It was supposed to be a quick fix for a sudden problem in credit markets.

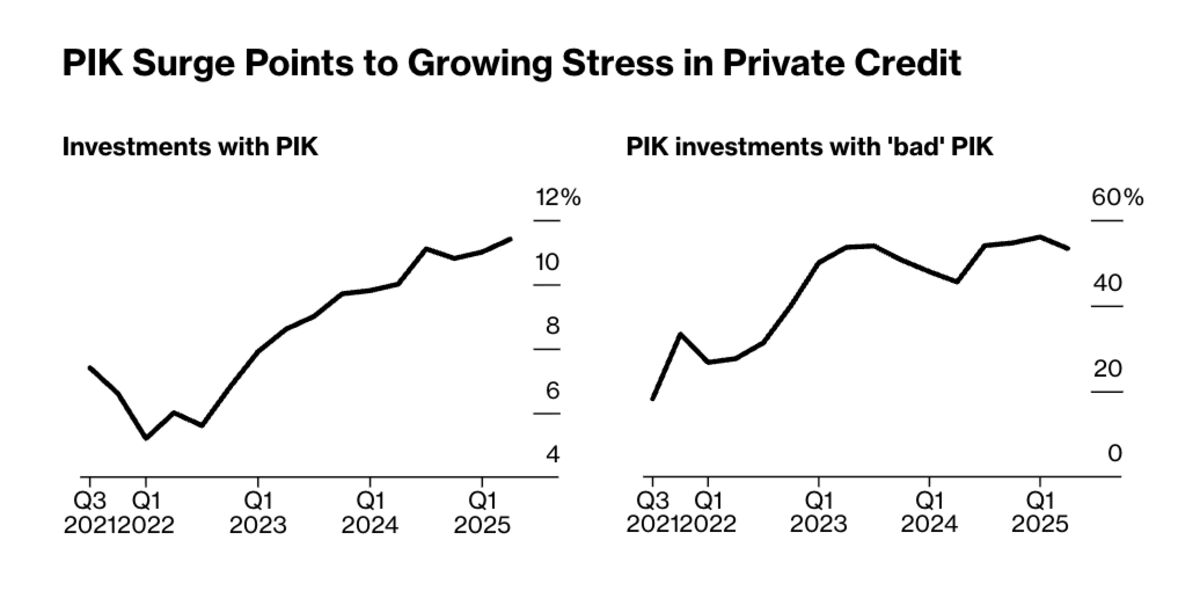

Payment-in-kind debt, the argument went, would give struggling borrowers breathing room to deal with soaring interest rates — by letting them push back payments until the debt itself had to be repaid. But the pile of this expensive debt keeps on swelling, and is now raising concern in some circles that private credit funds are using PIK to mask a deterioration in loan quality.