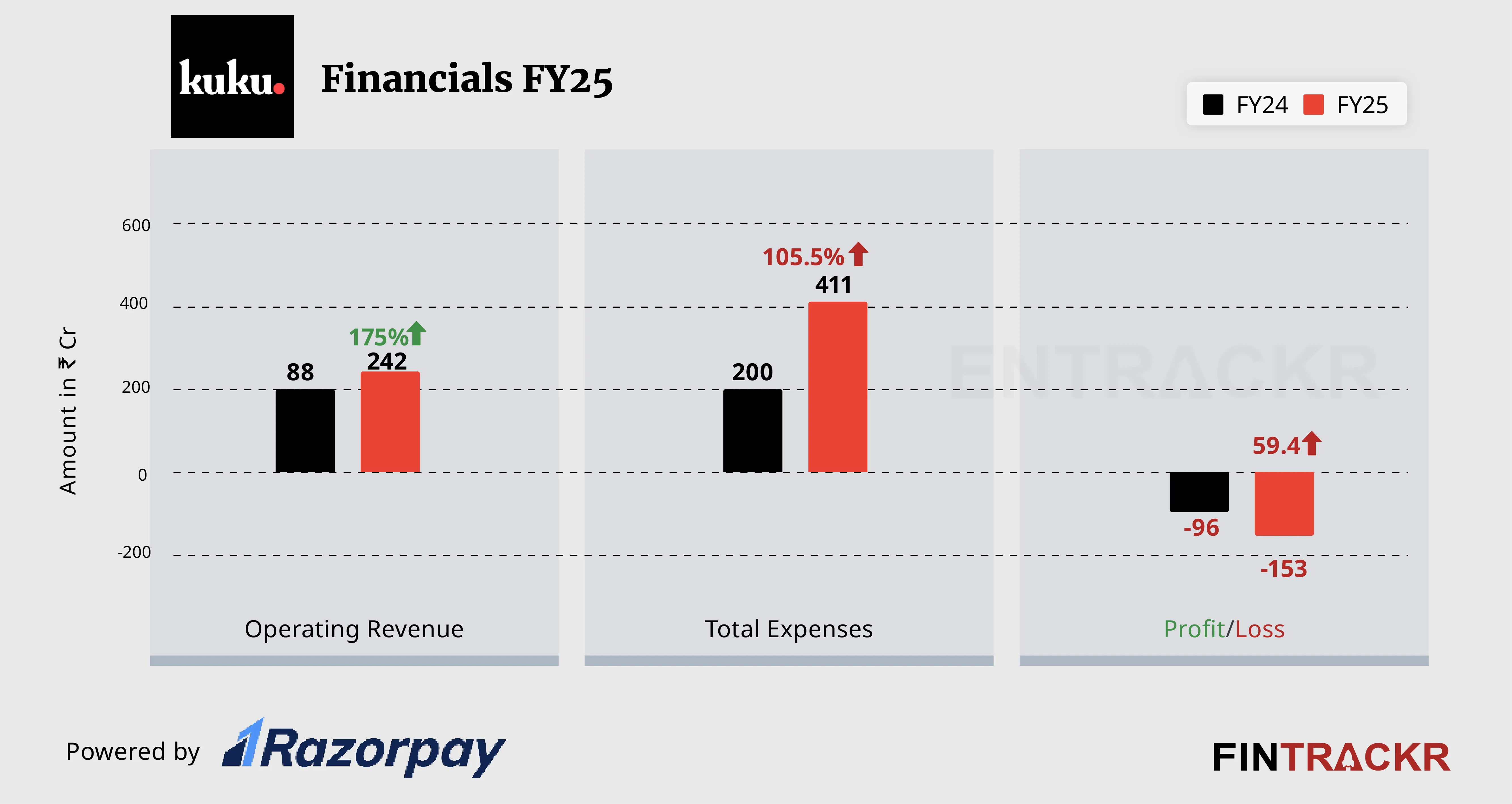

Kuku FM has continued its impressive growth trajectory with nearly tripling its scale in FY25. After clocking a 114% year-on-year revenue growth in FY24, the audio content platform reported a sharper 175% jump in its scale in FY25. However, the IPO-bound firm slipped deeper into losses during the period due to high advertising spends.

Kuku FM’s operating revenue surged to Rs 242 crore in FY25 from Rs 88 crore in FY24, according to its financial statements sourced from the Registrar of Companies (RoC).

Kuku FM offers a diverse range of audio content across genres such as business, self-help, personal finance, history, religion, entertainment, and fitness. Revenue from paywalled subscription sales was the sole source of income for Kuku FM. The company also earned Rs 16 crore from other income which pushed its total income to Rs 258 crore in FY25.

The sharp rise in revenue was accompanied by a steep increase in expenses. Kuku FM’s total expenses more than doubled, to Rs 411 crore in the last fiscal year from Rs 200 crore in FY24.

Advertising expenses emerged as the biggest cost component which accounted for nearly 70% of the total expenditure. To the tune of scale, this cost rose 2.8x to Rs 285 crore in FY25 from Rs 102 crore in FY24. Employee benefit expenses increased 28% to Rs 60 crore, while information technology expenses rose 28% to Rs 27 crore during the year. Depreciation costs tripled to Rs 9 crore in the same period.

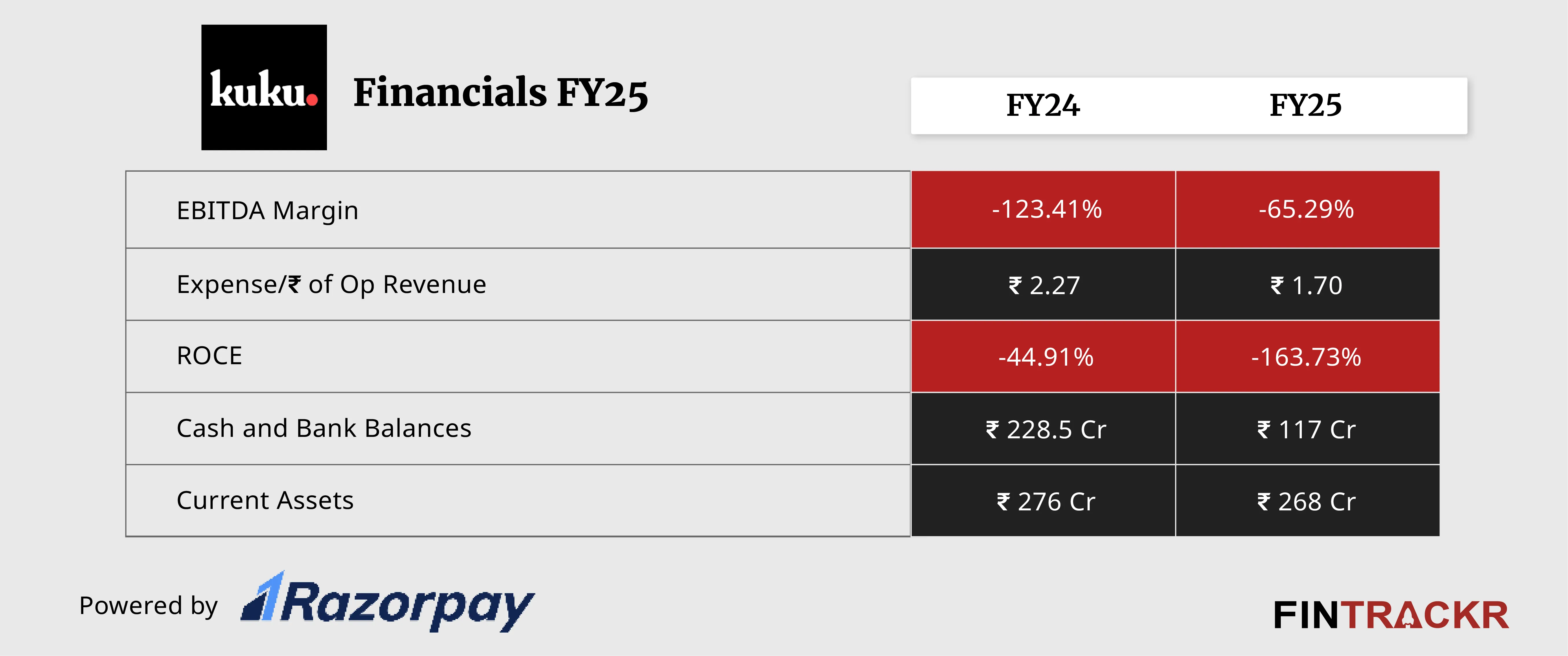

The aggressive spending pushed Kuku FM’s loss to increase by 59% to Rs 153 crore in FY25 from Rs 96 crore in FY24. Its ROCE and EBITDA margin stood at -163.73% and -65.29% respectively.

On a unit level, it spent Rs 1.70 to earn a rupee of operating revenue in FY25, compared to 2.27 in FY24. The company reported current assets worth Rs 268 crore, including Rs 117 crore in cash and bank balances during the year.

According to TheKredible, the company has raised a total of $157 million of funding till date. Having The Fundamentum Partnership, Vertex Ventures and Krafton as its lead investors which owns 12.79%, 11.12% and 10.17% of the company respectively.

Kuku FM is also gearing up for the public markets. The audiobooks and storytelling platform has reportedly shortlisted four investment banks to help it raise up to Rs 3,000 crore through an initial public offering (IPO). The proposed IPO is expected to comprise a mix of fresh issuance and an offer for sale (OFS).