A 21-year-old revealed how she has managed to save £54,000 while working in McDonald’s.

Preston-based Stella McCormick is a manager at the fast food chain, and shared how some clever spending hacks are helping her save for her ‘forever home’.

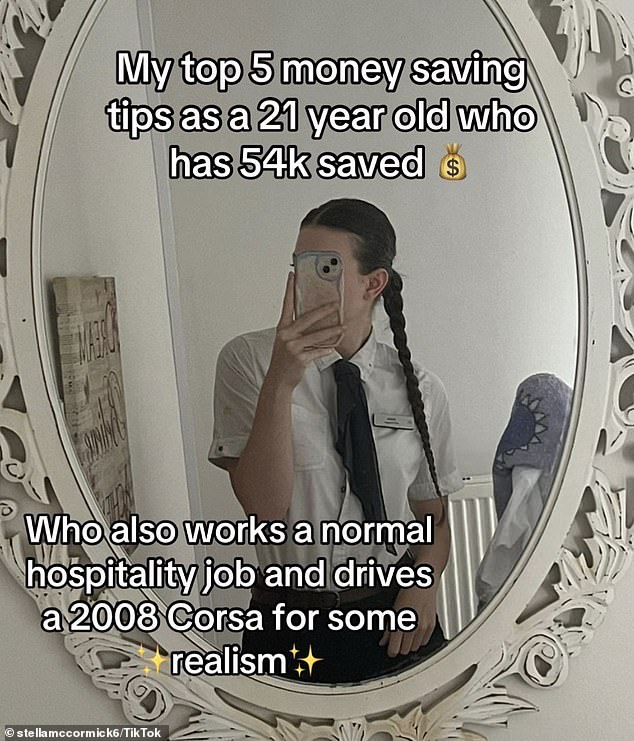

Taking to her TikTok @stellamccormick6, the influencer said she sticks to a few simple rules when it comes to money, including making a ‘wishlist’ of things she wants to buy.

In a clip, which racked up more than 41,000 views, Stella claimed planning days out, making financial goals and investing were great ways to make sure you are in control of your finances.

The savvy saver drives a 2008 Corsa and admitted she is ‘very lucky’ and ‘privileged’ because she lived with her mother until she was 19-years-old and was paying just £150 a month in rent.

Her first tip was to keep track of ‘essential outgoings’ which she said was the key place to start.

‘This is a non-negotiable – if you don’t know exactly what you spend on bills etc, your personal finances need organising,’ she stressed.

Stella also urged people to write down every payment they make each month, to ensure they are aware of their outgoings.

Stella McCormick, who is from the UK, revealed she has managed to save £54,000 while working in McDonald’s and sticking to some clever hacks

Her next tip was to plan out your weekly meals ahead of your food shop so you don’t overspend.

‘Make a meal plan or at least a list of dinners for the week,’ she advised, ‘and curate a shopping list based on those meals.’

The third hack was to make a ‘wish list’ of things you want to buy and come back to it at a later date to see if it’s still important.

‘If you see something you’d like to buy, add it to a wishlist in your notes – go back to it in a months’ time and you will realise you didn’t actually want it,’ Stella shared.

‘For example, new trainers, new phone etc. I’ve done this since I was 16 and I have hardly ever bought the items I wanted because I didn’t even want them anymore.’

Another piece of advice was to set ‘financial goals’ – no matter how small.

‘If I have a goal to spend less than £100 in a week for example – I will without fail do this even if I had to walk an hour to work if my car broke down instead of paying for an Uber,’ she shared.

‘Make sure these are achievable for you so you get some little wins.’

Stella is a manager at the fast food chain and is saving for her ‘forever home’

She revealed that her mother and stepfather taught her the importance of this and how best to utilise money

Social media users were impressed by Stella’s savings hacks and many rushed to the comments with their own thoughts

Finally, Stella revealed the importance of investing. As well as keeping money in an ISA and Premium Bonds she also has ‘a lot’ of money in Columbia – an investment company.

‘Do your research before investing,’ she warned. ‘I learnt this from my parents but I have money in numerous places that just sit there and earn me money every year.

‘A couple of good ones are MoneyBox for all the ISA’s, Premium Bonds is good for 100 percent financial safety if you are worried about losing money and I also keep a lot in Columbia but they charge a lot.’

Social media users were impressed by Stella’s saving hacks and many rushed to the comments with their own thoughts.

One person said: ‘Ahah great tips !! I do exactly the same things and have 110k saved at 28.’

Another added: ‘Budgeting is like gym… hard to start, but the gains are worth it.’

‘Finally seeing someone else my age actually have savings!’ another penned. ‘I’m also saving for a house, slow process but will be worth it in the long run.’

‘The wish list thing is genius!’ a fourth praised. ‘Most of us would wait a month but actually not want it by then!’

Share or comment on this article:

I’m 21 and work in McDonald’s but have £54,000 in savings – these are my top spending tips