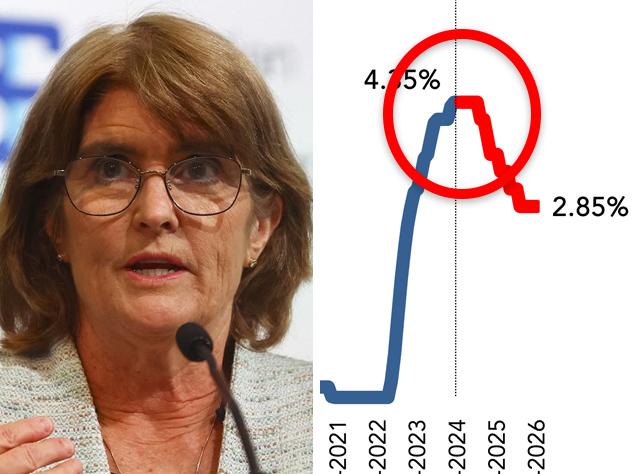

Westpac chief economist Luci Ellis has forecast rate cuts. Picture: Jane Dempster

High levels of mortgage stress and extreme pressure placed on households by a crippling cost of living crisis saw the nation hanging on every word of RBA Governor Michele Bullock in 2025.

After a brutal rate hiking cycle of 13 increases between 2022 and 2023, the cash rate finally began to come down from its 4.35 per cent high point in February this year.

Three cuts later, the figure now sits at 3.60 per cent, and for much of the year, the conversation was focused on how much further it would reduce, rather than whether it would be cut at all.

Now, a resurgent inflation has many commentators worried that the cutting cycle is over and we are even in danger of the RBA’s next move being an increase.

As we prepare for a fascinating and uncertain 2026, I took a look at what the experts are predicting for interest rates over the next 12 months.

And it makes for pretty grim reading, apart from one beacon of hope among our prominent lenders.

Three out of the big four agree

The nation’s biggest banks have walked back their earlier forecasts for further rate cuts, after having their minds changed by recent inflation numbers.

ANZ was the most recent of the big banks to predict the cutting cycle had now ended and the cash rate would remain at 3.60 per cent for the long haul.

“We no longer see one final rate cut from the RBA in the first half of 2026 given recent inflation pressures,” ANZ head of Australian economics Adam Boynton said. “With growth around potential, the activity case for further easing is also less clear.”

ANZ’s revised forecast saw it join CBA and NAB in predicting the cash rate will now remain unchanged for the foreseeable future.

MORE: Home loan trap taking years to escape

Luci Ellis believes inflationary policy is “still a bit tight”. Picture: Martin Ollman

Only Westpac is still relatively bullish on cuts, predicting two more in 2026 (likely May and August) to see the cash rate bottom out at 3.1 per cent.

Westpac chief economist Luci Ellis told realestate.com.au she believes inflationary policy is “still a bit tight”.

“We see some modest softening in the labour market already underway and likely to continue. And if inflation plays out according to our forecasts, which have trimmed mean inflation troughing at around 2.3%, then the RBA will have to cut some more,” Ms Ellis said.

“However, if we’re wrong, and inflation plays out according to the RBA’s forecast, then rates will be on hold.”

Rate expectations

A Finder survey on the cash rate trajectory for 2026 saw 29 per cent of experts predict at least one rate hike in 2026.

But it seems the 35 commentators surveyed are pretty evenly split, with the same percentage predicting at least one cut in the same period.

Finder head of consumer research Graham Cooke described the survey as “the most divided panel I’ve seen in years”.

“Nobody knows which way the RBA will go next,” he said. “Borrowers should tread carefully over the festive period. You don’t want to go into the New Year with a Christmas debt hangover, especially when your mortgage could be getting more expensive.”

When asked where rates wold be by December 2026, experts were more closely aligned.

“3.6 per cent” was the short response from AMP’s Shane Oliver.

Tim Reardon of the Housing Industry Association elaborated a bit further.

“Unchanged from today,” he said. “The cash rate remains high. The economy is likely to remain strong given elevated levels of government spending and population growth. This will see CPI elevated, and the cash rate contractionary.”

MORE: Where the population has boomed most and why

Graham Cooke says borrowers should be careful with spending over the holidays.

University of Sydney economist Stella Huangfu predicted a “long period of stability”.

“I expect the RBA cash rate to sit around 3.6 per cent by December 2026,” she said. “Inflation is easing only gradually and is still projected to hover near the top of the target band, which makes large cuts unlikely, but growth is also too soft to justify hikes.”

Action borrowers can take

Canstar’s data insights director Sally Tindall said the uncertainty around rates movements means borrowers should take steps to prepare themselves for the year ahead.

“The RBA is not going to spring a rate hike on borrowers without ample warning, however, if the central bank isn’t on track to get inflation back into the target band as forecast, then it could be forced to act,” Ms Tindall said.

“While we wait for the RBA to make up its mind, there is one lever borrowers can pull right now – their own equity.

“If you’ve racked up 40 per cent equity or more, you’re suddenly a VIP, at least in the eyes of your bank. The good news is plenty of Australians fall into this camp.

“APRA data shows $621 billion worth of owner-occupier loans have been with the same lender for over three years. The owners of these mortgages are likely to have a decent amount of equity built up, not just from their repayments but also from rising property prices. The irony is, they’re also likely to be on an uncompetitive rate.

MORE: Countries that will pay Aussies $140k to move there

Canstar data insights director Sally Tindall. Picture: Tim Hunter.

“Take 10 minutes to check your equity. Work out how much you still owe on your mortgage, minus this from a current estimate of how much your property is worth and there’s your equity.”