September 3, 2025

Sentiment indicators for consumers and firms are pointing to a weaker employment report for August.

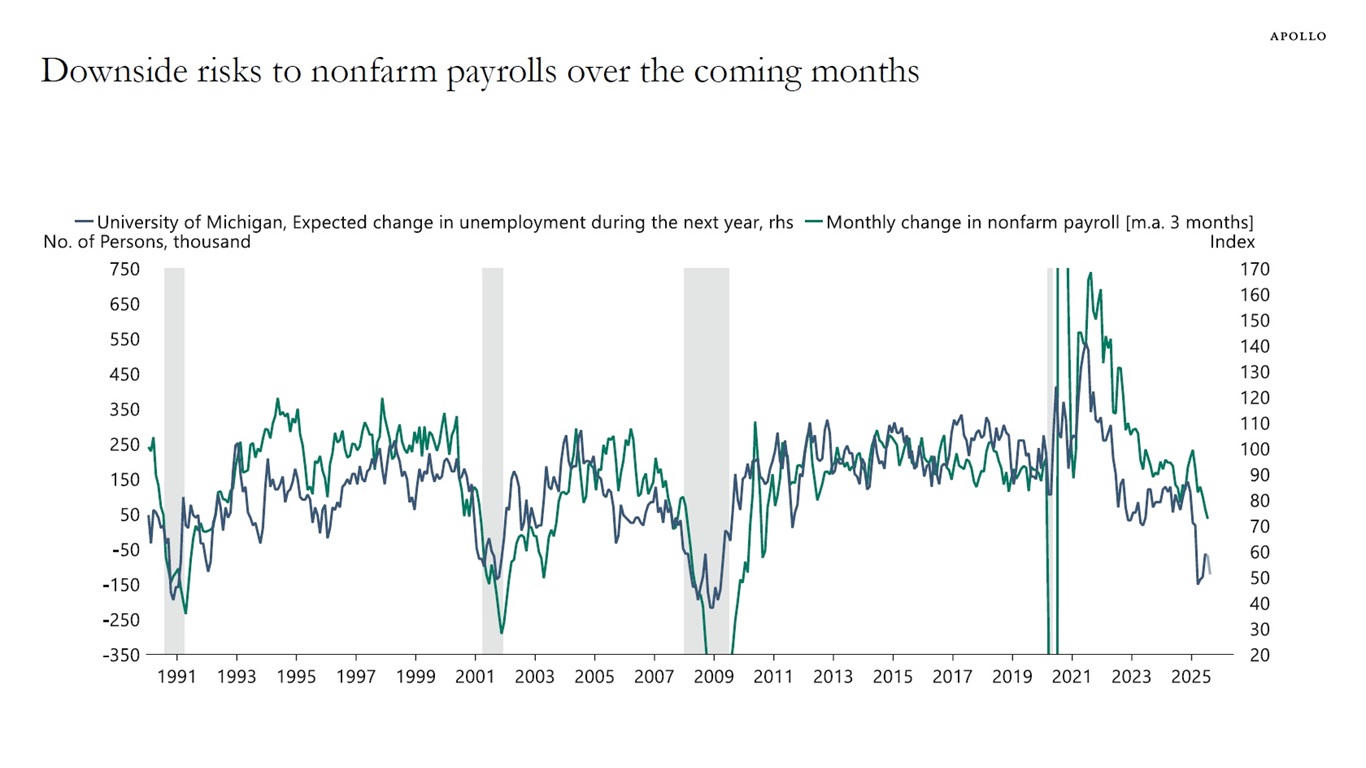

First, consumer sentiment about the outlook for the labor market has historically been a leading indicator for job growth. Using the historical relationship to predict the August employment report suggests that nonfarm payrolls on Friday could come in lower than the 90,000 expected by the consensus, see the first chart below.

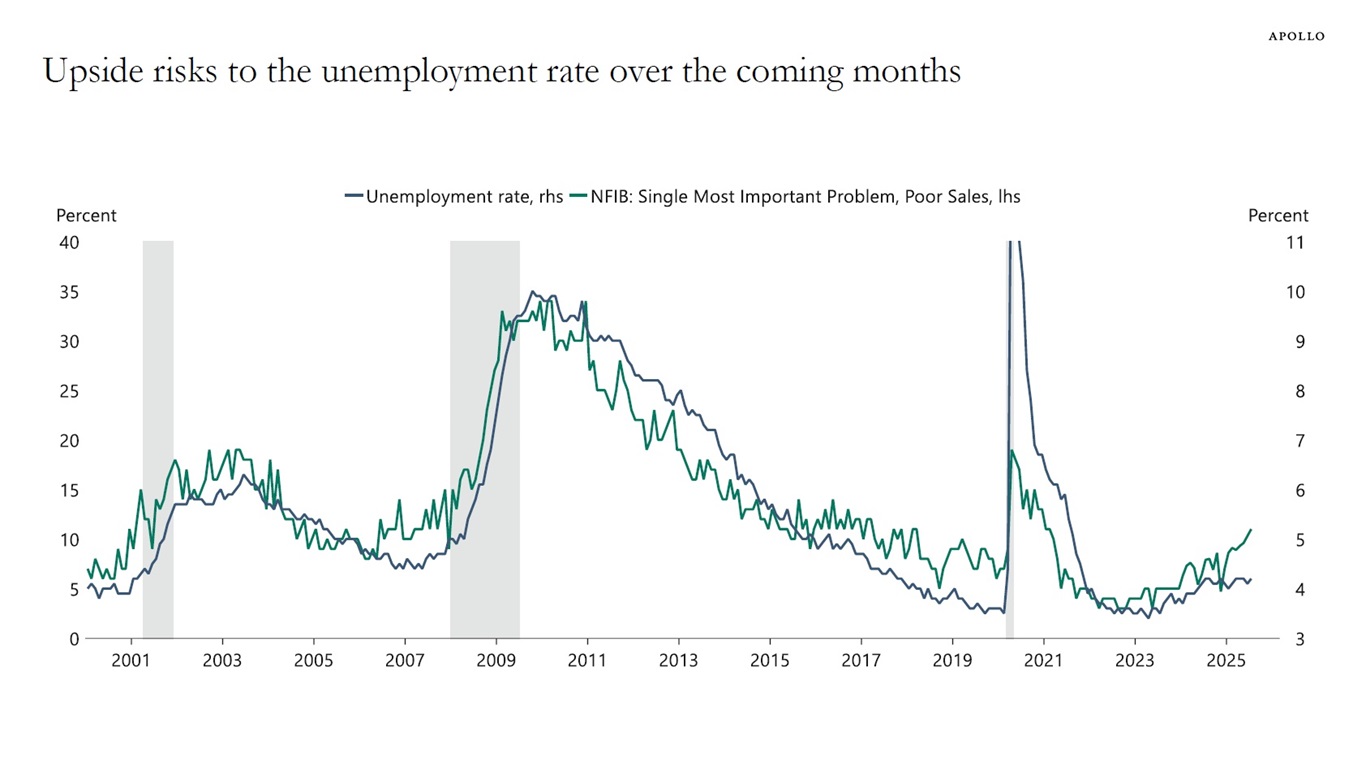

Second, small businesses saying that they are experiencing poor sales has also been a leading indicator for the unemployment rate, and the current reading suggests the unemployment rate could rise over the coming months, see the second chart.

The bottom line is that sentiment indicators are suggesting that the labor market will continue to weaken.

Note: University of Michigan’s expected change in unemployment during the next year August numbers are preliminary estimates. Sources: US Bureau of Labor Statistics (BLS), University of Michigan, Macrobond, Apollo Chief Economist

Note: University of Michigan’s expected change in unemployment during the next year August numbers are preliminary estimates. Sources: US Bureau of Labor Statistics (BLS), University of Michigan, Macrobond, Apollo Chief Economist

Sources: National Federation of Independent Business, US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist

Sources: National Federation of Independent Business, US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.