New-vehicle inventory is gradually increasing as next-model-year vehicles arrive and measures to encourage electric vehicle purchases take effect. Sales in August were higher compared to previous months and the previous year; new-vehicle inventory and days’ supply have declined year over year, based on Cox Automotive’s analysis of vAuto Live Market View data.

2.76M

Total Inventory

as of Aug. 31, 2025

$48,697

Average Listing Price

As of early September, the total U.S. supply of unsold new vehicles stands at 2.76 million units, marking a 4.8% increase month over month, but still 3.9% below last year’s levels. This modest rise in inventory suggests a stabilizing supply chain, though not yet a full recovery to pre-pandemic norms.

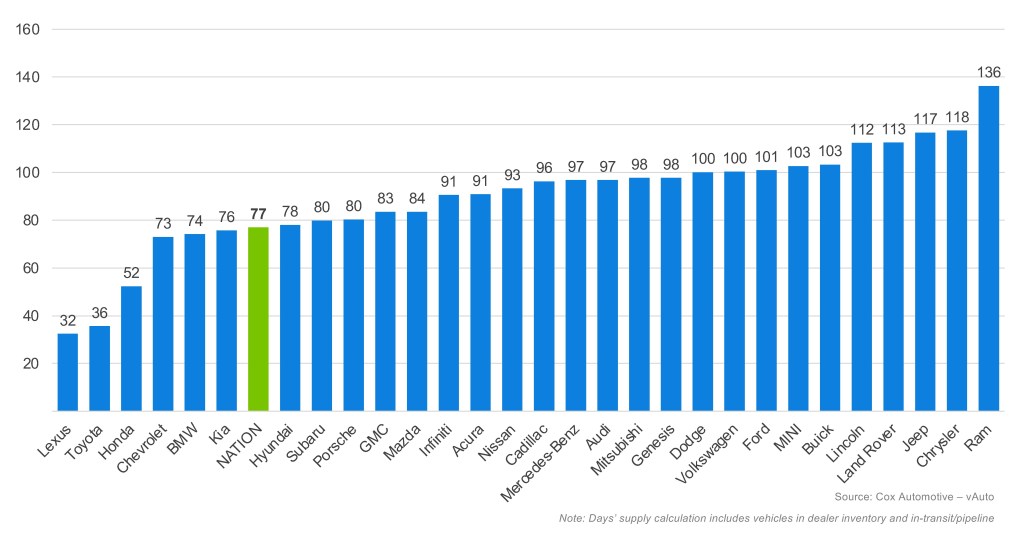

Days’ supply rose to 77, up 4.1% from August, but down 10% year over year, indicating that while inventory is growing, vehicles are moving off lots faster than they were a year ago. This dynamic reflects a more balanced market, with automakers showing discipline in uncertain times and consumer demand holding steady.

The average listing price climbed to $48,697, a slight 0.2% increase from August, and up 4% compared to September 2024. This continued upward trend in pricing reflects both inflationary pressures and a continued shift in consumer preference toward higher-trim models and larger vehicles.

The sales pace was also healthy in August, according to the vAuto data, with new-vehicle sales up 0.7% month over month and a robust 6.7% increase year over year. This growth is supported by an urgency of electric vehicle sales as the market rushes to benefit from expiring tax credits, as well as dealers taking advantage of increased traffic given some of the eye-popping incentives being offered on EVs.

Inventory Trends: A Tale of Two Halves

The first half of 2025 saw a clear decline in inventory from January through May, driven by an initial rush on sales amid widespread media coverage of potential tariff-induced price hikes. Consumers moved quickly to secure vehicles before anticipated cost increases, leading to a sharp drawdown in available supply.

From May onward, however, the inventory story shifted into a steady state. A large part of the continued downward pressure on supply can be attributed to manufacturers not replenishing their EV models, as well as being highly disciplined with underperforming models and those directly impacted by tariffs. Meanwhile, more successful models have been slowly recovering in inventory, suggesting a strategic recalibration by automakers to focus on profitability and demand alignment.

Brand-Level Inventory Discipline and Potential Strategic Shifts

Within the Stellantis portfolio, niche players like Fiat and Alfa Romeo are shrinking inventory. Whether this signals a broader strategic shift or a potential wind-down of these brands in the U.S. remains to be seen. Their reduced presence could open the door for Stellantis to reallocate resources toward more competitive segments or emerging technologies. The same could be said for low-volume, import-focused brands like MINI, Infiniti and Jaguar (Jaguar is in the midst of a strategic rethink; days’ supply is more than twice the industry average). Meanwhile, brands like Toyota, Honda and Kia are seemingly holding production in balance with demand. Chevrolet and Mazda are showing strong inventory discipline as well.

August Days’ Supply of Inventory by Brand

Average New-Vehicle Listing Prices Edge Up Amid Cost Pressures

The average new-vehicle listing price at the end of August inched higher by 0.2% month over month to $48,697. Compared to last year, average listing prices were 4% higher, which is likely the beginning of the steady climb towards higher prices, given the enormous cost pressure on automakers due to tariffs. Still, given some tailwinds in the industry from the rollback of EV penalties and sizeable benefits from the One Big Beautiful Bill Act for large businesses, it may be early 2026 before we see substantial increases.

According to Kelley Blue Book, the average transaction price (ATP) of a new vehicle in August was $49,077, representing a month-over-month increase and a year-over-year jump of 2.6%. New-vehicle sales incentives softened slightly to 7.2% of ATP, down from 7.3% in August.

Looking Ahead

Although inventory levels remain below last year’s benchmarks, the upward momentum in sales and pricing reveals a resilient and adaptive market. The first half of 2025 saw significant inventory drawdowns as consumers rushed to purchase vehicles ahead of anticipated tariff-driven price hikes, while the latter half is beginning to show disciplined manufacturer replenishment strategies and selective focus on profitable, in-demand models.

As we approach the final quarter of the year, attention will center on how automakers recalibrate production, respond to cost pressures, and leverage promotional activities, all while consumers weigh new incentives amid rising retail prices.

Erin Keating

Executive Analyst

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.