The economy of the Salem area is a stand-out.

Even though job growth has been slowing, the area’s economy looks good compared to other areas of western Oregon, specifically Portland and Eugene.

So, we’ll analyze and compare trends for overall employment and for several industries, as well as unemployment trends in the Salem, Portland and Eugene areas. Finally, we’ll briefly discuss what might be ahead – is there a recession on the horizon?

To begin: job growth is slowing down.

In general, after large job losses early in the pandemic, jobs were regained quickly, up until about a year or so ago – at least in the Salem metropolitan statistical area.

Employment levels in the Portland area(comprised of nearly 1.5 million jobs) and in the Eugene-Springfield area (which has similar numbers of jobs as the Salem area – 161,000 and 181,000 respectively) show a more varied pattern of job losses and gains.

The differences began with the pandemic.

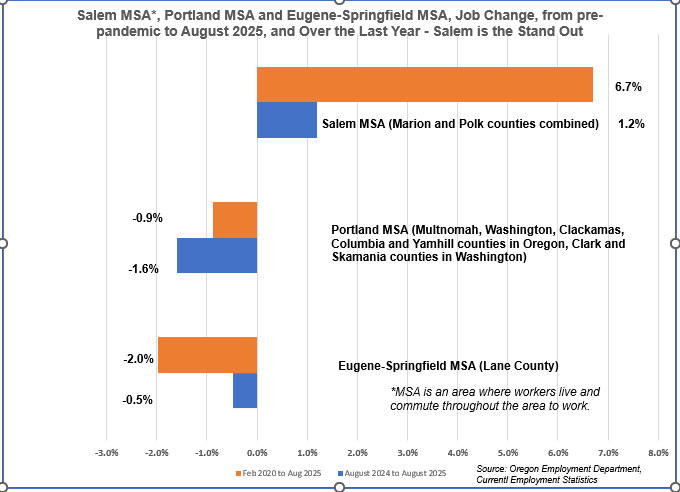

Looking back to February of 2020, one month before the pandemic hit with full force, three comparisons stand out.

The first is the size of total job loss. Salem lost 13% of jobs in the first two months of the pandemic, Eugene lost 16% and Portland 14%. These were job losses due to government-mandated business shutdowns to slow the spread of Covid. As the shutdowns eased, all three areas began to gain back jobs.

But the Salem area took 26 months to regain employment back to the level of February 2020 (pre-pandemic). The Portland and Eugene areas each took 35 months.

Another difference is employment change from February of 2020 (pre-pandemic) to August of 2025.

In August of 2025, Salem area employment was nearly 7% ahead of its pre-pandemic level. Both the Portland and Eugene-Springfield’s employment levels were slightly behind where they were pre-pandemic.

(PAMELA FERRARA/For Salem Reporter)

(PAMELA FERRARA/For Salem Reporter)

What about recent trends?

From August 2024 to August 2025, Salem gained several thousand jobs, the Portland area lost 2%of its jobs, and Eugene-Springfield area lost a handful of jobs.

The differences are at least partly due to the impact of specific industry employment on the total picture.

Analysis of three private sector industries is in order: leisure and hospitality, retail sales and health care. These industries experienced the largest pandemic job losses, and the health care industry experienced the added stress of being in the front lines of the pandemic. In addition, workers in these industries are a large portion of private sector employment – nearly one of every two private sector workers works in one these three industries.

The leisure and hospitality industry:

Is 9% of Salem’s private sector employment; lost four of ten jobs from March to April of 2020; and added 6% to its employment from 2019 to 2025;

Is 11% of Eugene area employment, lost one of two jobs in the first months of the pandemic, and gained a small handful of jobs from 2019 to 2025;

Is 11% of the Portland area employment; lost one of two jobs in the first pandemic months; and has declined by 2% from pre-pandemic employment levels.

To sum up, the leisure and hospitality industry is a somewhat smaller portion of private sector jobs in the Salem area, didn’t lose as large a portion of its jobs early in the pandemic, and has not only recovered to its pre-pandemic employment level, but has substantially added to it.

What happened with retail trade jobs? Retail trade is between 10% and 14% of employment in the three urban areas. All three areas lost considerable numbers of retail jobs (between 13% and 16% of total employment) in the first months of the pandemic. But in August 2025, retail employment was still behind pre-pandemic levels in all the areas, doubtless in part due to increased online shopping habits persisting beyond the pandemic.

The health care industry is a different story. Industry employment levels in August 2025 in Salem, Eugene and Portland were all well above where they were pre-pandemic. And this, in spite of the fact that in the early pandemic, all three areas lost 10% of health care jobs.

But, as a 2023 Harvard study stated, “the pandemic brought unprecedented instability to the (health care) labor market” especially in nursing, direct care and behavioral health. The instability seems to be ongoing.

As examples, in California, Kaiser Permanente, a large health care organization, is currently laying off workers. Oregon’s Kaiser Permanente was affected by a five-day strike (from Oct. 14 through the 19) called by several Kaiser unions. And, in spite of employment levels well recovered from the pandemic, there are reports of shortages of primary care doctors, nurses, other health care personnel now and into the future, especially in rural areas.

The Willamette Workforce Partnership, the local workforce development board and the sponsor of this column, recognized the industry’s challenges and formed a behavioral health consortium several years ago to organize sharing and problem-solving among participating organizations. The consortium has recently been expanded to include all types of health care organizations, and staff was hired to implement the expansion.

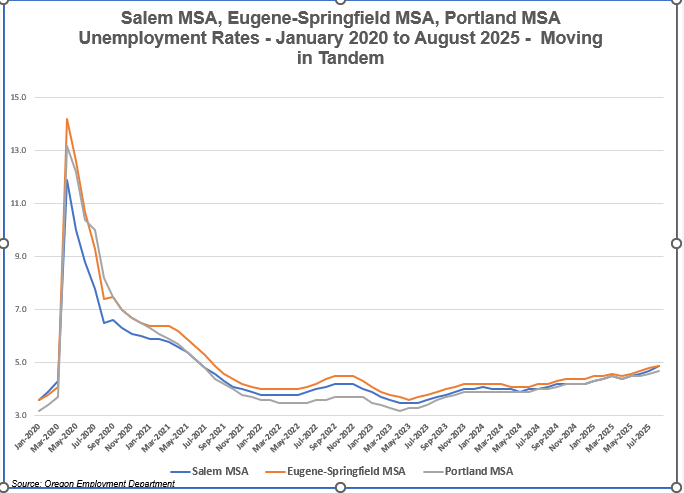

As the health care industry struggles with workforce issues, leisure and hospitality employment hopefully continues to recover, and retail employment likely continues its decline due to online shopping, unemployment rates have been increasing slowly. Salem’s rate in August was 4.9%. That is 11,000 people unemployed. This is up from lows of below 4% in 2023. Portland and Eugene unemployment rates have increased as well.

(PAMELA FERRARA/For Salem Reporter)

(PAMELA FERRARA/For Salem Reporter)

With weak job growth and increasing unemployment, is a recession in the offing? One has been predicted for several years now, but so far hasn’t appeared. The economists of the Oregon Office of Economic Analysis, in the latest revenue forecast published on Aug. 27, say we are “approaching the danger zone” and that the consensus probability of a recession is now 35%.

As of this writing, the federal government shutdown is still in effect. The Bureau of Labor Statistics (BLS), a federal agency, produces and publishes much of the economic information used regularly by economists in Oregon, the U.S. and the world.

However, because of the shutdown, the BLS isn’t publishing its monthly schedule of informational releases with an exception – the consumer price index press release. This will occur on Oct. 24. The CPI is considered vital because it is used to calculate numerous cost of living adjustments including that for Social Security. What the Oct. 24 press release tells us about the CPI is interesting for another reason. The CPI measures inflation, which has been ticking up lately – will it show another increase?

As usual, stay tuned. We’ll write again at the first of the year, and there’ll be plenty to report by then!

Pam Ferrara of the Willamette Workforce Partnership continues a regular column examining local economic issues. She may be contacted at [email protected].

STORY TIP OR IDEA? Send an email to Salem Reporter’s news team: [email protected].

A MOMENT MORE, PLEASE– If you found this story useful, consider subscribing to Salem Reporter if you don’t already. Work such as this, done by local professionals, depends on community support from subscribers. Please take a moment and sign up now – easy and secure: SUBSCRIBE.

Pamela Ferrara is a part-time research associate with the Willamette Workforce Partnership, the area’s local workforce board. Ferrara has worked in research at the Oregon Employment Department, earned a Master’s in Labor Economics, and speaks fluent Spanish.