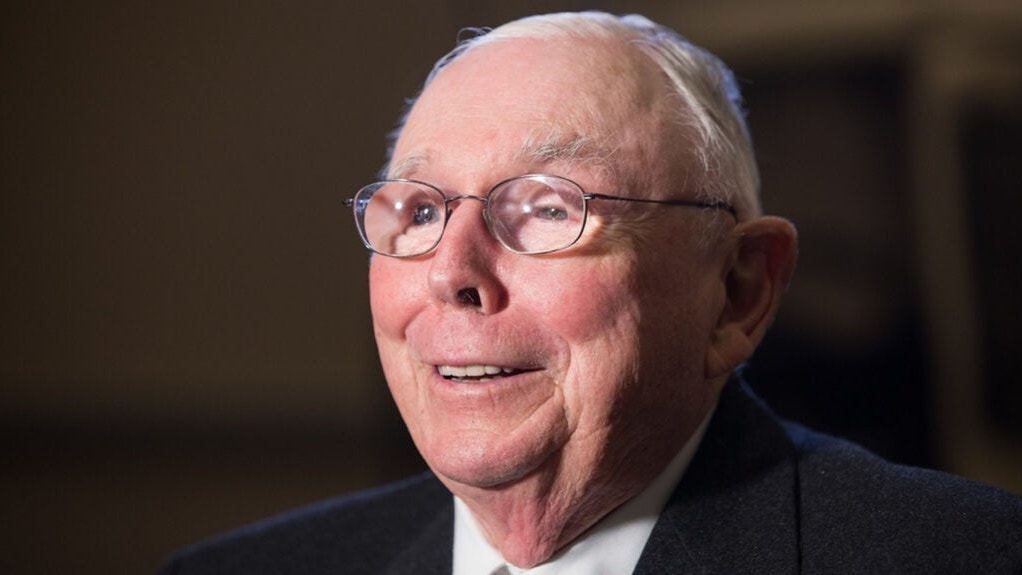

The late billionaire Charlie Munger once shared his unique approach to financial success and longevity, emphasizing the importance of avoiding conventional pitfalls.

What Happened: Munger said that his strategy was simple and direct. He focused on steering clear of standard ways of failing and was cautious in his decision-making.

Munger, who lived in the same modest home for seven decades, believed that extravagant living often leads to dissatisfaction.

During an interview with CNBC, he stated, “I avoided the standard ways of failing, because my game in life was always to avoid all standard ways of failing. And, of course, I’ve avoided a lot, because I’m so cautious.”

Munger’s practical approach was reflected in his spending habits. When his business partner at Berkshire Hathaway decided to replace a company jet, Munger considered the $6.7 million expense excessive.

According to Munger, avoiding apparent risks, frivolity, and irrational scenarios were key to his financial success and longevity. He advised, “Steer clear of insanity at all costs. Insanity is far more prevalent than you’d imagine.”

“Avoid crazy at all costs. Crazy is way more common than you think. It’s easy to slip into crazy. Just avoid it, avoid it, avoid it,” Munger also said.

Munger’s philosophy provides valuable insights into his work ethic and life. His avoidance of conventional failure modes, his cautious decision-making, and his disdain for extravagance and risky ventures, all paint a picture of a man who valued practicality and prudence over quick gains and lavish lifestyles.

His legacy serves as a reminder that success can be achieved through simplicity, caution, and a steadfast refusal to participate in irrational ventures.

Read Next

Image: Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?