Key points

US pig prices strengthened in mid-2025, with July carcase values up 15% year-on-year as tighter supplies lifted margins

Pork production fell 4% in July as slaughter numbers and carcase weights declined, with USDA trimming its 2025 forecast

Exports to Mexico grew 5% year-to-date, but weaker demand from Asia meant total US pork exports fell 4%

UK exports to China benefit as buyers actively favour British product

Prices

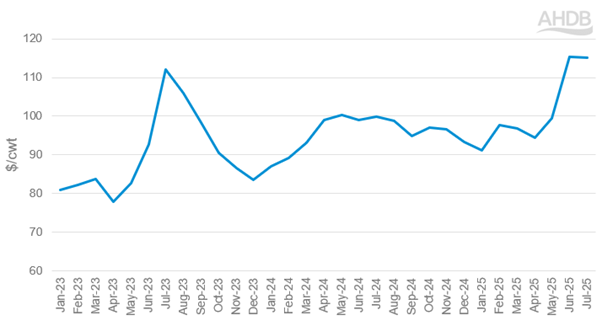

US pig prices have staged a strong recovery through mid-2025, reflecting tighter supplies and firm demand. The pork carcase cutout value averaged $115.03/cwt in July, up 15% year-on-year. On a month-to-month basis, prices also firmed compared with June. While prices are currently providing relief to producer balance sheets, Rabobank notes that a meaningful expansion in production has not yet materialised. Some producers are said to be retaining more animals for breeding, encouraged by improved margins and tighter supply expectations. The latest USDA inventory figures show only limited herd growth, further reinforcing upward pressure on prices.

Line chart of US pig prices, 2023–25 (monthly average, $/cwt)

.png)

Source: USDA

Production

Despite the price recovery, production volumes have been constrained. Federally inspected slaughter in July reached 10.3 million head, down 3.9% year-on-year and significantly below USDA inventory expectations. Year-to-date figures (Jan–Jul) showing a 2% fall in slaughter compared to 2024.

As a result, pork production declined 4% YoY, totalling 2.1bn lbs (950,000 tonnes) in July. This also reflected lighter average dressed carcase weights. Year-to-date figures (Jan–Jul) show a smaller decline than the monthly figures, down 1% compared to 2024.

A key factor has been the surge in disease outbreaks in Q2 2025, specifically Porcine Reproductive and Respiratory Syndrome (PRRSV). The Swine Health Information Centre reported the highest rate of outbreaks since 2013, particularly in wean-to-finish. This reduced slaughter availability through July and is expected to limit production into the autumn, although case numbers appear to be easing.

According to USDA’s June 2025 inventory report, the total US pig population stood at 75.1 million head, up just 1% from June 2024. Fattening pig numbers rose slightly year-on-year, but the breeding herd contracted to 5.98 million head, highlighting the limited scope for production expansion with farrowing having fallen slightly.

The USDA’s latest projections also lowered full year 2025 pork production expectations to 27.7bn lbs (12.6m tonnes), almost 300m lbs (-1%) less than the previous forecast and fractionally below 2024 levels. This downward revision further underlines the constrained production outlook, even as prices encourage producers to consider expansion.

For 2026, USDA forecasts production at 28.4bn lbs (12.9m tonnes), a 2.3% increase year-on-year, though still trimmed slightly from earlier estimates.

The recent combination of reduced slaughter, limited breeding herd growth, and strong demand has created a more balanced supply picture, helping lift pig prices, but growth prospects remain constrained in the short term.

US pork production & pig slaughter YTD (Jan–Jul)

.png)

Source: USDA

Trade

US pig meat trade flows shifted notably in the first half of 2025. Exports in June totalled 1.51m tonnes, down 4% year-on-year.

The top destination for US product is Mexico, which bucked this trend, with shipments increasing by 5% (Jan–Jun 2025 vs Jan–Jun 2024). Mexico accounted for around 40% of US total pig meat export volume in the first half of 2025, up from 37% in the same period of 2024.

By contrast, year-to-date (Jan–Jun) shipments to Asia weakened, with Japan (-10%), South Korea (-10%) and China (-20%) all recording lower volumes. Increased tariffs have created political tensions particularly between the US and China, likely dampening trade demand in the region.

US pig meat exports by destination (YTD Jan–Jun)

.png)

Source: Trade Data Monitor LLC

On the import side, year-to-date (Jan–Jun) volumes into the US fell by 6%, largely due to lower shipments from Canada (-6%) and EU countries such as Denmark (-16%). This ties with the USDA report showing the Canadian pigherd contracted 1% year-on-year in July, reducing supplies. Meanwhile, increased import tariffs are likely to have been the driver for lower EU volumes.

The net effect is a tighter US domestic market, with less imported product available and export growth focused closer to home.

US pork imports by country (YTD Jan–Jun)

.png)

Source: Trade Data Monitor LLC

Implications for the UK

For UK producers, the relevance of the US pork market in 2025 lies in tight supply dynamics, influenced by disease and altered trade flows, supporting global prices.

Lower North American supply is providing strong support to global pork prices, creating a firmer trading environment for UK exporters. At the same time, US trade policies and tariff disputes are reshaping trade flows, and the UK is already benefitting from these shifts.

In the first half of 2025, UK pig meat export volume to China rose 25%. Market insight from AHDB’s China office confirms that the UK is increasingly viewed as a favourable trading partner. This gives UK exporters an edge at a time when global protein supplies remain tight and political tensions are high.

The EU, meanwhile, faces an ongoing anti-dumping investigation in China, adding further uncertainty for one of the UK’s major competitors in Asian markets.

Elsewhere, the UK has secured additional market access to Mexico, but while this presents a positive step, the reality is that the US is still expected to meet the bulk of Mexican demand given its scale and geographic advantage.