Report Overview

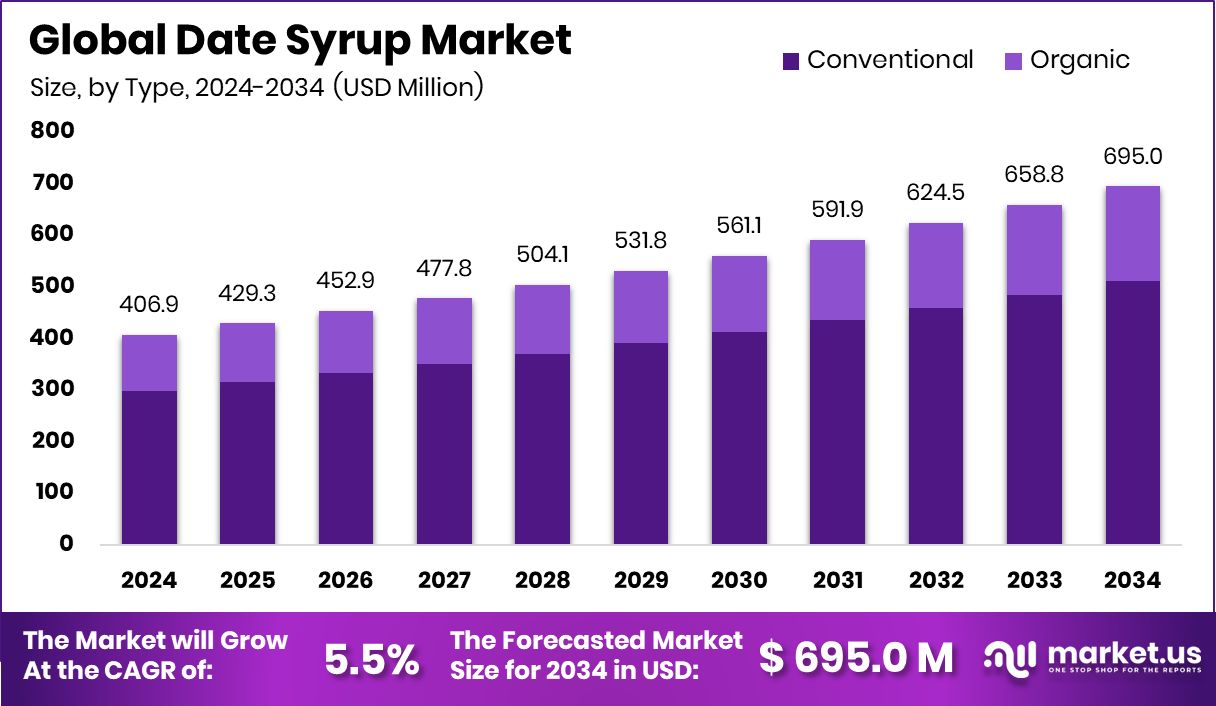

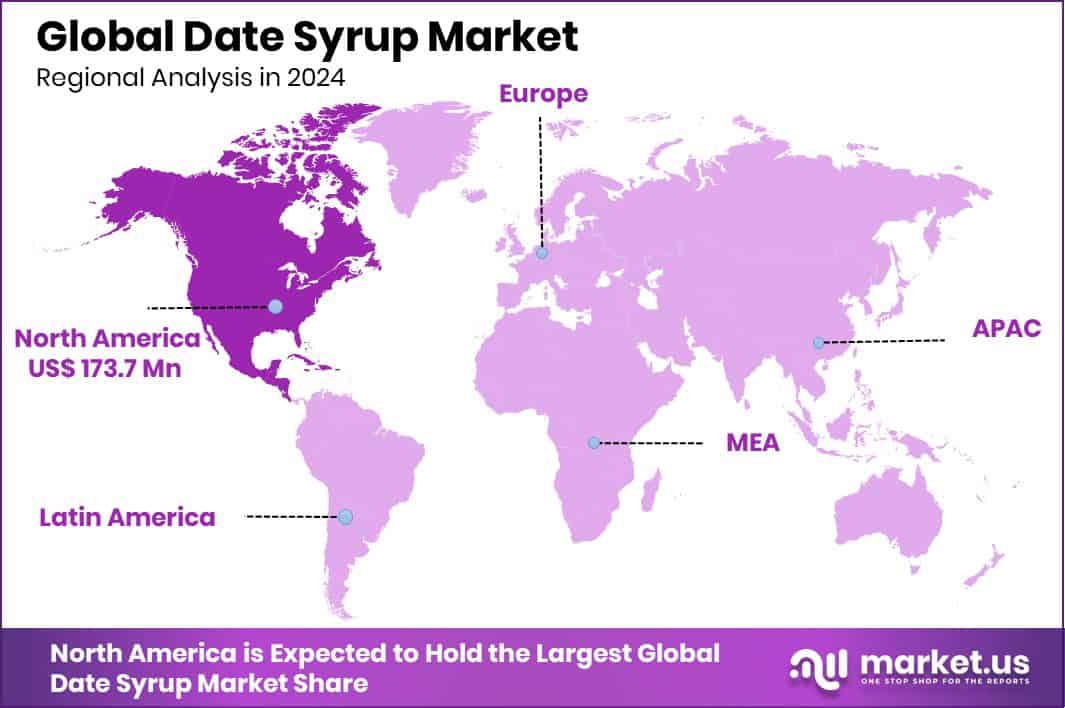

The Global Date Syrup Market is expected to be worth around USD 695.0 million by 2034, up from USD 406.9 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. North America’s Date Syrup Market captured 42.70% share in 2024, totaling USD 173.7 Mn.

Date syrup is a natural sweetener made by extracting and concentrating the juice of dates. It has a dark, rich texture with a caramel-like flavor, making it a healthier alternative to refined sugar. Rich in minerals such as potassium, magnesium, and iron, it is often used in baking, cooking, and as a topping for foods like pancakes, yogurt, or porridge. Its natural origin and nutritional profile make it increasingly popular among health-conscious consumers.

The date syrup market is growing as people look for natural sugar substitutes and plant-based sweeteners. With rising awareness about the harmful effects of excessive sugar consumption, many households and food producers are shifting toward healthier alternatives. Date syrup also appeals to vegan and vegetarian consumers as a clean-label product with no additives, giving it an edge in today’s health-driven food culture.

One of the key growth factors for date syrup is the increasing preference for natural sweeteners over artificial ones. Consumers are more mindful of what they consume, and products derived directly from fruits, like date syrup, are considered safer and more nutritious options. This shift is driving adoption in both home kitchens and packaged food industries. According to an industry report, Chamberlain Coffee secured $7 million in fresh funding.

The demand for date syrup is also supported by its versatility in food applications. It can be used in confectionery, beverages, dairy products, and bakery items, offering manufacturers a natural way to sweeten products without compromising taste. Its ability to provide both flavor and nutrition has led to growing interest in its use in everyday diets. According to an industry report, Mid-Day Squares obtained $10 million in new funding.

Key Takeaways

The Global Date Syrup Market is expected to be worth around USD 695.0 million by 2034, up from USD 406.9 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

Conventional date syrup dominates the date syrup market, holding a 73.5% share with widespread availability.

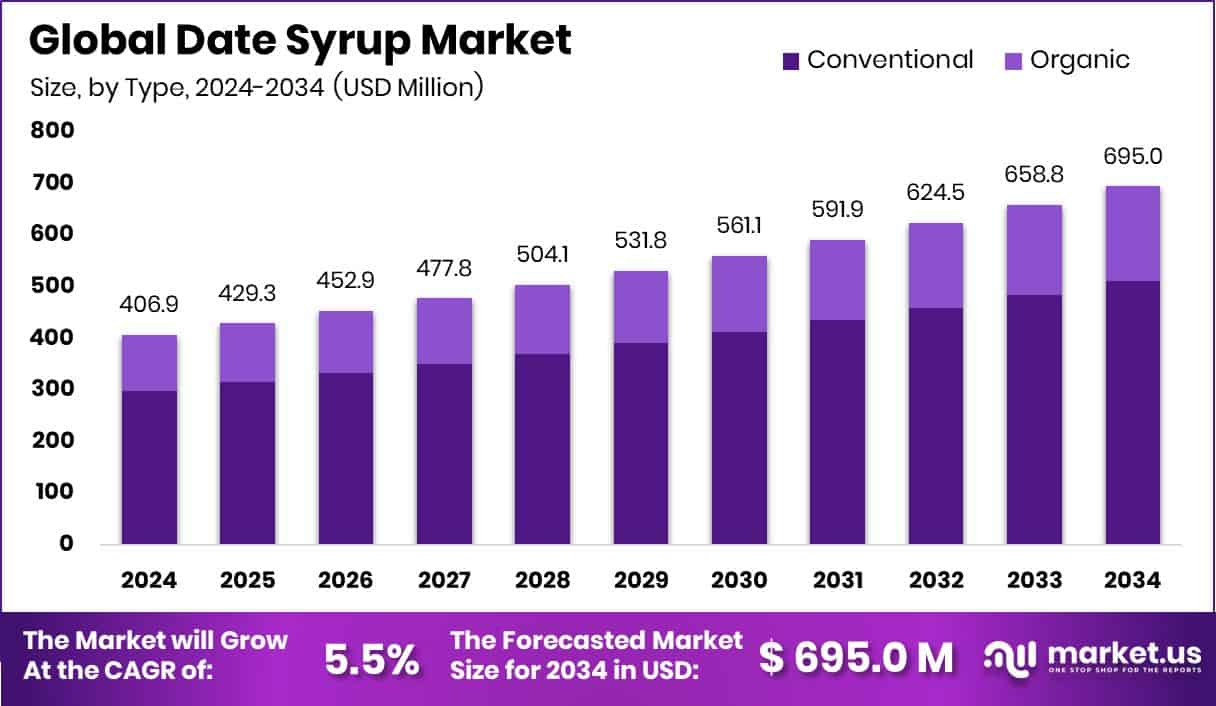

The date syrup market sees a 38.7% share from natural sweetener applications, reflecting health preferences.

Hypermarkets and supermarkets account for 33.4% of date syrup market sales worldwide.

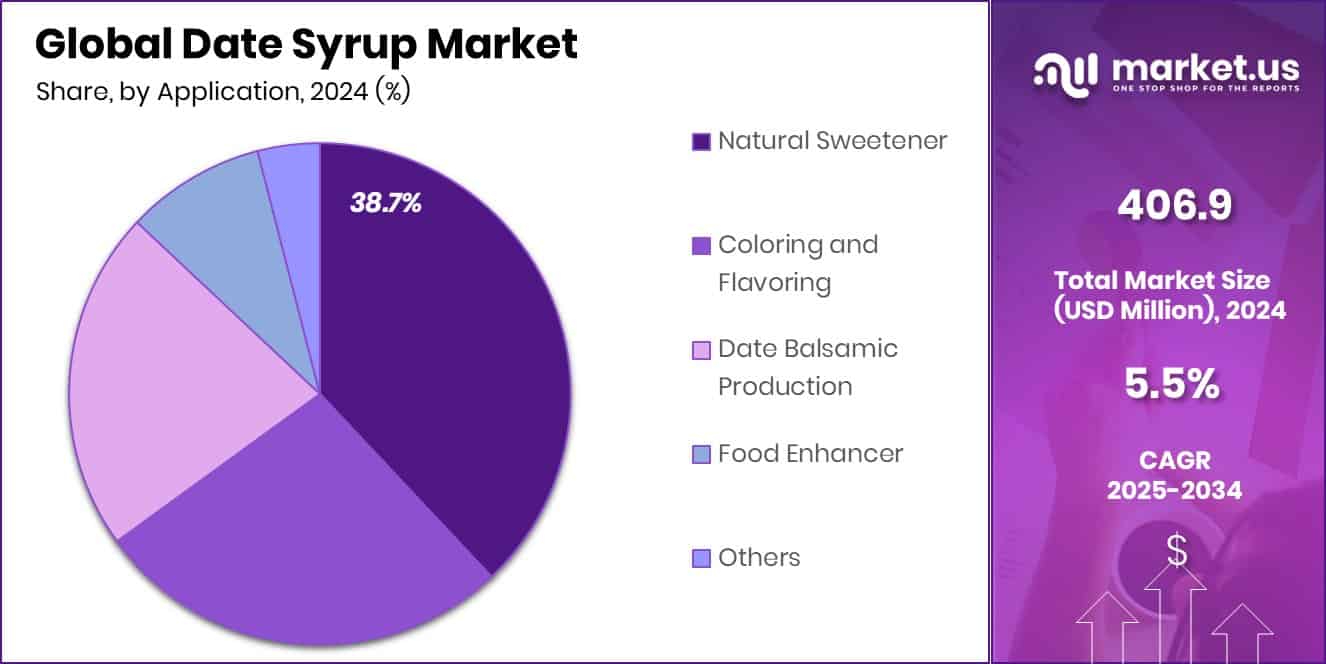

The strong demand in North America, with a 42.70% share, is valued at USD 173.7 Mn.

By Type Analysis

The conventional date syrup market holds the majority share with 73.5%.

In 2024, Conventional held a dominant market position in the By Type segment of the Date Syrup Market, with a 73.5% share. This strong presence is primarily due to the widespread availability and affordability of conventionally produced dates, which form the base for syrup production.

Conventional farming practices allow producers to maintain steady supply chains and cater to the high-volume demand from food and beverage manufacturers. The cost-effectiveness of conventional date syrup makes it more accessible to both industrial buyers and household consumers, particularly in emerging markets where affordability plays a crucial role in product choice.

The dominance of conventional date syrup is further reinforced by its integration into mainstream food processing, including bakery, confectionery, and beverage industries. Its flavor consistency and relatively lower production costs compared to organic alternatives make it the preferred choice for mass-market applications.

In regions with high consumption of natural sweeteners, conventional date syrup benefits from established trade networks and consumer familiarity, ensuring continued preference. Moreover, as global demand for plant-based sweeteners rises, conventional date syrup provides an efficient solution to meet bulk requirements.

By Application Analysis

Natural sweetener application leads the date syrup market with 38.7%.

In 2024, Natural Sweetener held a dominant market position in the By Application segment of the Date Syrup Market, with a 38.7% share. This leading position is driven by the growing consumer shift toward healthier sugar alternatives and the increasing awareness of the nutritional benefits of date syrup.

As a natural sweetener, it is rich in essential minerals such as potassium, magnesium, and iron, making it a preferred choice for health-conscious individuals who seek to reduce their reliance on refined sugar and artificial additives. Its caramel-like taste and clean-label profile further strengthen its appeal in both household and commercial applications.

The dominance of natural sweetener applications in the market is also supported by the rising demand across the food and beverage industries. Date syrup is increasingly being used in bakery, confectionery, cereals, and dairy products to enhance flavor while offering a healthier image to brands.

Beverage manufacturers are also incorporating it as a natural ingredient in energy drinks, smoothies, and plant-based products, aligning with the global trend toward sustainable and wholesome diets. With its 38.7% share, the natural sweetener segment reflects the strong consumer preference for nutrient-rich, plant-based alternatives and is expected to maintain growth momentum in the years ahead.

By Distribution Channel Analysis

Hypermarkets dominate the date syrup market distribution with a 33.4% share.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Date Syrup Market, with a 33.4% share. This dominance is attributed to the wide product visibility and consumer convenience offered by these large retail outlets.

Hypermarkets and supermarkets provide an extensive range of food and beverage products, allowing consumers to directly compare date syrup with other natural sweeteners, which enhances purchasing confidence. Their ability to stock multiple brands and product variations, from different packaging sizes to premium ranges, further supports their role as the leading channel for date syrup sales.

The strong position of hypermarkets and supermarkets is also reinforced by their penetration in both urban and semi-urban areas, where consumer footfall remains consistently high. Attractive in-store promotions, discounts, and product sampling encourage buyers to adopt date syrup as part of their regular grocery basket.

Additionally, the structured shelf placement and established supply chains of these outlets ensure that consumers have reliable access to the product. With a 33.4% share, the hypermarket/supermarket channel continues to play a critical role in shaping consumer buying behavior, supporting the overall market expansion by making date syrup more accessible and familiar to a broad demographic.

Key Market Segments

By Type

By Application

Natural Sweetener

Coloring and Flavoring

Date Balsamic Production

Food Enhancer

Others

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Convenience Stores

Online Retail

Others

Driving Factors

Rising Health Awareness Boosting Natural Sweetener Demand

One of the biggest driving factors for the date syrup market is the increasing awareness among consumers about the harmful effects of refined sugar and artificial sweeteners. People today are actively looking for natural and healthier options, and date syrup fits perfectly into this trend. It is rich in essential nutrients such as potassium, magnesium, calcium, and antioxidants, making it more than just a sweetener.

Consumers also value its clean-label image, as it is free from chemical additives and preservatives. With rising cases of diabetes and obesity, many households and food producers are replacing sugar with natural alternatives. This shift is pushing the demand for date syrup globally, strengthening its market position as a trusted natural sweetener.

Restraining Factors

Higher Production Costs Limiting Wider Market Reach

A major restraining factor for the date syrup market is its relatively higher production cost compared to refined sugar and some other natural sweeteners. The process of extracting syrup from dates involves labor-intensive steps, including careful harvesting, cleaning, processing, and concentration. Since dates are largely grown in specific regions, the cost of raw materials and logistics also adds to the overall expense.

This makes date syrup more expensive for both manufacturers and consumers, limiting its reach in price-sensitive markets. While health-conscious buyers are willing to pay a premium, large-scale adoption in everyday households remains a challenge. Unless production efficiency improves or costs are reduced, this price gap could slow down its growth potential globally.

Growth Opportunity

Expanding Use in the Food and Beverage Industry

A key growth opportunity for the date syrup market lies in its expanding applications within the food and beverage industry. Manufacturers are increasingly incorporating date syrup as a natural sweetener in bakery items, dairy products, cereals, and beverages to cater to health-conscious consumers. Its unique caramel-like flavor and nutritional benefits make it a strong substitute for refined sugar, honey, and artificial syrups.

The growing popularity of plant-based and vegan diets further supports its adoption, as date syrup is 100% natural and free from animal-derived ingredients. With rising demand for clean-label and functional foods, food brands can leverage date syrup to create healthier product lines. This versatility positions it as a promising driver of long-term market growth.

Latest Trends

Growing Popularity of Organic and Clean-Label Products

One of the latest trends in the date syrup market is the rising demand for organic and clean-label products. Consumers are becoming more careful about what they eat, preferring foods that are natural, minimally processed, and free from artificial additives. Organic date syrup, made from dates grown without chemical fertilizers or pesticides, is gaining attention as a premium and healthier option.

Shoppers are also drawn to products with transparent labeling that clearly highlight natural sourcing and nutritional value. This trend is particularly strong in urban areas and among younger consumers who are willing to pay more for quality and sustainability. As clean eating becomes a lifestyle choice, organic date syrup is finding wider acceptance worldwide.

Regional Analysis

In 2024, North America held a 42.70% share of the Date Syrup Market, reaching USD 173.7 Mn.

In 2024, North America emerged as the leading region in the Date Syrup Market, capturing a dominant 42.70% share valued at USD 173.7 million. This strong position is supported by the region’s rising consumer shift toward healthier and natural sweeteners as alternatives to refined sugar.

The United States and Canada, with their growing health-conscious population, have seen increased adoption of date syrup across households, bakeries, and beverage industries. The product’s nutritional benefits, including its mineral and antioxidant content, align well with the region’s demand for functional and clean-label food products.

Europe also shows steady growth, supported by increasing vegan and organic product consumption, while Asia Pacific is gradually gaining momentum due to its expanding middle-class population and dietary diversification. Meanwhile, the Middle East & Africa region benefits from being one of the largest producers of dates, providing a reliable supply base for syrup processing, and Latin America reflects early-stage adoption with potential in urban centers.

Despite these emerging opportunities across other regions, North America continues to dominate, driven by its established retail infrastructure, higher consumer spending capacity, and strong inclination toward natural food innovations. This positions the region as the key growth hub for the global Date Syrup Market.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Ario Co, with its deep expertise in date-derived products, has positioned itself as a reliable supplier catering to both local and international markets. Its emphasis on maintaining authenticity while scaling up production ensures steady demand from food processors and retail channels seeking dependable quality.

Al Barakah Dates Factory LLC plays a crucial role as one of the prominent producers in the Middle East, where date cultivation is abundant. The company benefits from close proximity to raw material sources, enabling competitive pricing and strong export capabilities. Its diversified product range allows it to serve multiple customer needs, from industrial bulk buyers to retail consumers looking for natural sweeteners.

Rapunzel Naturkost, a Europe-based organic and natural food company, brings a unique angle by integrating date syrup into its portfolio of clean-label and sustainable products. Its strong reputation in the organic market enhances the visibility of date syrup among health-conscious European consumers.

Top Key Players in the Market

Ario Co

Al Barakah Dates Factory LLC

Rapunzel Naturkost

Sun Seas Business Group

AL FOAH

Lion Dates

RatinKhosh

Bateel

Just Date

Royal Dates

Recent Developments

In May 2025, Al Barakah continues its growth as a global leader in date-based ingredients. Certified organic and BRC Grade A, the company now exports to over 97 countries. Its advanced, solar-powered facility in Dubai Industrial City processes over 120,000 metric tonnes annually, covering syrups, pastes, powders, and more—reinforcing its position in the date syrup market.

In January 2024, Lion Dates Private Limited supported a community health initiative by distributing one-kilogram packs of date syrup to around 8,000 school students in Trichirappalli, India. The drive aimed to address iron deficiency among students, showing how the company leverages its date syrup for social impact through its CSR (Corporate Social Responsibility) efforts.

Report Scope