The NZD/USD exchange rate started this year at 0.5600, traded to a high of 0.6120 in July on US dollar depreciation, reached a low of 0.5485 in early April reacting to Trump’s “Liberation Day” on tariff announcements and is finishing the year at 0.5760 – not far from where it started. The trading range in 2026 was rather a narrow six cents, compared to the long-term average annual range for the Kiwi dollar of 11 cents (from high to low over each year).

However, it is not a time to look back, as currency markets are continually looking forward and pricing-in the varied expectations of the future economic and financial markets landscape. Looking ahead, the likely themes that will impact the NZ dollar direction and value in 2026 are discussed below: –

1. Interest rate differentials closing in

The recurring negative for the Kiwi dollar in 2025 was the wide gap between US interest rates and our interest rates. The RBNZ cut the official OCR interest rate aggressively to 2.25%, whilst the US Federal Reserve went through periods of doubt about reducing interest rates and finally cut the Fed Funds rate to 3.50%/3.75% in early December. In previous currency and economic cycles global investors bought the Kiwi dollar as a higher yielding currency with our interest rates typically well above the US rates. Through 2025 there was a high incentive for the currency speculators to sell the Kiwi dollar as the lower NZ interest rates meant that they were “paid” the forward points to hold short-sold NZD positions.

The interest rate differential that has prevented the Kiwi dollar from appreciating against the USD in 2025 is starting to change and will present a different dynamic for 2026. The local NZ interest rate market is pricing-in interest rate increases later in 2026 from the 2.25% OCR base. RBNZ Governor Anna has stated that this higher forward pricing is at odds with the RBNZ’s assumption for the OCR track in 2026, which is for no change. The markets are reflecting a stronger economy not allowing the annual inflation rate to fall from the current 3.00% to 2.00% over the next six months as the RBNZ are forecasting. The forward interest rate curve has our short-term interest rates closer to 3.00% by the end of 2026.

On the other hand, the US short-term interest rate market is pricing in two 0.25% cuts to the Fed Funds interest rate in 2026, decreasing the rate to 3.00%. If US jobs and inflation date continues to print lower than forecast (as it is currently doing), the Fed may be forced in to more than two cuts next year.

The very large disincentive to buy the Kiwi dollar is rapidly disappearing. Whether the converging of the two interest rates to be at the same 3.00% level is an incentive to buy the Kiwi dollar remains to be seen. What we do know is that the US will be cutting interest rates in early 2026 when most other countries are either increasing their interest rates (Japan, and possibly Australia and New Zealand) or holding their interest rates stable. Further US dollar depreciation against all currencies appears highly likely on the lower interest rates, mediocre US economic performance and disinvestment of capital from the US due to the uncertainty surrounding the Trump administration’s economic policies.

2. Relative economic performance

The outlook for the New Zealand economy has turned very positive in recent months with the strong export performance lifting spending and investment in the regions throughout 2025. Now with the OCR interest rate cut to historically very low levels of 2.25%, the domestic retail and housing economy in the largest city of Auckland will also be rebounding with increased activity levels in 2026. GDP growth forecasts for the year of 2026 are being lifted into the 2.50% to 3.00% area. In a surprisingly rapid turnaround, the external observer will be witnessing the NZ economy transforming from underperformance to overperformance. As many point out, we still have a problem with poor productivity, underinvestment in infrastructure and capital being deployed to unproductive parts of the economy. Our exports have not really increased as a percentage of the total economy for 30 years, however, there seems to be a renewed energy today with more free trade agreements coming on stream and new markets becoming available to our exporters.

For the first time in a number of years, 2026 is likely to see superior economic numbers for New Zealand, compared to other economies, hitting financial and investment market screens around the globe. Our GDP growth rate in 2026 close to 3.00% is likely to be above that of Australia’s, causing a re-think of the value of the NZD against the AUD currently at 0.8700.

Last week’s GDP growth of +1.00% for the September quarter has belatedly confirmed the strong rebound in the NZ economy since July. Everyone, including the RBNZ, was expecting the June quarter’s GDP numbers to be revised by Statistics NZ to something a lot less than the -0.90% contraction originally announced. However, somewhat surprisingly, Statistics NZ revised the June quarter to -1.00%. Given the massive historical revisions to GDP data over recent years, do not be surprised to see further adjustments to 2025 GDP numbers next year.

Currency values are relative prices, and over the last 12 to 24 months the economic news coming out of New Zealand has been relatively inferior to others. As a consequence, the NZ dollar has generally been on a trajectory lower, albeit it repeatedly bounces back up from 0.5500 against the USD. In 2026 the economic news coming out of New Zealand is likely to be relatively superior to other economies, prompting a reassessment of the value of the NZ dollar as essentially a share price of the NZ economy. Time will tell whether our improved relative economic position will be enough to attract speculative and investment interest from offshore into the NZ dollar. What we can say is that the economic environment, identical to the interest rate differential environment, has changed to be much more positive for the outlook of the NZ dollar value.

3. Direction of the Australian dollar

Admittedly we have been saying it for a considerable time, however the Australian dollar has all the ingredients in place to post a substantial appreciation against the US dollar in 2026. For 80% of the time the NZ dollar closely follows the Australian dollar in global forex markets. In 2026 the Aussies are likely to be increasing their interest rates to get their stubborn inflation under control, whereas the US will be cutting interest rates. The interest rate differential on their respective two-year interest rates has already moved from Australian rates being 0.75% below the US four months ago, to Australian rates now being 0.50% above the US today. The speculators are still short-sold the AUD expecting Aussie dollar depreciation. Now that Australian interest rates are above those of the US, these speculators will be “paying away” the forward points to stay short-sold AUD. They are likely to close and reverse their AUD positions.

Rightly or wrongly, the Aussie dollar is traded as a proxy for the Chinese economy. Chinese economic data has been sideways to lower over recent months as their domestic spending remains weak. Chinese export performance has been spectacular in 2026 as they diversified away from the US market, to Europe, Asia and South America. The reason the Australian dollar has been disappointing over recent weeks in being unable to gain from a weaker USD market environment, is that there has been no positive economic news coming out of China. Therefore, no reason to buy the AUD. It does now appear that the Chinese authorities will introduce a domestic economic stimulus package early next year to encourage more spending and less saving by households.

Australia has had massive global media coverage for the wrong reasons over recent weeks, also expect to see renewed international interest in its undervalued currency as a higher yielding alternative to the US dollar.

4. Likely resurgence in the Japanese Yen

The Bank of Japan increased their interest rates from 0.50% to 0.75% last Friday, the highest level since 1995. The Japanese Yen failed to appreciate against the USD as the markets were seeking more definitive guidance that the Bank of Japan will increase interest rates again next year. The absence of Yen buying following the widely telegraphed interest rate hike was surprising, however perhaps the time of year in late December curtailed speculative currency trading activity over the December financial year end. On a number of counts, the Yen at 157.75 against the USD appears significantly undervalued. The 10-year bond differential between Japan and the US has closed up to 2.25%. Historically, the correlation between the USD/JPY exchange rate and the bond yield differential has been very close and the 2.25% gap we have today points to a 120.00 USD/JPY exchange rate.

Japanese investment houses with funds invested in the US markets will be targeting the current 157.75 exchange rate as a prime opportunity to repatriate funds home, buying Yen in the process. The Bank of Japan will be worried about continued Yen depreciation pushing up inflation as imports become more expensive. Verbal and actual currency market intervention looks very close to being actioned as the Yen failed to appreciate on the interest rate hike. The appreciation of the Yen, when it comes, (based on historical movements) is likely to be rapid and substantial as traders and investors follow each other like sheep.

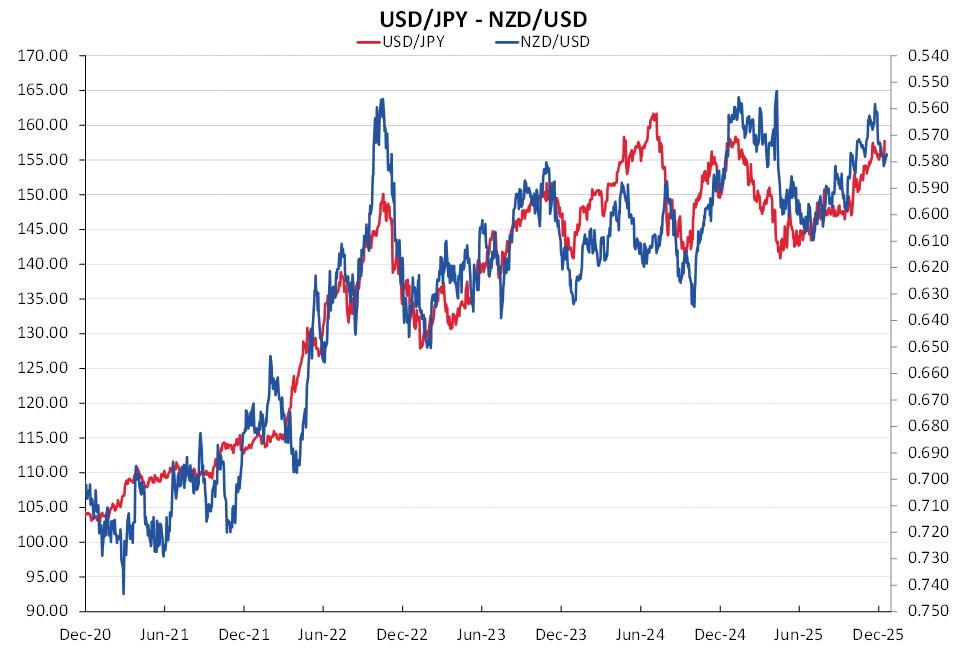

The NZD/USD exchange rate is closely correlated with the largest traded currency in Asia, the Japanese Yen. The expected appreciation of the Japanese Yen in 2026 will be a major reason for a NZ dollar recovery back well above 0.6000 (refer chart below).

5. Continuing depreciation of the US dollar

Whilst listed as the fifth determining theme for the NZ dollar in 2026, the continuing depreciation of the US dollar is likely to be the most prominent influence over the NZD/USD exchange rate over coming months.

Global investment banks such as Goldman Sachs and Deutsche Bank, who are big players in foreign exchange markets, both cite the US dollar as still between 15% band 20% overvalued against major currencies and are forecasting further USD depreciation in 2026. As data become available in the final three months of 2026 for the US economy it is very clear that the employment situation has deteriorated rapidly and inflation has not increased (due to tariffs) as much as feared for most of the year. What new jobs are being added to the US economy are all in the healthcare sector as more workers are required to care for the aging population. For the rest of the economy, Trump’s wild and inconsistent policy shifts has caused hesitancy, uncertainty and a lack of demand from both business and households.

Expect further panic economic adjustments from Trump in the early months of 2026 as he attempts to garner voter support in the lead up to the mid-term elections for the Senate and House of Representatives in November 2026. The Trump promised improvements in Americans lives under his leadership has been an abject failure, with lower and middle-income groups worse off with the rise in living costs and limited wage increases.

There are very few reasons for the US dollar to be appreciating in 2026, most global fund managers will be continuing to decrease their US dollar exposure levels.

6. Global geo-political developments and the oil price

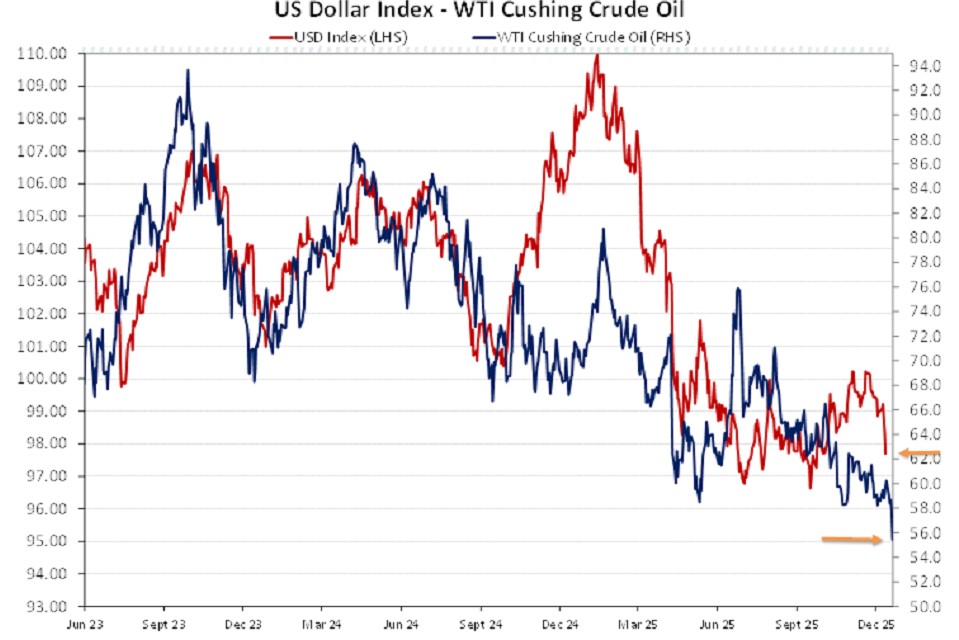

The latest Russian/Ukraine peace talks appear no closer to achieving an agreement than the earlier attempts. The Russians are complete masters at playing Trump and the US negotiators along for the ride of false hope. However, despite that low chance of success, the oil market in pricing crude prices lower over recent weeks is reflecting the likelihood of increased oil supply from a more settled geo-political landscape.

The lower oil prices we are now seeing bodes well for falling gasoline prices in the US economy pulling down the headline inflation rate. Another reason for the Fed to be cutting interest rates again in early 2026.

The correlation between crude oil prices and the USD Dixy Index is confirmed in the chart below. There is less global trade demand to buy USD’s if oil purchases in USD are lower due to lower oil prices. It is a double whammy hit for oil producers if their home currencies are higher against the USD and the oil price is down. However, it is great news for lower inflation in the oil importing countries with a stronger currency value against the USD (Euroland and Japan).

Wishing all our readers a Merry Christmas and Prosperous New Year. Our next column will be Sunday 4th of January 2026.

Select chart tabs

US$

AU$

TWI-5

¥en

¥uan

€uro

GBP

Bitcoin

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.