By Moses Choi, Dana Hummel, Dylan Mibu & Clifford Mann

Published December 5, 2025 | 4 min

read

This edition of RBCCM’s Sustainability Matters highlights companies offering emerging products and solutions that address climate adaptation and resilience. Climate adaptation and resilience (“Climate A&R”) represents interconnected strategies for addressing the impacts of climate change: adaptation involves systemic adjustments to prepare and respond to impacts of climate change, while resilience focuses on the capacity to recover from its risks and impacts.1 This paper will examine these concepts collectively and showcase a range of innovations that illustrate the breadth of opportunities in Climate A&R.

Growing costs from severe weather events

As the impacts of climate change accelerate in scale and frequency, the global economy faces an inflection point. Wildfires, flooding, and extreme weather events are no longer distant threats—they are present realities for governments, corporations, and households. In Los Angeles, the Pacific Palisades wildfires in 2025 burned over 50,000 acres, impacted over 20,000 structures, and caused 30 fatalities.2

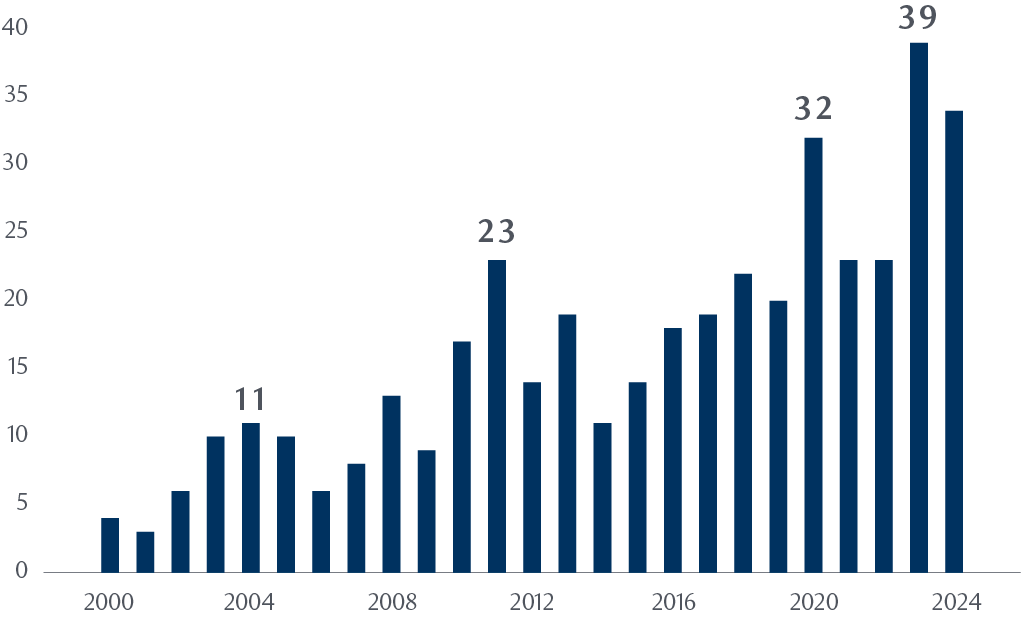

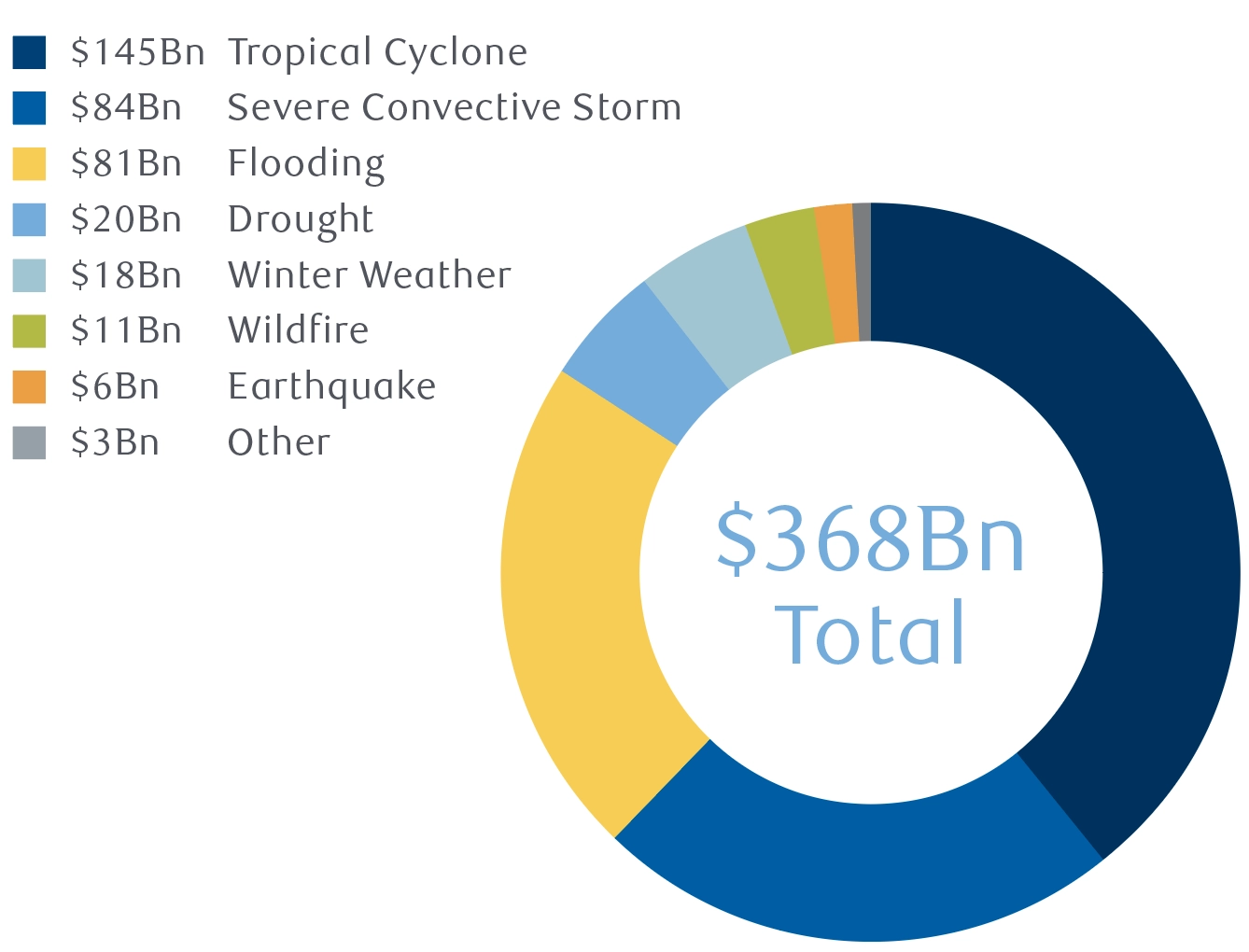

Global natural catastrophes in 2024 caused $368 billion in economic losses and $145 billion in insured losses.3 In 2024, 34 global disasters caused insured losses of $1 billion or higher, second only to 2023, with this trend of “billion dollar disasters” expected to increase.4 As a result of bigger and more frequent disasters and chronic stressors, Moody’s projects that the global economic impact from physical risk may reach $41 trillion, equivalent to a 14.5% loss in GDP in 2050.5 By 2050, one estimate suggests there could be 1.2 billion people internally displaced by weather-related hazards by 2050.6

Global Billion-Dollar Insured Loss Events7

(Number of Events above $1Bn)

Global Economic Losses by Peril8

(2024 $Bn)

Climate adaptation and resilience market

While climate mitigation efforts remain a priority to decarbonize industry, Climate A&R efforts have become increasingly in focus. According to BCG, global demand for Climate A&R investments is projected to expand up to $1.3 trillion by 2030.9

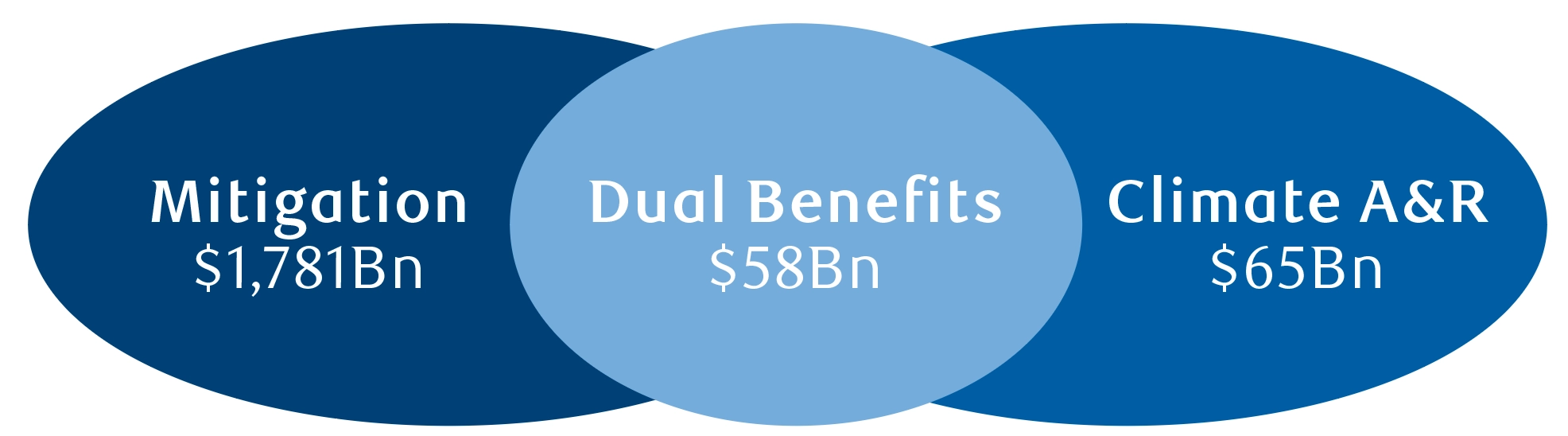

Investing in Climate A&R, however, has been perceived as a secondary initiative to climate mitigation, and thus, Climate A&R has been a historically underinvested theme. The closest approximation comes from the Climate Policy Initiative, which estimates that $65 billion in investment and financings went towards adaptation in 2023.10 Meanwhile, approximately $1.8 trillion of capital flows were allocated to mitigation that same year.11

Recent findings from the MSCI Institute observe that only 11% of roughly 800 public companies offer technologies, solutions, or equipment to address Climate A&R,12 and according to McKinsey, less than $8 billion has been raised for dedicated private market climate resilience funds, whereas more than $650 billion has been raised for decarbonization and broader sustainability investments.13 For the private sector, this represents not just a challenge, but a transformative economic opportunity for Climate A&R innovation and investment.

Climate Mitigation

Efforts to stop or slow contributions to climate change

Climate Adaptation & Resilience

Efforts to prepare for, respond to, and recover from impacts caused by climate change

Examples of mitigation solutions:

Renewable energy development procurement

Energy efficiency improvements

Electrification

Clean transportation

Examples of Climate A&R solutions:

Advanced systems monitoring

Infrastructure upgrades to prepare for extreme weather events

Flood and stormwater management

Business continuity planning

Building retrofits to enhance resilience

Opportunity in the innovation economy

In this context, a growing number of emerging companies are advancing Climate A&R opportunities, driven by the convergence of three factors: the escalating toll of severe weather damages, the funding gap in Climate A&R, and the market inefficiencies of climate risk. These factors may present an opportunity for entrepreneurs and investors, especially in the venture capital ecosystem.

According to PwC, startups focused on Climate A&R accounted for 28% of all climate tech deals in the first three quarters of 2024. Of this group, dual benefit startups comprised 18% of deals and pure-play ventures made up 10%. Dual benefit and pure-play Climate A&R deals, however, only accounted for 12% of the total climate tech investment by value through the same period.14

As the investment universe broadens, there are opportunities across three phases of adaptation and resilience: preparation and prevention, response, and recovery.15

Prepare and Prevent

Solutions enabling prevention and preparation prior to a climate-related natural disaster. These companies offer risk, analytics, modeling, or forecasting to increase foresight and understanding of climate-related risks.

Respond

Solutions enabling elevated response during climate-related natural disasters. These innovations often involve technology that strengthens physical systems to withstand climate shocks.

Recover

Solutions enabling accelerated recovery after adverse physical impacts. These innovations involve technology that enables faster re-builds and more resilient business operations.

Examples include Climate X, which helps businesses integrate climate intelligence into real asset investment decision-making; and Technosylva, which specializes in wildfire and extreme weather risk modeling and real-time monitoring. Tomorrow.io provides advanced weather intelligence through its satellite constellation.

Cascadia provides energy-efficient and wildfire-resistant building materials. TS Conductor develops advanced power line technology that improves grid resilience and supports renewable energy integration. ZwitterCo enables industries to reclaim and reuse water, addressing climate-induced water stress.

Adaptive Insurance offers parametric insurance products for small businesses after power outages. Parsyl insures temperature-sensitive goods like food and vaccines, reducing supply chain losses from climate disruptions. Floodbase leverages AI and real-time flood monitoring to power parametric flood insurance, ensuring swift financial relief for communities recovering from flood events. Kin Insurance utilizes advanced data and analytics to more effectively price and market insurance policies in high-risk areas.

CONCLUDING THOUGHTS

As this publication will illustrate, Climate A&R is a thematic opportunity for innovators and investors where there is no “one size fits all.” Each solution tackles a unique problem, and innovation will be needed to address the increasing frequency and intensity of extreme weather events.

While decarbonization has dominated climate investment historically, Climate A&R solutions have been historically underinvested and viewed increasingly as essential to complement mitigation.

Climate A&R solutions must address local impacts, demanding context-specific strategies to address regional risks and vulnerabilities.

Addressing climate impacts requires a myriad of solutions, including asset-light technologies for risk modeling, physical hardening products for resilience, and financial mechanisms for recovery.