Solid Phase Carrier Resin for Peptide Drug Synthesis Market Forecast and Outlook (2025-2035)

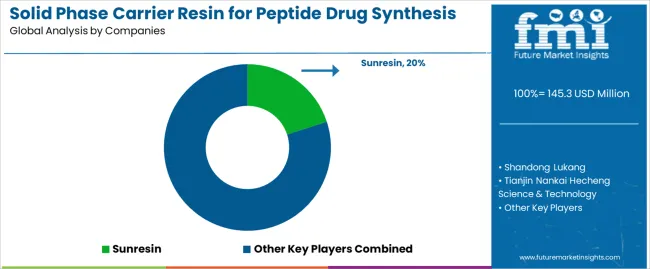

The solid phase carrier resin for peptide drug synthesis market, expected to grow from USD 145.3 million in 2025 to USD 397.8 million by 2035 at a CAGR of 10.5%, is undergoing innovation cycles that directly influence efficiency, scalability, and therapeutic outcomes. A primary area of innovation is in resin design, where manufacturers are focusing on controlled pore size, optimized functional group density, and chemically stable backbones to enable longer peptide chains with reduced aggregation. Advances in linker chemistry are also enhancing the release efficiency of peptides from resins, minimizing by-products and improving overall yield in synthesis operations. These developments are closely tied to the increasing demand for high-purity peptides in both drug discovery and large-scale commercial production.

Automation-driven peptide synthesizers are further shaping innovation, as carrier resins are being engineered for compatibility with high-throughput systems. This shift is enabling contract manufacturing organizations and pharmaceutical firms to scale peptide production with minimal variability, aligning with stricter regulatory requirements for complex biologics. Another emerging trend lies in the creation of hybrid resins that combine organic and inorganic frameworks, delivering enhanced swelling properties and solvent compatibility. Such improvements are particularly significant for complex or highly hydrophobic peptides, where traditional resins often limit synthesis success.

Environmental and cost-efficiency concerns are also prompting the development of recyclable and reusable resins, aimed at reducing synthesis waste and operational expenditure. Academic research institutions are playing a vital role in piloting these innovations, while biotechnology firms are translating them into commercial-grade solutions. The growth trajectory suggests that peptide drug developers will increasingly rely on differentiated resin technologies not only for drug candidates targeting oncology, metabolic disorders, and infectious diseases but also for advanced therapeutic modalities like peptide–drug conjugates. The next wave of innovation is expected to emphasize integration with digital process control systems, allowing real-time monitoring of resin performance during synthesis.

Quick Stats for Solid Phase Carrier Resin for Peptide Drug Synthesis Market

Solid Phase Carrier Resin Market Value (2025): USD 145.3 million

Solid Phase Carrier Resin Market Forecast Value (2035): USD 397.8 million

Solid Phase Carrier Resin Market Forecast CAGR: 10.6%

Leading Resin Type in Market: Hydroxyl Resins

Key Growth Regions: East Asia, North America, and Western Europe

Key Players: Sunresin, Shandong Lukang, Tianjin Nankai Hecheng Science & Technology, Zhejiang Zhengguang

Where revenue comes from — now vs next (industry-level view)

Period

Primary Revenue Buckets

Share

Notes

Today

Hydroxyl resins (orthopedic applications)

42%

Traditional chemistry, established pharmaceutical applications

Chloromethyl resins (cardiovascular)

31%

Versatile linker chemistry, broad therapeutic use

Amino resins (metabolic diseases)

19%

Specialized applications, diabetes and obesity treatments

Others (tumor applications)

8%

Emerging oncology peptides, research applications

Future (3-5 yrs)

Advanced hydroxyl systems

38-41%

Enhanced loading capacity, improved purity

High-performance chloromethyl

26-29%

Optimized synthesis efficiency, automated compatibility

Specialized amino resins

16-19%

Novel metabolic targets, precision medicine

Oncology-focused resins

12-15%

Cancer immunotherapy, targeted drug delivery

Custom therapeutic resins

6-9%

Rare diseases, personalized medicine applications

Research & development

4-7%

Academic institutions, early-stage drug discovery

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Key Takeaways

Metric

Value

Market Value (2025)

USD 145.3 million

Market Forecast (2035)

USD 397.8 million

Growth Rate

10.6% CAGR

Leading Resin Type

Hydroxyl Resins

Primary Application

Orthopedics Segment

The solid phase carrier resin for peptide drug synthesis market demonstrates strong fundamentals, with hydroxyl resin systems capturing a dominant share through advanced linker chemistry and pharmaceutical application optimization. Orthopedic applications drive primary demand, supported by the increasing development of therapeutic peptides and modernization initiatives within the pharmaceutical industry. Geographic expansion remains concentrated in developed markets with established pharmaceutical infrastructure, while emerging economies show accelerating adoption rates driven by biotechnology sector growth and rising research investments.

Imperatives for Stakeholders in Solid Phase Carrier Resin for Peptide Drug Synthesis Market Design for synthesis efficiency, not just capacity

Offer complete resin packages: carrier resins + linker systems + cleavage reagents + synthesis protocols + analytical guides + purification instructions.

Preconfigured synthesis workflows: automated protocols, yield optimization, purity monitoring, and digital synthesis management for pharmaceutical operations.

Pharmaceutical integration readiness

Real-time synthesis monitoring, resin performance tracking, and smart pharmaceutical integration (LIMS connectivity, batch management systems).

Quality-by-design approach

Advanced resin manufacturing systems, real-time quality monitoring, synthesis performance integration, and comprehensive peptide documentation.

Value-based pricing models

Clear base resin price + transparent service tiers (synthesis consulting, method development, technical support); subscriptions for resin supply management services.

Segmental Analysis

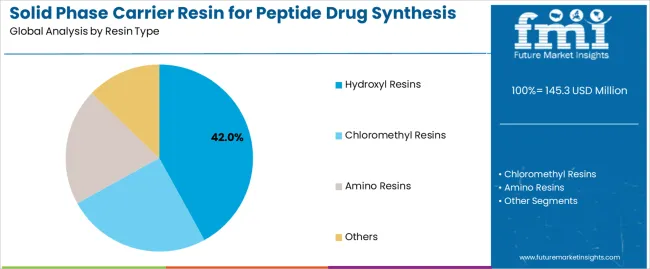

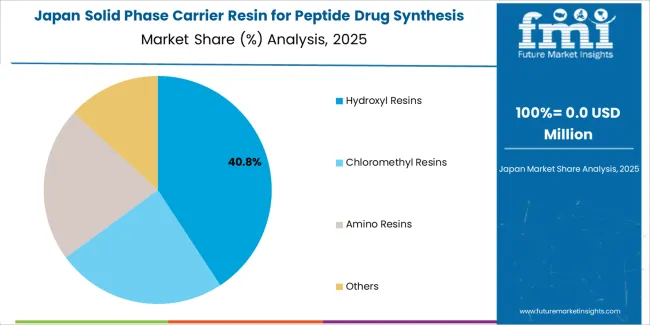

Primary Classification: The solid phase carrier resin for peptide drug synthesis market segments by resin type into hydroxyl, chloromethyl, amino, and others, representing the evolution from traditional solid-phase synthesis chemistry to sophisticated linker technologies for comprehensive peptide synthesis optimization.

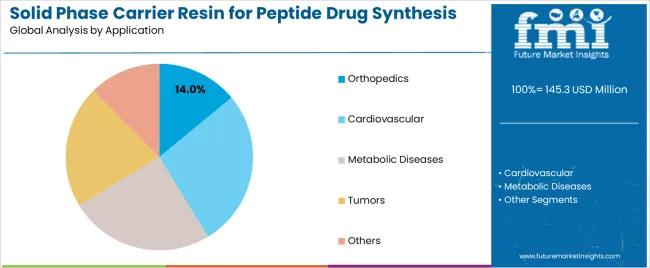

Secondary Classification: Application segmentation divides the solid phase carrier resin for peptide drug synthesis market into orthopedics, cardiovascular, metabolic diseases, tumors, and others, reflecting distinct requirements for therapeutic peptides, synthesis efficiency, and pharmaceutical development specifications.

Tertiary Classification: End-use segmentation covers pharmaceutical companies, biotechnology firms, contract research organizations, academic institutions, and specialty chemical manufacturers, while distribution channels span direct sales, chemical distributors, and specialized pharmaceutical suppliers.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by pharmaceutical industry modernization programs.

The segmentation structure reveals resin progression from traditional hydroxyl chemistry toward sophisticated amino and specialty resins with enhanced synthesis capabilities, while application diversity spans from established orthopedic peptides to emerging oncology therapeutics requiring precision synthesis solutions.

By Resin Type, the Hydroxyl Segment Accounts for Dominant Market Share

Market Position: Hydroxyl resin systems command the leading position in the solid phase carrier resin market with 42% market share through proven linker technologies, including efficient coupling chemistry, high loading capacity, and synthesis reliability that enable pharmaceutical manufacturers to achieve optimal peptide production across diverse orthopedic and therapeutic applications.

Value Drivers: The segment benefits from pharmaceutical industry preference for established resin systems that provide reliable synthesis performance, consistent peptide quality, and operational compatibility without requiring specialized synthesis infrastructure. Advanced hydroxyl chemistry features enable enhanced coupling efficiency, improved peptide purity, and integration with existing synthesis platforms, where performance reliability and therapeutic effectiveness represent critical manufacturing requirements.

Competitive Advantages: Hydroxyl resin systems differentiate through proven synthesis reliability, versatile linker compatibility, and integration with established peptide manufacturing systems that enhance facility effectiveness while maintaining optimal pharmaceutical standards suitable for diverse therapeutic applications.

Key market characteristics:

Advanced resin designs with optimized loading capacity and synthesis reliability capabilities

Enhanced coupling effectiveness, enabling 94-97% synthesis efficiency with reliable peptide production

Pharmaceutical compatibility, including automated synthesis systems, purity optimization, and quality control for therapeutic applications

Chloromethyl Shows Versatility Market Position

Chloromethyl resin systems maintain a 31% market position in the solid phase carrier resin market due to their versatility advantages and broad therapeutic application benefits. These materials appeal to facilities requiring flexible synthesis solutions with enhanced coupling profiles for diverse peptide sequences. Market growth is driven by cardiovascular peptide expansion, emphasizing versatile linker solutions and synthetic efficiency through optimized coupling designs.

By Application, the Orthopedics Segment Shows Strong Growth

Market Context: Orthopedic applications demonstrate strong growth in the solid phase carrier resin market with 14% market share due to widespread adoption of therapeutic peptide programs and increasing focus on bone and joint treatments, operational synthesis efficiency, and peptide therapy applications that maximize therapeutic effectiveness while maintaining pharmaceutical standards.

Appeal Factors: Pharmaceutical operators prioritize synthesis reliability, therapeutic consistency, and integration with existing drug development infrastructure that enables coordinated peptide operations across multiple therapeutic programs. The segment benefits from substantial pharmaceutical industry investment and orthopedic research programs that emphasize the acquisition of premium resins for peptide differentiation and therapeutic outcome applications.

Growth Drivers: Orthopedic peptide development programs incorporate carrier resins as essential components for therapeutic synthesis, while specialized pharmaceutical growth increases demand for synthesis capabilities that comply with regulatory standards and minimize development complexity.

Market Challenges: Varying therapeutic requirements and regulatory complexity may limit resin standardization across different peptides or synthesis scenarios.

Application dynamics include:

Strong growth in bone regeneration and joint therapy peptides requiring premium synthesis capabilities

Increasing adoption in orthopedic biotechnology applications for pharmaceutical developers

Rising integration with synthesis automation systems for yield optimization and quality assurance

Cardiovascular Applications Maintain Therapeutic Demand

Cardiovascular applications capture 31% market share through specialized therapeutic requirements in cardiac peptides, vascular treatments, and pharmaceutical applications. These facilities demand premium resins capable of supporting regulatory requirements while providing therapeutic synthesis access and pharmaceutical development capabilities.

Metabolic Diseases Applications Show Specialized Growth

Metabolic diseases applications account for 19% market share, including diabetes treatments, obesity therapeutics, and endocrine applications requiring performance resin capabilities for therapeutic optimization and pharmaceutical effectiveness.

By End-Use, Pharmaceutical Companies Drive Market Leadership

Market Context: Pharmaceutical Companies dominate the solid phase carrier resin for peptide drug synthesis market with an 8.2% CAGR, reflecting the primary demand source for carrier resin technology in therapeutic peptide applications and drug development standardization.

Business Model Advantages: Pharmaceutical Companies provide direct market demand for standardized resin systems, driving volume production and cost optimization while maintaining quality control and regulatory compliance requirements.

Operational Benefits: Pharmaceutical Company applications include therapeutic standardization, synthesis efficiency, and quality assurance that drive consistent demand for resin systems while providing access to the latest synthesis technologies.

What are the Drivers, Restraints, and Key Trends of the Solid Phase Carrier Resin for Peptide Drug Synthesis Market?

Category

Factor

Impact

Why It Matters

Driver

Pharmaceutical industry growth & peptide drug development (therapeutic peptides, biologics expansion)

★★★★★

Growing pharmaceutical market requires specialized resins with enhanced synthesis capabilities and purity properties proven effective across therapeutic applications.

Driver

Therapeutic standards advancement & regulatory requirements (FDA approval, GMP compliance)

★★★★★

Transforms resin requirements from “basic chemistry” to “pharmaceutical grade synthesis”; manufacturers that offer quality resins and compliance features gain competitive advantage.

Driver

Biotechnology market growth & precision medicine (personalized therapy, targeted treatments)

★★★★☆

Biotechnology companies need sophisticated, high-performance resins; demand for specialized and superior synthesis solutions expanding addressable market.

Restraint

Cost pressures & development constraints (especially for small biotech companies)

★★★★☆

Smaller pharmaceutical developers defer resin upgrades; increases price sensitivity and slows premium resin adoption in cost-conscious markets.

Restraint

Alternative synthesis methods competition (liquid phase synthesis, enzymatic approaches)

★★★☆☆

Alternative peptide synthesis offer different advantages and established protocols, potentially limiting solid phase resin adoption in traditional applications.

Trend

Synthesis technology integration & automation enhancement (automated synthesizers, process monitoring)

★★★★★

Advanced synthesis automation, efficiency optimization, and process analytics transform operations; technology integration and performance enhancement become core value propositions.

Trend

Customization & application-specific solutions (therapeutic targeting, specialized linkers)

★★★★☆

Custom resins for specific therapeutic applications; specialized designs and targeted synthesis capabilities drive competition toward customization solutions.

Analysis of the Solid Phase Carrier Resin for Peptide Drug Synthesis Market by Key Country

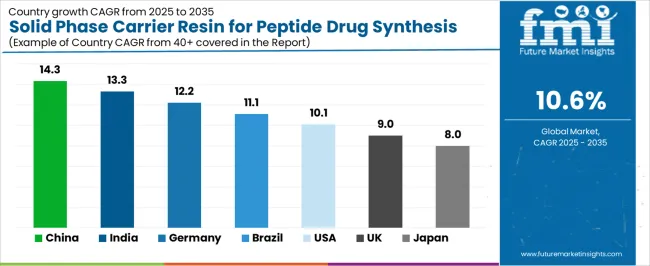

The solid phase carrier resin for peptide drug synthesis market demonstrates varied regional dynamics with Growth Leaders including China (14.3% growth rate) and India (13.3% growth rate) driving expansion through pharmaceutical development initiatives and biotechnology industry modernization. Steady Performers encompass Germany (12.2% growth rate), Brazil (11.1% growth rate), and developed regions, benefiting from established pharmaceutical industries and therapeutic peptide adoption. Mature Markets feature United States (10.1% growth rate), United Kingdom (9.0% growth rate), and Japan (8.0% growth rate), where pharmaceutical advancement and regulatory standardization requirements support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through pharmaceutical expansion and biotechnology development, while North American countries maintain steady expansion supported by resin technology advancement and therapeutic standardization requirements. European markets show strong growth driven by pharmaceutical applications and quality integration trends.

Region/Country

2025-2035 Growth

How to win

What to watch out

China

14.3%

Focus on pharmaceutical manufacturing solutions

Regulatory changes; quality standards

India

13.3%

Lead with cost-effective biotechnology applications

Import restrictions; technical barriers

Germany

12.2%

Provide premium pharmaceutical-grade resins

Over-regulation; lengthy approvals

Brazil

11.1%

Offer value-oriented therapeutic solutions

Currency fluctuations; import duties

United States

10.1%

Push technology integration

Compliance costs; scaling challenges

United Kingdom

9.0%

Focus on biotechnology applications

Economic impacts; development costs

Japan

8.0%

Emphasize precision manufacturing

Traditional preferences; adoption rates

China Drives Fastest Market Growth

China establishes fastest market growth through aggressive pharmaceutical development programs and comprehensive biotechnology industry expansion, integrating advanced carrier resin systems as standard components in pharmaceutical facilities and research installations. The country’s 14.3% growth rate reflects government initiatives promoting pharmaceutical infrastructure and domestic resin capabilities that mandate the use of professional synthesis systems in pharmaceutical and biotechnology facilities. Growth concentrates in major pharmaceutical hubs, including Beijing, Shanghai, and Guangzhou, where biotechnology development showcases integrated resin systems that appeal to pharmaceutical operators seeking synthesis optimization capabilities and therapeutic applications.

Chinese manufacturers are developing cost-effective resin solutions that combine domestic production advantages with advanced synthesis features, including enhanced coupling control and improved purity capabilities. Distribution channels through pharmaceutical suppliers and chemical distributors expand market access, while government support for biotechnology development supports adoption across diverse pharmaceutical and research segments.

Strategic Market Indicators:

Government biotechnology programs providing substantial funding for domestic resin technology development

Export market development for cost-effective synthesis solutions targeting emerging pharmaceutical markets

India Emerges as High-Growth Market

In Mumbai, Delhi, and Bangalore, pharmaceutical facilities and biotechnology operators are implementing professional carrier resin systems as standard equipment for peptide synthesis and therapeutic optimization applications, driven by increasing government pharmaceutical investment and biotechnology modernization programs that emphasize the importance of synthesis quality capabilities. The solid phase carrier resin for peptide drug synthesis market holds a 13.3% growth rate, supported by government pharmaceutical initiatives and biotechnology development programs that promote professional resin systems for pharmaceutical and research facilities. Indian operators are adopting resin systems that provide consistent synthesis performance and quality features, particularly appealing in urban regions where therapeutic development and operational excellence represent critical business requirements.

Market expansion benefits from growing pharmaceutical capabilities and international biotechnology partnerships that enable domestic production of professional resin systems for pharmaceutical and research applications. Technology adoption follows patterns established in pharmaceutical equipment, where reliability and performance drive procurement decisions and operational deployment.

Market Intelligence Brief:

Pharmaceutical modernization programs emphasizing resin systems for synthesis effectiveness and therapeutic excellence

Local manufacturers partnering with international providers for resin system development

Pharmaceutical facilities implementing resin systems for synthesis optimization and quality management

Germany Maintains Technology Leadership

Germany’s advanced pharmaceutical market demonstrates sophisticated carrier resin deployment with documented synthesis effectiveness in pharmaceutical applications and biotechnology facilities through integration with existing pharmaceutical systems and operational infrastructure. The country leverages engineering expertise in chemistry and quality systems integration to maintain a 12.2% growth rate. Pharmaceutical centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia, showcase premium installations where resin systems integrate with comprehensive pharmaceutical platforms and facility management systems to optimize synthesis performance and operational effectiveness.

German manufacturers prioritize system quality and EU compliance in resin development, creating demand for premium systems with advanced features, including facility integration and pharmaceutical synthesis systems. The solid phase carrier resin for peptide drug synthesis market benefits from established pharmaceutical infrastructure and a willingness to invest in professional resin technologies that provide long-term operational benefits and compliance with international pharmaceutical standards.

Market Intelligence Brief:

Engineering focuses on EU standardization and quality compliance, driving premium segment growth

Technology collaboration between German manufacturers and international chemical companies

Professional training programs expanding resin system integration in pharmaceutical scenarios

Brazil Shows Strong Regional Leadership

Brazil’s market expansion benefits from diverse pharmaceutical demand, including biotechnology modernization in São Paulo and Rio de Janeiro, pharmaceutical facility upgrades, and government healthcare programs that increasingly incorporate professional resin solutions for therapeutic applications. The country maintains a 11.1% growth rate, driven by rising pharmaceutical activity and increasing recognition of professional resin benefits, including precise synthesis control and enhanced therapeutic effectiveness.

Market dynamics focus on cost-effective resin solutions that balance synthesis performance with affordability considerations important to Brazilian pharmaceutical operators. Growing pharmaceutical industrialization creates continued demand for modern resin systems in new biotechnology infrastructure and facility modernization projects.

Strategic Market Considerations:

Pharmaceutical and biotechnology segments leading growth with focus on synthesis optimization and therapeutic effectiveness applications

Regional pharmaceutical requirements driving a diverse product portfolio from basic resin systems to premium solutions

Import dependency challenges offset by potential local production partnerships with international manufacturers

Government healthcare initiatives beginning to influence procurement standards and operational requirements

United States Maintains Market Leadership

United States establishes market leadership through comprehensive pharmaceutical programs and advanced biotechnology infrastructure development, integrating carrier resin systems across pharmaceutical and research applications. The country’s 10.1% growth rate reflects established pharmaceutical industry relationships and mature resin technology adoption that supports widespread use of professional synthesis systems in pharmaceutical and biotechnology facilities. Growth concentrates in major pharmaceutical centers, including California, Massachusetts, and New Jersey, where resin technology showcases mature deployment that appeals to pharmaceutical operators seeking proven synthesis capabilities and operational efficiency applications.

American pharmaceutical providers leverage established distribution networks and comprehensive technical support capabilities, including synthesis programs and training support that create customer relationships and operational advantages. The solid phase carrier resin for peptide drug synthesis market benefits from mature regulatory standards and pharmaceutical requirements that mandate resin system use while supporting technology advancement and operational optimization.

Market Intelligence Brief:

Established regulatory standards providing consistent demand for resin technology advancement

Technology integration programs expanding synthesis capabilities in pharmaceutical scenarios

United Kingdom Shows Premium Integration

United Kingdom’s pharmaceutical market demonstrates integrated carrier resin deployment with documented synthesis effectiveness in pharmaceutical applications and biotechnology facilities through integration with existing pharmaceutical systems and operational infrastructure. The country maintains a 9.0% growth rate, supported by pharmaceutical excellence programs and synthesis effectiveness requirements that promote professional resin systems for pharmaceutical applications. Pharmaceutical facilities across England, Scotland, and Wales showcase systematic installations where resin systems integrate with comprehensive pharmaceutical platforms to optimize synthesis performance and operational outcomes.

UK pharmaceutical providers prioritize system reliability and industry compatibility in resin procurement, creating demand for validated systems with proven synthesis features, including quality monitoring integration and pharmaceutical synthesis systems. The solid phase carrier resin for peptide drug synthesis market benefits from established pharmaceutical infrastructure and excellence requirements that support resin technology adoption and operational effectiveness.

Market Intelligence Brief:

Pharmaceutical industry compatibility requirements driving standardized resin system adoption

Biotechnology partnerships providing synthesis validation and effectiveness data

Technology integration between UK pharmaceutical providers and international resin companies

Professional training programs expanding resin system deployment in pharmaceutical scenarios

Japan Shows Precision Market Development

Japan’s market growth benefits from precision pharmaceutical demand, including advanced biotechnology facilities in Tokyo and Osaka, quality integration, and therapeutic enhancement programs that increasingly incorporate resin solutions for synthesis applications. The country maintains a 8.0% growth rate, driven by pharmaceutical technology advancement and increasing recognition of precision resin benefits, including accurate synthesis control and enhanced therapeutic outcomes.

Market dynamics focus on high-precision resin solutions that meet Japanese quality standards and synthesis effectiveness requirements important to pharmaceutical operators. Advanced pharmaceutical technology adoption creates continued demand for sophisticated resin systems in biotechnology facility infrastructure and therapeutic modernization projects.

Strategic Market Considerations:

Pharmaceutical and biotechnology segments leading growth with focus on precision resins and quality applications

Quality requirements driving premium product adoption from advanced resin systems

Technology integration challenges balanced by strong synthesis effectiveness and precision capabilities

Pharmaceutical quality initiatives beginning to influence procurement standards and resin requirements

Europe Market Split by Country

The European solid phase carrier resin for peptide drug synthesis market is projected to grow from USD 31.2 million in 2025 to USD 89.4 million by 2035, registering a CAGR of 11.1% over the forecast period. Germany is expected to maintain its leadership position with a 41.3% market share in 2025, supported by its advanced pharmaceutical infrastructure and major biotechnology centers.

United Kingdom follows with a 28.1% share in 2025, driven by comprehensive pharmaceutical programs and biotechnology excellence development initiatives. France holds a 16.7% share through specialized pharmaceutical applications and regulatory compliance requirements. Italy commands a 9.2% share, while Spain accounts for 4.7% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.9% to 3.4% by 2035, attributed to increasing pharmaceutical adoption in Nordic countries and emerging biotechnology facilities implementing pharmaceutical modernization programs.

Competitive Landscape of the Solid Phase Carrier Resin for Peptide Drug Synthesis Market

Structure: ~8-12 credible players; top 3-5 hold ~70-75% by revenue.

Leadership is maintained through: chemical expertise, pharmaceutical relationships, and product innovation (resin technology + synthesis efficiency + therapeutic applications).

What’s commoditizing: basic resin chemistry and standard synthesis systems.

Margin Opportunities: custom resin development, therapeutic specialization, and integration into pharmaceutical workflows (synthesis optimization, quality control).

Stakeholder

What they actually control

Typical strengths

Typical blind spots

Global chemical companies

Supply chain reach, broad product portfolios, pharmaceutical relationships

Wide availability, proven quality, multi-region support

Product innovation cycles; customer dependency on pharmaceutical validation

Technology innovators

Resin R&D; advanced synthesis technologies; enhanced performance properties

Latest technologies first; attractive ROI on synthesis effectiveness

Service density outside core regions; scaling complexity

Regional specialists

Local compliance, fast delivery, nearby customer support

“Close to customer” support; pragmatic pricing; local regulations

Technology gaps; talent retention in customer service

Full-service providers

Synthesis programs, technical services, method development

Lowest operational risk; comprehensive support

Service costs if overpromised; technology obsolescence

Niche specialists

Specialized applications, custom resins, therapeutic services

Win premium applications; flexible configurations

Scalability limitations; narrow market focus

Key Players in the Solid Phase Carrier Resin for Peptide Drug Synthesis Market

Sunresin

Shandong Lukang

Tianjin Nankai Hecheng Science & Technology

Zhejiang Zhengguang

Jiangsu Haipu Functional Materials

RawPEG

Merck

CEM Corporation

ChemPep Inc.

Iris Biotech

Bachem

Gyros Protein Technologies

AAPPTec

Advanced ChemTech

Peptides International

GL Biochem

Chempep

Scope of the Report

Item

Value

Quantitative Units

USD 145.3 million

Resin Type

Hydroxyl Resins, Chloromethyl Resins, Amino Resins, Others

Application

Orthopedics, Cardiovascular, Metabolic Diseases, Tumors, Others

End Use

Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations, Academic Institutions, Specialty Chemical Manufacturers

Regions Covered

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa

Countries Covered

China, India, Germany, Brazil, United States, United Kingdom, Japan, Canada, France, Australia, and 25+ additional countries

Key Companies Profiled

Sunresin, Shandong Lukang, Tianjin Nankai Hecheng Science & Technology, Zhejiang Zhengguang, Jiangsu Haipu Functional Materials

Additional Attributes

Dollar sales by resin type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with chemical manufacturers and pharmaceutical suppliers, pharmaceutical operator preferences for synthesis effectiveness and therapeutic optimization, integration with pharmaceutical platforms and quality management systems, innovations in resin technology and synthesis enhancement, and development of advanced carrier resin solutions with enhanced performance and pharmaceutical optimization capabilities.

Solid Phase Carrier Resin for Peptide Drug Synthesis Market by Segments Resin Type:

Hydroxyl Resins

Chloromethyl Resins

Amino Resins

Others

Application:

Orthopedics

Cardiovascular

Metabolic Diseases

Tumors

Others

End Use:

Pharmaceutical Companies

Biotechnology Firms

Contract Research Organizations

Academic Institutions

Specialty Chemical Manufacturers

Region:

North America

United States

Canada

Mexico

Latin America

Brazil

Chile

Rest of Latin America

Western Europe

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Western Europe

Eastern Europe

Russia

Poland

Rest of Eastern Europe

East Asia

South Asia Pacific

India

ASEAN

Australia & New Zealand

Rest of South Asia Pacific

Middle East & Africa

Kingdom of Saudi Arabia

Other GCC Countries

Turkey

South Africa

Other African Union

Rest of Middle East & Africa

Frequently Asked Questions

How big is the solid phase carrier resin for peptide drug synthesis market in 2025?

The global solid phase carrier resin for peptide drug synthesis market is estimated to be valued at USD 145.3 million in 2025.

What will be the size of solid phase carrier resin for peptide drug synthesis market in 2035?

The market size for the solid phase carrier resin for peptide drug synthesis market is projected to reach USD 397.8 million by 2035.

How much will be the solid phase carrier resin for peptide drug synthesis market growth between 2025 and 2035?

The solid phase carrier resin for peptide drug synthesis market is expected to grow at a 10.6% CAGR between 2025 and 2035.

What are the key product types in the solid phase carrier resin for peptide drug synthesis market?

The key product types in solid phase carrier resin for peptide drug synthesis market are hydroxyl resins, chloromethyl resins, amino resins and others.

Which application segment to contribute significant share in the solid phase carrier resin for peptide drug synthesis market in 2025?

In terms of application, orthopedics segment to command 14.0% share in the solid phase carrier resin for peptide drug synthesis market in 2025.