Well, house prices might not have moved much this year due to the abundant supply for sale – but it doesn’t mean there hasn’t been demand as well.

A crunch of the Reserve Bank (RBNZ) loans by purpose figures for the first nine months of this year show that the banks’ mortgage pile is set to grow by easily its biggest amount this year since the pandemic splurge of 2021 when the amount of outstanding mortgage money surged by an astonishing $30 billion, a growth rate of $2.5 billion a month, or well over half a billion dollars a week.

After this massive pile-on came a perhaps inevitable pull-back, with the mortgage pile growing by only about $38 billion over the course of the next THREE years, including a 2023 low in there of about $10 billion.

For the first nine months of this year the bank mortgage pile has grown by $15.203 billion (to a grand total of $379.302 billion by the end of September 2025).

As some means of comparison, in the first nine months of 2021 the mortgage pile grew by $23.3 billion, while in the first nine months of 2024 it grew by just $9.3 billion and for the first three-quarters of 2023 by only $7.8 billion – so, the growth rate so far this year is close to double what we saw two years ago.

The participation, or non-participation, of investors has been a big part of the story.

In the second half of 2020, with the RBNZ having removed the loan to value ratio (LVR) limits, investors grew their share of the mortgage pile by $5.28 billion.

With the subsequent reinstatement of the LVR limits and with air escaping from the housing market bubble during 2022, investors very much took a back seat. Some months their share of the mortgage pile actually fell.

In 2023 just $340 million was added to the investors’ mortgage pile.

However, by last year things were on the move again and the pile increased by over $3 billion.

And for the first nine months of this year, investors’ share of mortgage money has increased by $5.2 billion to $98.672 billion as of the end of September. It seems a reasonable bet that the $100 billion mark will be reached by the end of the year.

As the RBNZ noted in its highlights summary of the September month, total housing lending stock increased by $1.8 billion (0.5%) in September 2025, down on the $2 billion (0.5%) increase recorded in August.

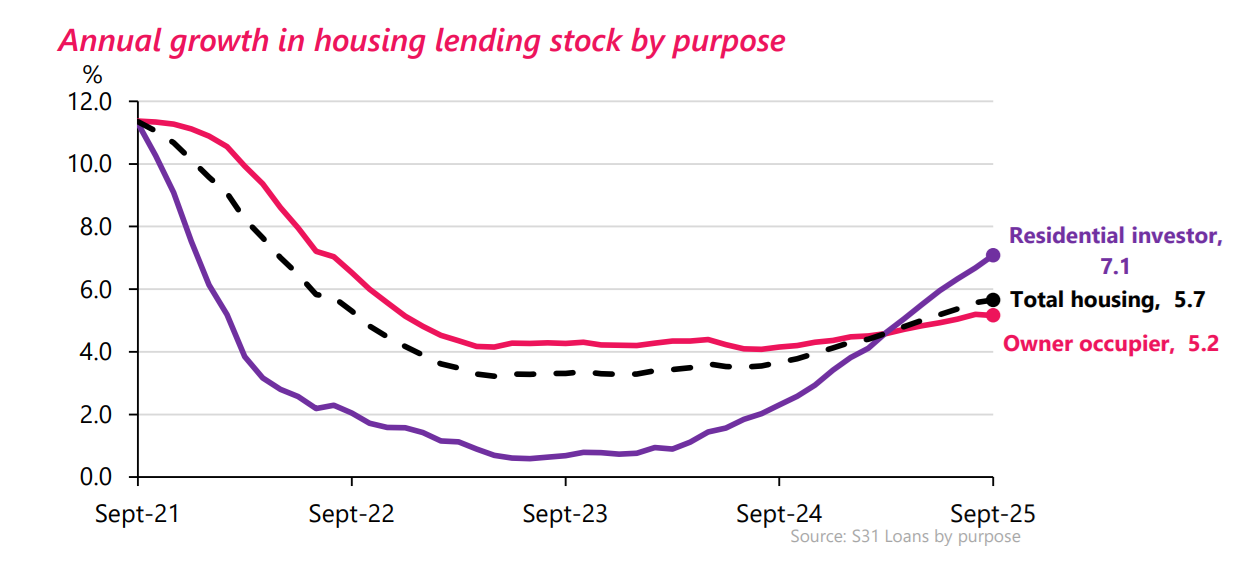

The annual growth rate increased from 5.6% to 5.7%, marking its highest rate since August 2022. Owner occupier lending increased by $1.1b (0.4%), while residential investor lending increased by $699 million (0.7%).

While the overall growth rate of the mortgage pile stands a 5.7%, the investors are actually outstripping that with 7.1%.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.