Central Banks Easing as Markets Broaden

Tuesday, September 9th 2025, 10:33AM

by Harbour Asset Management

Key market movements

Global equities continued their strong run in August, returning 2.5% in unhedged NZD terms and 2.0% NZD-hedged, their fourth month in a row of gains. Equity market performance broadened, with investors rotating away from the mega-cap technology companies and into small-cap stocks.

The New Zealand equity market posted a modest gain, with the S&P/NZX 50 Gross Index (including imputation credits) returning 0.9% for the month. The June reporting season produced mixed results, with aggregate earnings forecasts trimmed. Defensive sectors led performance, while consumer discretionary and information technology sectors lagged.

Bond markets also rallied in August. New Zealand bonds rose 1.2%, supported by a dovish pivot from the RBNZ at its Monetary Policy Statement, cutting the OCR by a further 25bps. Global bonds posted a gain of 0.5%, weak jobs data increased expectations of a Fed rate cut in September with the US 10-year Treasury yields falling 15bp over the month.

Key developments

August delivered positive returns across most asset classes as steady economic activity and controlled inflation supported investor sentiment, despite weakening data from US labour markets and concerns around AI valuations. While global activity remained resilient, political uncertainty emerged in France where the prime minister faces a vote of no confidence over budget cuts, and the US where the administration is increasing its influence on monetary policy.

US labour market weakness increased the prospect of Fed rate cuts, overwhelming tariff-related inflation risk. Just 73k jobs were added in July and given substantial negative revisions to June and May, the US labour market added just 35k jobs per month between April and July. The unemployment rate rose to 4.2%, from 4.1%. At his Jackson Hole Economic Symposium speech, Fed Chair Powell noted that “downside risks to employment are rising.” Following the July data, markets ascribed an 80-90% chance of a Fed rate cut in September vs. 40% prior to the data, and a total of 50-60bp of easing this year, vs. 30bp prior.

The RBNZ recognised the need to provide more stimulus to the ailing NZ economy by cutting the OCR by 25bp to 3.0% at its August MPS decision and implying two more rate cuts this year. Another part of the RBNZ’s dovish pivot was that two members of the Monetary Policy Committee preferred to cut the OCR by a larger 50bp. While the market has moved to price an OCR low consistent with the new forecasts, it appears to ascribe little chance of a more negative scenario with the market implying the hiking cycle to start in the second half of next year.

The external sector remains the bright spot and along with lower interest rates, may play a role in the overall economic recovery. Our primary exporters continue to enjoy historically high revenue and a positive outlook, despite a 15% US tariff which we think is unhelpful but not disastrous. As if a record-high farmgate milk price of $10.15/kgMS wasn’t enough, Fonterra shareholders have been given an additional boost from the sale of the consumer business which may see as much as $400,000 paid to the average shareholder in the first half of next year. Farmers had already been looking more confident, with an increase in borrowing in the past two months and a small reduction in cash balances. This will be an important part of the economy to monitor and gauge the degree to which it is contributing to a broader improvement in economic growth.

The second-quarter US earnings season concluded with S&P 500 companies delivering an average earnings gain of 11.7% year-over-year, marking the third consecutive quarter of double-digit growth. The much-anticipated Nvidia earnings result saw the company post revenue of US$46.7bn, up 56% on last year, with demand for AI chips continuing to underpin data-centre strength. However, management struck a more cautious tone in its outlook, excluding potential sales to China. Fading enthusiasm for artificial intelligence weighed on technology shares during the month, with investors rotating away from mega-cap technology companies that have dominated market returns and into cheaper valued small-cap stocks.

What to watch

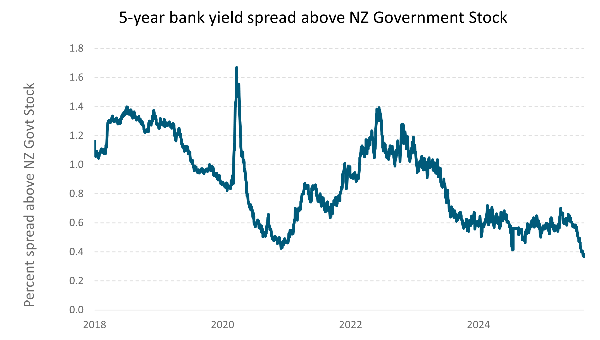

A sign that global markets are seeing the economic environment as being comfortably benign can be seen not only in elevated equity markets, but also in credit markets. Risk premiums attached to corporate bonds relative to government bonds have tightened considerably. This phenomenon is also at play in New Zealand and was illustrated recently, with ASB Bank managing to issue a new 5-year bond at a margin of 0.45% above equivalent maturity NZ Government Stock. This is the tightest level we have seen since the GFC. The deal size, at $1.2bn, was large and garnered support from a broad range of investors. However, with current tight levels we see a skew of risks towards credit spreads widening at some stage, adversely affecting the bonds valuation.

Market outlook and positioning

The macroeconomic outlook is looking seemingly benign as tariffs settle at lower levels than initially feared, inflation remaining under control and China’s economy growing above 5%. Global growth estimates for this year and next are around 3%, suggesting a moderation in activity rather than a sharp drop. However, as a reminder that stability may prove to be temporary, the US courts are currently deeming the tariffs as unlawful. If this view is supported by the US Supreme Court, tariffs could be reduced and with that, debt sustainability could come back as a challenge, given the revenue the tariffs provide the US Government.

The June reporting season for New Zealand and Australian equities produced mixed results, with aggregate earnings forecasts trimmed primarily due to lower revenue expectations. Despite this, more companies issued positive outlooks than negative, and improving confidence saw several firms announce a modest increase in dividends and buybacks. Both markets continue to trade above long-term price-to-earnings averages. Ongoing central bank rate cuts may support liquidity and valuations, while economic growth is picking up, albeit from a low base in New Zealand. While supportive conditions may not last indefinitely, we expect them to underpin local share market returns over the next year, with potential profit upgrades offering additional upside if company guidance proves conservative.

Political developments are adding complexity to global bond markets. The Trump administration has announced plans to remove US Federal Reserve Governor Lisa Cook, undermining confidence in the Fed’s independence. The political influence on monetary policy and concerns about government debt levels – both in the US and Europe – have pushed longer-term yields higher. Meanwhile soft employment data has increased expectations of Fed rate cuts in the near-term. In New Zealand, the RBNZ delivered on expectations with a 25bp OCR cut to 3.0% at its August MPS, with two committee members voting in favour of a larger 50bp move. The dovish pivot implies two further cuts this year, though markets appear complacent about downside risks. With the output gap approaching -2% and new RBNZ research suggesting the neutral rate may be closer to 2% than 3%, we see scope for more prolonged easing than is currently priced in by the market.

Within equity growth portfolios, our strategy remains to be patient, position for a range of scenarios and to be selective, with a focus on quality growth companies. We continue to emphasise businesses delivering earnings per share growth that can exceed and extend beyond market expectations, supported by long-term structural themes such as digitisation, disruption, de-carbonisation and demographic change. Portfolios are overweight in companies exposed to these secular tailwinds, particularly in the defensive growth healthcare sector and the higher growth technology sector, where strong cashflows support valuation. We also maintain overweight positions in selected materials and consumer staples shares that benefit from structural change and have pricing power. Within financials we remain underweight in banks where valuation multiples leave limited room for an earnings slowdown. The portfolio remains underweight in the lower growth utilities, communications, infrastructure and real estate sectors.

In fixed interest, our positioning for an RBNZ pivot towards a 2.50-2.75% OCR was validated by the 20 August MPS decision, which acting Governor Hawkesby delivered with surprising confidence. While we continue to hold a long duration position, we have shifted our focus from the 3-year maturity towards the 5-to-8 year maturity range where more attractive yields remain available. If the OCR reaches 2.5% or lower and remains there for a year or two, this longer maturity positioning should deliver considerable benefit despite potential volatility. We are cognisant of emerging risks from global long-term bond yields potentially rising and lifting New Zealand yields with them. The domestic yield curve has begun steepening with longer-term bonds underperforming, prompting us to reduce our long-term bond exposure. Additionally, we have been increasing our allocation to inflation-indexed bonds. We believe these bonds have cheapened to attractive entry levels and provide valuable medium-term protection should inflation rise again.

Within the Active Growth Fund, we moved to a modestly overweight position in global equities following month end, reflecting our growing confidence in the broadening market rally. August has seen previously unloved areas of the market perform well, suggesting participation beyond the narrow leadership that dominated earlier this year. We are seeing signs of global growth acceleration, while earnings momentum continues to be broadly supportive. A Fed rate cut in September appears highly likely, along with a reduction in the “dot plot” projections of Fed Funds rates, and this could serve as a meaningful catalyst to propel markets further. We have funded this overweight equity position through an underweight to domestic fixed interest and cash. We remain overweight global bonds, as they offer not only attractive yield levels in our base case of moderate global growth, but also portfolio protection should economic conditions deteriorate. With global central banks easing and term premia still elevated, we see bonds as an increasingly compelling asset class. Currency-wise, we remain long NZD versus foreign currencies. The USD remains expensive on long-term valuation metrics, and many of Trump’s policies carry downside risk for the dollar through potential capital outflows.

In the Income Fund, we retain the view that the medium-term outlook for Australasian equities is positive, based on our views about inflation and the expectation that a cyclical recovery in New Zealand is more likely than not. In fixed interest, the lower Official Cash Rate is one reason why the yield curve has been steepening. Global concerns about fiscal concerns continue to be the other major key theme, causing 30-year bond yields to rise in most markets. The New Zealand yield curve is affected by both of these factors, with the net effect being that there is considerable yield pickup available from investing in 5, 10 and 20 year securities relative to cash. The maths that supports this proposition is motivating us to lengthen duration provided we can keep a close eye on global and domestic fiscal developments and avoid risk if volatility flares up. Overall, our strategy is a relatively cautious one at present, as we do not see any opportunities that argue for a large active position.

DISCLAIMER information September 2025

Important disclaimer information

Comments from our readers

No comments yet

Sign In to add your comment