Bloomberg

(Bloomberg) — Disco Corp. shares jumped as much as 15% after the supplier of chipmaking tools reported better-than-expected quarterly earnings on surging demand for AI-related hardware.

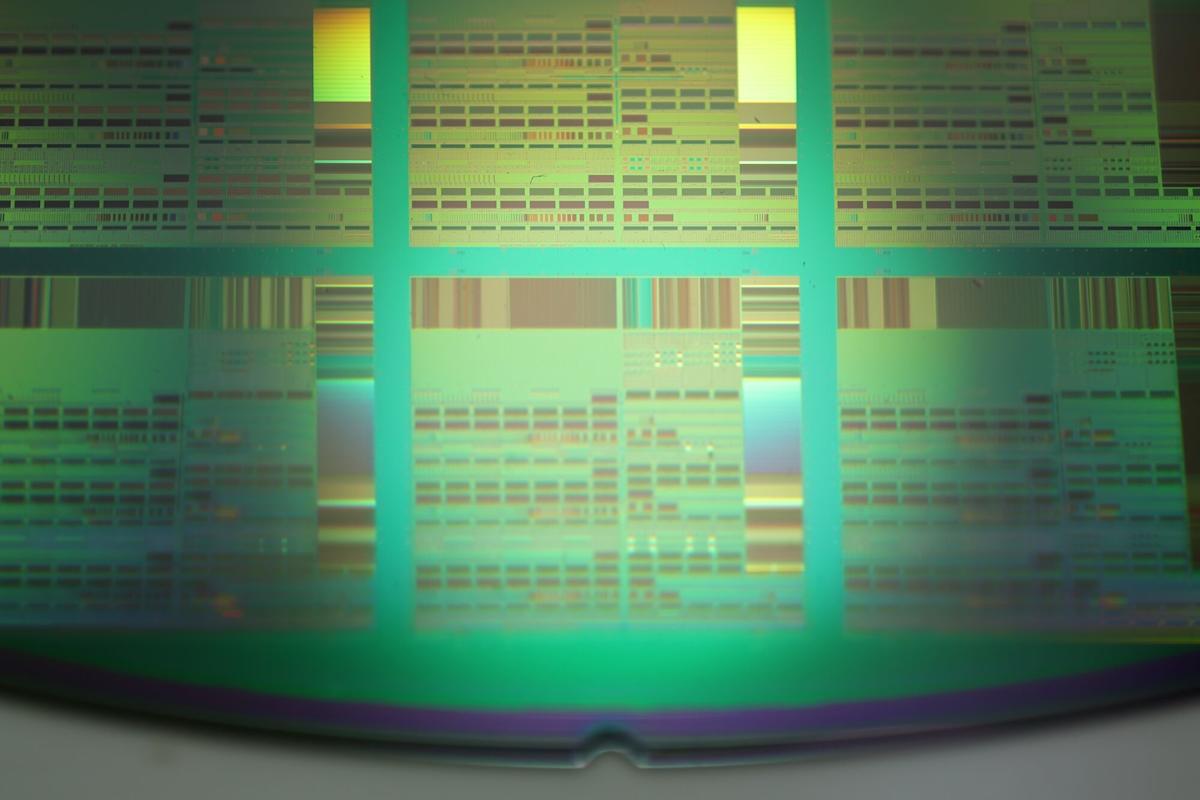

The maker of grinders and dicers that shape and cut silicon wafers into individual semiconductors earned operating income of ¥47.3 billion ($299 million) in the December quarter, beating the average of analyst estimates of ¥39.3 billion. Given the Tokyo-based company is known for its conservative outlook, investors largely dismissed its outlook for the current quarter which missed expectations. Its shares gained the most since April and hit their highest intraday level since July 2024.

Most Read from Bloomberg

“Demand is broadly expanding, including for generative AI and for China,” Jefferies analysts Masahiro Nakanomyo and Hisako Furusumi wrote in a note to investors. Actual shipments indicate the real trend, they said.

A race by the likes of Meta Platforms Inc. and Amazon.com Inc. to build data centers for artificial intelligence services is spurring chipmakers to ramp up production. Taiwan Semiconductor Manufacturing Co. is earmarking as much as $56 billion in capital spending for this year, while memory makers SK Hynix Inc. and Samsung Electronics Co. are also building new capacity.

Disco has been a beneficiary of the AI boom in part due to the need for equipment that can slice through stacks of densely packed chips.

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.