(Bloomberg) — China’s broad fiscal spending slumped in October by the most since at least 2021, crippling a key driver of investment and economic growth.

The combined expenditure in China’s two main budgets — the general public account and the government-managed fund book — tumbled 19% in October from a year earlier to 2.37 trillion yuan ($334 billion), according to Bloomberg calculations based on data released by the Ministry of Finance on Monday.

Most Read from Bloomberg

It was the steepest slide since comparable data started in early 2021, while the value of money spent was the least since July 2023. Goldman Sachs Group Inc. said its proprietary “augmented fiscal deficit” metric narrowed last month, indicating that budget policy “turned less supportive of growth.”

The plunge reflects an evolution of government policies and underlines waning fiscal support for the world’s second-largest economy, which lost steam across the board last month.

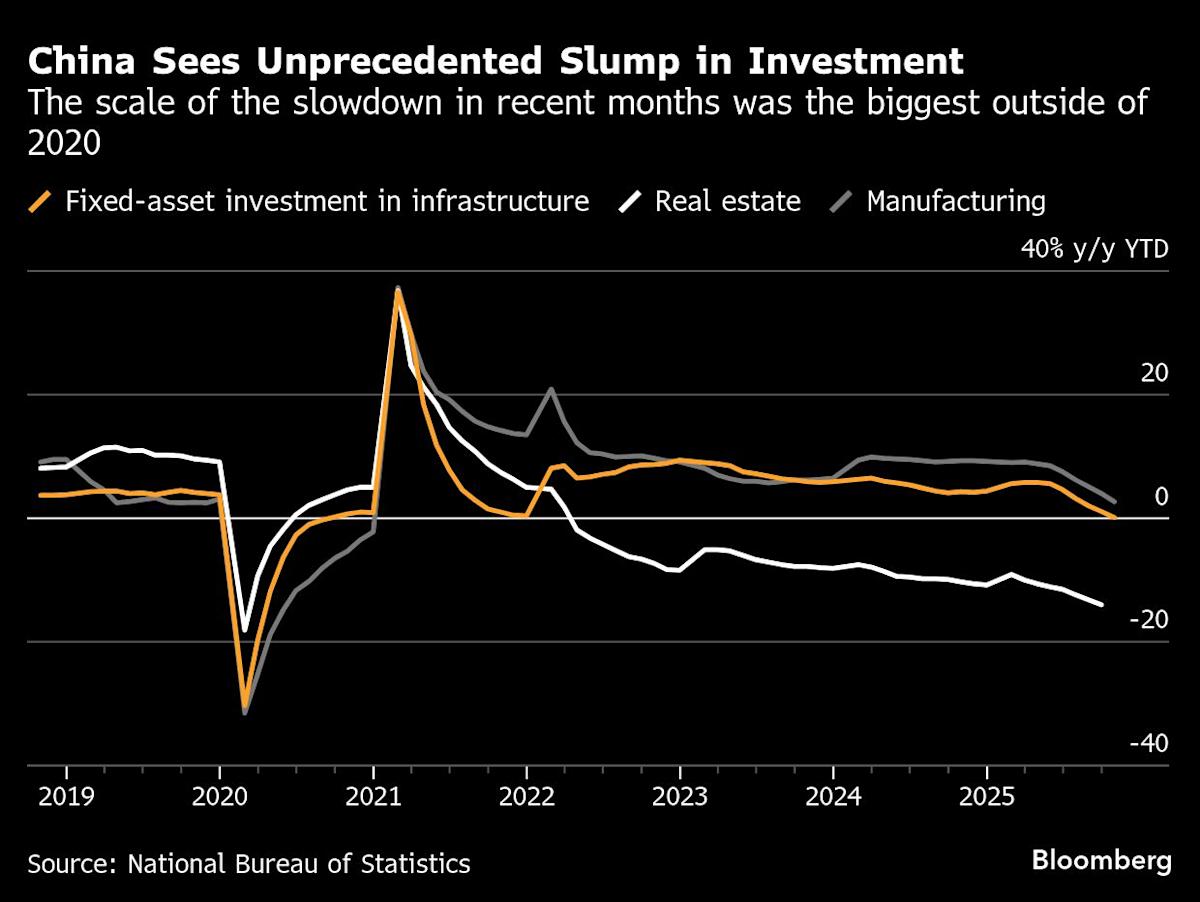

Investment, a large part of which is driven by budget expenditure, posted an unprecedented decline in October, adding to a drag from sluggish consumption and weaker foreign demand.

The “data suggest that the meaningful deceleration in government spending growth, together with a larger portion of incremental spending being spent on repaying corporate arrears — rather than investment projects — may have significantly weighed on headline fixed-asset investment growth,” Goldman economists including Lisheng Wang wrote in a note.

Infrastructure-related spending under the general public budget, including outlays on transportation, water conservation and urban and rural community affairs, fell almost 26% on year last month to 361.6 billion yuan, according to Bloomberg calculations based on the Ministry of Finance numbers.

The contraction in budget spending also indicates that fresh stimulus added since late September will likely take time to trickle through the economy. The 500 billion yuan in new policy financing tools to spur investment was only fully deployed by the end of last month, the government has said.

Another 500 billion yuan in special local government bond quota was announced in mid-October, but only 40% of it was meant for qualified provinces to invest in projects. The move suggests Chinese authorities are leaning toward containing debt risks now that Beijing’s growth target of around 5% for this year looks safely within reach.

Story Continues

What Bloomberg Economics Says…

“The government may continue to direct more resources toward local government debt resolution by year-end, rather than investment. In early 2026, it will probably allocate part of the 2026 local government special bond quota ahead of the March National People’s Congress to frontload project spending.”

— Eric Zhu, Chang Shu and David Qu. For full analysis, click here

The additional bond quota, which Beijing has said is also meant for reducing off-balance-sheet borrowing by local governments and repaying arrears owed to companies, came on top of another 2.8 trillion yuan of notes previously earmarked this year to trim debt.

“Policymakers seem pleased about economic growth in 2025 and believe announced stimulus should allow them to hit this year’s target,” said Michelle Lam, Greater China economist at Societe Generale SA. Therefore, “markets are looking forward to fiscal support in 2026,” she said.

China’s Finance Minister Lan Fo’an has pledged to set the budget deficit as a percentage of gross domestic product — as well as the scale of government borrowing — at “reasonable” levels over the next five years as part of efforts to support economic growth, the official Xinhua News Agency reported last week.

Fiscal resources will be allocated to focus on supporting development in areas ranging from technology and education to social security, agriculture and environmental protection, he said, envisaging stronger coordination with monetary, industrial and regional policies.

For the first 10 months of the year, the broad government expenditure totaled 30.7 trillion yuan, with its growth rate slowing to 5.2%. The combined government income edged up 0.2% to 22.1 trillion yuan, even with land sales in January-October down 6.5% on year.

That left the broad budget deficit at 8.6 trillion yuan, over 20% more than during the same period last year.

“This year, a large amount of the bonds issued was used for debt replacement instead of real economic activity,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd.

The Chinese government “will need to review the spending pattern of the funds available” to smooth growth momentum from now through the first quarter of 2026, he said.

(Updates with ANZ economist’s comment in final two paragraphs.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.