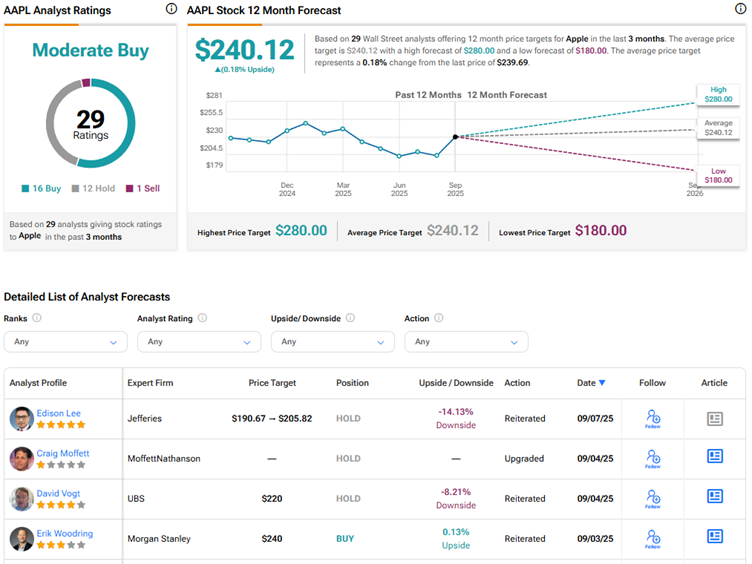

Currently, Wall Street has a Moderate Buy consensus rating on Apple stock based on 16 Buys, 12 Holds, and one Sell recommendation. The average AAPL stock price target of $240.12 indicates the stock is fully valued at current levels. AAPL stock is down 4.3% year-to-date.