Spend enough time around traders and you’ll hear it.

“The algos ran the stops.”

“The market’s manipulated.”

“Retail can’t win anymore.”

It’s an easy story to believe. When a market spikes out of nowhere or reverses just before your stop, blaming a mysterious algorithm gives the chaos a face. But that explanation overlooks something much simpler and far more powerful.

Markets aren’t random, and they aren’t controlled by a single machine.

They are living auctions.

Every tick, every move, every candle represents participants negotiating value. Buyers and sellers are constantly testing where the market believes fair value should be. That process is called Auction Market Theory, and it has existed long before algorithms or high-speed trading ever entered the picture.

The Foundation of Auction Market Theory

Auction Market Theory is built on one simple principle: the market’s purpose is to discover and define fair value.

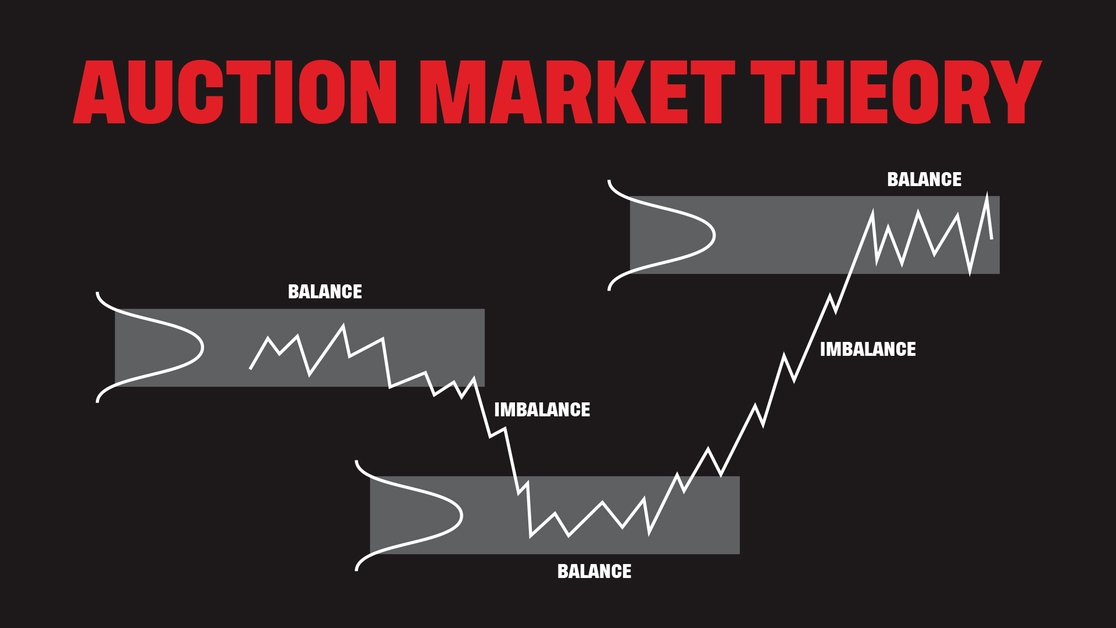

Fair value is the range where both sides agree. When price stays within that range, the market is in balance. When it leaves to explore new territory, it’s in imbalance.

Those two conditions drive everything we see on a chart.

Balance is a state of agreement. Imbalance is discovery. The market swings between them endlessly, forming the structure of price.

This framework explains consolidations, breakouts, and reversals without any need for conspiracy. It gives logic and context to add to your trade ideas.

Balance: Where the Market Feels at Home

In a balanced market, price oscillates inside a well-defined range. Both buyers and sellers are active. Liquidity is deep, volatility compresses, and the auction is calm.

Statistically, this looks like a bell curve. About 68 percent of trading activity happens within one standard deviation of the mean, and roughly 95 percent occurs within two.

The more trades that occur at a price, the more accepted that price becomes. That’s why balanced areas often show up as thick high-volume regions on a Volume Profile or TPO chart. These tools visualize where the market has found agreement where business is getting done.

Balance is temporary though. When one side of the auction weakens, imbalance begins.

.png) AMTImbalance: The Market’s Search for New Value

AMTImbalance: The Market’s Search for New Value

Imbalance is the market’s way of exploring.

When buyers stop defending the highs or sellers step aside at the lows, price moves away from balance to test where new participation will appear. Volume thins out, ranges expand, and the auction travels.

This isn’t manipulation. It’s the market doing exactly what it’s designed to do find a new area of fair value. Once enough trading activity develops there, balance returns.

That constant rotation between balance and imbalance is the heartbeat of the market. It has always been this way, and it always will be.

These Ideas Aren’t New

Long before screens, algorithms, or high-frequency trading, a man named Peter Steidlmayer introduced the concept of Market Profile while trading at the Chicago Board of Trade in the 1980s.

He noticed that price and time formed repeating patterns of balance and imbalance. His Market Profile visually organized this information into a distribution curve, showing how often the market traded at each price.

What Steidlmayer discovered was revolutionary for its time, but the idea itself wasn’t new. It simply put structure around something that had existed since the first marketplace: buyers and sellers negotiating value.

Today’s tools Volume Profile, TPO charts, order flow software are just modern ways of visualizing those same age-old dynamics. The technology looks different, but the logic hasn’t changed.

Markets still behave the same way they did a century ago. Only the speed and the screens have evolved.

Even If Algorithms Move the Market, They Still Play the Auction

Let’s address the “algos control everything” belief directly.

Yes, algorithms account for most modern trading volume. They react faster than any human could. But even if they dominate execution, they don’t replace the auction they participate in it.

Every algorithm is written by a human being who understands supply and demand. Whether it’s an execution algorithm breaking a large order into smaller pieces or a high-frequency model reacting to microstructure signals, all of them still have to do one thing: buy or sell.

And when they do, that activity is recorded in time and sales, reflected in volume, and visible in order flow. They aren’t ghosts. They leave footprints.

Algorithms may shape the tempo of the auction, but they don’t control its rules. They are still bound by the same laws of liquidity and participation that have guided every market since trading began.

In other words, even if algorithms are helping to move the market, they’re still playing the same game described by Auction Market Theory. They react to imbalance, they search for liquidity, and they ultimately help define where fair value is found.

A Framework That Actually Makes Sense

Blaming “the algos” for every unexpected move is an emotional response to complexity. Auction Market Theory gives traders a logical framework instead.

I’ve spent years studying order flow, footprint charts, and Market Profile to understand how these dynamics appear in real time. Every market I’ve analyzed, from futures to equities, follows the same logic. Some assets give more clarity than others.

The auction moves from balance to imbalance and back again. It pauses when value is found and travels when value shifts. Algorithms may accelerate the process, but they don’t alter it. The same principles that guided traders on the floor of the Chicago Board of Trade are alive inside today’s electronic markets.

Understanding that connection changes everything. It turns what seems chaotic into something coherent and measurable.

The Market Is Still Human

Despite all the technology, the market remains a reflection of human behavior. It represents fear and greed, patience and aggression, agreement and conflict just expressed through price.

Once you start viewing price action as a living auction, you start seeing logic. You learn to recognize when the market is comfortable and when it’s searching. You begin to anticipate where participation is likely to return.

That’s how traders gain context. That’s how they adapt.

Watch the Full Breakdown on YouTube

If you want to see how these concepts play out on real charts — from how balance forms to how imbalance develops — I break it all down in my latest video using Volume Profile and TPO examples.

👉 Watch the full Auction Market Theory breakdown by Errol Coleman

Final Thoughts

The idea of a single algorithm controlling the market sounds simple, but it’s not accurate. What we see every day is the same timeless process that’s governed markets since the beginning: an auction searching for fair value.

Technology has changed the way we participate, but not the underlying truth. Whether it’s a trader shouting bids in the pit or a machine submitting orders in microseconds, the same forces are at work.

The market doesn’t need an all-powerful algorithm to make sense. It already operates with perfect logic- the logic of the auction.

Errol Coleman appears on the tastylive network shows Today’s Assignment , Risk & Reward and Trades on the Go.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.