(Sept 9): Asian stocks climbed on Tuesday as Wall Street’s upbeat mood ahead of expected US Federal Reserve (Fed) rate cuts flowed into regional trading.

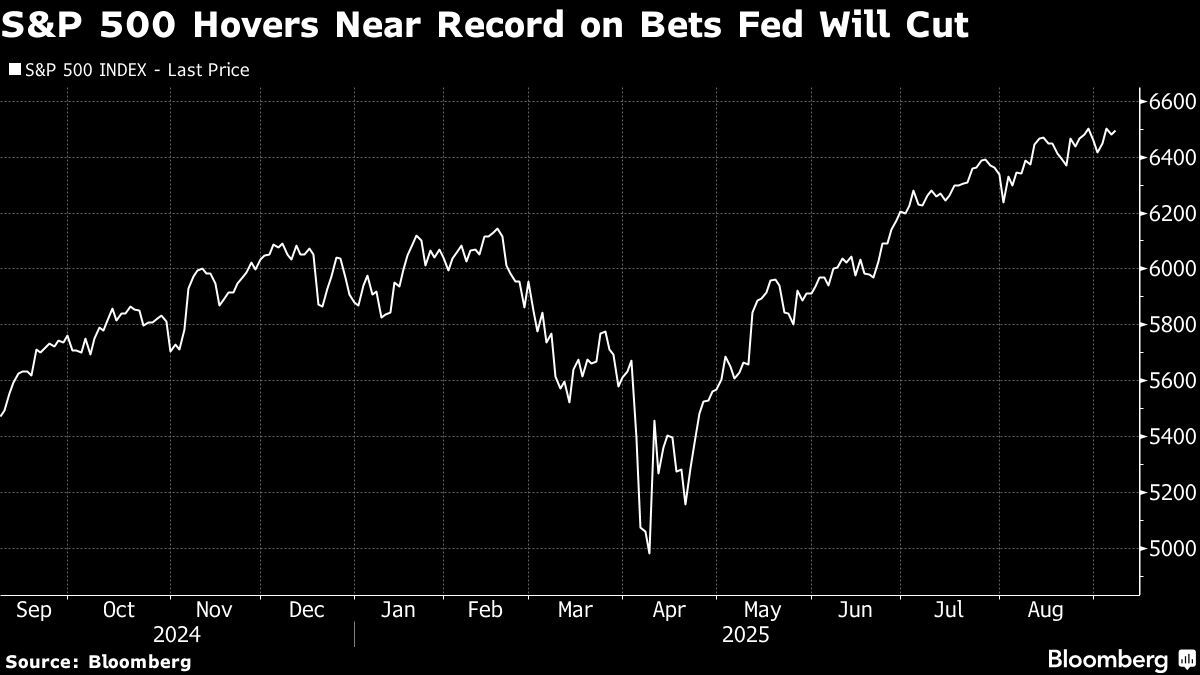

MSCI’s Asia-Pacific equities gauge reached its highest levels since February 2021 as shares in Japan and South Korea rose. The moves followed a surge in bets on rate cuts by the US central bank that pushed stocks near record highs on hopes that easier policy will bolster corporate America.

In Japan, the implications of the nation’s latest political turmoil have spilled into markets. Long-maturity Japanese government bonds slumped Monday as Prime Minister Shigeru Ishiba’s decision to step down underscored expectations for looser fiscal policy.

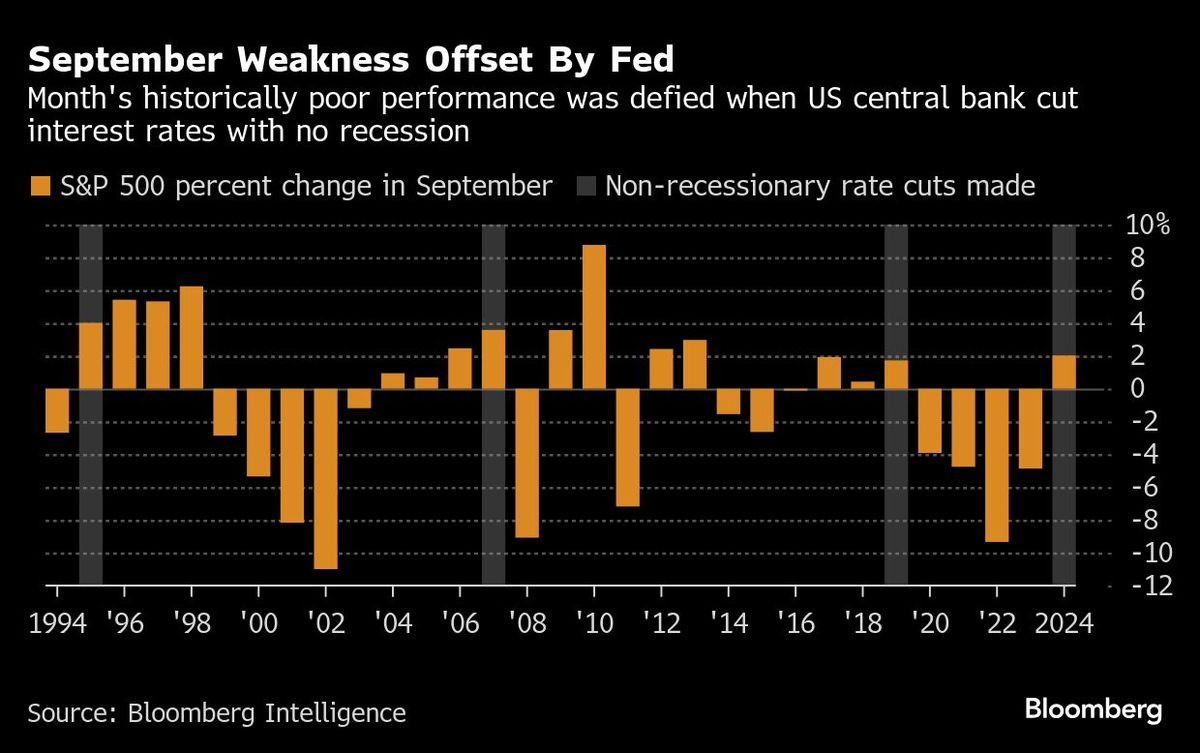

The S&P 500 rebounded on Monday after a sell-off the prior session due to the weak jobs report. Even as upcoming data is projected to show stalled progress on reducing inflation, traders expect almost three Fed cuts this year, starting this month. Treasuries were steady, with the two-year yield remaining at its lowest since 2022. The dollar fell and gold stayed around record high levels.

“For the next several days, markets in Asia are likely to take their cue from the US, with few regional catalysts in sight,” said Frederic Neumann, HSBC’s chief Asia economist. He sees American inflation data as helping to clarify the interest-rate path not just for the Fed, but also for Asian central banks including the People’s Bank of China.

Ahead of next week’s Fed meeting, Thursday’s core consumer price index is projected to show a 0.3% increase in August for a second month. Before that, figures from the Bureau of Labor Statistics on Tuesday will likely unveil another US jobs markdown that will set the stage for a rate cut.

Fed officials have signalled concerns are shifting from the inflation risks posed by tariffs to weakness in the job market. Steady inflation expectations are an indication that tariffs could prove a one-time price shock. That’s even if they take several months to work their way through the economy.

“While the Sept 5 report showed job growth had slowed, it doesn’t appear to be signaling a recession,” according to the Invesco Global Market Strategy Office. “Slower growth, anchored inflation expectations, falling yields, and anticipated rate cuts point to an optimistic outlook for stocks.”

Elsewhere, Indonesian President Prabowo Subianto abruptly replaced Sri Mulyani Indrawati as the finance minister, risking renewed financial turmoil for Southeast Asia’s biggest economy following violent protests in recent weeks against his administration.

China’s export growth slowed to the weakest in six months as a slump in shipments to the US deepened again, although a surge in sales to other markets kept Beijing on track for a record trade surplus.

In France, Prime Minister Francois Bayrou lost a confidence motion in Parliament, forcing a third change in government in just over a year. The country’s 10-year note futures opened steady.

To Megan Horneman at Verdence Capital Advisors, upcoming inflation data probably won’t be enough to change the likelihood of a Fed reduction in September. The biggest question for investors now is how many more rate cuts we will receive.

“After this week’s inflation data, we will get a better picture on what the Fed can do with rates,” Horneman said. “However, we are not out of the woods with inflation, and the Fed may deliver a ‘hawkish cut’ while reminding investors of their dual mandate, especially if inflation continues to move further away from their target.”

In commodities, oil rose for a second day as investors weighed the the prospect for softening demand after Saudi Arabia cut pricing for most of its grades.

Stocks

S&P 500 futures were little changed as of 9.49am Tokyo time on Tuesday

Japan’s Topix rose 0.7%

Australia’s S&P/ASX 200 fell 0.5%

Euro Stoxx 50 futures fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at US$1.1772

The Japanese yen rose 0.2% to 147.21 per dollar

The offshore yuan was little changed at 7.1203 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to US$111,810.08

Ether rose 0.2% to US$4,306.34

Bonds

The yield on 10-year Treasuries was little changed at 4.04%

Japan’s 10-year yield declined 2.5 basis points to 1.545%

Australia’s 10-year yield declined three basis points to 4.25%

Commodities

West Texas Intermediate crude rose 0.3% to US$62.44 a barrel

Spot gold was little changed