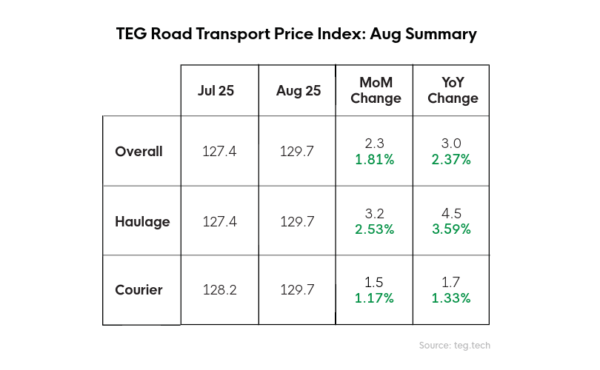

The TEG Price Index rose by 2.3 points (1.81 %) in August, reaching 129.7—2.37 % higher than a year earlier. Haulage recorded the sharpest increase, up 3.2 points (2.53 %), while courier services rose 1.17 %. Remarkably, all three indices converged at 129.7.

Overall transport demand rose by 6.26 %, placing strong upward pressure on rates. Supply also grew—particularly for artic lorries—but could not fully keep pace. Artic demand soared by 13.31 %, while supply rose 14.63 %, yet prices still climbed 3.2 % compared with July.

Seasonal factors drove demand: the bank holiday weekend and continued warm weather boosted consumer goods sales, with beer and cider up 5 % and 3 %, respectively, per CGA by NIQ. The Bank of England’s base rate cut to 4 % further eased household budgets, supporting stronger spending.

However, labour constraints remain a challenge, TEG warns. Adzuna reported 4,027 HGV driver vacancies in August; up from July’s 3,645, exacerbated by annual leave. Driver pay rose accordingly; average salaries reached £42,121, exceeding the UK national average for a second straight month.

Meanwhile, the SMMT reports a 11.2 % year-on-year drop in new HGV registrations for Q2, suggesting ongoing supply restrictions.

Economy: cautious optimism, persistent risks

Consumer confidence edged up, with the GfK index climbing two points. According to the ONS, 17.9 % of businesses expected improved performance over the next year, while 15.8 % foresaw declines.

Inflation rose slightly to 3.8 % in July, yet the Bank of England lowered rates. UK car production offered some relief, with July output up 5.6 % year-on-year. Still, trade tensions remain, with a US court ruling against President Trump’s tariffs and tax hike speculation ahead of the Autumn Budget.

Fuel costs remained elevated in August. Diesel averaged 142.26 ppl: up 0.62 % from July and 3.74 % year-on-year. Petrol increased 0.27 % month-on-month and 5.69 % compared to last year. Encouragingly, global oil prices started to ease towards month’s end.

“It’s a relief now August is behind us, to see the TEG Road Transport Price Indices return to a more expected pattern. The summer lull is over – let’s look forward to a busy but normal peak,” told senior logistics consultant Kirsten Tisdale of Aricia Ltd to TEG.

UK economy split between services growth and manufacturing decline

The broader economic picture provides useful context for transport trends. According to S&P Global, the UK service sector rebounded strongly in August, with the Services PMI climbing to 54.2, the highest in 16 months. New orders surged, supported by lower borrowing costs and stronger demand both domestically and from overseas, while business optimism reached a ten-month high.

In contrast, manufacturing remained mired in contraction. The UK Manufacturing PMI slipped to 47.0, signalling a further downturn in output and marking the sector’s eleventh consecutive month below the neutral 50.0 threshold. Factories reported one of the steepest drops in new orders in two years, with both domestic and export demand weakening. Job cuts persisted for a tenth straight month.

Taken together, the divergence underlines a two-speed economy: resilient consumer and service activity boosting freight demand, while industrial weakness restrains longer-term growth. This split mirrors the pressures captured by the TEG Index, where stronger household spending is driving volumes, but structural challenges such as labour shortages and cost inflation continue to weigh on the transport sector.

Across the Channel, eurozone data show a more balanced picture. The eurozone Manufacturing PMI edged up to 50.7 in August, returning to expansion for the first time since mid-2022, while the Composite PMI stood at around 51.0. Services in the bloc continued to expand moderately, suggesting that Europe’s recovery is broader-based than the UK’s.

In other words, while the UK economy is being pulled in opposite directions: consumer-driven services growth on one side and persistent industrial weakness on the other, the eurozone has begun to see manufacturing stabilise alongside services. That divergence places the UK in a more fragile position: its transport sector is buoyed by household demand, but it risks missing out on the industrial uplift that could anchor growth more firmly across continental Europe.