Core inflation rose to 2.9 percent last month, sending Wall Street into a spiral.

The personal consumption expenditures (PCE) price index showed prices, excluding volatile food and energy costs, were 2.9 percent higher in July compared to the same time last year.

Analysts and economists have made repeated warnings that Trump’s tariffs on foreign imports will drive up the prices of consumer goods for ordinary Americans.

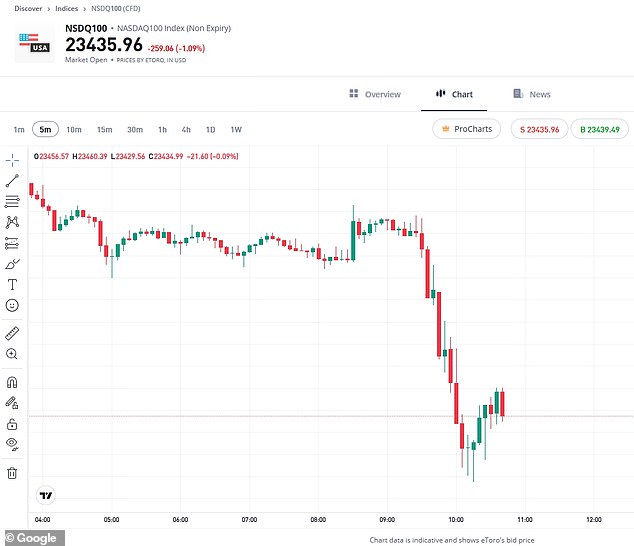

Stocks turned red in morning trading over concerns the figures show tariffs continuing to bite consumers spending power.

The Nasdaq dropped 1.1 percent and the S&P 500 dipped 0.8 percent on Friday morning.

Although it is only a 0.1 percent increase from June, the new figures represent the highest annual rate since February, according to a Commerce Department report.

The Federal Reserve, which sets benchmark interest rates, prefers the PCE index as a long term indicator of inflation.

The latests figures – still far higher than the Fed’s two percent inflation goal – could throw cold water on Fed chair Jerome Powell’s indication that a rate cut could come next month.

The Nasdaq dropped 1.1 percent and the S&P 500 dipped 0.8 percent on Friday morning

The Nasdaq dropped 1.1 percent on Friday morning

Markets, which hit a record high just yesterday, still expect the rate to be lowered in September but enthusiasm has cooled.

‘The Fed opened the door to rate cuts, but the size of that opening is going to depend on whether labor-market weakness continues to look like a bigger risk than rising inflation,’ Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management told CNBC.

‘Today’s in-line PCE Price Index will keep the focus on the jobs market. For now, the odds still favor a September cut,’ she added.

Despite rising prices consumer spending increased 0.5 percent in July, indicating resilient consumer demand.

‘Inflation continues to rise, which may complicate things for the Fed down the road,’ Bret Kenwell, U.S. investment analyst at eToro said of the latest figures.

‘While the Fed will likely cut rates to accommodate the labor market, it may be hard for them to move as quickly or aggressively as they’d like with inflation moving higher,’ Kenwell explained.

Share or comment on this article:

Wall Street panics as key inflation gauge suggests tariffs will wreak havoc on prices