The Point

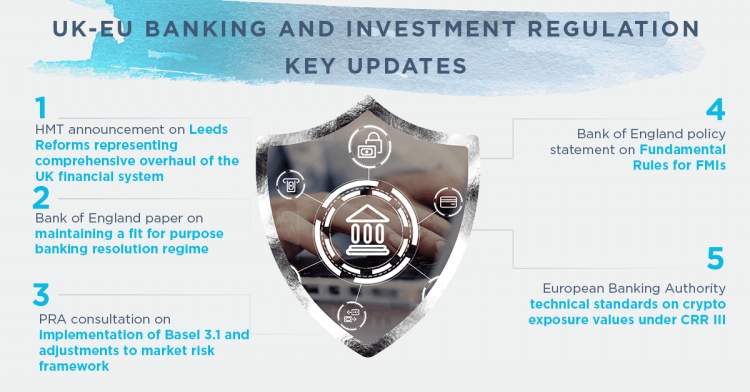

In this edition, we discuss latest developments in the UK and EU

banking and investment regulation. These include recent

announcement from the HM Treasury of Leeds Reforms which represent

the most comprehensive overhaul of the UK financial system in over

a decade, key papers from the Bank of England on fundamental rules

for Financial Market Infrastructures and the banking resolution

regime and from the Prudential Regulation Authority on

implementation of Basel 3.1. Our edition also features key EU

publications on recent technical standards published by the

European Banking Authority on crypto exposure values under CRR

III.

Leeds Reforms outline plans for financial services sector

On 15 July, HM Treasury announced Leeds Reforms which represent

the most comprehensive overhaul of the UK financial system in over

a decade, with the aim of making the UK the leading global

destination for financial services by 2035. Key initiatives include

unlocking retail investment through FCA-led “Targeted

Support” and allowing Long Term Asset Funds within ISAs.

Reforms will also free up capital for investment by raising the

MREL threshold and reviewing the ring-fencing regime, while Basel

3.1 rules will be tailored to support UK competitiveness.

Read here to know more on the upcoming initiatives

that have been announced.

Bank of England paper on maintaining a fit for purpose

resolution regime

On 15 July 2025, the Bank of England (BoE) published a paper on

maintaining a fit for purpose resolution regime. The paper outlines

the BoE’s approach to maintaining a fit-for-purpose resolution

regime that ensures financial stability while fostering

proportionality for firms of varying sizes and complexities. The

paper also summarises the various updates the BoE and the

Prudential Regulation Authority are making or are proposing to the

resolution regime.

Click here to read further on the proposed updates

in relation to the regime.

PRA consults on implementation of Basel 3.1 and adjustments to

market risk framework

On 15 July 2025, the Prudential Regulation Authority (PRA)

published a consultation paper (CP17/25) on ‘Basel 3.1:

adjustments to the market risk framework’. The purpose of this

consultation is to finalise the implementation of the Basel 3.1

standards in the UK, focusing on market risk requirements under the

Fundamental Review of the Trading Book (FRTB).

Read more on the PRA’s proposals here.

BoE policy statement on Fundamental Rules for FMIs

On 18 July 2025, the Bank of England published a policy

statement on Fundamental Rules for Financial Market Infrastructures

(FMIs). These rules, effective from 18 July 2026, outline the

high-level outcomes FMIs must achieve in areas such as financial

resources, operational resilience, and risk management. The policy

is relevant for recognised UK Central Counterparties, recognised UK

Central Securities Depositories, UK Recognised Payment System

Operators and UK Specified Service Providers.

Click here to read more on these fundamental

rules.

EBA final report on draft RTS on crypto exposure values under

CRR III

On 5 August 2025, the European Banking Authority (EBA) published

a final report on the ‘draft regulatory technical standards on

the calculation and aggregation of crypto exposure values under

Article 501d(5) of the CRR III’. Amongst other things, these

draft RTS aim to ensure that institutions have reliable valuation

processes of their cryptoasset exposures to ensure that they

correctly calculate the own funds’ requirements for exposures

to cryptoassets within the scope of Regulation (EU) 2023/1114 on

markets in crypto-assets (MiCA), which are not financial

instruments or commodities.

Click here to learn more on these

standards.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.