By Gary Anders

It is the quantum technology leap that scientists have waited decades to take.

It is also a gap that is rapidly closing, as a growing number of technology companies join the race to develop the world’s first quantum computer.

Among those companies are IT giants Google, Microsoft, IBM, NVIDIA and the relatively small Silicon Valley-based technology firm PsiQuantum.

In an industrial precinct adjacent to Brisbane Airport in Queensland, Australia, PsiQuantum and its partner, Germany’s Linde Engineering, are building a cryogenically cooled plant that they say will house the first utility-scale, fault-tolerant quantum computer.

This ambitious project is backed by A$940 million in funding from the Australian and Queensland governments.

What is quantum computing?

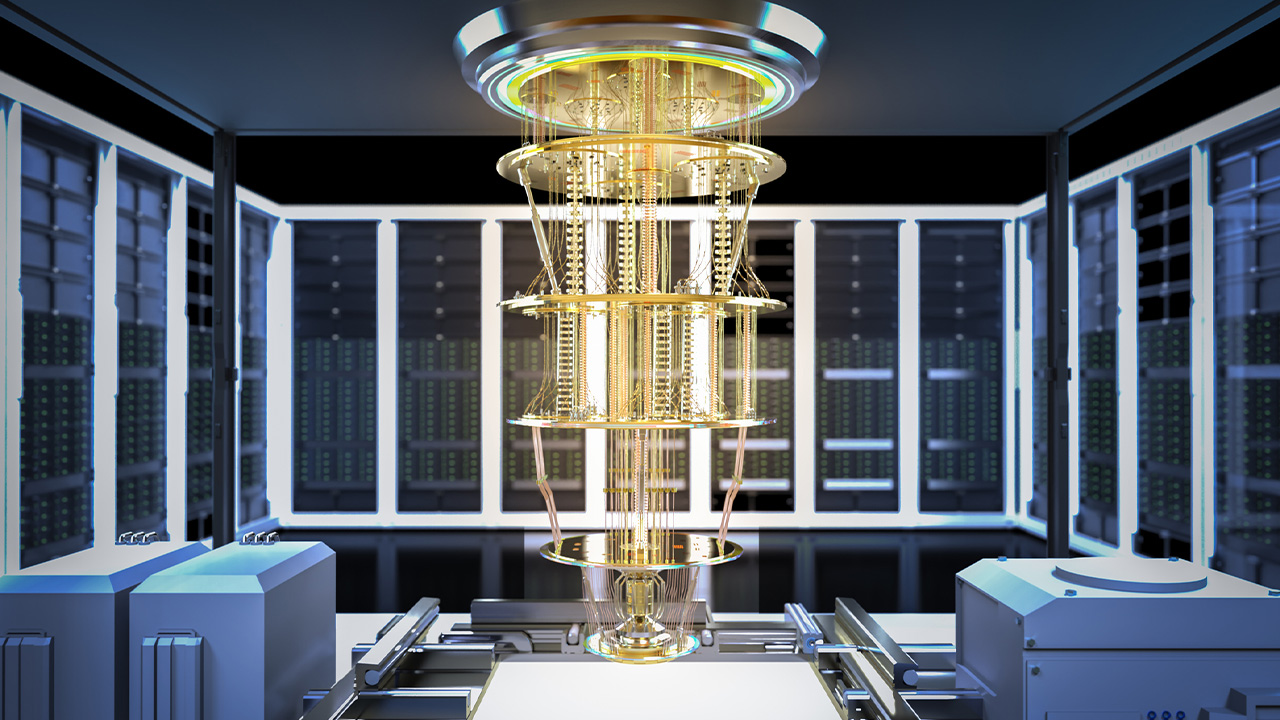

Unlike traditional computers, which process millions of bits of data separately, quantum computers aim to harness advancements in physics and chemistry to process much larger amounts of information simultaneously and at significantly higher speeds. The units of information that enable this processing leap are known as quantum bits (qubits).

Quantum computing has the potential to bring about groundbreaking advancements across fields such as medical research and artificial intelligence (AI). It could also optimise many complex, time-sensitive processes undertaken across the global financial sector.

For accountants, quantum computing could lead to game-changing enhancements, such as the ability to conduct complex internal audits and complete granular tax modelling in milliseconds. Another advancement could be the ability for organisations to leverage quantum systems to instantly detect accounting anomalies and potential fraud.

“The moment for most financial services organisations to begin addressing their vulnerabilities to quantum threats is now, before large-scale quantum machines arrive.”— David Guarrera, EY Americas Generative AI Leader

Once access to such technology becomes commercially available and affordable, regulators may also utilise quantum computing technologies to assist with compliance activities and better inform policy development.

Management consulting firm McKinsey & Company says financial services companies that are able to leverage quantum computing are likely to achieve significant productivity gains by being able to analyse large or unstructured datasets more effectively.

“Sharper insights into these domains could help banks make better decisions and improve customer service, for example, through timelier or more relevant offers,” notes McKinsey.

“There are equally powerful use cases in capital markets, corporate finance, portfolio management and encryption-related activities.”

When will the first quantum computer be a reality?

In December 2024, Google announced the development of Willow, a quantum chip that could perform a complex computation in less than five minutes, which Google said would have taken one of today’s fastest supercomputers billions of years.

“The next challenge for the field is to demonstrate a first ‘useful, beyond-classical’ computation on today’s quantum chips that is relevant to a real-world application,” said Hartmut Neven, founder and manager of Google Quantum AI.

Earlier this year, Microsoft published a report to illustrate its progress in investigating the possibility of creating qubits using superconductors. It is still a work in progress. Microsoft has been conducting its research for over a decade and is yet to prove its technology will work in a quantum computer.

Meanwhile, PsiQuantum is pressing ahead with its Brisbane plant with the aim of achieving an operational launch by late 2027.

The PsiQuantum team at the Brisbane Airport site will include cryogenic, mechanical and electrical engineers, as well as physicists, technicians and a range of tech professionals.