Content supplied by Rabobank

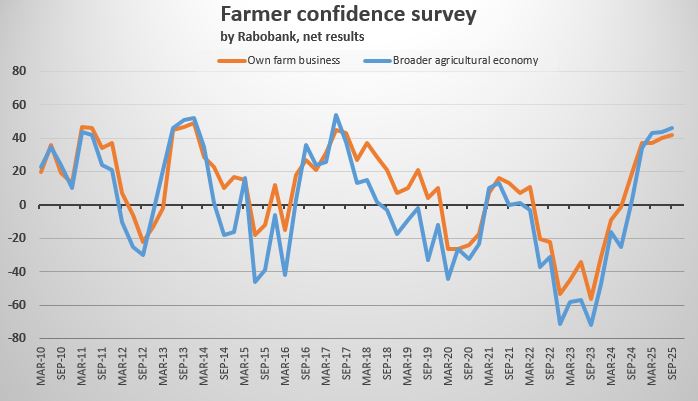

Farmer confidence in the broader agricultural economy has inched higher and is now at its second highest reading at any stage across the last decade, the latest Rabobank Rural Confidence Survey has found.

Following net readings of +44% in the last two quarters, farmer confidence in the broader agricultural economy crept marginally higher to a net reading of +46%. The latest net confidence reading has only been bettered once across the last 10 years (+54% in quarter two, 2017) and marked the fourth successive quarter of elevated farmer sentiment.

The latest survey — completed early this month — found 51% of New Zealand farmers were now expecting the performance of the broader agri economy to improve in the year ahead (up from 48% in the previous quarter), while the number expecting conditions to worsen had also risen to 5% (from 4% previously). The remaining 43% of farmers expected conditions to stay the same (44% previously).

Rabobank Chief Executive Officer Todd Charteris said it was fantastic to see strong farmer confidence extending into a fourth successive quarter.

“The cyclical nature of farming means it’s rare for farmer sentiment to stay elevated for such an extended period. And if we look back across the history of the survey, we have to go all the way back to the 2013/14 season for the last time we had four consecutive quarters where confidence was at such lofty heights,” he said.

As was the case in 2013/14, Mr Charteris said, a record milk price has been the catalyst for the latest extended spell of strong farmer sentiment.

“Since our last survey in June, we’ve seen Fonterra maintain its milk price forecast of $10.00/kgMS for the 2025/26 season, and we’ve also seen them raise their forecast for 2024/25 season to $10.15/kgMS,” he said.

“On top of this, the co-operative recently announced they’ve agreed to sell their consumer and associated businesses to Lactilis and, if approved, this could bring a tax-free capital return of $2.00 per share for their farmer shareholders.

“All this news has been warmly welcomed by sector participants and has helped keep dairy farmer sentiment high.”

Mr Charteris said red meat sector confidence was also soaring off the back of an ongoing wave of high commodity pricing for beef and sheepmeat.

“Led by the US, global demand for New Zealand beef remains strong and this has flowed through to record-breaking prices for cattle over recent months,” he said.

“Farmgate lamb prices are also at historical highs and a combination of tight domestic supply and strong overseas demand is expected to ensure pricing stays elevated over the remainder of 2025.”

Unsurprisingly, the survey found farmers with an optimistic view on the broader agri economy cited ‘rising commodity prices’ (67%) as the main reason for their optimism.

‘Increasing demand’ (20%) and ‘falling interest rates’ (17%) were the next most-frequently cited reasons for positive sentiment. Among the 5% of farmers expecting conditions in the agri economy to deteriorate, ‘government policy/ intervention’ (43%) ‘rising input prices’ (30%) and overseas markets/ economies (29%) were the major reasons given for pessimism.

Own farm business performance

The survey found farmers’ expectations for their own farm business operations were also marginally higher than last quarter, with the net reading rising to +42% (from +40%).

The readings for dairy farmers and sheep/beef farmers rose to +54% and +53% respectively, however growers were less optimistic than three months ago, falling to a net reading of +1% from +20% three months ago.

“While prices for key New Zealand horticultural products like kiwifruit and apples remain healthy, they haven’t quite reached the record-breaking heights that we’ve seen in the dairy and red meat sectors,” Mr Charteris said.

“And growers were split on the prospects for their own businesses in the year ahead with 31% expecting performance to improve, 30% expecting it to worsen and 34% expecting it to remain the same.”

Investment intentions

The survey found New Zealand farmers’ investment intentions were largely unchanged from last quarter with the net reading falling to +24% from +25% previously.

“Dairy farmers continue to have the strongest investment intentions and their net reading on this measure rose to +43% with close to half (46%) expecting to increase investment and only 3% expecting investment will reduce,” Mr Charteris said.

“Sheep and beef farmers and horticulturalists investment intentions were weaker than those of their dairy counterparts, but positive overall at net readings of +17% and +5% respectively.”

Mixed level of concern over US tariff rate hike

Mr Charteris said farmers who participated in the most recent survey were asked to rate their level of concern on a scale from 1-10 about the recent increase in the US tariff rate on New Zealand goods from 10% to 15%.

“While we are yet to see any major drop off in US demand for New Zealand’s agricultural products, the recent increase – announced on July 31 – to a 15% tariff does put us at a competitive disadvantage to countries like Australia which remained at a tariff of 10%,” he said.

“The level of farmer concern over this tariff increase was variable with farmer responses at either end of the scale and the average score sitting at 5.5 out of 10.”

“The full impact of the increased US tariff rates on New Zealand, and on other countries like Brazil, has yet to be fully felt. And New Zealand farmers and growers will be keeping a close watch on how these tariffs impact global agri commodity trade over the months ahead.”

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.