Cybersecurity In CIP Market Summary

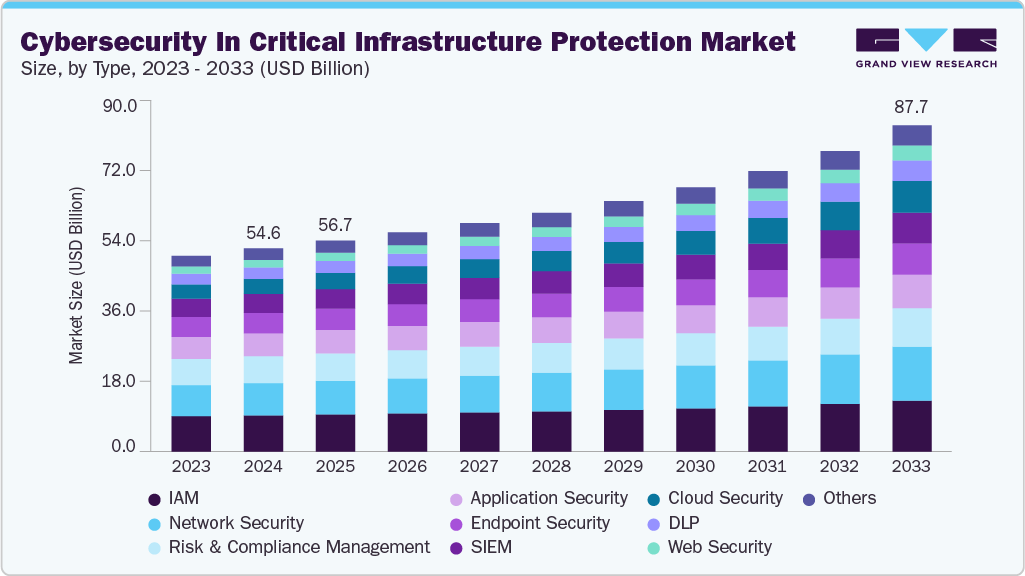

The global cybersecurity in critical infrastructure protection market size was estimated at USD 54.60 billion in 2024 and is projected to reach USD 87.71 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The growing complexity of supply chains and third-party vendor ecosystems is driving cybersecurity in the critical infrastructure protection (CIP) market

Key Market Trends & Insights

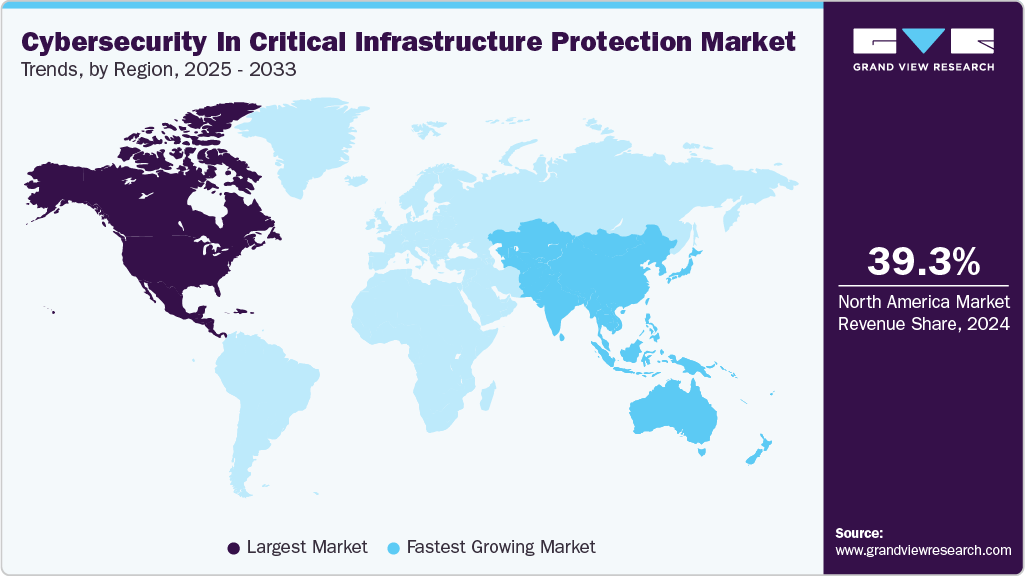

North America held a 39.3% revenue share of the cybersecurity in CIP market in 2024.

In the U.S., the proliferation of Internet of Things (IoT) and industrial IoT (IIoT) devices is accelerating the demand for cybersecurity in critical infrastructure protection.

By type, the identity & access management segment held the largest revenue share of 17.9% in 2024.

By deployment, the on-premise segment held the largest revenue share in 2024.

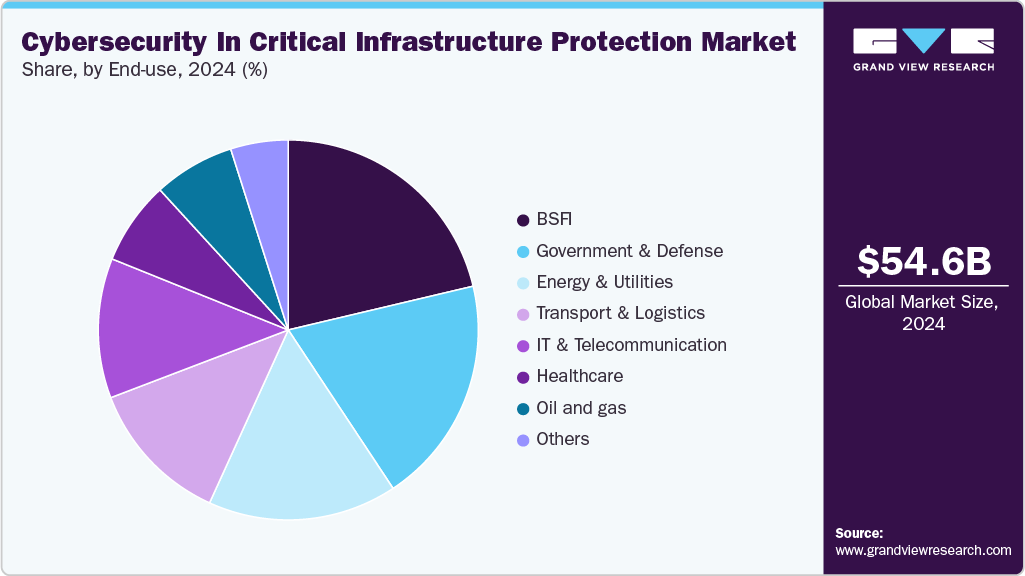

By end use, the BFSI segment held the largest revenue share in 2024.

Market Size & Forecast

2024 Market Size: USD 54.60 Billion

2033 Projected Market Size: USD 87.71 Billion

CAGR (2025-2033): 5.6%

North America: Largest Market in 2024

Asia Pacific: Fastest Growing Market in 2024

The growing reliance on cloud computing and virtualization within critical systems is also expanding the growth of the cybersecurity in critical infrastructure protection industry. Cloud platforms are increasingly being used for data analytics, centralized control, and disaster recovery across critical infrastructure environments. While cloud services offer scalability and cost-efficiency, they also introduce shared responsibility models and new attack vectors that many infrastructure operators are still adjusting to. Misconfigurations, unauthorized access, and insecure APIs are common issues in these environments. To mitigate such risks, critical infrastructure operators are prioritizing cloud security solutions that offer real-time visibility, compliance enforcement, and automated threat detection tailored to hybrid environments, where on-premises control systems interact with cloud-based applications.

The emergence of AI-powered cyber threats is driving the cybersecurity in critical infrastructure protection market growth. Attackers are beginning to leverage machine learning to automate reconnaissance, evade detection, and launch more targeted, persistent threats against industrial systems. These advanced techniques make traditional signature-based defenses inadequate, especially in high-value infrastructure environments. To counter this, infrastructure operators are turning to AI-driven threat detection platforms capable of analyzing vast volumes of data, learning behavioral baselines, and flagging anomalies in real time. These solutions improve response time and help identify zero-day vulnerabilities and previously unknown attack patterns, reinforcing security in increasingly complex digital ecosystems.

The growing role of predictive analytics and digital twins in infrastructure management is also fueling demand for cybersecurity in critical infrastructure protection market. Critical sectors are using digital replicas of physical systems to simulate operations, monitor performance, and test maintenance scenarios. While these technologies increase efficiency and reduce downtime, they also create new entry points for cyber threats, especially if the twin is connected to real-time operational systems. Securing these simulation environments requires strong data governance, endpoint protection, and real-time anomaly detection to prevent them from becoming weak links in infrastructure defense strategies. As the use of digital twins and predictive tools becomes more common, cybersecurity becomes integral to ensuring their safe and uninterrupted operation.

Furthermore, the increased investment in national cyber defense and resilience strategies is pushing both public and private infrastructure operators to align with broader security goals. Countries around the world, including those in Asia Pacific, North America, and Europe, are developing national-level resilience plans that include real-time cyber threat sharing, national vulnerability registries, and coordinated incident response frameworks. As part of this broader push, operators of critical infrastructure are being required to participate in drills, contribute to early warning systems, and report breaches within defined timelines. This emphasis on collective defense is motivating investments in scalable cybersecurity infrastructure, secure data exchange systems, and collaboration platforms, ensuring that all nodes of the infrastructure ecosystem are protected and able to respond cohesively during cyber crises.

Type Insights

The identity & access management (IAM) segment dominated the cybersecurity in critical infrastructure protection market with a revenue share of 17.9% in 2024. The shift toward Zero Trust Architecture (ZTA) is driving IAM adoption in cybersecurity in the critical infrastructure protection market. For critical infrastructure operators, especially in sectors like energy, transportation, and water, adopting Zero Trust principles is becoming a necessity. IAM platforms that include multi-factor authentication (MFA), biometric controls, adaptive access policies, and identity federation play a foundational role in enabling this architecture. The push for Zero Trust, often mandated or encouraged by governments and cybersecurity agencies, is resulting in increased investment in IAM systems that support granular access management and continuous user behavior monitoring.

Cloud security is projected to be the fastest-growing segment from 2025 to 2033. The growing complexity of hybrid and multi-cloud architectures within critical infrastructure environments is intensifying the need for specialized cloud security capabilities. Operators are no longer using a single cloud vendor; instead, they often rely on multiple cloud platforms along with private on-premises systems. This hybrid environment introduces visibility gaps, inconsistent policies, and difficulty in threat correlation. To address these challenges, infrastructure providers are investing in unified cloud security platforms that offer centralized policy enforcement, cross-cloud visibility, and integrated threat analytics. These platforms ensure that all components, regardless of location or provider, meet the same rigorous security standards and are protected from attack.

Deployment Insights

The on-premise segment dominated the cybersecurity in critical infrastructure protection industry in 2024. The concern over national security and protection against foreign cyber espionage is also a significant factor in the continued prioritization of on-premise cybersecurity for critical infrastructure. State-sponsored threat actors increasingly target vital national infrastructure for intelligence gathering or disruption. Governments and infrastructure operators are reluctant to store operational data, user credentials, or threat intelligence logs on third-party cloud platforms, especially those based outside national borders. On-premise security systems provide full control over encryption keys, access logs, and network segmentation, thereby reducing the risk of supply chain vulnerabilities or geopolitical exposure.

The cloud segment is projected to witness the fastest CAGR from 2025 to 2033. The growing adoption of remote work, remote asset management, and decentralized operations in critical infrastructure sectors is further accelerating the need for secure cloud-based cybersecurity. Post-pandemic, many infrastructure organizations have shifted toward remote diagnostics, remote access for maintenance teams, and cloud-hosted control panels. These functionalities require highly secure, identity-governed cloud environments that can prevent unauthorized access while supporting the dynamic workflows of dispersed teams. As infrastructure operators open access to their networks via mobile devices or browser-based portals, they are increasingly adopting cloud-based security frameworks like Secure Access Service Edge (SASE), cloud-native firewalls, and identity and access management (IAM) tools built to operate in flexible, dynamic environments.

End-use Insights

The BFSI segment dominated the cybersecurity in critical infrastructure protection market in 2024. The emergence of financial technology (fintech) partnerships and decentralized finance platforms (DeFi) is driving the cybersecurity in the critical infrastructure protection market growth. As traditional banks collaborate with fintech startups and integrate blockchain-based systems, they face challenges in maintaining consistent security standards across disparate platforms. These new financial models often involve real-time data exchange, tokenized assets, and smart contracts, all of which require secure design and monitoring. Cybersecurity solutions tailored for this evolving infrastructure must address risks such as unauthorized access, manipulation of transactions, and software supply chain vulnerabilities, further intensifying the demand for integrated, real-time protection in BFSI environments.

The oil & gas segment is projected to grow at the fastest CAGR from 2025 to 2033. The interconnected nature of oil and gas infrastructure across borders and business ecosystems drives cybersecurity in the critical infrastructure protection market growth. From multinational exploration joint ventures to shared pipeline infrastructure and shipping logistics, oil and gas companies operate in a deeply interdependent supply chain. A breach in one company’s network can compromise the entire chain. This exposure is driving demand for solutions that provide secure remote access, vendor risk management, and advanced identity and access management (IAM) across third-party partners. Ensuring the security of contractors, suppliers, and field technicians, many of whom use mobile devices or work in unmanned facilities, is a growing concern being addressed through zero-trust architectures and secure authentication solutions.

Regional Insights

North America dominated the cybersecurity in critical infrastructure protection market with a revenue share of 39.3% in 2024. The adoption of cloud, IoT, and remote operations in North American infrastructure sectors is driving the market growth. From cloud-hosted SCADA platforms to IoT-connected energy meters and predictive maintenance tools, infrastructure providers are leveraging digital transformation to improve efficiency and responsiveness. This shift is driving investment in cloud-native security, threat analytics, and secure access solutions, particularly those capable of protecting hybrid environments where traditional control systems intersect with modern IT networks.

U.S. Cybersecurity In Critical Infrastructure Protection Market Trends

The U.S. cybersecurity in critical infrastructure protection (CIP) industry is projected to grow during the forecast period. The rapid digitalization and modernization of U.S. infrastructure systems are driving the cybersecurity in the critical infrastructure protection market growth. From smart grid deployments and remote pipeline monitoring to AI-powered traffic control systems and cloud-based hospital networks, the U.S. is integrating digital technologies at an unprecedented pace. While this digital shift enhances efficiency and responsiveness, it also creates new vulnerabilities. Legacy systems, many still in use across the electric grid, transportation networks, and water utilities, were never designed to operate in connected environments. This creates a complex threat surface that requires real-time monitoring, segmentation of operational technology (OT) from IT, and AI-based anomaly detection to prevent cyber-physical attacks.

Asia Pacific Cybersecurity In Critical Infrastructure Protection Market Trends

The Asia Pacific cybersecurity in critical infrastructure protection (CIP) industry is expected to grow at the fastest CAGR of 7.0% over the forecast period. The introduction of national cybersecurity policies and regulatory frameworks across the region is also propelling the market growth. Governments in Asia Pacific are increasingly recognizing the need to secure infrastructure as part of national security and economic resilience strategies. For instance, Australia’s Critical Infrastructure Bill, India’s CERT-In directives, Japan’s Cybersecurity Strategy, and Singapore’s Cybersecurity Act all include requirements for critical sector operators to implement advanced cybersecurity controls, conduct risk assessments, and report incidents to central authorities. These regulations are driving adoption of identity and access management (IAM), endpoint detection and response (EDR), intrusion detection systems (IDS), and secure communication platforms that align with compliance mandates and audit requirements.

The cybersecurity in critical infrastructure protection market in Japan is projected to grow during the forecast period. The country’s growing dependence on smart infrastructure and data-driven governance is fueling the growth of the cybersecurity in the critical infrastructure protection market in Japan. Japan has been actively promoting digital transformation through national strategies such as Society 5.0, which aims to integrate advanced technologies like IoT, AI, big data, and robotics into public infrastructure, utilities, and logistics systems. While these technologies offer efficiency and innovation, they also significantly expand the attack surface. Critical systems such as smart grids, intelligent traffic management, and automated water treatment facilities are increasingly exposed to cyber risks due to their connectivity and data flows. This digital shift necessitates highly responsive cybersecurity frameworks capable of managing large-scale, real-time data while protecting sensitive operations from disruption or manipulation.

Europe Cybersecurity In Critical Infrastructure Protection Market Trends

The cybersecurity in critical infrastructure protection industry in Europe is expected to grow during the forecast period. Europe’s transition to renewable energy and digital infrastructure, which is creating a more complex and interconnected operational environment, is driving the growth of cybersecurity in the critical infrastructure protection market. The shift toward decentralized energy generation, through solar, wind, and smart grid technologies, requires real-time data exchange, cloud platforms, and automated controls. While these advancements improve efficiency and environmental sustainability, they also increase cybersecurity risks due to the large number of connected endpoints and third-party integrations. To mitigate these risks, energy providers and grid operators are deploying advanced threat monitoring, secure communication protocols, and anomaly detection tools that can identify and isolate cyber threats before they spread across critical systems.

The Germany cybersecurity in critical infrastructure protection market is growing during the forecast period. Germany’s emphasis on industrial automation and AI-driven manufacturing, especially in sectors like automotive and advanced machinery, further increases cybersecurity risks across critical production chains. As factories become smarter and more interconnected through Industrial IoT (IIoT) and digital twins, the attack surface grows exponentially. A successful cyberattack in this environment could halt production lines, corrupt product designs, or even cause physical harm to workers and equipment. Recognizing this, German manufacturers are deploying cybersecurity solutions that specifically target the OT layer, such as industrial firewalls, behavior-based monitoring, and segmentation of networks, to prevent lateral movement of threats from IT systems into production zones.

Key Cybersecurity In Critical Infrastructure Protection Company Insights

Some of the key companies operating in the market include Rockwell Automation, Inc. and Johnson Controls.

Rockwell Automation, Inc. is an industrial automation company. Rockwell is a key provider of cybersecurity solutions designed to protect critical infrastructure. Leveraging its deep domain expertise, it offers a comprehensive Industrial Cybersecurity framework grounded in the NIST Cybersecurity Framework phases Identify, Protect, Detect, Respond, and Recover, which are applied specifically to OT systems in critical infrastructure environments.

Johnson Controls is a multinational company specializing in building automation, HVAC systems, fire safety, and integrated security, serving smart campuses, cities, transportation hubs, and energy facilities across over 150 countries. Through its OpenBlue suite and Metasys building management platform, the company embeds security controls across the entire lifecycle from product design and development to deployment and retirement. These efforts follow a secure-by-design philosophy, incorporating rigorous DevSecOps practices, secure boot, micro-segmentation, and encrypted video streams to safeguard sensitive operations.

Delta Risk and Cyberfort are some of the emerging participants in the cybersecurity in critical infrastructure protection market.

Delta Risk is a cybersecurity firm that specializes in safeguarding critical infrastructure across sectors such as energy, utilities, communications, and public service. Delta Risk provides a comprehensive set of services designed to align with the high stakes of critical infrastructure environments. Their critical infrastructure security practice is built around specialized capabilities in NERC CIP compliance, tailored security exercises, and customized vulnerability assessments. These include cyber exercises and simulations to test and validate an organization’s readiness, helping clients identify critical assets, respond effectively to breaches, and ensure policy alignment under regulatory mandates.

Cyberfort is a privately held cybersecurity managed services provider. The company specializes in delivering comprehensive data and infrastructure security solutions tailored to sectors such as critical national infrastructure, energy, utilities, and public services. Cyberfort operates a Security Operations Centre (SOC) that integrates real-time threat detection and incident response using technologies from partners such as Elastic for observability and SIEM, as well as Microsoft Azure and VMware environments.

Key Cybersecurity In Critical Infrastructure Protection Companies:

The following are the leading companies in the cybersecurity in critical infrastructure protection (CIP) market. These companies collectively hold the largest market share and dictate industry trends.

GE Vernova

Rockwell Automation, Inc.

OPSWAT Inc.

Airbus

BAE Systems

CyberArk Software Ltd.

Delta Risk

Plurilock Security Inc.

Johnson Controls

NVIDIA Corporation

CyberSecOp Consulting

Certcube Labs Private Limited

Cyberfort

AECOM

Endian

Recent Developments

In June 2025, Illumio Inc. announced a strategic collaboration with NVIDIA aimed at enhancing the cybersecurity of critical infrastructure organizations and advancing their Zero Trust initiatives. This partnership integrates Illumio’s breach containment platform with the NVIDIA BlueField networking platform, enabling improved security and operational efficiency across both IT and Operational Technology (OT) environments. Through this integration, organizations can deploy Illumio directly on NVIDIA BlueField, granting security teams deeper visibility into network dependencies and enabling precise security enforcement at both the host and network levels.

In May 2024, OPSWAT Inc. partnered with Hitachi Systems India to strengthen cybersecurity efforts across the country. This collaboration aims to expand OPSWAT’s presence in India while enhancing cybersecurity capabilities in the region. Together, OPSWAT and Hitachi Systems India will address the evolving cybersecurity demands across various critical infrastructure sectors, including government, banking and financial services (BFSI), IT and IT-enabled services (ITES), telecommunications, healthcare, manufacturing, retail, and e-commerce.

In April 2024, OPSWAT Inc. acquired CIP Cyber with the goal of connecting, training, and certifying cybersecurity professionals dedicated to protecting critical infrastructure. This acquisition, now integrated into OPSWAT Academy, a robust training platform focused on educating and certifying professionals in securing critical environments, represents a major advancement in cybersecurity education. By merging the strengths of both organizations, the collaboration will offer high-quality training to cybersecurity professionals around the world, featuring a total of 31 certification courses spanning IT and OT/ICS domains.

In February 2024, GE Vernova partnered with Dragos Inc. to deliver comprehensive cybersecurity solutions by leveraging their combined expertise in grid automation and operational technology cybersecurity. Through this collaboration, GE Vernova Grid Solution business will offer its global grid automation customers access to Dragos’ advanced cybersecurity offerings, including the Dragos Platform, Dragos Worldview threat intelligence, and incident response services. The goal is to provide a unified and robust approach to protecting critical infrastructure and other OT environments.

Cybersecurity In Critical Infrastructure Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.69 billion

Revenue forecast in 2033

USD 87.71 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

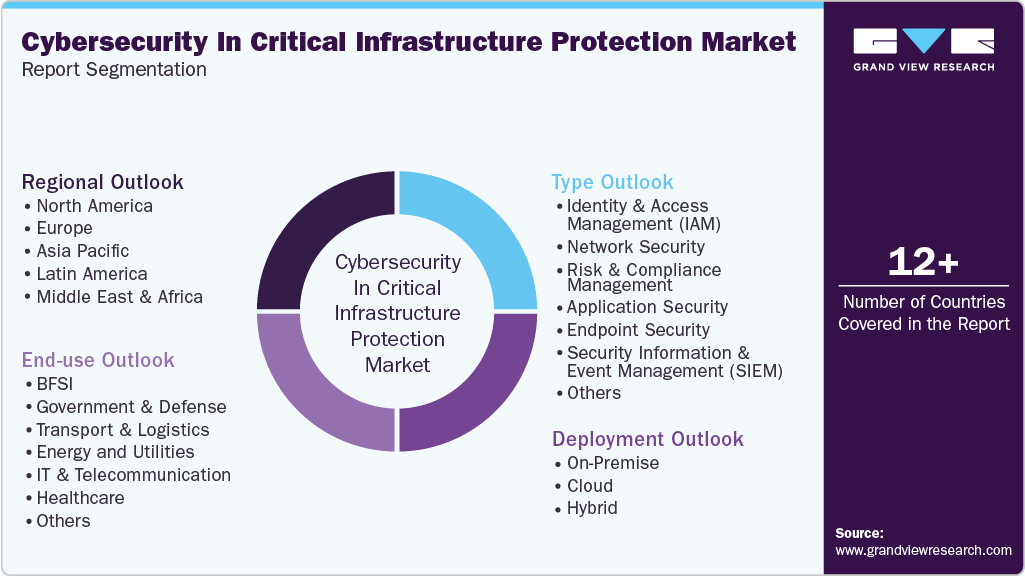

Segments covered

Type, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

GE Vernova; Rockwell Automation, Inc.; OPSWAT Inc.; Airbus; BAE Systems; CyberArk Software Ltd.; Delta Risk; Plurilock Security Inc.; Johnson Controls; NVIDIA Corporation; CyberSecOp Consulting; Certcube Labs Private Limited; Cyberfort; AECOM; Endian

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cybersecurity In Critical Infrastructure Protection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cybersecurity in critical infrastructure protection market report based on type, deployment, end-use, and region:

Type Outlook (Revenue, USD Billion, 2021 – 2033)

Identity & Access Management (IAM)

Network Security

Risk & Compliance Management

Application Security

Endpoint Security

Security Information and Event Management (SIEM)

Cloud Security

Data Loss Prevention (DLP)

Web Security

Threat Intelligence & Incident Response

Encryption and Tokenization

Others

Deployment Outlook (Revenue, USD Billion, 2021 – 2033)

End-use Outlook (Revenue, USD Billion, 2021 – 2033)

BFSI

Government & Defense

Transport & Logistics

Energy and Utilities

IT & Telecommunication

Healthcare

Oil & Gas

Others

Regional Outlook (Revenue, USD Billion, 2021 – 2033)

North America

Europe

Asia Pacific

China

India

Japan

South Korea

Australia

Latin America

Middle East & Africa

UAE

Saudi Arabia

South Africa