Phil SimScotland political correspondent

Getty Images

Getty Images

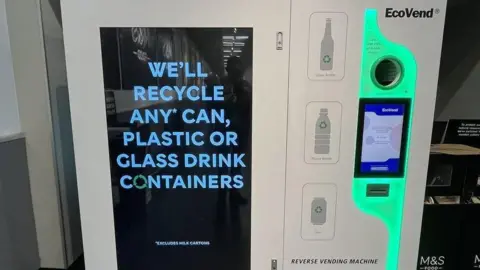

Waste firm Biffa was contracted to collect and process bottles and cans under the scheme

A civil servant has denied the Scottish government told “half truths” when it was trying to persuade firms to sign up to its failed deposit return scheme.

The recycling plan collapsed in 2023 following a dispute with the UK government over internal market rules, and waste firm Biffa is suing Scottish ministers for £166m in damages.

Official Charles Holmes told the Court of Session that the government had been aware of a “substantial risk” of the Internal Market Act affecting the scheme.

But government letters to Biffa and insurance broker Locktons did not mention this, and spoke of an “unwavering” commitment to launching the system on schedule.

Roddy Dunlop KC, representing Biffa, told the Court of Session it was “disingenuous in the extreme” and a “half truth” to voice confidence in the scheme going ahead without mentioning the potential for it to be derailed.

Mr Holmes said he did not accept this.

The Scottish government has always insisted it was not to blame for the collapse of the scheme, and says it did not offer special or unique assurances to Biffa.

‘Disingenuous in the extreme’

Mr Holmes was head of “extended producer responsibility” at the Scottish government at the time the scheme was being drawn up.

It would have seen Scots pay an extra 20p for a can or bottle in the shops, which would be refunded when it was returned for recycling.

The civil servant told the court that the government had considered a clash with internal market rules – which aim to maintain a level playing field for businesses north and south of the border – a “substantial risk” from December 2021, although it was one of “half a dozen or more” such risks.

Legal advice from a Cambridge University professor was sent by Holyrood’s net zero committee in January 2022 which warned that “core aspects” of the scheme could be “disapplied” by the Internal Markets Act.

This ultimately came to pass when the UK government said it would only back a more limited version of the system which excluded glass bottles, and which capped deposits at an unspecified level based on proposed schemes elsewhere in the UK.

Getty Images

Getty Images

The deposit return scheme was aimed at boosting recycling of bottles and cans

Scottish and UK officials had originally been in talks about an exemption from the regulations for both a law banning single-use plastics and for the deposit return scheme.

But in March 2022 it was confirmed that exemption would only apply to single-use plastics, and it was considered likely by officials that a fresh application would be needed for the recycling project.

Mr Dunlop highlighted that Lorna Slater, then the government minister in charge of the plans, had a meeting with her UK government counterpart on 16 May 2022, and that briefing notes for that meeting included discussion of the internal markets issue.

The next day, a letter was issued to Biffa underlining the government’s “unwavering” commitment to launching the system in August 2023.

Mr Holmes accepted the letter was an attempt to help persuade the company to sign a contract to carry out key functions in collecting and processing bottles and cans for recycling.

He said there were a lot of factors involved in the company’s decision, but that the government wanted to help with “a couple of points”.

But the letter made no mention of any potential issues with Internal Market Act rules – and Mr Dunlop said that made the letter a “half truth”.

Mr Dunlop said: “It was disingenuous in the extreme to say there is a complete and unwavering commitment to bring something into play when there is a known possible risk that the internal market act will prevent that from ever happening.”

Mr Holmes replied that he did not accept that.

Biffa has made the letter from Ms Slater a key part of its case, saying it was “foundational” in the firm’s decision to sign up to the scheme and invest more than £65m in infrastructure.

But the Scottish government has sought to downplay its importance, saying it did not offer special or unique assurances.

It has argued that Biffa was aware there were risks to the deposit return scheme, pointing to the fact the firm took out a £20m insurance policy – with a £3m premium – against any delay.

The scheme would have seen “reverse vending machines” set up to process returns

The court also examined emails between civil servants from earlier in May 2022 which Mr Dunlop said showed issues were being “kept secret” from firms.

A working group had been set up for companies which would be subject to the new system, with a publicly available register of potential risks to the plans.

The boss of one firm had written in on 6 May questioning whether compliance with internal market rules should be added to the register.

Civil servants discussed not doing this, because they had separately been threatened with legal action by a member of the Scottish Grocer’s Federation, which was part of the group.

Emails said it would be “difficult to include” information about the internal market concerns when the grocer’s federation and other “potentially litigious partners are in the room”.

Mr Dunlop said this appeared to be an attempt to “run down the clock” on a judicial review – which has to be lodged within three months of a decision being made.

Mr Holmes replied: “I read it more as saying there’s a general awareness of these risks and we are keen to avoid being pinned down on our own evaluation of how significant they are, given we are involved in an ongoing legal challenge.”

When Mr Dunlop suggested the government was “keeping things secret” to avoid legal action, the civil servant replied: “I think that’s a very strong way of putting it.

“We were trying to manage what information we put out in the public domain when there is a threat of being involved in litigation with a stakeholder who is in the room.”

Ms Slater is due to give evidence to the court in due course – as is former Scottish Secretary Alister Jack, who Ms Slater accused of an “act of sabotage” after the scheme collapsed.