US Treasury dataset on “Long-Term Securities Held by Foreign Residents”

(Bloomberg) — The Danish pension fund AkademikerPension is planning to exit US Treasuries by the end of the month, amid concerns that the policies of President Donald Trump have created credit risks too big to ignore.

“The US is basically not a good credit and long-term the US government finances are not sustainable,” Anders Schelde, chief investment officer at AkademikerPension, told Bloomberg on Tuesday.

Most Read from Bloomberg

AkademikerPension, which manages around $25 billion in savings for academics, held about $100 million in US Treasuries at the end of 2025, Schelde said. Risk and liquidity management is the only reason to remain in Treasuries, and “we decided that we can find alternatives to that,” he said.

Though a drop in the ocean in the context of the US Treasury market, the planned divestment by AkademikerPension marks an important symbolic step in the current political context as institutional investors rethink what constitutes a safe haven. The specter of money managers in Europe weaponizing capital was raised earlier in a note by Deutsche Bank AG as a way for the bloc to retaliate in the face of Trump’s continued threats.

Schelde cited Trump’s talk of taking over Greenland as part of a number of reasons that drove the fund to back away from US Treasuries. Concerns about fiscal discipline and a weaker dollar also justify a retreat from US exposure, he said.

The development comes as Trump ratchets up his threats to seize Greenland, sparking dismay among Denmark’s allies in Europe. Greenland, which is part of the Kingdom of Denmark, has consistently responded to Trump’s efforts to buy the island by stating it’s not for sale.

“You cannot put the genie back into the bottle,” Schelde said. “Things might get better and more calm a few months down the road, and Trump, he can’t be reelected, and the next president might be somewhat different,” he said. “But what comes then in five, six, 10 years? I think there’s a strong realization across Europe that we need to be able to stand on our own feet.”

AkademikerPension is the latest Danish pension fund to sell down its Treasury holdings. Laerernes Pension slashed its exposure to US Treasuries before this month’s flareup over Greenland, citing concerns over US debt sustainability and threats to the Federal Reserve’s independence. PFA, which oversees about $120 billion in pension assets, recently reduced its holdings as part of a broader product and portfolio adjustment. And Paedagogernes Pension said it will stop launching new strategies targeting illiquid US assets, after dropping Treasuries, according to FinansWatch.

Story Continues

Greenland and Trump’s threat to impose new tariffs will be top of the agenda when the US president arrives in Davos on Wednesday. Trump has said that he would meet with various parties to discuss the matter. His Treasury Secretary, Scott Bessent, is urging calm and dismissed suggestions that Europe would dump Treasuries.

Meanwhile, Danish business leaders are discussing whether and how to reduce their exposure to the US more generally, from the companies in which they invest to the US technology firms that keep their operations running.

Concerns about dependency on US services were heightened after Denmark’s intelligence agency for the first time described America as a potential security risk. In a December report, the Danish Defense Intelligence Service cited US willingness to use its “economic and technological strength as a tool of power, also toward allies and partners.”

Last weekend, Danes and Greenlanders took to the streets in their thousands to protest US threats to take over Greenland. Trump has repeatedly insisted the US needs to control the semi-autonomous territory for security reasons.

Protesters in Copenhagen.Source: Bloomberg

“Of course we are following the situation very closely,” said Rasmus Bessing, the head of ESG investing and co-chief investment officer at Danish pension fund PFA. “We are not in the business of politics. We are in the business of investing and our aim is to make the best portfolio for our customers,” he added. “We hope and expect that we will find common ground with the US, and then we’ll find a good solution to the current situation.”

Several pension funds noted that it’s not feasible to entirely extract their portfolios from exposure to the US, given its dominance in global markets. Nor is it necessarily the best decision financially, they said.

Bessing at PFA said the fund continues to hold “a strong belief in US corporate America” and to maintain “a very large exposure to US equities” and corporate credit. But it also made sense for the fund to reduce US Treasury holdings, “in order to create the best and most diversified portfolio,” he added.

“The markets are quite good at absorbing geopolitical risk in many ways,” Bessing said. “And for us it’s of course a question of understanding – or trying to understand — if geopolitical risk really develops into financial and economic risk that we need to take into consideration.”

What Bloomberg Strategists Say:

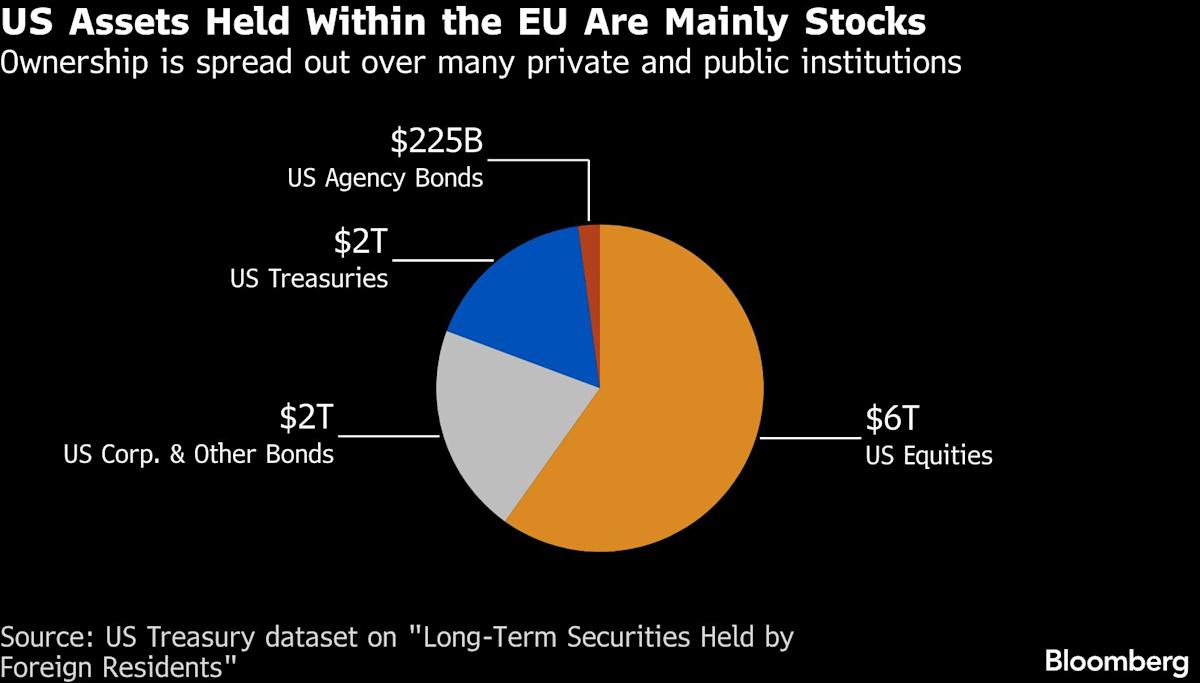

“Any potential threat by Europe to sell its Treasuries in retaliation for President Donald Trump’s aim to annex Greenland is likely to be an empty one. …Europe is the second largest holder of Treasuries, with more than $3.5 trillion, just shy of Asia’s total, but unlike in Asia, the majority of Treasuries in Europe are not held by central banks. It would take a corralling of private holders to force a coordinated sale, less likely than governments ordering their central banks to do so.”

— Simon White, macro strategist. For the full analysis, click here.

–With assistance from Jenny Leonard.

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.