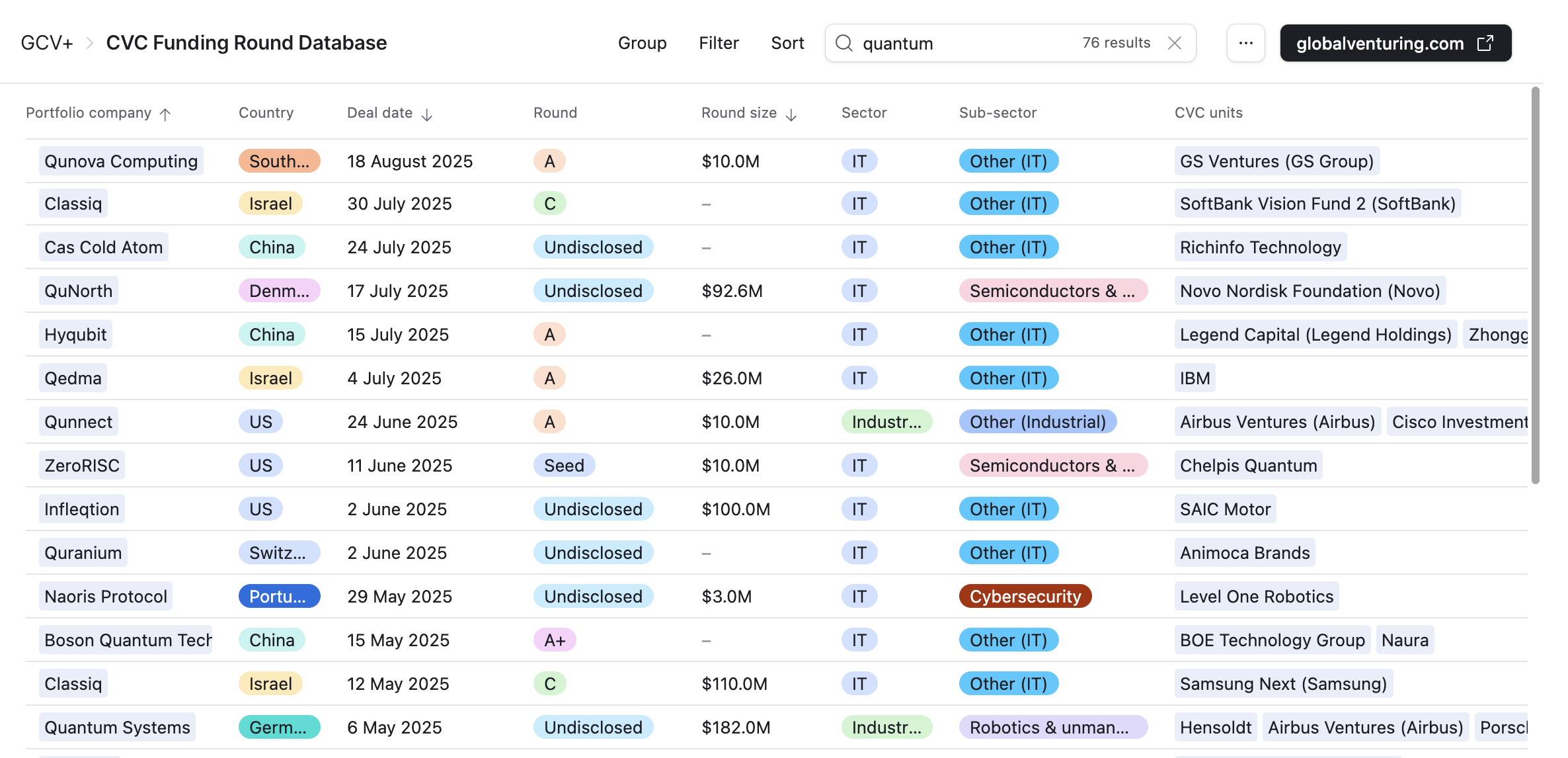

GCV’s data shows that corporate-backed quantum computing funding rounds have leapt up following breakthroughs at the world’s largest labs.

Corporate investors are showing an increased interest in backing quantum computing startups following recent technological breakthroughs that are bringing the technology closer to commercial viability.

Investors are also changing the pattern of what parts of the quantum computing stack they are backing. While software has often in the past received the lion’s share of investment, hardware has now come more into focus.

GCV’s CVC Funding Round Database shows that corporate-backed deals for quantum computing hardware and software companies came out of a slump in the first half of 2025, surpassing their previous peak in the same period of 2023.

Breakthroughs at the major quantum labs have put quantum computing in focus in 2025. In December, a leap forward in error correction technology by Google made headlines. Since then, Microsoft and Amazon have launched new chips, and IBM, Google’s closest rival in the sector, updated its roadmap and announced it will release a new processor later this year. Both IBM and Google have announced roadmaps to create a large, fault-tolerant quantum computer by the end of the decade.

In preparation, IBM’s head of VC, Emily Fontaine, recently told GCV that her unit is investing in quantum computing startups to develop an ecosystem of hardware, software and algorithms that can work with IBM’s technology.

There is still no consensus on what will become the dominant hardware approach to quantum computing. The computational elements of quantum computing, qubits, can be created using supercooled circuits, photonics, trapped ions, neutral atoms and other approaches. Investments in the first half of the year were still across all of these technologies. Chinese electronics company BOE Technology Group backed Boson Quantum Technology, which is using photons to create qubits, while South Korea’s OQT, backed by Kakao Ventures, is using neutral atoms — as is Google and SoftBank-backed QuEra Computing from the US. Qolab, a US startup backed by Applied Materials’ venture unit, uses superconducting qubits, the method favoured by IBM.

As the chart below shows, hardware investments made up the bulk of the H1 2025 funding rounds GCV tracked, which was a change from the dominant pattern in 2023 and 2024, where software usually drew the most attention.

Software, algorithms and a potential cybersecurity nightmare

As IBM’s Emily Fontaine indicated, making a success out of the technology will depend as much on the software and algorithms as it will the hardware.

Startups innovating in these areas could be decisive in making quantum computing applicable to a particular sector. For example, Samsung-backed startup Classiq, which provides a quantum software development platform and algorithm library, has worked with BMW and Nvidia to explore how the technology can be applied in the car industry.

Another adjacent development is the rise of cybersecurity startups that are providing services to protect against the unprecedented codebreaking abilities full-scale quantum computers are expected to have. As the graph above shows, these have increased in the first half of the year to overtake software investments, albeit by a modest amount.

The security startups that received corporate backing included Quranium, a Swiss company that makes a blockchain layer 1 protocol that it claims is quantum secure. Most blockchain networks are thought to be vulnerable to quantum decryption, so there is pressure on to find a solution. Quranium received investment from Animoca Brands, a blockchain-based gaming company. The professional services firm Accenture invested in a post-quantum cryptography startup called QuSecure, in its $28m series A round in February. Qusecure says it can apply its technology on top of an existing cybersecurity stack, and so can help companies transition to quantum readiness.

See all the quantum computing startups backed by corporate investors since 2023 in the CVC Funding Round Database

Where next?

As both IBM and Google expect a large-scale computer to be ready no earlier than 2029, the sector still has a lot of development ahead of it. Today’s list of venture-backed startups is likely to be whittled down before then.

But for now, the lab breakthroughs are encouraging, and early quantum investors are even achieving exits. In June, the US trapped-ion quantum computer maker IonQ acquired Oxford Ionics, a UK startup that also uses trapped-ion technology, for $1.25bn.

So, while there may be several more ups and downs in the hype cycle of quantum computing, the sums of money are starting to get more serious.