Spy sank several rather satisfying bottles of Schloss Eggenberg Hopfenkönig Pilsner this week contemplating the Labubu doll phenomenon. As the miniature, toothy-grinned vinyl toys fly off the shelves faster than the average politician tells lies, desperate consumers are paying ridiculous prices on the black market, such is the insane demand. There is nothing new under the sun however; Spy remembers Cabbage Patch Dolls, Trolls and Bratz among other doll manias. Pop Mart International should enjoy its happy moment in the sun but investors chasing the stock should remember that sugar rushes like these seldom last, as fickle toy consumers suddenly move on, as quickly as they dived in, in the first place.

VanEck, the American asset manager that is celebrating seventy years in business this year, is tackling one of the most annoying rules in fund and portfolio construction: limiting what a fund can hold due to an individual stock’s outsize market cap, which often leads to comparative index underperformance. With the launch of a new series of sectoral ETFs, the manager explains, “Our TruSector ETFs are designed to solve one of the most persistent issues in sector investing: the tracking error caused by regulatory diversification limits that force sector funds to underweight the largest companies in their benchmarks.” The initial new funds are, the VanEck Consumer Discretionary TruSector ETF (TRUD) and the VanEck Technology TruSector ETF (TRUT). So, are the funds simply ignoring the rules, wonders Spy? According to VanEck, “The investment team uses a hybrid portfolio construction process that blends individual equities with ETF exposures” to solve the problem. About as clear as mud, thinks Spy, but interesting, nonetheless.

Do lunch or be lunch? According to data provided by London Stock Exchange Group, and initially reported by FN London, global M&A in the asset management sector has reached a decade high. Deals worth $50.8bn have been struck since the beginning of the year and July. This is a healthy, increase of 76% on the same period in 2024. What is driving the consolidation? It is not hard to imagine, reckons Spy. Fee compression, a growing regulatory burden, product commodification and intense competitive pressure means CEOs are looking for scale to survive and thrive. Whether the deals work, is another thing entirely.

Vontobel Asset Management has tackled the eternal portfolio management dilemma: when do you sell? It is probably the hardest question of all, when managing money. In a good thought leadership piece, they answer the question very wisely in Spy’s humble opinion. “To answer the sell question, we apply two simple heuristics. First, we ask ourselves ‘if we did not own it today, would we start a position now?’ An important part of this first question is analysing our “kill criteria” – a clearly defined set of potential breaches that would cause us to sell. Second, we analyse opportunity cost: is there another stock in the portfolio or in our recommended buy list that we like more? Fortunately, if our sell decision proves to be wrong, we can always buy the stock again later. What we can’t do, however, is recover our permanent loss of capital due to our hesitation to sell the stock [if the stock falls 50%, for example]. Our main concern is not FOMO, rather it is Fear of Losing Money (FOLM).” A bond market mindset for an equity world.

Another week, another acronym to get used to. According to UBS we need to care about EMILLIs, also known as ‘Everyday MILLIonaires”. These are the people who have one to five million US dollars. According to the Swiss bank’s annual Wealth Report, “The number of EMILLIs in the world has more than quadrupled since 2000 to around 52 million. At the end of 2024, EMILLIs accounted for around USD 107 trillion of total wealth. That’s more than four times the amount seen at the end of the year 2000, equivalent to over 2.5 times in real terms. It’s also close to the USD 119 trillion owned by people with more than USD 5 million in wealth.” Keeping ahead of the pack is not easy these days, chuckles Spy.

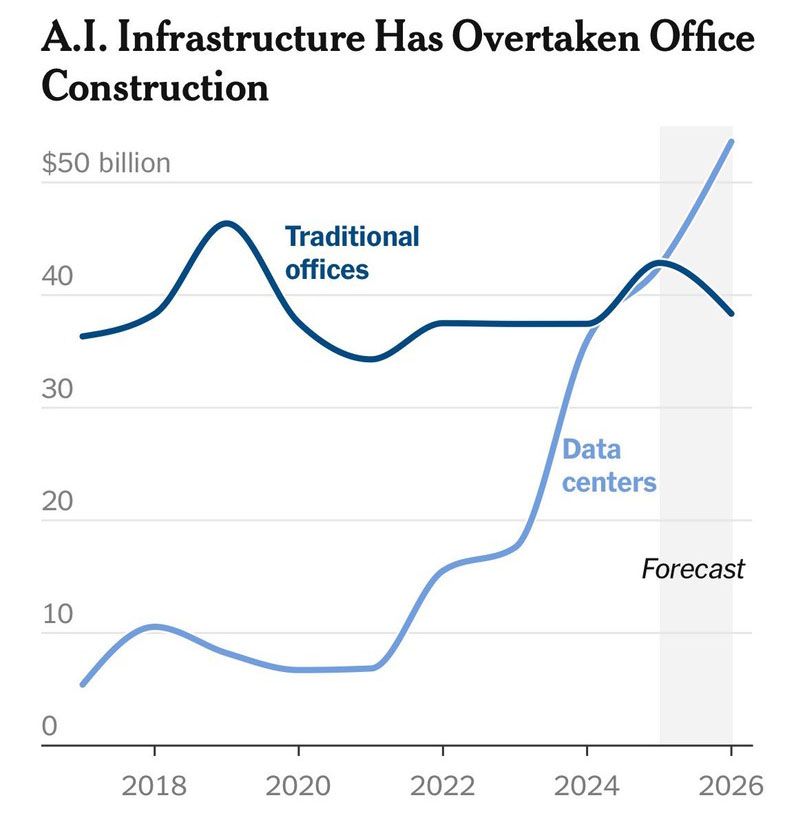

The rise and rise of the data centre seems inexorable, these days. In the United States, an interesting milestone was reached this year. For the first time ever, more money has been spent constructing data centres than has been spent building new office blocks. Each sector has had more than $40bn invested but the long-term trend suggest stagnation for offices but a rosy future for warehouses stuffed with servers.

Spy is used to corporate-speak: ‘downsizing’ or ‘challenging environment’ and other such euphemisms to deliver bad news. He spotted a new one this week, “valuation fatigue”. In simpler words, overvalued, or perhaps investors are just sick of paying higher and high prices for US tech firms. It could be good news for Asian tech companies though. Investors have been rotating out of eye wateringly expensive U.S. technology stocks and into other sectors, as concerns grow that the lofty valuations of the mega cap leaders are increasingly difficult to defend. Despite recent gains, the Asian technology index trades at 16.9 times forward earnings—below its five-year median of 17.6—while the Nasdaq 100 sits at 26.8 times, above its median of 25.7. Not hard to see which one offers better value, thinks Spy.

The markets march on, regardless of one’s personal concerns. The Dow closed at an all-time high last week and history was made. The index has delivered thirteen straight years with at least one all-time high. This run has now surpassed the fabulous 1989-2000 streak of twelve years.

Watching some financial news earlier this week, Spy was reminded of this gem of a quote by Robert Rubin, “Some people are more certain of everything than I am of anything.” One can’t but help admire their confidence.

Until next week…