Its gas network covers Taranaki, Horowhenua, Hawke’s Bay, Manawatū, Porirua, Hutt Valley and Wellington.

Firstlight Network, formerly known as Eastland Network, was acquired for $260 million in 2023 by Clarus, known as Firstgas Group at the time.

Firstlight serves 26,355 installation control points (connections to the network, not all of which are homes or businesses), plus 5072 distributed, unmetered load fixtures and 243 metered streetlight fixtures across 12,000 square kilometres in Tairāwhiti and Wairoa.

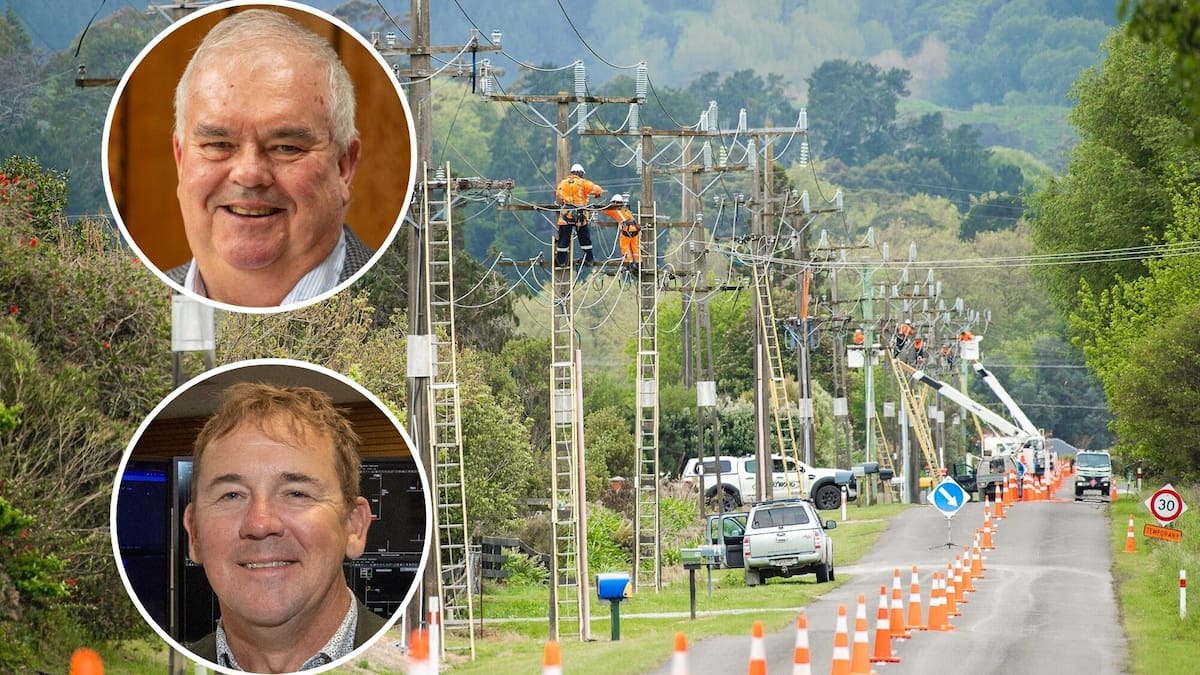

“Powerco is excited to be investing further in New Zealand’s electricity industry, and we believe there’s an opportunity to utilise the skills and resources within Powerco to further strengthen the performance of this electricity network for the benefit of the local people,” Powerco Board chairman John Loughlin said.

“We’re proud to be part of the communities we live and work in, and know that the best way to manage an electricity network is to have local people serving local communities.”

Loughlin said local people would continue to work with Powerco on the network if it was given approval to acquire Firstlight.

“Those local people will be supported by Powerco’s ability and experience for already serving communities across geographically large and diverse regions.”

Powerco chief executive Jason Franklin said Powerco believed the most efficient and cost-effective way for local communities to receive reliable, resilient and affordable electricity was through economies of scale.

“With almost 360,000 homes, businesses and industries in regions across the North Island connected to our electricity network, we have the scale, capability and capacity, along with innovative solutions and experience working with communities, big and small, to make the necessary long-term investments and lead a sustainable energy transition for Tairāwhiti and Wairoa communities,” Franklin said.

“I’m really looking forward to meeting with Firstlight Network employees and talking with community leaders about how we can work together to deliver reliable, resilient and affordable power for their communities into the future.”

Powerco Limited is 49% owned by superannuation fund Australian Retirement Trust, managed by investment manager QIC Limited, and 51% owned by funds managed by assets manager Dexus.

The sale of Clarus, if it goes ahead, will cover its Firstgas, Rockgas and Flexgas businesses.

According to a statement, Igneo will retain its shareholding in the Tauhei Solar Farm while the leader of the project, First Renewables, will remain part of Clarus.

Clarus CEO Paul Goodeve said the company looked forward to welcoming Brookfield as its new shareholder once approvals were confirmed.

“As a highly credible, long-term investor in essential infrastructure, we are confident they will be a strong owner for Clarus,” Goodeve said.

“It’s positive to have an investor of Brookfield’s scale and experience choosing to invest in Clarus.”

A number of conditions and requirements still need to be satisfied, including overseas investment approval.

Clarus aims to finalise this over the next few months and expects settlement in the first half of 2026.

“In the meantime, it’s business as usual at Clarus, and our focus remains on delivering good energy and great service to nearly half a million homes and businesses of all sizes around New Zealand each day.”

The Australian Financial Review earlier reported that a sale could value Clarus at more than A$2 billion ($2.2b).

Brookfield has more than US$1 trillion ($1.7t) of assets under management across infrastructure, renewable power and transition, private equity, real estate and credit.

Igneo, part of the First Sentier Group, is a specialist global infrastructure manager investing in mature, mid-market infrastructure companies in renewables, digital infrastructure, waste management, water utilities, transportation and logistics sectors in Europe, the UK, Australia, New Zealand and North America.